Trade Alert: Buying China + Don’t Forget This Week’s Chat

The best time to invest in a new market or asset class is typically when that market or asset class is universally hated like it is right now with China.

We’ll do this week’s Live Q&A Chat at the regular time today (Wednesday, January 17th) at 3:00 pm ET in the TradingWithCody.com chat room

“The bear went over the mountain

The bear went over the mountain

The bear went over the mountain

To see what he could see

The other side of the mountain

The other side of the mountain

The other side of the mountain

Was all that he could see…” One of Amaris’ favorite songs from her iPad

Chinese stocks are down big this morning after a slew of bad economic news came out of the mainland. The most recent decline comes after nearly every Chinese stock was already at or near 52-week lows. We are buying some more Tencent Holdings (TCEHY) and also building a new basket of Chinese positions that includes BYD Company (BYDDY). We also picked up some near-the-money calls on the iShares China Large-Cap ETF (FXI) and Alibaba (BABA) dated out one to two months. The combined value of the basket will be a medium-sized position for us in the hedge fund. There is always a ton of risk in owning any non-US company, especially in China, and we don’t want to make China stocks too big of a position for us.

So what’s up with China? To start, below is a chart of the Hang Seng index over the last five years for context. Ouch! That’s big underperformance compared to American markets which are up about 77% in the same amount of time.

Our bull case for Chinese stocks centers on two key ideas: (1) negative sentiment for China is extreme and has completely flipped from where it was early last year and in years past when Cody was warning people about the very same risks that China investors now recognize; and (2) valuations for Chinese stocks are at or close to all-time lows. As often happens, our “top-down” analysis of the Chinese economy and markets has led to a “bottom-up” review of some of the best companies which is why we are buying Tencent, BYD, and Alibaba.

Let’s look at sentiment first. Sentiment toward the Chinese economy has soured over the course of the last few years as the steady decline in equity prices seemingly never ends. However, until recently, a lot of pundits and investors still held hope for the Chinese economy and Chinese stocks. In fact, at the beginning of last year, nearly all experts agreed that China’s reopening after almost three years of COVID lockdowns would be the catalyst to drive global economic growth higher in 2023. Look at these headlines regarding the Chinese reopening and its potential economic impact from this time last year:

Let’s compare that to the current headlines regarding the Chinese economy:

And here’s the news specifically about Chinese stocks back from early 2023:

Compare that to today:

Such extreme negative sentiment always comes around closer to bottoms in markets than it does to tops. However, the sea change in sentiment we have seen over the course of the last year is not entirely disconnected from reality. And negative sentiment alone is not a reason to buy a stock or any asset class. So let’s look at the fundamentals and see what we can see, like the aforementioned bear from Amaris’ iPad.

To begin, the Chinese economy is clearly facing some major issues right now. Below is a list of the most important economic factors affecting the Chinese economy in our view:

Population decline. China’s population shrunk slightly in each of the last two years after decades of rapid growth. Unlike in the US, there is very little immigration to China (for good reasons) to make up for the country’s declining birth rates. This dynamic is resulting in the overall Chinese population getting much older.

- Real estate collapse. Approximately 70% of the wealth of Chinese families is in real estate, compared to about 35% for Americans. The Chinese real estate market was in a massive bubble fueled by easy fiscal and monetary policies, and all of that came crashing down last year. Multiple real estate developers went bankrupt leading to huge declines in the price of real estate. Thus, most Chinese citizens have seen their net worth decline significantly in the last year or so.

Possible Deflation. The cooling Chinese economy has led to rapidly falling inflation and the possibility of deflation if things don’t get going again soon. Economists hate deflation because it can be a problem for debt-laden countries. Debt payments are fixed and if deflation takes hold everyone is earning less money in nominal terms, therefore making it much harder to service the debt. However, for an exporting country like China, deflation could make its products relatively cheaper for the rest of the world which could help spur additional exports.

- Decline in Foreign Direct Investment (FDI). The extensive COVID lockdowns and rising geopolitical tensions have caused a massive drop off in foreign companies and individuals investing capital in China. In fact, China saw negative FDI (meaning foreigners pulled more money out of China than they put into the country) in the third quarter of 2023 for the first time since the country began collecting those records. We’ve talked about the American Reshoring Revolution and this is indicia of that. We expect to continue to see a lot fewer “made in China” tags and more “made in Vietnam/India/Indonesia/Mexico/and even USA” tags.

