Trade Alert: Avoiding The Frauds, Finding The Opportunities

It’s sad to think about all the hundreds of billions of dollars that have been torched as Wall Street met what seemed like endless demand for new issues with a bunch of not-so-good companies. Whenever I scroll through any lists of small- to mid-cap stocks, I’m amazed at how many of them are so bad. The prospects are questionable, they’re burning through cash, sometimes management has been turned over (and over) and their stock charts are terrible — I’d guess that 90% of the individual small- to mid-cap stock charts I look at on a daily basis are down more than 80% from their highs last year and that 80% of them are down 80% from their SPAC/IPO levels where they came public at. Some of these companies sold themselves to the public at $10 and sold their company out to another bidder later at $1 or $2 per share. Likewise, hundreds of the small- to mid-cap companies/stocks that have been around trading publicly for years that were penny stocks before the Great Bubble-Blowing Bull Market took them up 10-20 fold are mostly back to their penny stock status and/or headed right back to those levels now.

Part of the problem with the broader stock market right now, is the incredible amount of crappy stocks out there that need to just go away. Reminder: There are thousands of different stocks out there that are headed to zero. Many of them are frauds. Many others are going to run out of money long before they ever get profitability.

I’m not sure that there’s a single stock that I have said was a good-looking shortselling opportunity because I thought their stock was headed much lower during 2021 and/or earlier this year that hasn’t crashed. Each of the stocks in bold in the reprinted article about all the fraud in the markets that I wrote back 18 months ago are down 80% or 90% or more from their highs last year.

There are, of course, hundreds of these small- to mid-cap stocks which have been demolished but which will eventually bottom and will even rise again, some of which will go up 10-fold or 100-fold. But the majority of the current batch of small- to mid-cap stocks that I look at on a daily basis are headed to zero in the next year or three.

I have been shorting some IWM and shorting some TAN as well as buying IWM and TAN puts any time the small cap indices rally. And I continue to selectively buy puts on some of the stocks with the worst fundamental outlooks, including NIO, CVNA, VUZI, DWAC. I don’t think that we’ll make our big money on these shorts and I do think it’s very important to continue to avoid owning the worst of the crap out there.

We’re starting to get some good buying opportunities as the markets throw out some of the babies with the small cap bathwater, but we’ll have to be careful, as always, along the way.

A couple other Trade Alerts to mention:

I’ve been nibbling some TSLA call options again, dated out to next week with strikes around $185 or higher. These are lottery tickets on a potential pop from the little covered Tesla Semi Delivery Event coming up on Thursday this week. I’m obviously not sure that the stock will pop after the event, but I do like the fact that the event doesn’t seem to be being talked about at all by analysts, media or anyone else. They talk about Elon every 20 minutes on the finance news channels but haven’t mentioned the semi event once that I know of.

I sold my ADBE common stock for a nice short-term gain. I’ll revisit it again if it gets down to the levels where we bought it last time, but I want to free up that capital again for now.

We’ll do this week’s Live Q&A Chat Thursday morning at 10am ET. Join me in the TWC Chat Room or just email us your question to support@tradingwithcody.com.

Finally, here’s a reprint of one of the many articles I wrote last year warning about the troubled times for bulls and the frauds coming to roost:

Trade Alert: Beware The Frauds When The Tide Goes Out

May 27, 2021 by Cody Willard

Back like 15 years ago, I started a company called “TubeRevolution.com” which was a site where we filtered and organized all the Hollywood and/or other major copyrighted content on YouTube. I was approached by a friend who wanted me to meet a friend of his who owned another video streaming start up. I took the meeting and when I got to the penthouse office suites in a high rise just off of Wall Street, I was greeted by a tall Swedish woman who would have passed for a model at Ford’s. She took me into a long, tall room with a 300-year old oak table glistening from the sun’s reflections and the Atlantic Ocean below many floors below us.

I sat down and in walked a team of three very handsome and well-dressed 30-something year old men and behind them, their boss, the man I was here to talk with about how we could do business together. Mr. Jones, let’s call him, was a rotund and bald with long white wisps of hair falling from the sides and back of his head down to his shoulders. Dressed impeccably in a navy blue pinstriped suit, bankers shirt with diamond pinky rings on both fingers with gold and diamond cufflinks glistening in that bright sunlight from the incredible views outside.

We talked for a bit and then he explained that he actually wanted to buy my company for stock from the publicly-traded video streaming company he owned. He gave me the symbol (which I wrote down because no smartphones back then) and some pamphlets about the company and the stock and invited me to dinner at Delmonico’s the steakhouse below us.

