Trade Alert: Biotech microcap buy and a biotech ETF short

There’s a lot of consolidation out there in the broader markets and in technology in particular and in semiconductor stocks specifically.

Two of our own positions, EZCH and SYNA are up big in the last week on consolidation moves. EZCH is being bought by an Israeli competitor and SYNA turned down a $108 offer from a Chinese semiconductor firm.

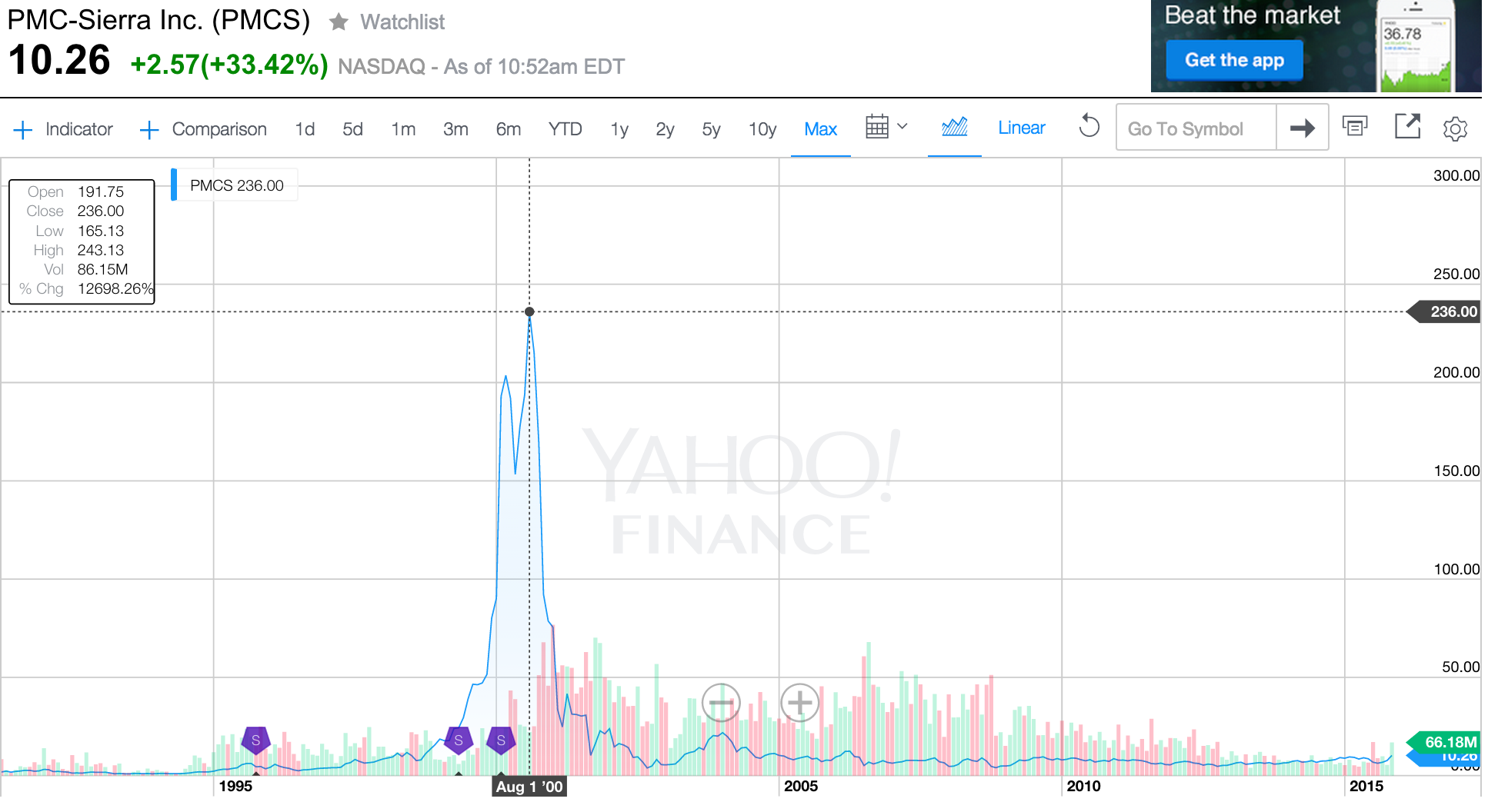

The consolidation continues as just today, $PMCS announces that it is to be bought by $SWKS for $2BB. Did you know that even with today’s 33% pop in $PMCS that it’s still down 96% from its all-time highs when it was worth more than $100BB? Tech stocks were truly bubbled back in 2000 and many never got back close to those highs. Is biotech set up to look the same fifteen years from now?

