Trade Alert: Another Investment In The Space Revolution

The Space Revolution is, over the next five to ten years, going to change the world we live in (and the worlds we don’t live in too!). Here’s another bucket I want to stick out in front of this Space Revolution, which I fully expect to become the next trillion dollar market place.

I began writing this Space Revolution report about Astra/Holicity a few weeks ago right before Rocket Lab (VACQ) announced that they are coming public via a SPAC. I have long followed Rocket Lab and have wanted to invest in it for a long time now, and so I immediately shifted focus to it. As I have continued to research everything Space Revolution related and Astra/Holicity specifically, I am ready to pull the trigger on this name too, which announced their intention to leave the private markets as well a few weeks earlier.

In my recent Trade Alert about Rocket Lab, I referred to a handful of space companies coming public via SPACs. Today, I’m bringing you another one of those names that I feel has also positioned themselves to be one of the big winners in the coming multi-trillion dollar Space Revolution. The company is called Astra. Just like Rocket Lab, it’s also being brought public by a SPAC, this one trading under the symbol HOL for now. Astra is similar to Rocket Lab (and also a competitor of) in that it is building a vertically integrated rocket platform to help their customers optimize their ability to get their small satellites into orbit. Although there are many similarities between the two companies, one major difference is in the portable system that Astra uses to launch their rockets into space. Astra can pack their launch system in four shipping containers and deliver it along with five people anywhere on the globe and launch a rocket in as little as five days. This mass produced launch system can be shipped via train, truck, ship or even loaded onto a C-130 transport plane and delivered anywhere in the world.

Chris Kemp, Astra CEO, “At the foundation of our platform is the software that helps us optimize the cost structure of our business, from our supply chain to the materials and the labor that go into operating our launches and our company, to the systems that allow us to automate the manufacturing and the launch of our rockets. Astra fundamentally is a software company that is understanding and collecting data about every aspect of our business all the time, and that allows our engineers to focus on improving the efficiency, productivity, and cost structure of our space operations.”

Astra builds rockets that are scalable to the point they plan on being able to build quickly enough that they can have daily launches by 2025. Astra’s rocket factory is located on the old Alameda Naval Air Station just outside of San Francisco. This former naval jet engine test facility provides some built-in efficiencies for Astra. They are able to literally have raw materials brought in one door of the factory and then wheel a manufactured rocket out another door and then test it on-site. As I mentioned earlier, they then take the finished rocket and launch system and in a matter of days after receiving their customer’s payload, deploy their mobile launch system to any spaceport (any gravel or concrete pad with a fence around it) in the world.

Unlike other companies, all the development, manufacturing and testing occurs on one campus. You can check out a video of the factory here. These efficiencies are evident by Astra’s ability to quickly change their rocket based on changes in the markets in which they serve. After their first test launch in 2018, Astra learned that the market was dictating a larger rocket. Based on their customer’s demands, they successfully doubled the size of the rocket which they launched in 2020.

Another area in which Astra’s efficiencies show is in their work in taking advantage of all of their rocket’s available space. Astra is currently working on a satellite bus that is shaped like a disc so that they would be able to efficiently stack these disc satellites on top of each other, efficiently filling up the capacity of the rocket. This is similar to how SpaceX has stacked their Starlink satellites into a Falcon 9 rocket. Astra’s satellite discs are basically routers for space, building a server-like platform for their customers to attach their devices like radios, cameras, etc directly to Astra’s satellites before they are launched. This concept will allow Astra’s customers to take their concepts and payloads and rapidly deploy them to a constellation in a matter of months, not the years that it would take to design their own satellites.

As my team and I have been spending a lot of time researching SPACs recently, one of the factors that we think will be in determining success and failure of a SPAC is the experience of the team behind the SPAC (both the founders of the company and the sponsor of the SPAC). This is one area where Astra and Holicity really shine. Chris Kemp, co-founder, Chairman and CEO of Astra has a background in both space and building companies. Kemp was formerly CTO of a little space organization called NASA, where among other things, he helped form a partnership between NASA and Google. Co-founder of Astra, Adam London, has an equally impressive resume. He was founder of Ventions, which later became Astra, where he worked in a partnership with NASA and DARPA in designing small rockets. Dr. London, has a PhD in Aerospace Engineering from MIT. Other members of the executive team have been plucked from companies such as SpaceX, Blue Origin, Virgin Galactic, and Apple. The sponsor of the SPAC, Pendrell, was founded by Craig McCaw. McCaw is a billionaire investor whom I’ve met over the years and who has partnered once again with Bill Gates on this venture and who he has clearly had a lot of success in space, telecom and wireless broadband over the past three decades.