At Delmonico’s the next night, I was greeted at the door by name by the maitre de. They took me to a large table in the back the restaurant and sat me down with an 30-year old scotch. A few minutes later, Mr. Jones and his team of 30 year old men joined me at the table. I’d already figured out that I wasn’t going to be selling my company to Mr. Jones because I’d looked him up and found his criminal record for fraud and I’d found that the symbol of his streaming company had last year been trading under a different symbol as a shell. But I did enjoy that night of listening to his stories, his charm and eating one of the best meals of my life on his tab.

…

A couple nights ago, I grabbed another random book off my library’s shelves and started reading The Fountain Pen Conspiracy: How a few dozen professional swindlers are fleecing hundreds of millions of dollars from banks, businesses and private investors — and why they are getting away with it. I’d taken possession of this now out-of-print book when we’d cleaned out the office of my wife’s grandfather after he died at the age of 98 a few years ago. Over the years, he’d worked as a railroad worker, a banker, a mayor, a liquor store owner and a renowned expert on the state of New Mexico and Lincoln County. Here’s a picture of him (he’s the man on the right):

I was shocked at how relevant the book is to what I’m working on right now — finding frauds on Wall Street. I’d mentioned the other day that “I’m worried that there’s a lot of fraud in the small cap stock market and probably some major cap fraud is going on out there too. And when that gets revealed, many companies won’t ever come back as their stocks head to $0.”

I couldn’t believe it when the book explained Mr. Jones scheme in such accurate detail from 35 years before I’d met Mr. Jones. It’s absolutely disgusting that 50 years after this book was written that these scams still exist and are probably being used by hundreds of companies in the stock market right now.

The Con-Glom Game, as Jonathan Kwitny, the author of The Fountain Pen Conspiracy, calls the above scheme is a scheme that I’ve seen firsthand in decades past and I’m sure it’s going on right now all over the place, including in some mega cap roll up stocks. I’ll let Jonathan explain The Con-Glom Game for us:

Two Florida couples sold Coronet Kitchens, their sink and cabinet business, to a small cap publicly-traded conglomerate called Comutrix (it went to $0 of course) in return they received Comutrix stock. They later published a four-page pamphlet explaining how they’d gotten conned.

- Cause to be printed a large amount of “stock certificates.” This may call for an initial outlay of up to $3 unless the printers will accept “shares.”…

- Locate a thriving little business. Go into impressive detail concerning the advantages of a cooperative group of businesses: buying in great bulk, no problem of meeting bills when due, retirement with nary a financial worry. Outline the assets you have already- perhaps huge tracts of valuable land. (Be sure to locate this in a distant state.…) Wave some “shares” under [the owner’s] nose. (“Shares” have gold embossings somewhere on them….) If your pigeon hesitates, or asks absurd questions, offer him an “employment contract.” This can be for any number of years he demands- it probably won’t hold up in court, and how long will there be anything to “manage” after all? Then, too, he sometimes is so obtuse as to be ungrateful for your efforts on his behalf, calls you a son of a bitch and quits, relieving you of responsibility for his declining years.

- That was the hard part. Now the business is yours. Go immediately and borrow as much money on it as you can get. You may be able to do this in several places if you have practiced being sincere….

- You will now receive (so easy it comes in the mail!) “income” from your company. Place it in a checking account for your day-to-day living expenses. (For those little extras, just write more checks. If the bank gets sticky about your “overdraft”… take your business to another bank.)

- Pay no bills. This is very important as it depletes your “account” and you have to change banks oftener.

- Maintain your hold as long as possible. Many customers keep paying their bills.

- Sometimes “suppliers” become very nasty about payment. Explain sincerely [about] poor management (mention your helplessness in improving it- remember “employment contract” in Number 2)….

- This is called “back to the wall.” Banks, suppliers, even your own government have become critical of you. You may be able to sell [back] to the old, inept management, if they are maudlin about it, and can borrow the money.

- If this ploy fails, there is a system which protects you called “bankruptcy.” This means you sell the paper clips and coffee pot that are not in hock and give everybody a fair share [of the proceeds].

- Now you’ve earned your money. Enjoy it.

…

There was a time when I was invited to fly out to Vancouver to meet with an investment banker dude who said he wanted to pay me a bunch of money for my analysis that he’d been reading online. So I agreed to go up and meet with him if he’d fly me out and put me up in a nice way. I was excited to see what he was proposing until I walked into, you guessed it…the penthouse floor of a beautiful highrise building in downtown Vancouver. On the wall was a billboard that was streaming stock quotes for….penny stocks. And it was then that I realized that this guy was going to pitch me on a pump-and-dump scheme.

