Top Down Analysis of The S&P 500 Is Not Bullish

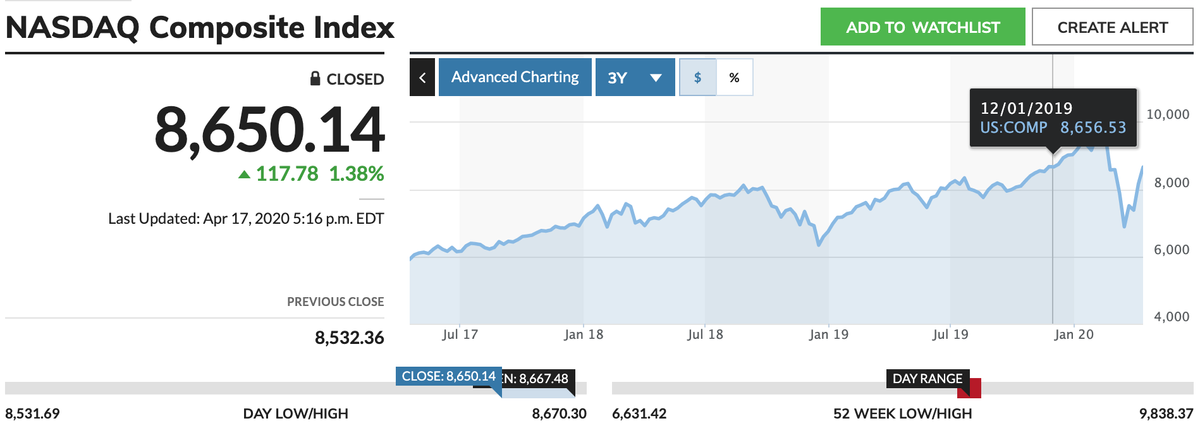

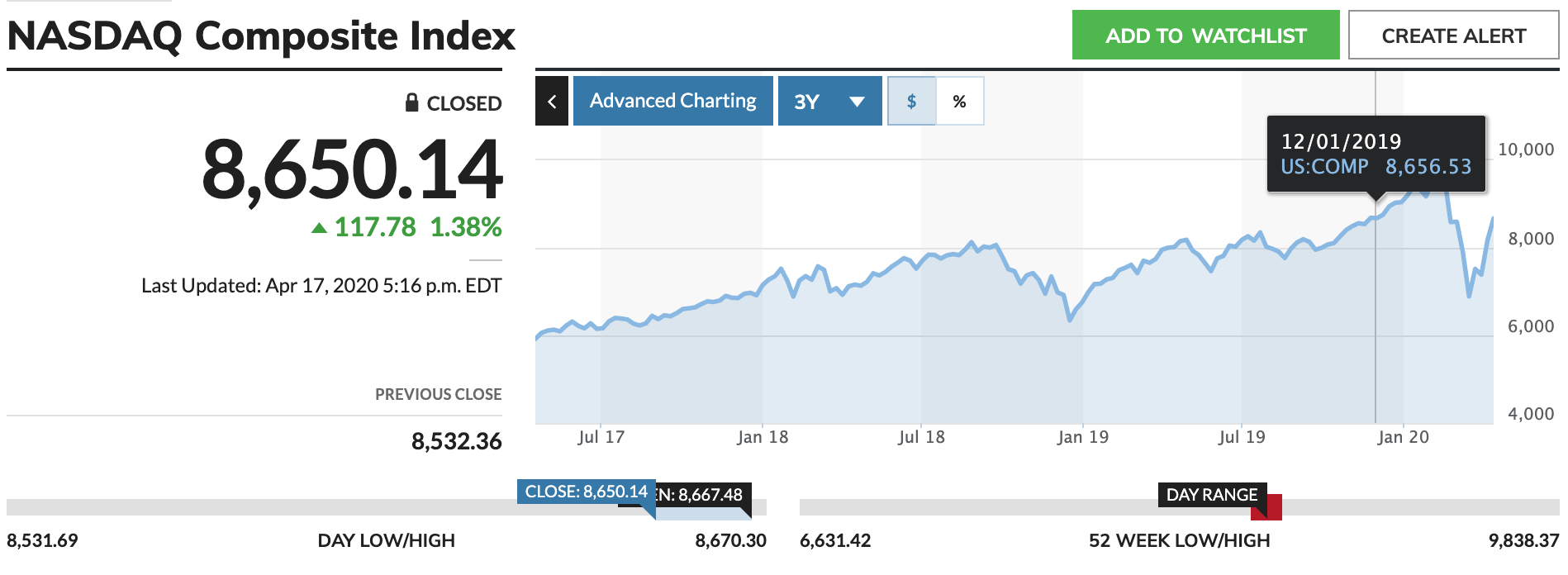

With all that’s going on with the Coronavirus Crisis, it’s shocking that the the markets are back to where they were just a few months ago, late 2019 levels. The Nasdaq is actually back to where it was in December:

