This Barney Fife Market Wouldn’t Impress Ben Graham

I introduced my six year-old daughter to The Andy Griffith Show this week and she loves it as much as I do (the black and white episodes with Barney only, of course).

“Well, I guess to sum it up, you could say, there’s three reasons why there’s so little crime in Mayberry. There’s Andy, and there’s me, and [patting gun] baby makes three.” – Barney Fife, aka, The Federal Reserve and the Republicans and Democrats in power.

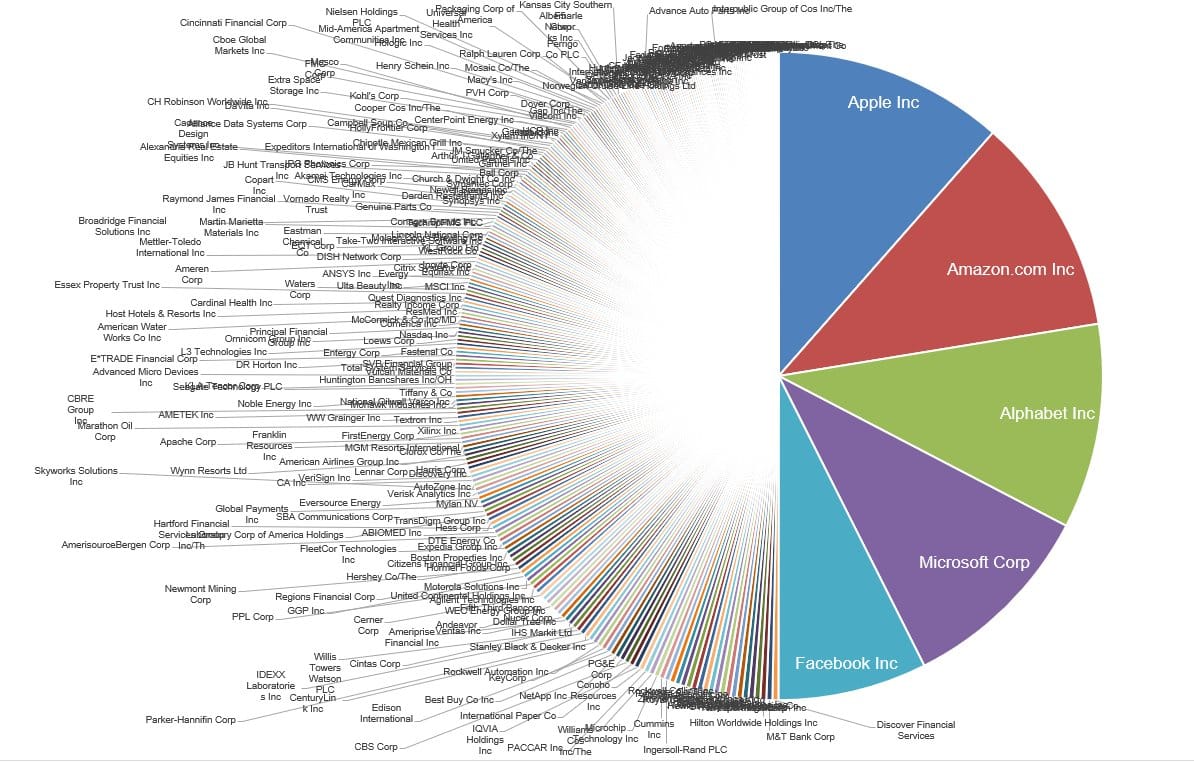

Maybe you’ve seen this pie chart that shows how Apple, Google, Amazon, Facebook and Microsoft combined are worth $4.095 trillion versus $4.092 trillion for the bottom 282 companies. It will be interesting to look back at a chart like this in another 20 years when other companies will likely be at the top of this list. I happened to have invested in and held onto four of the five names long before they dominated the S&P 500 as long-time followers of mine and I have owned Apple since its market cap was less than $5 billion, Google when its market cap was just $23 billion, Facebook since it was worth just $50 billion and Amazon when its market cap was $200 billion.

I want to use this chart to help us visualize the amount of money that the Republicans and Democrats and Federal Reserve pumped into the system/economy in the last 90 days, which is probably about $10 trillion worth…

Clearly a lot of that money, as I’d anticipated, has flowed into the stock markets, real estate markets, bitcoin, gold, etc…

And some of that money that went into the biggest five stocks in the S&P 500 then gets re-allocated into the smaller stocks as it creates yet more demand for smaller names. People taking 5% out of AAPL to diversify into some smaller cap names, for example, is a bunch of money. 5% of $1.9 trillion is nearly $100 billion. $100 billion will move a lot of S&P 500 stocks, but imagine what does to the small cap stocks that comprise the Russell 2000 where the median market cap is $680 million.