I was greeted by a woman who took me into another beautiful conference room, this one with a giant dark glass table and stylish modern chairs. In walked a short, handsome man with a slight Indian accent. He explained that he did indeed want to give me hundreds of thousand of dollars in cash and millions of dollars in stock if I’d write about said stock for my audience. You know, like pump it up for him. I was like, “No, that ain’t gonna happen. But thanks for flying me out here and for the nice hotel. I’ll be heading back home to NM tomorrow morning. Peace.”

…

The Corporate Shell Game, which this Vancouver was running as he wanted me to be “the promoter”, works as follows according to Jonathan Kwitny,:

“Having equipped themselves with a promotor, a lawyer, and a professional stock transfer agent, the swindlers now needed a publicly tradable vehicle into which they could put the fake assets they claimed to own. Before a company can offer its stock to the public, it must register with the SEC. As part of the registration, the responsible corporate officers must file sworn statements detailing the company’s financial status. These statements are carefully examined and criminal charges can result of they are inaccurate. The swindlers couldn’t send their fake assets through an SEC registration. They had to place the fake assets in a company that already had been approved for trading. Then they could sell the scheme to the public without need of further government approval. So they resorted to what’s called the shell game.

A shell is a corporation without substantial assets — usually a company that went broke and became dormant without bothering to call in its stock and formally resign from existence. Busted companies that have completed an SEC registration often don’t want to go out of business officially since the corporate shell is a marketable asset in itself. The misuse of corporate shells has played an important part in the rise of swindlers.”

The scams, the schemes, the bad actors are out there right now, more than ever, because of how strong the markets have been for so many speculative asset classes for the last year.

Mr. Jones passed away a few years ago. He continued to read my analysis up until his death and would occasionally send me some nice feedback. I never heard from the Vancouver dude again, of course. I’d be willing to bet that the Vancouver dude has some SPAC-related and/or new reverse merger shell game schemes going on right now. Mr. Jones probably would already have taken several questionable companies public via his own SPACs if he were still around right now.

