Trade Alert: Covering Solar Shorts And Buying A Little SEDG, HOOD, and BLDE

Good morning all, Bryce here –

We will do chat this week tomorrow, 8/16 at 3:00pm ET in the TradingWithCody.com Chat Room or you can just email us at support@tradingwithcody.com.

Please Follow us on our LinkedIn Page and Connect and Follow Cody here.

Markets have pulled back quite a bit since we were writing trade alerts about staying cautious, trimming longs, and adding shorts back in of July. Markets are down again this morning and we covered our remaining solar shorts (RUN, SPWR, and TAN). We also sold our small remaining positions in the beat-up space basket (BKSY and RDW) for a small gain. We’re afraid that these companies just don’t have enough growth for the time being, are still a long ways from being profitable, and may not have the cash to get through this next cycle in the market. Not to mention we already own the best space companies (SpaceX and RKLB), and want to be concentrated in the best. And we closed our short-lived NKE trade, just cleaning up the portfolio.

A lot of our longs which we had trimmed much higher have pulled back as well. We nibbled on a little bit of SEDG, HOOD, and BLDE. If stocks continue to drop, we will likely get the chance to buy more of these and some of our other favorite longs too. Make sure and review the “Where I’d Buy More” list that Cody sent out last Friday.

Most hedge funds and other institutional investors covered their remaining shorts at the end of last month as we’d surmised and now are likely feeling a little bit trapped in some of these positions. Although the indexes are only down about 5%, we have seen a lot of stocks, especially the meme’d-up small-cap stocks collapse over the last few weeks. But the pullback is not just limited to small caps either. Underneath the surface, a lot of big and established companies are putting in 52-lows. Utilities like NextEra Energy (NEE) are putting in multi-year lows.

Consumer staples like Kellogg (K) and Conagra (CAG) are also putting in 52-week lows.

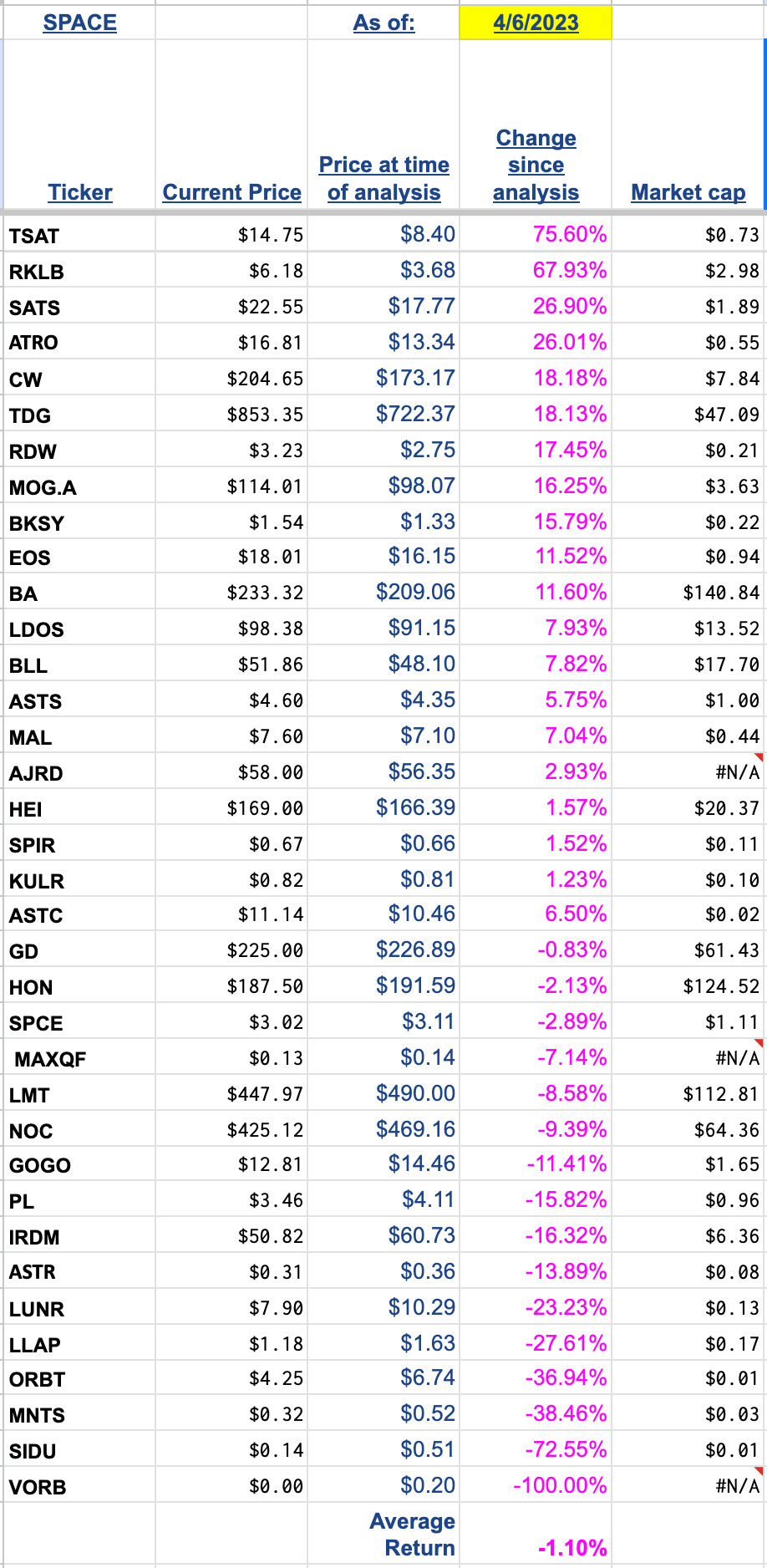

There have been a lot of bearish indicators for lots of companies and the underlying economy that the market has just been whistling past over these last few months, and there may be more pain ahead for the broader markets as it wakes up to reality. We will take advantage of these moves to buy more longs and/or reduce shorts when the pitches are presented to us. If we have learned anything in this market, it is that you cannot blindly buy or sell stocks at any one time, as there is clearly a divergence between good and bad companies, sectors, geographies, etc. Just look at the variance in the price action of Space stocks that we track over the last four months:

A handful (including RKLB) are up 60-70% and a decent bunch are down 35-70%, and many names are basically flat. The average return is -1.1% and if you had blindly bought the entire basket, you would be severely disappointed. This just goes to show that we are definitely in a stock-pickers market (for both longs and shorts), and we can get rewarded if we do our homework and find the best/worst companies to buy/short.

Easy does it for now. Not making any huge moves as we want to stay nimble and be prepared for what lies ahead. We are continuing to do more homework and may have some new longs/shorts in the next week or so.