Trade Alert: Cleaning Up The Portfolio As Rates Continue To Rise

A few housekeeping items to start here. I’ve been scaling out of IBB, XBI and JD, taking gains on all of them, the prior two being short-term gains and the JD position being one we have owned for years. I still think biotech might be a pretty good sector to be in for the next year or two, but I want to clean up the portfolio and reduce the number of positions again, for now.

Tesla will report earnings tonight and I’ve no edge on how to try to game it. We know they slightly missed on unit deliveries last quarter but average selling price is probably pretty good to help offset that. Regardless, I don’t have any sense of how the market will react to what I expect will be a mostly decent to pretty good report. I’m a buyer of TSLA below $200 if it goes there, but I won’t be making a big stand or anything. It would be the first time I’ve added to TSLA in years, I do believe.

Rates are continuing to rise and that’s got pressure on stocks — nothing new there. I do think rates are getting to beg extended here and I expect at least some near-term stabilization in rates here at these recent new highs today. In the hedge fund, I’ve nibbled a few TLT calls, slightly out-of-the-money and dated out to next Friday. Again, not a big bet at all, just a small short-term trade that win or lose, I will be out of it over the course of the next week and a half before they expire.

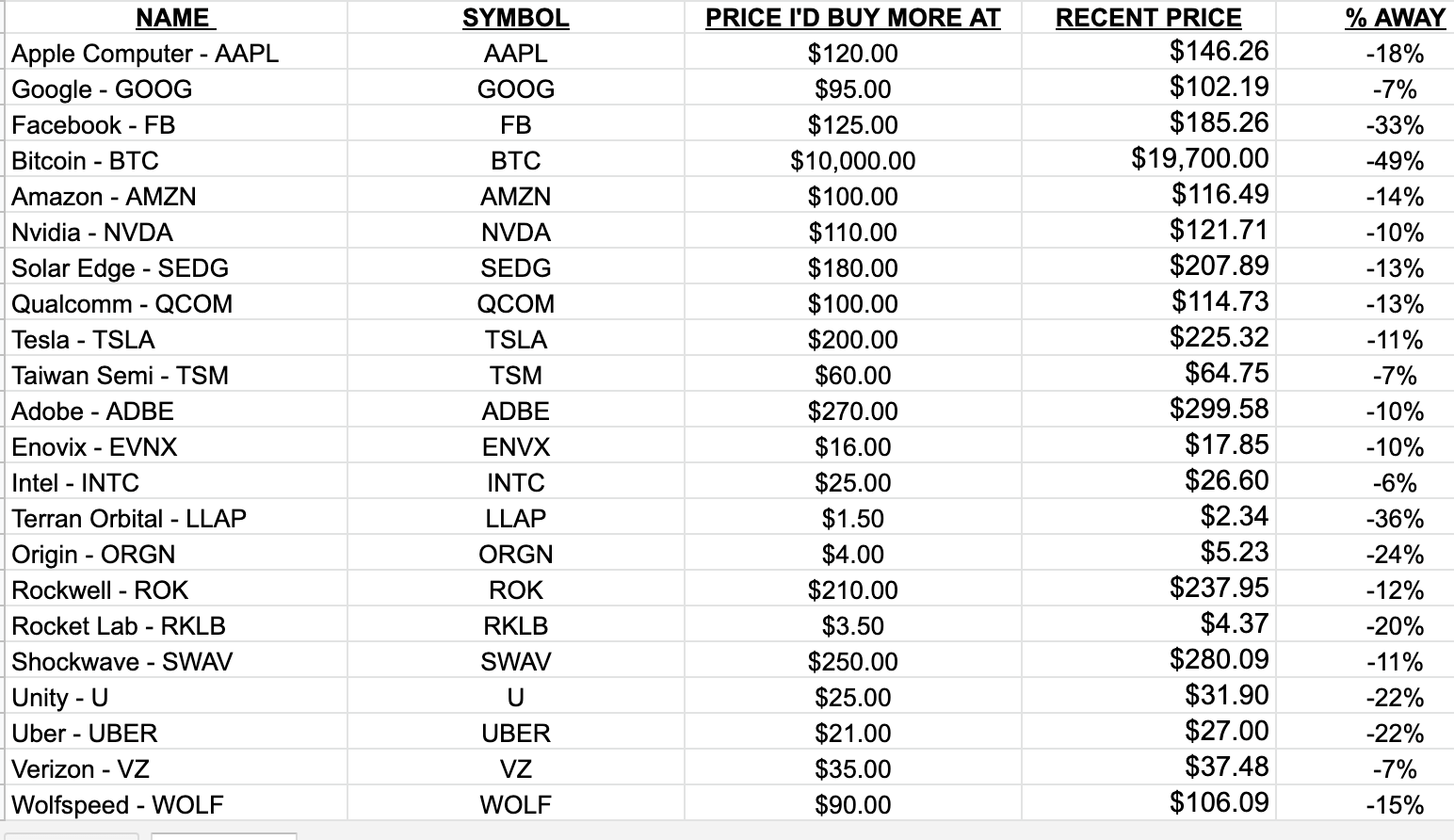

If rates do break out higher here, stocks, especially tech stocks are likely to take another let lower of course. As noted and planned, I put some hedges back on in the hedge fund in the recent pop and I’d look to sell those and, eventually, look to scale into more of my favorite name as noted in the recent “Where I’d Buy More Of Each Of Our Stocks” commentary (pasted again below using latest prices).