- Authoritarian leadership. While China has moved markedly toward a quasi-free market economy over the last 40 years or so, it is still a communist country led by a one-party government. The extensive COVID lockdowns, ongoing Uyghur genocide, the massive surveillance state, and the possibility of a Taiwan invasion (among many other issues) are all stark reminders of the evils of communist rule. Most of these issues are not new, but the culmination of the CCP’s poor economic and social policies seems to have come to a head lately.

These extensive economic issues are real and have rapidly decreased investors’ appetite to pay up for Chinese stocks. But that does not mean that these issues will never alleviate or that investors will never pay appropriate valuations for Chinese stocks again.

The best time to invest in a new market or asset class is typically when that market or asset class is universally hated like it is right now with China.

China is still the second-largest economy in the world and is expected to grow about 5% this year (if you believe the CCP). There are still long-term secular growth drivers in play including the fact that the move to freer markets continues to lift more and more people in China out of poverty and into the middle class. And there are some great companies in China that make real products that have real growth and earnings that we can invest in to capitalize on these secular growth trends.

That leads us to our bottom-up review of the best Chinese companies to buy right now.

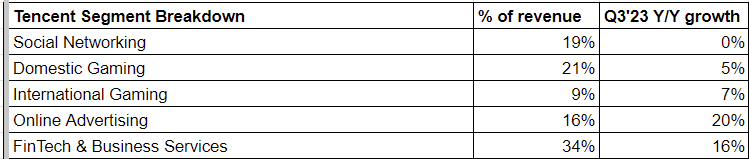

Let’s start with Tencent (TCEHY). Tencent is a massive holding company that owns some of the best and most important tech companies in China and internationally. In China, Tencent owns the #1 social media platform (WeChat), the #1 gaming platform, the #1 payments platform, and the #1 mobile browser. Here is a breakdown of Tencent’s major business segments which also shows the topline growth rate in the most recent quarter:

Source: 10,000 Days Capital & Tencent Filings.

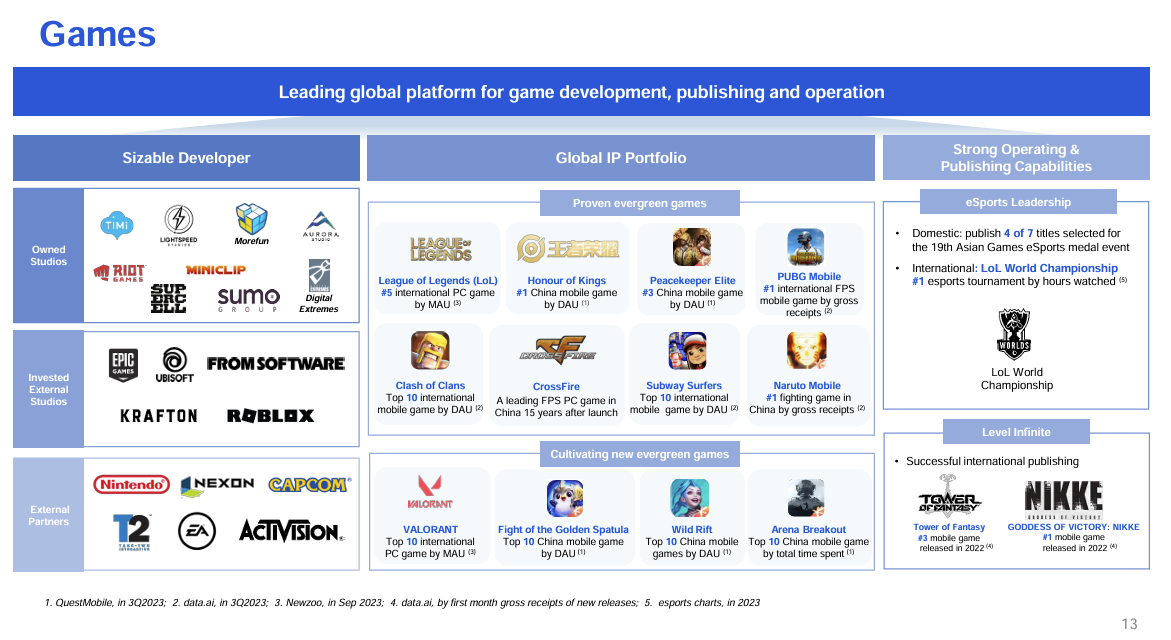

Tencent is also a major developer and partner in the gaming industry. Tencent owns a 40% stake in Epic Games (the maker of Fortnite and also Unity’s (U) only real competitor for gaming engines) and has made investments in other gaming studios like Ubisoft and Roblox. Tencent’s in-house developed gaming portfolio includes familiar titles like Clash of Clans and PUBG Mobile.

