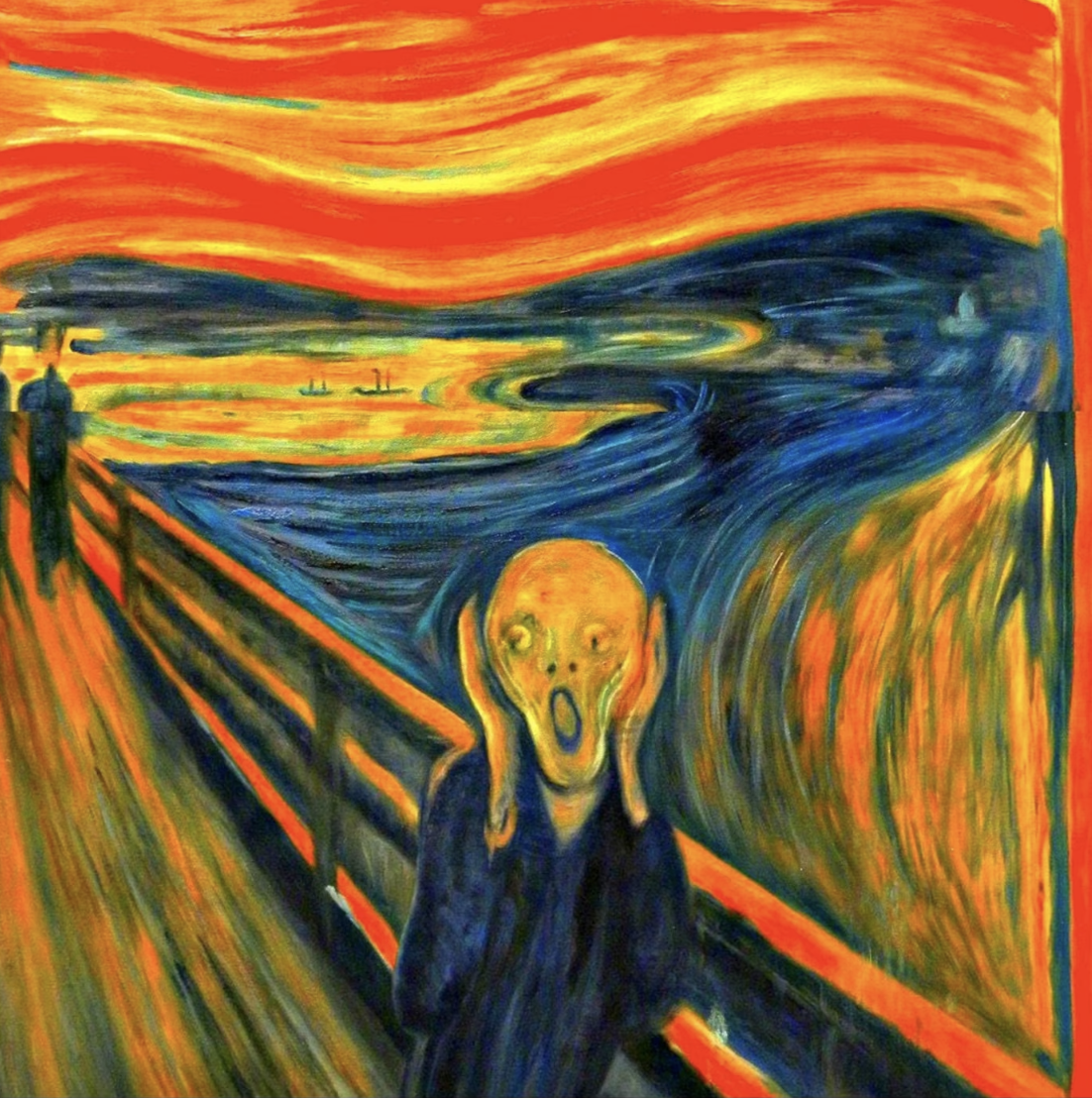

Trade Alert: Be Cool When Others Are Panicking

“The five day forecast, the Dow Jones average,

The price of beer, cigarettes, bread, milk and pampers

Life is a test and we all got the answers” – Mos Def

The hardest trade to make is often the right one. Emotions are the enemy. Be cool when others are panicking. The consensus is usually wrong.

These are words of wisdom that I’ve learned repeatedly over the nearly three decades that I’ve been on Wall Street.

So what’s the hardest trade to make right now? Buying and covering shorts and selling some of the puts we have on in the hedge fund.

What’s the emotions you’re feeling right now? Worry and dismay is probably what most traders, investors and retail meme lovers are feeling right now. The time to worry was a month or two ago when the markets were climbing steadily and the good stocks were rocking nearly every short-worthy crappy stock was in rally mode too.

What are others panicking about right now? Higher rates and lower stock prices.

What’s the consensus right now? The consensus is, at least as of this week, that rates are going much higher and like, right now. The consensus is also now sure that stocks are in a bear market and that it’s easy to short bonds and to short stocks and to sell, sell, sell!

What should we be doing, what am I doing today? I’m selling puts, covering some of our shorts. As of this morning, I’m closed out our QQQ hedge, and closed out half of our DIA, almost half of our IWM/VTWO/Russell 2000 small caps and I’ve sold a third or more of our SMH and SOXX puts. A few weeks ago, at much higher levels, I wrote about how my favorite shorts included: AI, APLD, AVGO, BE, CLSK, GDRX, RUN, SPWR, SMH, WCLD. As of the time of this writing, I have closed out the AI, BE, GDRX, RUN, SPWR, and WCLD shorts/puts.

We’ve bought a little bit of Amazon AMZN, some Instacart Maple Bear CART (more about this name later), some gold GLD, some NET, a few SHOP calls dated out to next week with strikes around $49 to $50, and even some TLT calls dated out to next week with strikes around $86 to $87.

I’m not sure the sell-off is over and I’m not sure that rates are headed lower tomorrow, but I want to listen to those wise words and follow the lessons I’ve learned over the years. Being disciplined and steady in our approach.