Now back to the company itself. Astra got to space faster than any private company in history. It took them only four years. As a comparison to other space companies, it took SpaceX seven years, Rocket Lab twelve years, and Virgin Orbit thirteen years. After being founded in 2016, Astra had their first “successful” launch in December of 2020. I put “successful” in quotes because although it passed the Karman line (100km altitude, commonly used as the demarcation of space), the rocket ran out of fuel about 12-15 seconds early and didn’t reach orbit. Astra was “beyond ecstatic” about the launch and they believe that they can easily correct the problem with a small tweak to the rocket’s fuel mixture of kerosene and liquid oxygen. Here’s the video of the launch.

Astra is planning their first commercial launch this summer, and they have their first 50 launches already under contract which represent more than $150 million of revenue. In December 2020, Astra was awarded a NASA contract, called Mission One, to launch 30 kgs of cubesats to orbit. Presenting the award, NASA said, “Astra provided the best value to the agency, the strongest technological solution, and the most mature launch vehicle of their peers.” In addition to Misson One, Astra was also awarded a February 2021 contract from NASA to launch six additional cubesats into three different orbits in 2022. In this awarded contract Astra beat out four other competitors whose names we are familiar with. They include Rocket Lab, Momentus, Virgin Orbit, and even SpaceX. In the source selection statement, NASA said the contract came down to two finalists, Astra and Rocket Lab with Astra winning based on a much lower price. I am sure that Astra founder Chris Kemp’s time at NASA didn’t hurt either.