Source: Company Filings.

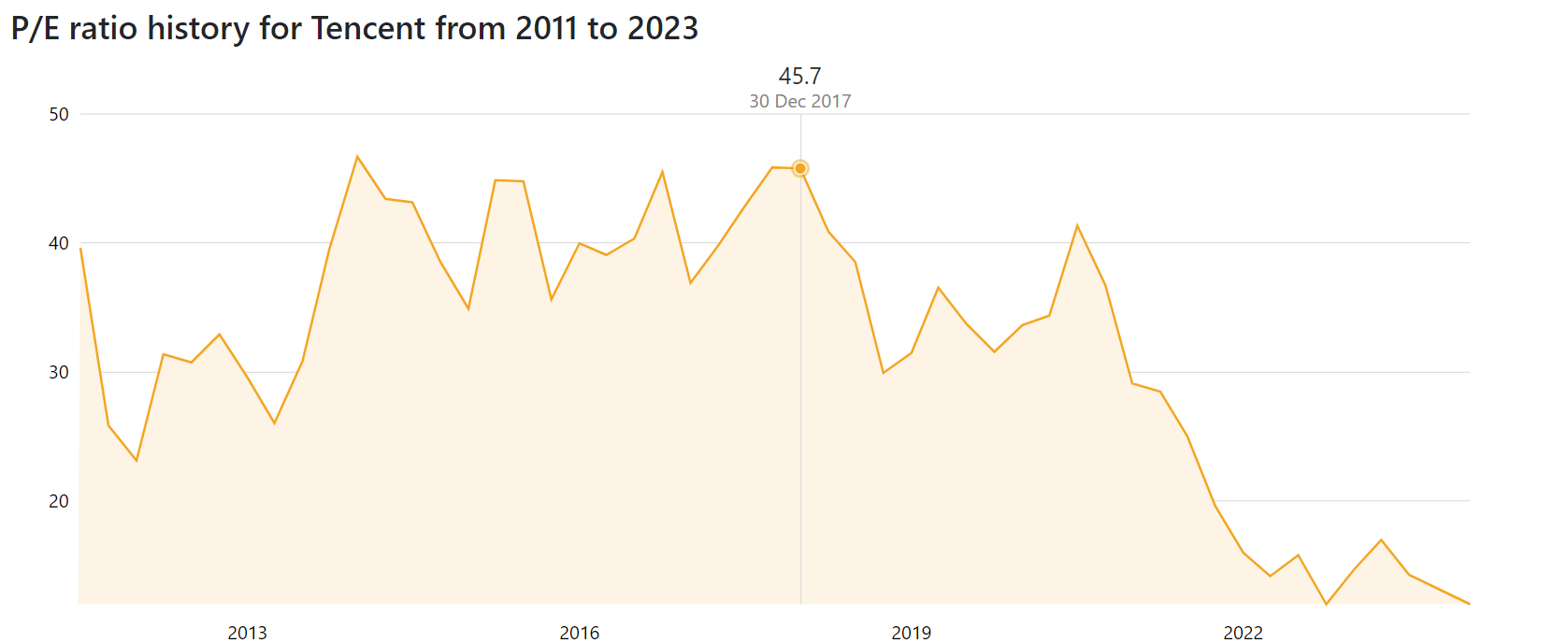

Tencent is expected to grow revenues by over 9% in 2024 and is trading at 13x its forward earnings estimates.

This is close to the cheapest that Tencent has ever traded:

Source: CompaniesMarketCap.com.

Next is BYD Company (BYDDY). BYD is now the largest pure-EV maker in the world with 1.86 million units sold in 2023, just barely edging out Tesla’s 1.81 million shipments. BYD’s total sales of both EVs and hybrids exceeded 3 million units last year. December saw the company grow total unit shipments by 45% year over year. BYD is Tesla’s primary competitor in China and BYD’s success has been driven by the relative affordability of its cars relative to Tesla. Tesla has been slashing prices to stay competitive with BYD in China but it still has a ways to go to reach cost parity. BYD’s best-selling model, the Qin Plus, sells in the range of $13,942 to $24,700 compared to $37,217 to $50,838 for a Tesla Model Y. We don’t have earnings estimates for BYD but it is trading at about 15x our current Price/Profits (P/P) ratio and we expect that can drop to the low single digits within 3 years assuming moderate topline growth (15% annualized) going forward. Side note: Warren Buffet’s Berkshire Hathaway (BRK.A) is an investor in BYD.