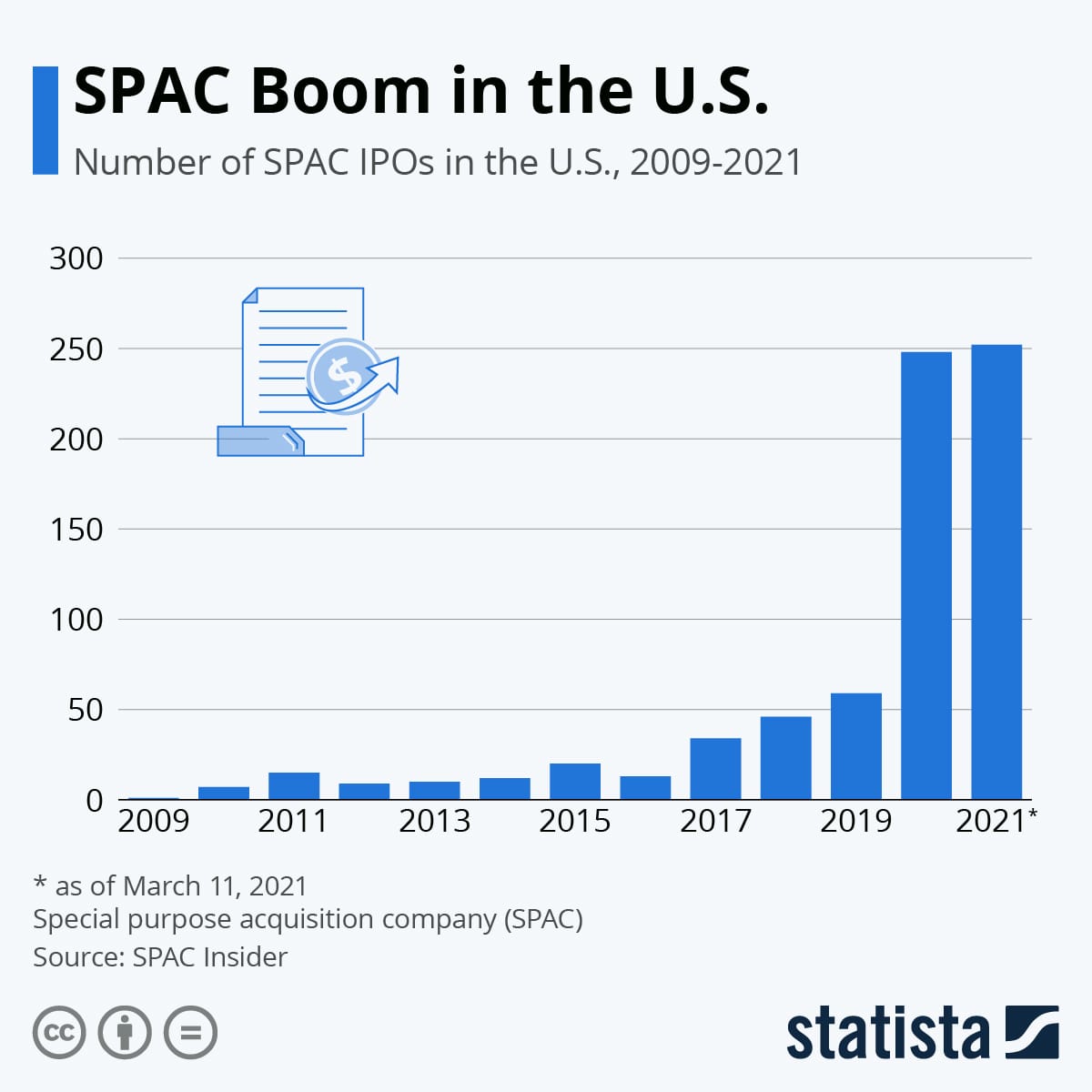

Look, we clearly just went through a bubble in SPACs and in cryptos and (perhaps to a lesser extent) in small cap tech stocks:

And when you’re in a bubble, there’s going to be a lot of bad actors on Wall Street and in corporate offices who are going to fleece a lot of unsuspecting investors and business people.

Where there’s loopholes and opportunities for bad actors to do bad things, there will be bad actors doing bad things. And clearly, as we just saw with the Archegos Capital blow up that cost (fleeced?) Wall Street tens of billions of dollars, there’s clearly some loopholes and opportunities for bad actors to do bad things and they are doing them. What’s the old Warren Buffett saying about “When the tide goes out, you find out who’s swimming naked.”

Additionally, a lot of companies that have come public in the last year or two via SPACs or IPOs or reverse shell mergers or shady spinoffs, will simply run into bad luck, tough problems and crises that will drive them out of business and take their stocks to zero. Even if they’re not frauds.

And it’s not just recent small cap stocks we should be worried about. Fraud is more rampant in the corporate office than you might expect. I’m not talking about Enron. I’m talking about the great late CEO of Apple, Steve Jobs. Does anybody recall when Steve and Apple’s CFO and general counsel rewrote all of their option packages with much lower strike prices and (probably fraudulent) backdated date stamps?

” During a meeting in 2001, Apple’s board of directors awards Steve Jobs new stock options that will become part of a stock-backdating scandal several years later.

When the matter eventually ends up in court, Apple’s former general counsel pays $2.2 million to settle charges that she backdated stock options for Jobs, herself and others — and created fake paperwork to hide this fact.”

I wrote about this back when the company finally admitted that they’d issued Steve options at a different strike price than they’d told us about and that it mattered when I was trying to do the fundamental analysis on a fully diluted per share basis because the company had seemingly purposely done this to make their numbers look better than they otherwise would have.

Like, do we not think there’s shady stuff happening right now?

In the grand scheme of things, most stocks won’t go to $0, won’t have fraud problems and many will go up from these current levels. I am actively on the hunt for some new names to buy that I think could go up 5-fold or more in the next year or two.

But I tend to think that this year will be much harder for the bulls than the last ten years or so has been. On the other hand, I think we have some opportunities to find some of these frauds and/or companies that came public with big promises and big hype but little substance. I’ll be mentioning some of the names I find that I will be betting against this year by shorting and/or buying puts. I’ve already started small short positions betting that the following stocks are headed lower: PLUG, BLNK, EXPI, MARA, RIOT. I think there’s a ton of fraud in the crypto markets. I think that most cryptos are headed much lower this year and that 90% of the current batch of cryptos are headed to, yes, $0.

Remember that we were aggressively buying tech stocks and cryptos in years past when nobody wanted them. These days, everybody wants tech stocks and cryptos. Be careful out there, don’t be greedy and don’t let yourself risk money on anything fishy out there. And there’s a lot of fishy stuff that’s come out in the last year.

There will be some great buying opportunities and some great themes to invest in at good prices this year. Stay tuned for that but be patient in the meantime.

We’ll do this week’s Live Q&A Chat Thursday morning at 10am ET. Join me in the TWC Chat Room or just email us your question to support@tradingwithcody.com.

Cody back in real-time Nov 2022 again. I do still short and/or buy puts on PLUG, BLNK, EXPI, MARA and RIOT when they put on big rallies sometimes, but I do not have any exposure to those names right this minute. I do think they are all headed much lower still. Be careful out there. But don’t be scared.