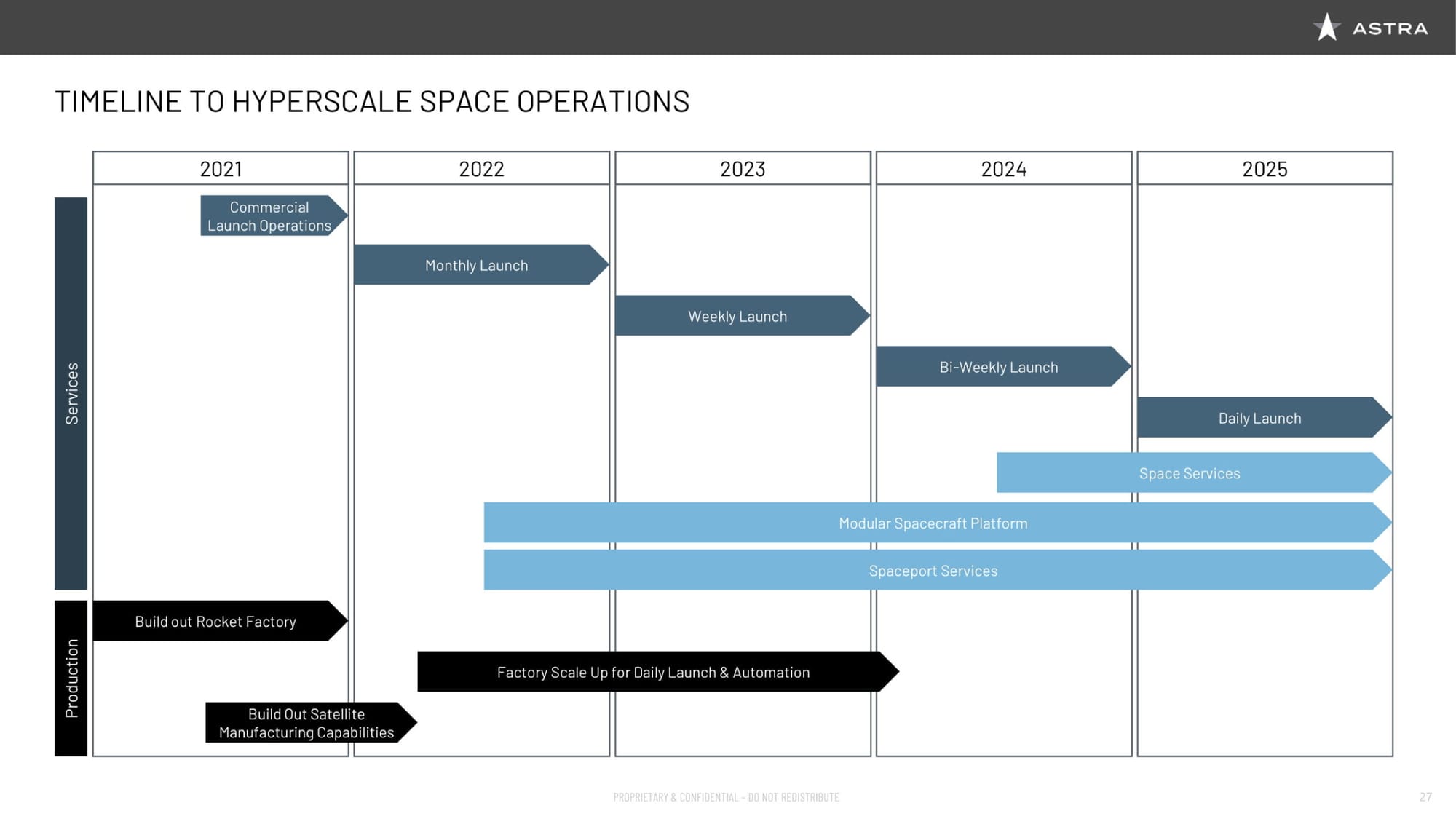

They also have a pipeline of $1.2 billion in contracts currently being negotiated in areas such as broadband satellites, earth observation satellites and satellites to send data to all the autonomous vehicles in that coming revolution. Starting with their next launch planned for this summer, launch cadence increases rapidly. They expect to scale to monthly launches in the fourth quarter of this year (recently moved up from early next year), to weekly in 2023, bi-weekly in 2024, and finally up to daily in 2025. If that pans out, that’s A LOT of revenue. In scaling up to their daily launch capability in 2025, Astra sees economies of scale bringing down their costs to build the rockets. They are targeting a cost of $500,000 to build a rocket capable of launching 500 kg in 2025. That cost of $1000/kg of costs compares very favorably to that of the larger reusable rockets in the market.

As the demand for small satellite launch explodes, Astra has positioned themselves in a great place to be one of the few companies able to meet that demand. They see over 38,000 satellites being built and launched over the next decade, of which about 90% will be the small satellites that Astra is focused launching with their current rocket. They see the majority of the demand coming from:

- Global broadband connectivity

- IOT

- Machine-to-machine

- Earth observation

- National security

- Next generation weather observation and forecasting, GPS, etc.

All of these capabilities are being deployed with a large number of small satellites. Due to the upgrade cycle of 3-5 years on small satellites, Astra and other launch companies will likely have escalating demand for their launch services as older satellites get replaced.