| NAME | SYMBOL | PRICE I’D BUY MORE AT | RECENT PRICE | % AWAY | |

| Apple Computer – AAPL | AAPL | $120.00 | $146.26 | -18% | |

| Google – GOOG | GOOG | $95.00 | $102.19 | -7% | |

| Facebook – FB | FB | $125.00 | $185.26 | -33% | |

| Bitcoin – BTC | BTC | $10,000.00 | $19,700.00 | -49% | |

| Amazon – AMZN | AMZN | $100.00 | $116.49 | -14% | |

| Nvidia – NVDA | NVDA | $110.00 | $121.71 | -10% | |

| Solar Edge – SEDG | SEDG | $180.00 | $207.89 | -13% | |

| Qualcomm – QCOM | QCOM | $100.00 | $114.73 | -13% | |

| Tesla – TSLA | TSLA | $200.00 | $225.32 | -11% | |

| Taiwan Semi – TSM | TSM | $60.00 | $64.75 | -7% | |

| Adobe – ADBE | ADBE | $270.00 | $299.58 | -10% | |

| Enovix – EVNX | ENVX | $16.00 | $17.85 | -10% | |

| Intel – INTC | INTC | $25.00 | $26.60 | -6% | |

| Terran Orbital – LLAP | LLAP | $1.50 | $2.34 | -36% | |

| Origin – ORGN | ORGN | $4.00 | $5.23 | -24% | |

| Rockwell – ROK | ROK | $210.00 | $237.95 | -12% | |

| Rocket Lab – RKLB | RKLB | $3.50 | $4.37 | -20% | |

| Shockwave – SWAV | SWAV | $250.00 | $280.09 | -11% | |

| Unity – U | U | $25.00 | $31.90 | -22% | |

| Uber – UBER | UBER | $21.00 | $27.00 | -22% | |

| Verizon – VZ | VZ | $35.00 | $37.48 | -7% | |

| Wolfspeed – WOLF | WOLF | $90.00 | $106.09 | -15% |

Easy does it, remember that you don’t constantly have to try to make big bets or catch the bottom. Remember when I used to write all the time when stocks had gone straight up for months and continued to do so that investing isn’t supposed to be fun because it’s hard. Now I find myself continuing to write about how we are getting closer to having some real opportunities to make great long-term risk/reward investments in Revolutionary companies — precisely because nobody but shortsellers are having fun in the markets these days.