With all these trillions of dollars floating around, doesn’t it make some sense that we’d be in the midst of a major spike up in the Bubble-Blowing Bull Market that we’ve been riding for the last decade?

More importantly though, what now, brown cow?

Well, at the bottom in March I wrote a post called, Trade Alert: Prepare For Better Times:

“The stock market headlines are full of fear, warnings and what I might even call hyperbole…

I know it’s hard to see past Coronavirus right now.

I do think the risk/reward of scaling into more long exposure when you and everybody can’t imagine that stocks can go up in the next few weeks or months is probably pretty ideal, risk/reward-wise. I’ll remind you that we should prepare for the worst of times when things are great — and prepare for better times when things are horrible. The headlines, the markets, the economy — they are all in the horrible category right now. That doesn’t mean they can’t get more horrible-er, but I think that’s what most traders and investors right now, with the markets already down 20-30% from their recent highs, are preparing for.”

Let’s re-write these lines, updating them for the set up in the market now:

The stock market headlines are full of euphoria, warnings that you’re missing out on easy gains and what I might even call hyperbole…

It seems almost easy now for most traders and investors to see past Coronavirus right now.

I do think the risk/reward of being defensive when you and everybody can’t imagine that stocks can go down in the next few weeks or months is probably pretty ideal, risk/reward-wise. I’ll remind you that we should prepare for the worst of times when things are great — and prepare for better times when things are horrible. The headlines, the markets, if not the economy — they are all in the euphoria category right now. That doesn’t mean they can’t get more euphoric-er, but I think that’s what most traders and investors right now, with the markets already up 20-30% from their recent lows, are preparing for.

The fact is that the Fed and the Republicans and Democrats aren’t done pumping trillions of dollars into the economy — but that’s not any news either and that itself will eventually get more than priced into the markets.

“Maybe you goin’ to have a weddin’, and maybe you goin’ to have a preacher; but you might not have a bride. You ever think of that?” – Ernest T. Bass

Another fact of the matter is that I’d be much more bullish and sanguine about these current parabolic stock charts if I thought the economy and corporate earnings would justify them in the next year or two. And maybe the bride, aka earnings, will show up — I’ve been writing for weeks about how the new trends developed during the Covid Crisis could actually end up helping most corporations make higher margins in coming years and I always like to be on the world innovating and creating more prosperity through technology for the long-term. But it’s not just about earnings, it’s also about valuations, right? At least, it will be again at some point. Earnings and valuations matter.

My problem is that if you’re not investing based on fundamentals and you’re not even bothering to analyze earnings trends and valuations, then you’re truly betting that you’ll be able to sell to a great fool at some point. I don’t want to bet that there are bigger fools out there. I want to invest in Revolutionary companies at terrific risk/reward set-ups.

So what will make the markets go down one day? What’s the downside catalyst? Heck, it could be fear of another wave of Covid, it could be a war, it could be a Black Swan we’re not looking for or it could just be an exhaustion of buyers.

