Trade Alert – Calgon take me away!

I’m just about finished up with my latest book, “The best growth industries and stocks for the next ten years” (working title still). In it, I’ve dug down on three of the biggest growth industries in the world and have then dug down and found the very best stocks to bet on in those industries. Last week, I offered up my analysis on the three best pureplays on the 3-D printing industry, at least one of which I expect will go up 1000% over the next five to ten years.

This week, I’m providing my analysis on the four best pureplays on what I’m calling the “Mankind Necessities” industry, which is mostly comprised of energy, food and water. Thus the name.

Anyway, to start with some top down industry overview, realize that the planet’s population has gone up seven-fold in the last two centuries, and that unless there is some sort of global economic/environmental crash, there’s no indication slowdown in that population growth ahead of us.

Measured across the centuries, as the population has boomed, there are indeed more people who are safe, well-nourished and with access to toilets and clean water than ever before in history. Likewise, there are more people who are scared, starving, and without access to toilets and clean water than ever before in history. And of course as the world’s climate changes (cycle or permanent/hotter or cooler, the climate will change) over time, new infrastructure must be built to accomodate the people left struggling by the change in their area. Isn’t it an exciting thought as a world citizen to picture a time where there’s a smaller percentage of the world’s population, which itself will also be at an all-time high, who are hungry than ever before.(Side thought – Is that even possible without significant societal shifts?)

At any rate, clean water, wholesome foods and low-pollutant recurring energy sources will be in growth mode for the rest of our lives so long as society doesn’t collapse. And without further ado, here are my four favorite plays on the Mankind Necessities industry. The first three I’ve written about for you before – Lindsay LNN, First Solar FSLR, and FutureFuel, FF. I’ll be buying a first tranche of CCC here around $17 a share.

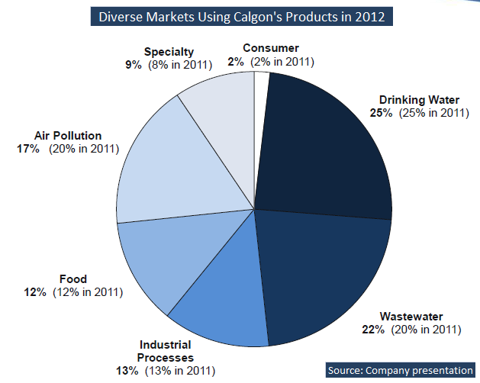

Calgone Carbon – I can’t help but think of that old commercial “Calgone take me away!”, but I digress. CCC’s primary business is making water more drinkable, waste water less potent, air more breathe-able and food resources more sustainable. And that’s not just “Green talk” either. The company’s revenue break down bores out exactly this way:

What exactly does Calgon Carbon do? The product line that generates the most revenue for the company is the more than 100 types of granular, powdered and pelletized activated carbons made from coal, wood or coconut. The activated carbon is used to remove organic compounds from liquids and gases. Last year that product line generated more than 80% of company sales.

The company is growing their “equipment technology” segment, which consists of are used at big water treatment sites. The liquid phase equipment systems are used for potable water treatment, process purification, wastewater treatment, groundwater remediation, and de-chlorination.This is a big growth opportunity for the company. The company is developing a consumer product line and a few other possible growth products, but I’d almost rather see the company just develop their sales of the primary existing product lines.

Regardless, I do believe all of this makes Calgon Carbon a great pure-play on our Mankind Necessities growth industry. I want to build this position up to about 3% or so of the overall portfolio to get started and I’ll be doing about half of that trade in a few tranches over the next couple days to start.