Trade Alert: A few small tranche buys and searching for the next tech stock to crash

First a couple updates:

1. I’m going to go back in and nibble a small tranche in several of the names, I’ve recently added to the portfolio and that I’ve been slowly but surely building. Today’s round of buying is what I’m calling a “small tranche” meaning that I’m buying about 1/5 of what I consider a full position in these names. For some people they might want to have up to 5% of their “stock portfolio” allocated to these names, and the most aggressive of you might eventually want to have up to maybe 7 or 8% allocated to a couple of the names that perform best over time and therefore become larger relative to the rest of your portfolio. Some of the least-risk-tolerant amongst you might not want to touch any of these names at all and just stick with the Facebook, Apple, Google and other core positions that you have more relative confidence in. At any rate, sometimes you might see me do up to a half-sized tranche at one time which I would consider a “large tranche”.

I’m buying small tranches in AMBA, INVN and IXYS today.

2. I was in Vegas over the weekend at the $WYNN. Talk about a big move in a stock that benefitted disproportionately from the bailouts. That, and real estate prices bottomed naturally in 2008-2010 in Las Vegas too. The Vegas economy was BOOMING over the w/e. I thought it felt “bubbly”, and you know that in this stage of the economic cycle we’re in, that is no surprise to me.

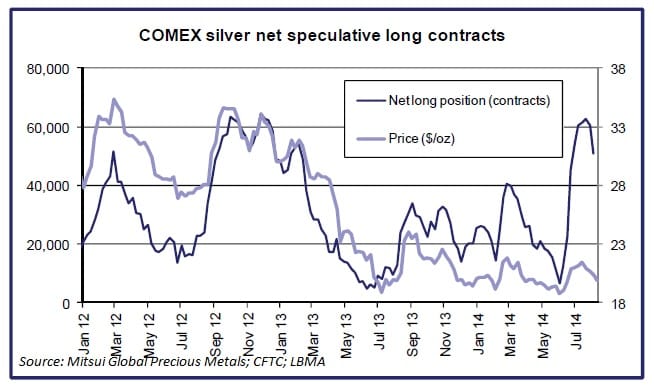

3. Perhaps the question is, “Will all these leveraged bets on near-term upside in $SILVER be a contrarian indicator and actually CAUSE a near-term pullback and/or keep a lid on $SILVER?” If so, I’ll likely buy a couple more $SILVER coins. 🙂 @MichaelHaynes“This chart below from giant trading firm Mitsui shows the net long position zooming while Silver prices languish.”

4. Now onto today’s report.

I need help. I need your guys help keeping an eye out for the next, I’ve highlighted a lot of questionable “tech” small cap stocks for you readers over the last few years.

On Friday, yet another one of those lousy stocks crashed right on cue, as patent troll, er, I mean, “Intellectual Property” company Vringo fell 70% in a single day after their suit against Google got tossed out of court.

Over the last year, I’d highlighed Vringo repeatedly on some of my various platforms.

That is a similar, outcome to another “Intellectual Property” stock I’ve highlighted for you guys before, namely Spherix, about which I wrote, “Blah, blah. My bet is the stock will be back at under $5 and probably under a $1 this time next year…” almost exactly a year ago in an article that was called, “Facebook isn’t in a bubble … yet.”

Fast forward to today, and guess what, Spherix is barely above $1 share.

The marijuana penny stocks are down huge as are several other lousy stocks I’ve highlighted over the last few years, such as Short NQ and buy BIDU, RIMM is truly dead (RIMM now goes by BBRY, of course). Back from 2010, a now defunct company I highlighted for you dear readers called, A 123 AONE “While I’m not sure I’d put an outright $0 target on this one, but unless the company finds some serious funds for cheap in a hurry I wouldn’t cover it.

Contrary to a comment on my most recent Marketwatch Cody Word article, I’m wrong about a lot of things and I’m wrong about them often. Which is frankly, why I bring this all up. When we find a trend that’s working, we need to be opportunistic about how best to profit from that trend. And as the Nasdaq flirts with all-time highs in this bubble blowing bull market, I think there’s going to be a lot of questionable tech stocks that are going to pop no matter what happens with the broader markets in the near- or mid-term.

That is, where is the next VRNG, NQ, BBRY and A123 and how best can we most safely try to profit from its coming fall? At times, we’ve complemented our profits by catching the collapse of some of these stocks, but I never did get a position built for myself in Vringo or NQ despite my conviction in my bearish analysis for them.

I’m starting a brand new spreadsheet of lousy tech companies whose stocks are up huge which are likely to crash and I’d like your help. Put a comment below or come join the discussion with your “lousy tech company about to crash next” pick. If you nail one, I’ll be sure to highlight it when it hits. Thanks in advance as this should be fun and profitable if we do it right.

The Android Tablet update for Scutify is now available on Google Play. It contains our new home screen redesign plus a bunch of other goodies. Get it now – https://play.google.com/store/…