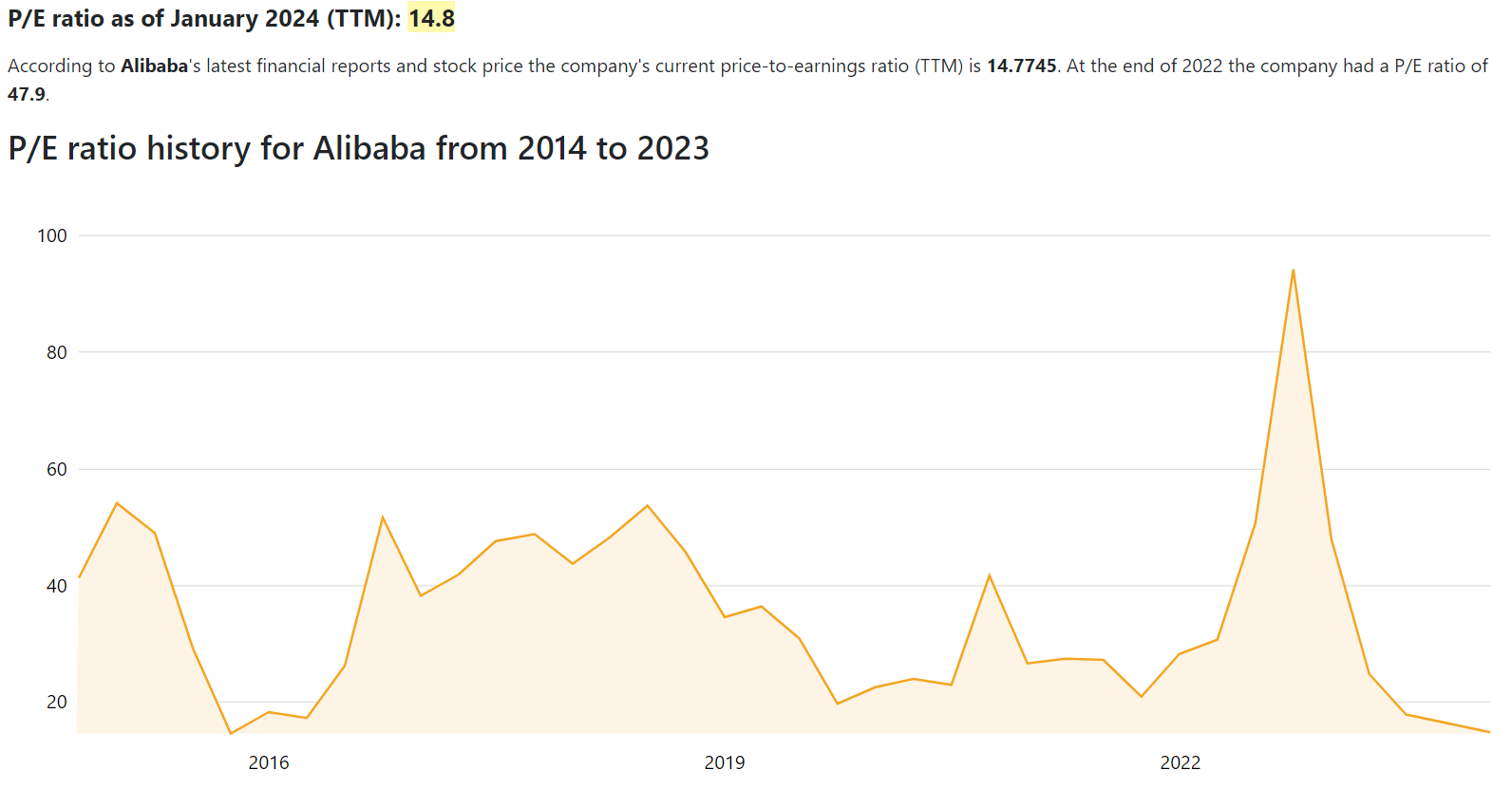

Last is Alibaba (BABA). Similar to Tencent, Alibaba is a holding company that owns a variety of tech businesses. Alibaba’s core business is its online marketplace which is very similar to Amazon.com. Alibaba also operates Alibaba Cloud which is the largest public cloud company in China (similar to Amazon Web Services (AWS), Google Cloud, or Microsoft Azure). Alibaba was once the darling of Wall Street but has lost a lot of its luster to competitor PDD Holdings (PDD) which is growing much faster and potentially stealing some market share from Alibaba’s online marketplace. Nevertheless, Alibaba should grow about 9% in 2024 and is currently trading at 7.45x its forward earnings estimates. Again, this valuation is at the very low end of Alibaba’s historic P/E range: