Trade Alert: Bullish On Wolf, Rivian and Tesla; Bearish on Fisker and Lucid and GM etc

First off, let me mention that we are picking up a little bit of Wolfspeed pre-market with the stock getting hit this morning. WOLF actually beat topline and bottom line estimates for the quarter but the market is punishing the stock because management lowered their FY24 revenue guidance down to $1.0-$1.1bb from $1.6bb. The reason for the reduction in full-year revenue is because of the delayed ramp of 200mm wafer production from their new Mohawk Valley fab. While the company was actually able to ship the first material from this new fab, they are having supply-chain issues which will keep their production low this year. Essentially, the revenue the market was expecting to see in FY24 won’t materialize until FY25. However, this is long-term bet for us and the company made clear that the demand for SiC chips is on the rise. Both automotive and non-automotive design-ins are through the roof with the cumulative total design-ins now at around $18bb with $1.7bb new design-ins in Q3 alone. WOLF is making a revolutionary new type of semiconductor that is more efficient and powerful than traditional silicon chips. Even with the 1-year delay in the ramp of the new fab, we still have WOLF at roughly an 11 P/P 3 years out and 2.7 P/P 5 years out. While the company will need to raise another $1bb in cash this year to continue the ramp of the new fab, we are confident that they can secure additional financing. Remember this is still a somewhat speculative investment and we don’t want to rush into this even with the stock down big.

Image Source: BBC.

Let’s start off with the trade alert: we bought some TSLA and RIVN this week and also put on some FSR and LCID puts back on the sheets. Fisker rallied this week on news that European authorities will allow it to begin deliveries of its Ocean SUVs. Lucid is also up perhaps in sympathy with Fisker. Meanwhile, Tesla was down another ~4% yesterday following a downgrade in a continuation of the selloff following Tesla’s series of price cuts this year. As we mentioned in the Latest Positions report, Tesla has now cut prices 6 times this year.

Remember that as always, we never rush into any of these positions and use tranches to slowly build up the position over time.

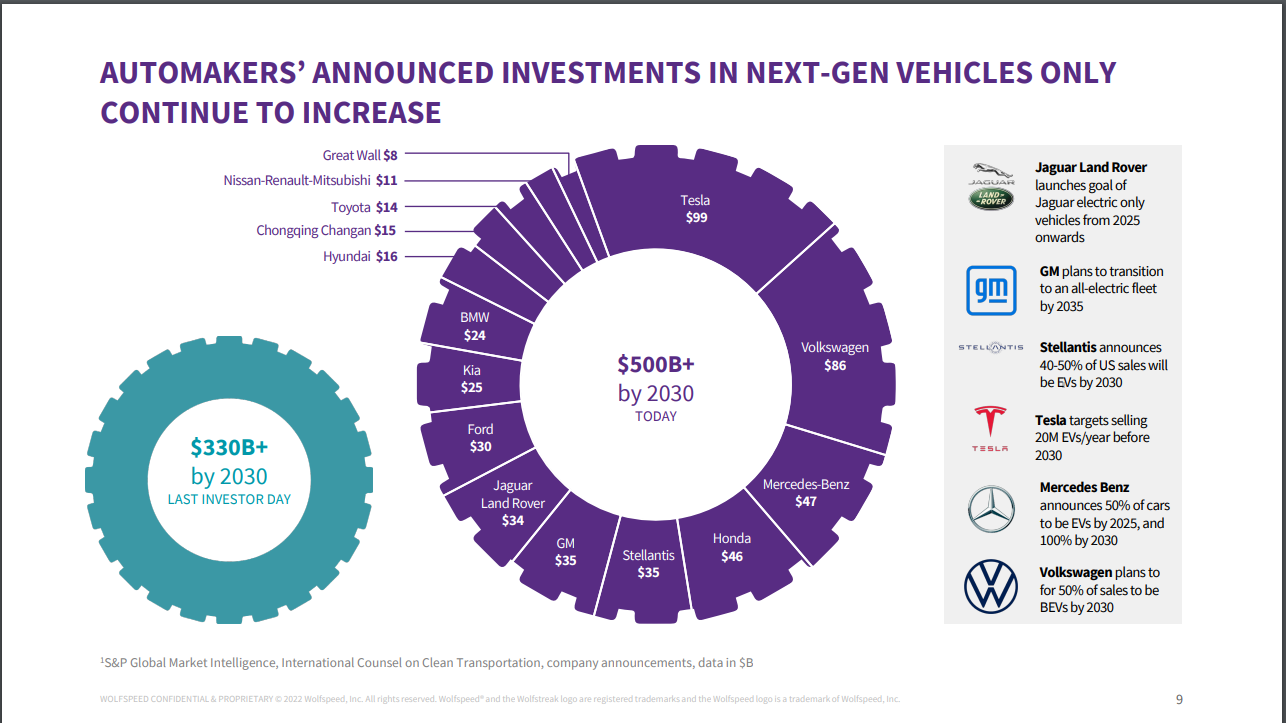

So let’s talk about EVs for a minute and explain why we are trading these names today. The EV landscape has quickly become a crowded field since we started buying Tesla in April of 2019. Just look at this chart from Wolfspeed which tracks the committed investments by various automakers in EVs:

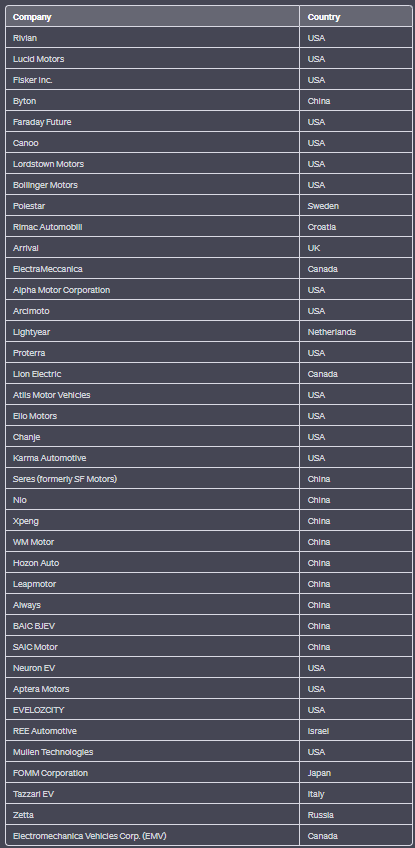

Not included in this chart are the dozens of EV-only startups. We asked Chat GPT to generate a list of EV manufacturers excluding TSLA and traditional automakers and it quickly came up with a non-exhaustive list of 40 companies:

And while many of these companies are likely to go bankrupt before actually making any cars, the point remains that together with the huge investments in EVs by the big automakers, TSLA is looking at a lot of competition coming online in the next 2-3 years. We often write about how Tesla is one of the only companies who can profitably make EVs at scale, but some of these other EV companies are actually starting to get some wheels on the road. Just check out this Fisker we saw at one of our favorite restaurants in Las Cruces last week:

When we started buying Tesla, most of these EV startups were barely off of the ground and many of the traditional automakers were just starting to roll out designs for the first versions of some EVs. Even today, it is extremely difficult to obtain most of the other EV cars . . . but it is starting to happen (see Fisker pic above). For example, in the first quarter, GM reported that it delivered 20,670 EVs. And in the biggest EV market in the world, China, Tesla is facing serious competition from BYD who reportedly delivered 102,670 all-battery EVs in March 2023 alone. GM noted that its China business saw net revenue and wholesale deliveries fall considerably in the first quarter claiming it was “primarily due to challenging industry conditions resulting in lower volumes, mix deterioration, and pricing pressure.”

In addition to this changing competitive environment for EVs, car companies are facing demand pressure as interest rates have risen dramatically over the last 12 months. According to one source, the average interest rate (APR) for new vehicles climbed to 7% in the first quarter, the highest on record since Q1 2008. Throw in a possible recession around the corner and we are looking at more and more pressure on demand for new vehicles.

So is Tesla backed into the corner right now? Is it being forced to cut prices because demand is waning? The answer: potentially yes. With all of the headwinds mentioned above, TSLA is taking some punches (in the form of price cuts) and potentially sacrificing some near-term profitability in exchange for increased market share. But we think we are only in the early rounds in the development of the EV market and TSLA will come out of this battle a winner.

Then you might ask why we are buying the stock today? It’s the same reason you would bet on Rocky to win even win he is backed into the corner and getting welled on by Apollo Creed, you know he is going to come out on top. We know that TSLA is the absolute best product on the market right now and it also has the best margins of any car company on the planet. Remember that almost every other car company is actually losing money on every EV that they sell. Tesla, on the other hand, still has a roughly 18% gross margins on its EVs and can afford to reduce that slightly in order to increase demand. We think Tesla is obviously playing the long game here and it is potentially going to eliminate tens of would-be competitors like FSR and LCID and at the same time fight back against the growing market share of BYD in China and higher interest rates here in the US. Our investment horizon is not this month or this year, but the next 10,000 days. While TSLA might be lower than it is here in the near term, we are willing to put more capital behind it when the stock is down huge in a straight line and hated by the market. Even many of the bearish articles we’ve read lately admit that they think TSLA will likely take market share with these price cuts.

We also like Rivian for the reasons mentioned last week but it is clearly not Tesla and is certainly not a beneficiary of TSLA’s price cuts. That said, RIVN also makes a great product and is rolling EVs off of the assembly line every day. The stock is close to net cash and we think the risk/reward setup is really nice right here. Just know that this is still a speculative bet on RIVN so don’t go plowing into it.

Bottom line: this is probably a good entry point if you don’t own any Tesla or want to add some more. We like to buy when our favorite longs like TSLA are hated by the market, analysts, retail, etc. TSLA could face more near-term pain but we think this is an attractive setup for the long term.

We will do this week’s live Q&A chat tomorrow at 2:00pm EDT. Talk soon!