Trade Alert: A new “healthy” short (and two other trades)

It’s widely been reported that Herbalife “won” its war against Bill Ackman, a hedge fund manager who has long claimed that the company is built upon a pyramid scheme and that it doesn’t have a sustainable business model. Herbalife’s big “win” was that US Federal Trade Commission didn’t officially call the company an illegal pyramid scheme, but the government did rule that Herbalife’s entire business model was unfair and unsustainable enough that the government found it to be essentially illegal and is forcing Herbalife to completely re-do their entire business model. Here, read what the FTC itself found:

“This settlement will require Herbalife to fundamentally restructure its business so that participants are rewarded for what they sell, not how many people they recruit,” FTC Chairwoman Ramirez said. “Herbalife is going to have to start operating legitimately, making only truthful claims about how much money its members are likely to make, and it will have to compensate consumers for the losses they have suffered as a result of what we charge are unfair and deceptive practices.”

The coverage of the Herbalife/Ackman battle reminds me of how the media covered Brexit — the media breathlessly repeats whatever storyline catches traction. With Brexit, the storyline was that the markets and economy were in big trouble despite the fact that Brexit might was actually a positive for the markets and probably for the economy too. With Herbalife/Ackman, the story is that Ackman was wrong in his accusations against Herbalife despite the fact that he was right.

But go back to that FTC press release itself and read this key quote:

“This settlement will require Herbalife to fundamentally restructure its business so that participants are rewarded for what they sell, not how many people they recruit,” FTC Chairwoman Ramirez said.

Meanwhile, Herbalife’s chairman and chief executive officer, Michael O. Johnson, said in a written statement. “The settlements are an acknowledgment that our business model is sound.”

Do you see the incredible disconnect between his statement and that of the FTC? I would think that the SEC will find that statement from the CEO quite interesting. The SEC is apparently already looking at the company as Herbalife’s 10-k filing from February 25, 2016 says, “the Company has previously disclosed inquiries from the FTC, Securities and Exchange Commission and other governmental authorities.”

We’ve got a stock that has spiked after the company’s settled with the FTC, widely declared a “victory” for company despite that the company has been built upon recruiting other sales people who are forced to buy so-called “health” products is now being forced by the FTC itself to adopt a new, completely unproven business model.

Herbalife has invested billions over the years in its efforts to build a business around recruiting vs selling products. It’s not like it can flip a switch and start executing as a products-first company. Imagine trying to shift a business model at Herbalife which is incorporated in the Cayman Islands and has its principal operating subsidiary in Los Angeles, 8,000 employees and 4 million members into building an even stronger and more focused nutrition company that meets the needs of consumers in our 94 markets around the globe.

How good are these Herbalife “health” products that the company’s $6.2 billion valuation is now wholly dependent upon? Well, how does this sound to you?

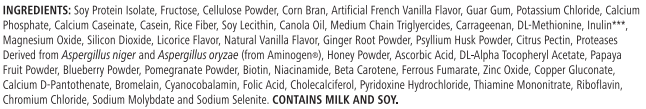

Here is the ingredient list for their protein drink mix:

Here’s the ingredient list for the Forumla 1 shake, which is labeled as healthy but is basically cancer in a can.

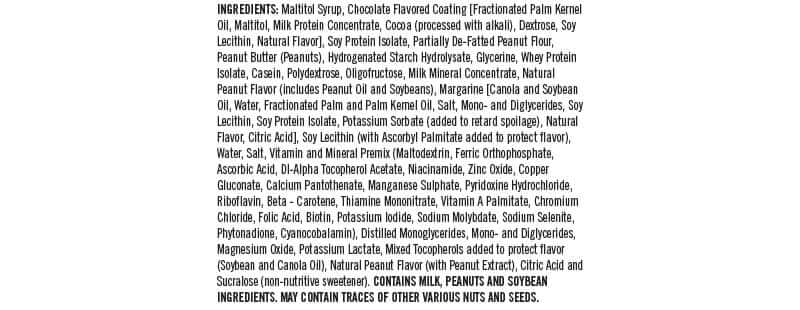

And the peanut butter protein bars:

Read this for more information on Herbalife ingredients and tell me how anyone can call this crap “healthy.” Heck, nowhere on its own history pages does Herbalife mention or explain the research and development of the actual Herbalife products as it focuses on the company’s previous business of “network marketing” Herbalife.

Herbalife trades at 15x this year’s earnings estimates and 16x next year’s earnings estimates, meaning that the two sellside analysts who cover the stock expect earnings to decline slightly in 2017 on 3-5% topline growth. I’ll be surprised if the company is able to meet those estimates. I expect that in the next quarterly earnings report or two, we’ll start to see the effects of this complete business model shift and how expensive it will be and how long it will end up taking. The company’s balance sheet isn’t great, as they had about $800 million in cash vs $1 billion in debt on the balance sheet and inventory risk beyond that.

Herbalife just reported earnings last week and says business will be steady into next year as they implement these changes. We’ll see if that holds up over the next two or three quarters.

Risks to being short this stock include the fact that smart investors like Carl Icahn and others have put a lot of money and reputation on the line betting on Herbalife and maybe it turns out that the company does pivot to its new business model and succeeds to new levels. The company does have ten more months to implement some of the changes to their business model so we could be very early even if we are right that the new unproven business model will be worth considerably less than today’s $6.2 billion valuation for Herbalife.

Here’s what I’m going to do. I’m going to start a new short position in HLF by shorting a small tranche of the common stock of about 1/3 of a full position and I am going to start a tiny position in some very long-dated puts with strike prices around $55-60 with expiration dates out into January and February of next year.

I’m also going to make a two other moves in the portfolio today.

I’m not pleased with FireEye’s most recent quarterly earnings report and the fact that the company is laying off people and retrenching. This is one of my small positions as it was part of the teenager stock basket along with Twitter and Lion’s Gate. I’m going to go ahead and sell the FireEye and move on from this name.

Meanwhile, I’m going to nibble a 1/3 position of Zillow $Z common stock, as the company reported strong 20% user growth and other strong growth metrics and I think it’s executing on our vision of disrupting the real estate commissions business via the App Revolution.