The Oil Market, Nikola Motors Is A Joke, Boeing Trouble And More

Markets strong to start off the week, especially small cap stocks. The QQQ and mega cap tech stocks were not participating in the rally. Don’t try to game the markets. Meanwhile, I’m sticking with our stocks and keeping some cash and hedges in place.

Here’s the second part of Friday’s Live Q&A Chat.

Subscriber:

Do you know anything about this Nikola Corporation? I think they IPO in June, so I didn’t know if you had thoughts on that, and I think the only way to get in on that right now is because VTIQ is doing a reverse merger with them.

Cody:

My initial reaction after reading about this company was if they were real, they’d have their own name. If they were a real company, they wouldn’t try to steal Tesla’s brand. That is such a huge red flag to me. I mean, Apple doesn’t call them self Macrohard instead of Microsoft, right? Google didn’t call itself Yeehaw because Yahoo was out there. A real company that has its own revolutionary pathway would seem very unlikely to try to ride Elon Musk, Tesla’s coattails with this brand stealing thing. Headlines here: “Tesla competitor Nikola Motors receives CARES Act funds.” How about that? VTIQ is valuing the company at more than $3 billion. VTIQ is the special acquisition vehicle much like IPOA was when Virgin Galactic reverse mergered into it as a way of going public and changed the symbol to SPCE.

Nikola is scheduled to receive more than $500 million in cash from investors when this reverse merger happens. I mean, on CNBC, the CEO predicted that Nikola would eventually be valued at $100 billion. I’ll take the under on that one. I’ll take the far under on that one. Says Fidelity is supposedly putting money in on this thing, but I don’t know if I believe that, and even if they do, who knows which junior manager at Fidelity decided it would be a good investment. “Nikola plans to begin production of its trucks, which are electric powered using hydrogen fuel cells”… Game over. Game over. There we go. Hydrogen fuel cells. That is not the future. Do you know the infrastructure, the tens of billions of dollars that would have to be invested to make hydrogen fuel cells critical mass worthy? Oh, my gosh. If it comes public and it doubles, I might short that stock at some point or at least buy some puts.

I do not like Nikola Motors. There’s your answer to your question. Yeah, I’m running for the hills with the hydrogen fuel cell Tesla brand ripoff truck company reverse merger IPO.

Subscriber:

Thank you for telling me how you really feel.

Subscriber:

Cody, what is your view on Boeing?

Cody:

Run for the hills at this point. I mean, this company seems so incompetent. The only reason you would really want to own them, you got two reasons to want to own them. Duopoly status in airplane manufacturing across the globe, them and Airbus. Then number two, a play on the space revolution. But Boeing is failing in the Space Race. SpaceX is running circles around Boeing and making Boeing look evermore silly in the space revolution. Meanwhile, the demand for Boeing airplanes over the next five or 10 years is going to be anywhere close to what it was supposed to be. Best case scenario, the stock might come up and get back to where it once was, which would be a double over the next five or 10 years. Again, that doesn’t seem like a very good risk reward, really, right? Am I going to risk my money and try and get a double in Boeing? No.

Subscriber:

Shorting Grubhub Cody, how can they ever make a profit?

Cody:

I don’t know know that they can, if you’re shorting Grubhub, you’re betting that the amount of growth in home delivery, not just in food, because Grubhub could start delivering other things too, right? You’re betting that that’s not going to grow. I don’t like that. I wouldn’t buy Grub, but I wouldn’t short it.

Subscriber:

I was thinking about adding to my TSM position on the Apple rumor.

Cody:

I assume the Apple rumor being that Apple is supposedly going to start making their own chips to go into MacBooks, and not use Intel’s chips. I believe that rumor. I think there’s very little reason to continue using mass produced generically designed general processing units when… If you guys watched last year when Tesla revealed their self driving chip that they had designed and that TSM was making for them, if you watched that presentation, Tesla was like, “Look, we know that this standardized technology we could put in there, and we know this standardized technology, we could put in there…” That’s basically where TSM has enabled that. Taiwan Semiconductor has enabled you, if you want, to go, “Hey, let’s pull these, this and this and this and this from these designs.”

Point being, yeah, Apple probably going to design their own chips. It’s not good for Intel. I don’t know that I’d buy TSM because Apple’s going to design their own chips. Apple’s going to be a very small fraction of their revenue. Apple’s already a small fraction of their revenue, because Apple’s designed some of their own chips for the phones and the iPods, iPads, tablets. I love the TSM. I trimmed some, but it’s still one of my largest positions. I’m holding it steady.

Okay. Go ahead. Oh, this is a good visual. I wish we had a better stream. He’s got his face mask on, and he’s in a Target at the pet food section of the store.

Subscriber:

With 401(k)s, you’re only limited to so many investment options. You think for the short term, we should suspend future contributions or is it worthwhile to keep investing? I have a bunch of IWM, which is most of what I have in my 401(k). Is it good to keep, for the next few years, investing in it? Do you think it’s going to be like S&P and be flatter to lower?