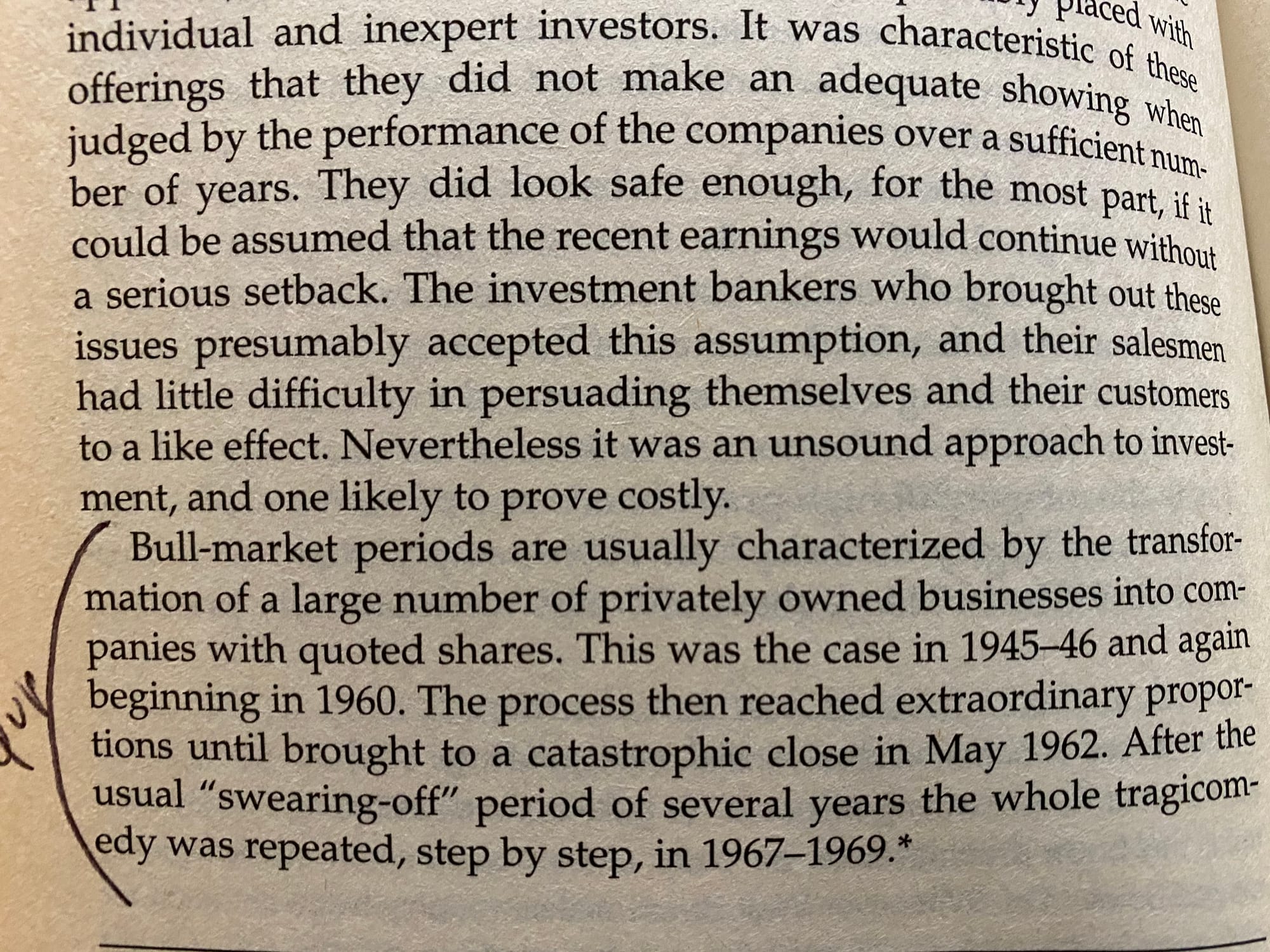

I don’t know, but I do know there’s no better time to re-read some hard core value investing lessons from Warren Buffett’s teacher, Ben Graham, which is what I’ve been doing. I’ve been re-reading his book “The Intelligent Investor” which I’d marked up back in 2006, when I had sold every long except for Apple, Google and Microsoft (as I explained to Brianna Golodryga on CNBC back at the time):

Notice the part there I’d put “yup” next to:

“Bull-market periods are usually characterized by the transformation of a large number of privately owned businesses into companies with quoted shares. The process then reached extraordinary proportions until brought to a catastrophic close. After the usual ‘swearing-off’ period of several years the whole tragicomedy was repeated, step by step.”

Does that sound familiar in a time of the ongoing SPAC bubble? See the next part about there being a catastrophic close to such bubbles?

Ben would tell us to nip this greed bug that so many traders have right now in the bud and to stick with doing our homework and being disciplined about the risks we take with our capital.

Barney Fife: Yeah, well, today’s eight-year-olds are tomorrow’s teenagers. I say this calls for action and now. Nip it in the bud. First sign of youngsters goin’ wrong, you got to nip it in the bud.

Andy Taylor: I’m gonna have a talk with ’em. Now, what more do you want me to do?

Barney Fife: Well, just don’t mollycoddle them.

Andy Taylor: I won’t.

Barney Fife: Nip it. You go read any book you want on the subject of child discipline and you’ll find that every one of them is in favor of bud-nippin’.

The upshot of all this analysis is that I continue to sit tight with our long positions and I’m even hard at work finishing up the analysis on a couple potential new long ideas for us. Using fundamental and Revolutionary Trend analysis. Just like always.