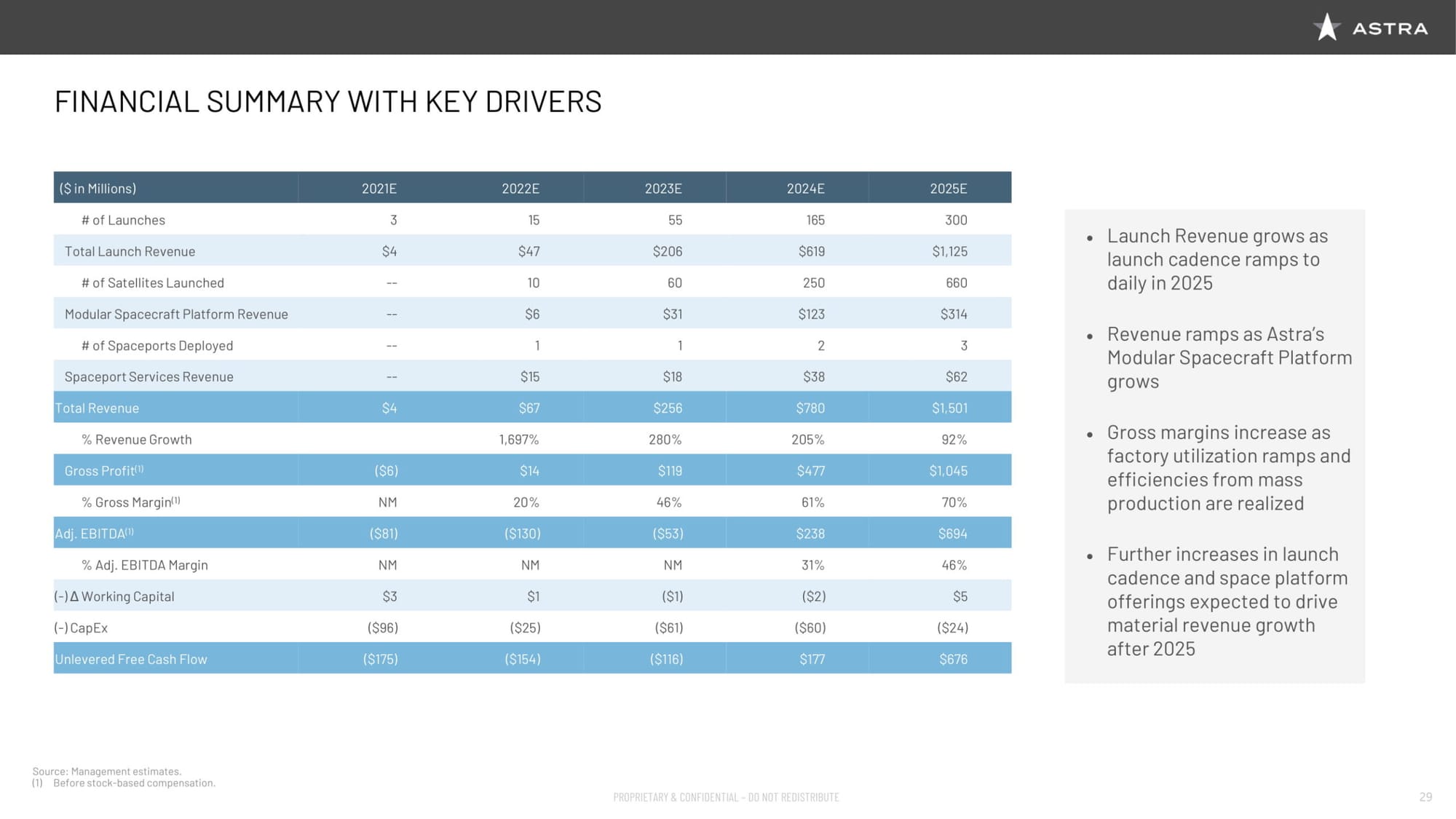

Let’s take a look at their financials. As with a lot of companies going public via a SPAC, Astra currently doesn’t produce much revenue (forecasting $4M this year). However, as you can see from the chart below, they are forecasting their revenue to begin increasing exponentially up to $1.5B in 2025.

During the investor presentation earlier this month, Astra CFO, Kelyn Brannon sees the company becoming both profitable and free cash flow positive sometime in 2024. As part of the SPAC process, Astra will end up with almost $500 million in cash with no debt at a current valuation of about $3 billion based on the current stock quote of about $12-13 which they see as fully funding their growth until free cash flow begins to fund any additional investments into the business that are needed. I actually would be surprised if they don’t come back to the markets for more cash at some point in the next year or two if/when their stock takes off. Also during this time, the company sees growth margins increasing to around 70% when they are fully up to scale — that would be some impressive profitability if it happens.

Astra is skating their business to where the Space Revolution is going, not where it has been. There are likely to be one of the big winners in space if they can deliver on all this vision.

My team and I are working day and night to find the best and safest ways to invest in the Space Revolution. Just like with VACQ, I see this stock as an opportunity for us to get into a venture capital-type investment at an attractive valuation of around $3 billion (even less than VACQ) before The Space Revolution becomes a multi-TRILLION dollar market.