Cody:

I’m short the IWM. It’s a hedge against my portfolio. It’s not a small short. I mean, all my shorts are relatively small, but compared to my other shorts, IWM is one of my bigger ones. Like the S&P 500, it’s got a similar setup. It’s not like I’m going to go buy puts on it, because I don’t think it’s about to crash, but I can’t model the next two to three years of growth. I would find some small cap stocks that you love, and maybe stick with those. Look, man, the problem with the advice you’re asking for is that you’re sort of asking me to help you game the broader market, and you know I like to pick stocks and not game markets. But, if feet to fire, I had to gain the market for the next two years, the IWM, the Nasdaq, the QQQs, the Dow Jones, the Russell 2000, I think they trend lower for at least a year or two.

I could totally be wrong. IWM could be at $170 this time in two years. But, I think more likely it’s at $70, or maybe still here at $120ish. I wouldn’t tell you to go sell all of it or something like that, if that’s what your main investment vehicle is for the long term, but I would prefer building cash as a strategy for now. Continue putting your contributions, but don’t buy more IWM. Let it sit in a money market or a cash account.

Subscriber:

So maybe I should get out of it completely? Or look to buy some inverse ETFs to hedge it?

Cody:

Look, I’m almost bearish, right? I think you guys know that. I’m as close to being bearish as I’ve been since 2007, really, when I turned outright bearish back then. But, instead of believing and betting the market’s about to crash, the problem is, I think it’s the slow grind thing. It’s not like I go net short. At some point, it’s good just to be defensive. I raised cash from longs, and I raised cash from shorts, because I just don’t like any of it right now. You don’t have to try to catch alpha. You don’t have to try to make gains at all right now. It is okay to protect, to be defensive, to just… Look, if the markets crash and we’re in cash, great. If the markets are down 10% this year and you’re mostly in cash, you’re still going to be pretty thankful. If the markets are up 20% and you’re cash, of course, you’re going to disappointed. It’s all about risk reward though.

And I wouldn’t want to be put money into a bond mutual fund right now. I don’t like bonds here. I don’t like treasuries here. I don’t like getting all aggressive on anything right here. The only two things that seem “safe-ish” to me right now now are probably gold and Bitcoin, and behind that, Tesla and some of our other favorite revolutionary stocks. But in general, cash is king. De-fense. De-fense. De-fense. De-fense.

Subscriber:

What do you think about oil futures? Is this somewhere we should look to invest? I do understand that solar and electrification is the growing stuff, but still there is always a market for everything.

Cody:

Right. How I would answer that is that, again, the risk reward in oil compared to Bitcoin for example seems skewed in favor of Bitcoin. If you know that the world is going to use ever less of a product in your lifetime by design… If the economy grows, we’ll use more oil for a while, but eventually, the costs of these alternative energies, especially solar, probably five or 10 years from now gets down to almost minuscule. Eventually, energy gets almost free. So I can’t come up with a bullish argument for oil other than maybe these guys will control their pumping enough that supply drops, and eventually, a year or two from now, maybe there’s been enough of a draw down of the inventory of oil sitting around on tankers and underground everywhere that it bounces. That’s your bet.

Subscriber:

I considered that, but where I live here in India oil is what is used… At present time, India consumes a lot of oil for everything, basically. The solar pretty much non-existent here for now.

Cody:

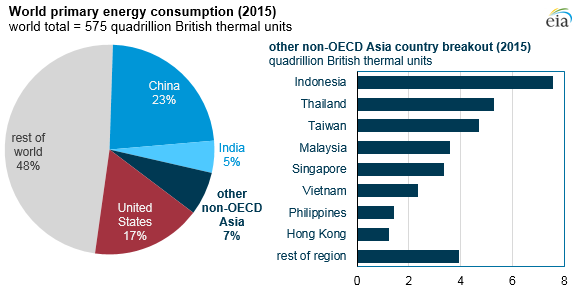

This is total energy consumption in the world right now. 10 years ago, it was the smaller circle. 20 years ago, it was even smaller circle, right? The total consumption of energy in the world is growing over time, until now. We have a new factor. We’ve seen the world get immediately clean. We’ve seen an economic crash. We have seen oil get almost free. Something’s changed. I don’t think we can just continue to go with the old assumptions about oil consumption. The pie of energy consumption is going to continue growing and getting bigger in the next five, 10, 15 years just like it did for the last 100 years. But things have changed all of a sudden during this coronavirus crisis. The world is much more conscious of its oil consumption, the waste, the pollution. We were getting there anyway, but now, even people who are not greenies, who are conservative are like, “Oh, it sure is nice to see downtown Dallas, much less Mumbai.” Right? It’s crazy, the beauty that you see in India all of a sudden, right?

The Green Movement is going to have more political leverage. There’s suddenly more political power behind the green movement that there wasn’t before. So I don’t think energy consumption in general is going to grow the way it used to. You’ve got that curve flattening out a little bit. Then, you mentioned the United States. United States is probably going to be, what, 15, 20% of oil consumption in the world or some much bigger number than most other countries. China’s gotten to be up there with us. But, you come over here to India, and I think it’s this little guy right here.

That’s how much energy India consumes in a year, right? Let’s say India doubles their energy consumption and it’s all oil. I don’t care. Oil, it’s not enough demand in India to impact, to overcome the shrinking pie of energy consumption or at least a lesser growing pie, and also, overcome the fact that there’s a trillion barrels of oil sitting around right now that still have to be worked through when this economic pie finally does grow again. I’d rather sell oil than buy it.