Trade Alert – A basket buy plus a bunch of must-reads and commentary

Okay, I’ve caught my breath a bit after my earlier rant about 3-D System’s management, but the fact remains that I have pretty much lost all faith in that particular companies competence once again. I’m likely to remove DDD from the 3-D printing basket and to replace it with a smaller company. More details as I make any moves and work on the other plays in this sector. SSYS and XONE have been my favorite of the basket the whole time and they remain so. I am going to tranche into a larger common stock tranche in XONE than I did earlier this week, buying about twice as many shares as I did in that very small buy which makes today’s buy still rather small. That is, I’m using my usual approach of scaling into some weakness in a stock as I see the opportunity to do so here. SSYS isn’t down enough from where we’ve trimmed tranches in it for me to want to add to it just yet.

Upshot is that 3-D printing is here to stay and is still going to be a huge industry in years and decades ahead and we want to keep some exposure to it via a basket of stocks. But I want the best three stocks in the industry that I can find and I think 3-D Systems has proven they fail to meet that standard. $DDD is not even a full-sized position for me since it’s part of this basket, which in total makes up a decent-sized position for me after these stocks have run up so much in the last year or so, and DDD goes into the penalty box for today and is likely to get a red card if I may mix my sports metaphors.

Okay onto a bigger picture and more important topics to our portfolio and futures.

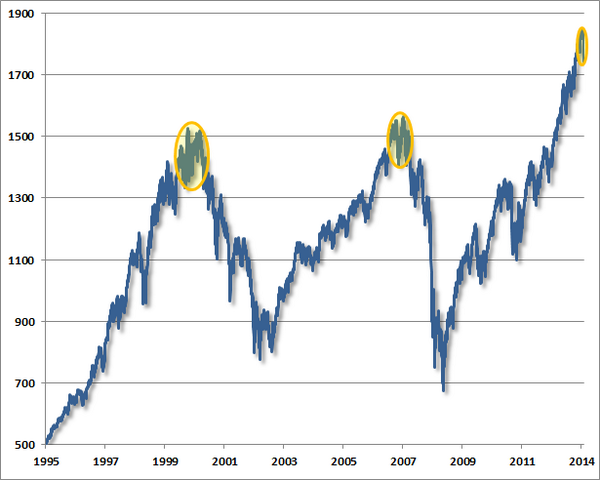

Here’s a Chart of the Day to put some perspective on why I have been saying there’s no fear and no pain in the markets yet, despite the recent and ongoing pullback.

Scutify/Cody WillardWhat pain?

There’s a lot to hit on today, so let’s jump right in and lay out our vision.

Where the *Bleep* Is Germany’s Gold?and Gold Daily and Silver Weekly Charts – Signs of the Times – Most gold bugs and many other folks out there are aware that Germany’s government requested 1500 tons of gold back from the Federal Reserve’s vaults and was basically told to buzz off. That leads me to our Trader’s Deep Thought of the Day: The reason Germany just “allows” the Fed TO NOT return Germany’s 1500 tons of gold is because that’s “only” $72BB worth of value, a small fraction of what Germany and Deutsche Bank get/got in the bailouts. Read for yourself here – https://www.google.com/search?q=deutsche+bank+bailout. I remain a buyer of gold coins anytime it gets near $1200/ounce, regardless of what the Fed and Germany and DB and the Comex and JP Morgan, et al are up to.

RadioShack’s ads make a promise its stores can’t keep – Darnitall, if $RSH closes 500 stores, where will I get ? my TRS-80 serviced? Can Best Buy avoid this same fate in five years’ time? I wonder sometimes, but haven’t shorted it yet.

BrianGallo making some very interesting points about Twitter: “Basically I think $GS and the Big Institutions holding Twitter do not let it break down. Not hard, small float. Sub-$60 is the new breaking syndicate. $FB is better and cheaper yes, but $TWTR is hotter & smaller float.”

My take is different in Why we own Facebook and not Twitter – If there’s going to be an AOL or a MySpace of the 21st century, I expect its going to be a company like Twitter.

Bitcoin trading heats up a block away from the New York Stock Exchange – bitcoin is everywhere, even literally on Wall Street! I’m still a holder of some bitcoins that I bought much lower. The bitcoin, a “too volatile a currency” sure has stabilized of late, eh?

Android vs. iOS 7: Google Dominated Apple in 2013 – Google and Apple are big positions that I’ve owned for many years, but here’s your Investor’s Deep Thought of the Day: $GOOG earned $43/share this yr. $AAPL earned $43/share this year. Yet one stock trades at 3x the multiple of the other one. Apple still has a bigger market cap though.