I’m also going to add a new name to my portfolio. And it’s going to surprise you given how bearish I’ve been on biotech and the fact that, as you’ll see below, I’m adding some IBB puts to my portfolio today.

You guys know that I‘m very leery about investing in penny stocks and/or stocks that came public through a reverse merger. So you can imagine how seriously I’ve taken my homework on researching this new pick that is indeed a small cap company that came public through a reverse merger and is practically a penny stock, trading at less than $5 a share.

Axogen AXGN is a biotech company that’s pioneering a brand new way for surgeons to rebuild and reconnect and save nerves in all kinds of surgeries. My best friend from college from twenty years ago at UNM is nowadays a hand transplant and reconstructive surgeon in Baltimore and he’s been using this company’s nerve connect technology in nerve reconstruction for patients where either the patient doesn’t want the morbidity of having nerves from another part of their body harvested to reconstruct a nerve elsewhere, or they don’t have enough nerve for him to harvest to reconstruct another nerve. My friend introduced me to this company when he was staying with me in NM recently and we were talking about his ground breaking work.

Now to be sure there is something almost morbid itself in this company’s patent-protected approach where they are sourcing nerves and nerve tissues from cadavers. These nerve tissues are processed, sterilized and otherwise prepared for use in surgeries. On the other hand, the goal of the product is to save the patient some morbidity by not having to have their own nerves harvested.

I spent a couple hours on the phone recently with the CEO and founder of Axogen, Karen Zaderej, a few weeks ago and came away very impressed with her and the companies long-term strategies and technological road map. I asked her why the company had come public through a reverse merger and she explained that when the company had finally prepared their product and process for the regulatory approval in 2008 that the financial markets had all but shut down and they were desperate for any cash infusion to keep the company going to get their products to market. The reverse merger got them access to a small amount of public money and the the market cap has slowly grown since then. Mind you this Axogen reverse merger should be a red flag as any reverse merger stock should be, but there are times to make exceptions and these insiders like the CEO aren’t unloading their shares onto hyped-up retail investors like those pot-penny stock pushers I always bash relentlessly do. Most important to us as investors, they have real revenues with very high margins that are growing quickly.

With 80% plus gross margins, the company will do nearly $25 million in sales this year up 50% this year, growing another 30% plus next year potentially growing into $1 billion a year in a few more years, as the company thinks there is already a $2.4 billion addressable nerve treatment industry.

So look, this is a tiny market cap stock at about $120 million and should be considered a very high risk venture capitalist investment that will take 3-5 years to playout and could end up a total bust if the company fails to manage growth or gets destroyed by some larger company that tries to get into the marketplace.

The company recently raised another $17 million for its balance sheet from, selling nearly 5 million new shares to Essex Woodland Fund IX, which invests in biotech companies. Axogen now has more cash than debt, though it is still spending money to grow. The company now has more than $30 million cash vs $25 million in debt on the balance sheet.

The stock will likely be wildly volatile and it already has been since I’ve been doing my work on it. I first started working on it in early August when the stock was at $3.80. It was still near those levels when I spoke to the CEO the first time, on August 20. And then it took off on me, while I was still researching it and working on my homework by talking to my hand transplant doctor friend and getting my arms around the company’s potential. I waited patiently for it to peak and hopefully come back down to earth after it spiked to nearly $6 per share just a couple weeks ago.

Obviously the company could also end up being swallowed by a larger competitor too and they likely would be open to selling at the right price along the way. High-risk, small cap biotech investing is not for the faint of heart and not suitable for a large chunk of your money. But I’m going to nibble a tiny flyer here of this stock to hold for the next 3-5 years at least. And I’ll look to add to it especially if the stock continues to sell off.

PMCS’s history over the last fifteen years, crashing and never recovering from its year 2000 glory days just might end up “rhyming” with some of biotech’s highest flyers and the future of their stocks.

For example, will $BIIB ever get back to $500 and its $100BB market cap?

On that note, I think it’s time to put our biotech index hedge back on the sheets. I’m going to nibble some IBB puts personally, using a $280 strike price dated out into January. I’ll add a little more puts if IBB pops in the near-term. I’ve been patient in letting the biotech sector bubble but with it down 20% from its highs, it looks like that bubble might be popping in front of our eyes presently. Furthermore, if the broader markets rally into year end, I expect that our growth Revolution Investing tech stocks will far outperform biotech which is likely seeing its bubbled bullish pendulum swinging back the other direction if I may mix metaphors.

Always remember that it’s best to sell when things are as “good as they can get” and I think biotech’s 90% gross margins are as good as they can get. I expect that the biotech industry’s pricing is about to be questioned and scrutinized as the government is setting the prices for the industry and the taxpayer is doing most of the paying for the treatments that are being marked up 10x what their actual cost is.