Aren’t you glad you didn’t panic out of the markets at the lows? Aren’t you glad you were cautious at the highs? Yea, yea, let’s look ahead and do some analysis on the markets and economy.

What would it take, if anything, for the company you own or work for to go back to pre-Coronavirus Crisis plans for growing, building, investing, hiring, etc?

The implication from the answer to the question is also why I am more defensive and hedged in the hedge fund than usual — because even in the best case scenario, there are going to be some horrible economic and financial bumps. The projected growth for big and small projects around the world probably has had its curve flattened for the next year or two, even in the best case scenario.

Analysts have been slow to update their earnings per share estimates for the S&P 500, for which consensus still shows that it’s expecting earnings in 2020 to be the same ($140ish) as they were in 2019. Fair price for S&P is probably 12-15x next year’s earnings estimates, which right now are:

- 2022: $200

- 2021: $182

- 2020: $141 (which has fallen from $177-$178 in early January 2020 to $141 today)

Those numbers are probably too high across the board, as I’d expect earnings for the S&P 500 might stagnate for another year or two. For reference, from 2007 to 2008, S&p 500 earnings fell from $104 to $18. So I think we might expect at least some similar declines in earnings this time around, but probably even more. It took until 2013, after the 2008 earnings crash for S&P 500 earnings to get back to the 2007 levels.

So let’s look at the 2021 estimates, which I think are also way too high, and let’s say $150 for 2021 would be generous, but let’s work with a $170 earnings potential estimate to be really generous. A 12-15 multiple on $170 of S&P 500 earnings per share would get you to S&P 500 at 2000-2500 (Currently, it’s at 2784 as I write this on Sunday). It’s always possible that the market stays overshot up here to the upside and could get to 20x (S&P 500 would be at 3400) or that it overshoots to the downside and could get to 10x (S&P would be at 1700). Again though, that’s assuming very generous numbers for 2021 and 2022.

So let’s use what I think might be some more accurate S&P earnings estimates, which probably means using an earnings per share estimate closer to $100ish, maybe $90 in 2021 and $110 in 2022. 17 times $110 gets you to S&P 500 at 1800. With the S&P 500 at 2874, the market is clearly looking past these upcoming earnings declines and/or the market doubting that earnings will drop that far.

How about revenue estimates for the S&P 500, which right now are:

- S&P 500 Q1 ’20 revenue is expected to be flat y/y.

- S&P 500 Q2 ’20 revenue is expected to be down 7%.

Clearly, these estimates are also still too high but the market doesn’t seem to be too worried about that. How long will that last?

My best guess is that the S&P trends lower from 2874 and grinds around for a year or two. That said, there will be, as usual, a lot big winners and lots of big losers in individual names over that time frame.

Our job is not to try to game the market’s moves. Our job is to gauge risk/reward and the amount of exposure we should have as we find the big winners, avoid the big losers over the next 10,000 days. I obviously don’t like the risk/reward of the overall market here.

The risk/reward of the markets changes when prices change and this year, we’ve seen me go from starting off with my quite net long with my continued bullishness in January to my near bearishness in late February, as I trimmed down our longs aggressively as I added shorts and put hedges as the markets topped. In March, I then started nibbling and buying new names and covering some of those shorts as the markets crashed. For most of April, I’ve been raising cash by trimming my longs and also covering some more of the short hedges. All of those moves, because the markets were making such huge swings in prices, were a reflection of my risk/reward analysis.

I like to bet bigger when the odds are strongly in our favor. This is not the case right now. I am keen on preserving capital at this moment. As Stanley Druckenmiller, one of the most successful hedge fund managers says, “George Soros has a philosophy that I have also adopted: The way to build long-term returns is through preservation of capital.”

Stick with our approach of Revolutionary Investing names, many of which actually benefit from the Coronavirus Crisis, but don’t be greedy or too scared right now. I leave you with this picture of one kid, at least, who’s not too upset about her latest self-isolation set up.