Trade Alert: Crypto Stock Idea

What a week to be back. That open this morning was terribly ugly but it was over within the first fifteen minutes or so. I did a little nibbling in the hedge fund premarket and near the open, but I had no idea the bottom (at least the short-term bottom for now) would be put in within the first hour of trading. Call it another Kurtzweil Rate Of Change Mini Crash that most tech stocks have just gone through.

I have a couple Trade Alerts that we started working on yesterday and finished up today. This is the first one. Now, one thing to note here. This stock that we are writing about was at $265 when we started writing this analysis and my cost basis is not at the $300 place that the stock is trading as we are sending this out. I expect that we will get another chance to buy this stock at $265 or lower in coming days or weeks or months, but I don’t know that for sure, and it’s a name I want to get into here for now, at least a starter position. The company reports earnings on Thursday for the first as a publicly-traded company and that adds extra potential volatility of course. Be careful as always.

A personal note to mention too. At a regularly scheduled eye examination yesterday, the doctor diagnosed my six year-old daughter who has Trisomy 13, Amaris, with a retina that is starting to detach. So everything has gotten a bit more stressed and chaotic than usual around here for now. We have scheduled a surgery for her in Denver for Friday morning. I’m going to stay at the office and work until Friday when I’ll run up there to be with her too. I plan on heading back over night on Sunday and being back here at my desk Monday morning. We don’t know how long we’ll need to keep her in Colorado, so bear with me for the next week or two as taking care of my family will require more time and energy and shoulders than usual. We’ll do this week’s Live Q&A Chat Thursday morning at 10am ET. Join me in the TWC Chat Room or just email us your question to support@tradingwithcody.com. Now onto my latest Trade Alert, ghost-written by my analysts, Cory Greak (with assistance from Piper Adamian).

Trade Alert: Coinbase

This seems like a perfect time to do our poll: Who’s more scared right now, the bulls or the bears? Be sure to email me your answer at support@tradingwithcody.com or by hitting reply on this email.

It is exactly times like these where we must stick to our playbook and not panic but take advantage of the panic that is in the market around us. It is opportunities like these that we try to find stocks that have come down too far and have become cheap. It is also in times like these that we are able to finally buy the stocks of revolutionary companies that we have been watching and waiting to pull the trigger on until they get to more reasonable valuations.

As I laid out to you in my playbook last month, I was interested in Coinbase as they came public in a direct listing but just not at the price that I would have to pay at the time. The stock did not quite double from the reference price like I predicted (up only 71%) and has since come down over the past few weeks to a much more reasonable valuation like I had also predicted. In fact, in early May the stock actually bounced off the $250 reference price and is trading in the mid $280s as I type this. I am taking advantage of the recent price drop to buy my first tranche of COIN.

At first glance, a company whose main business is a retail crypto brokerage does not appear very revolutionary. In their S-1 filing prior to coming public, Coinbase reported that about 96% of their 2020 revenue came from transaction fees of which 80% of that number is from retail trading commissions. That business is surely to see increased competition from the likes of Square, Paypal, Gemini, Binance and other crypto brokerages being founded in college door rooms in the coming years and their days of getting up to 4% trading commissions are probably numbered.

What makes Coinbase truly special is that they are becoming a platform and a tech infrastructure in the cryptoeconomy. The cryptoeconomy is still in the early innings of becomes a multi-trillion dollar market (Bitcoin’s market cap is already over one trillion by itself). As the “old” crypto assets like Bitcoin and Ethereum continue to gain momentum and acceptance and “new” crypto assets and projects such as coins, tokens, NFTs and DeFi gain traction, the cryptoeconomy will likely become worth tens if not hundreds of trillions of dollars over the next five to ten years and I will continue to put my buckets out in front of those trends.

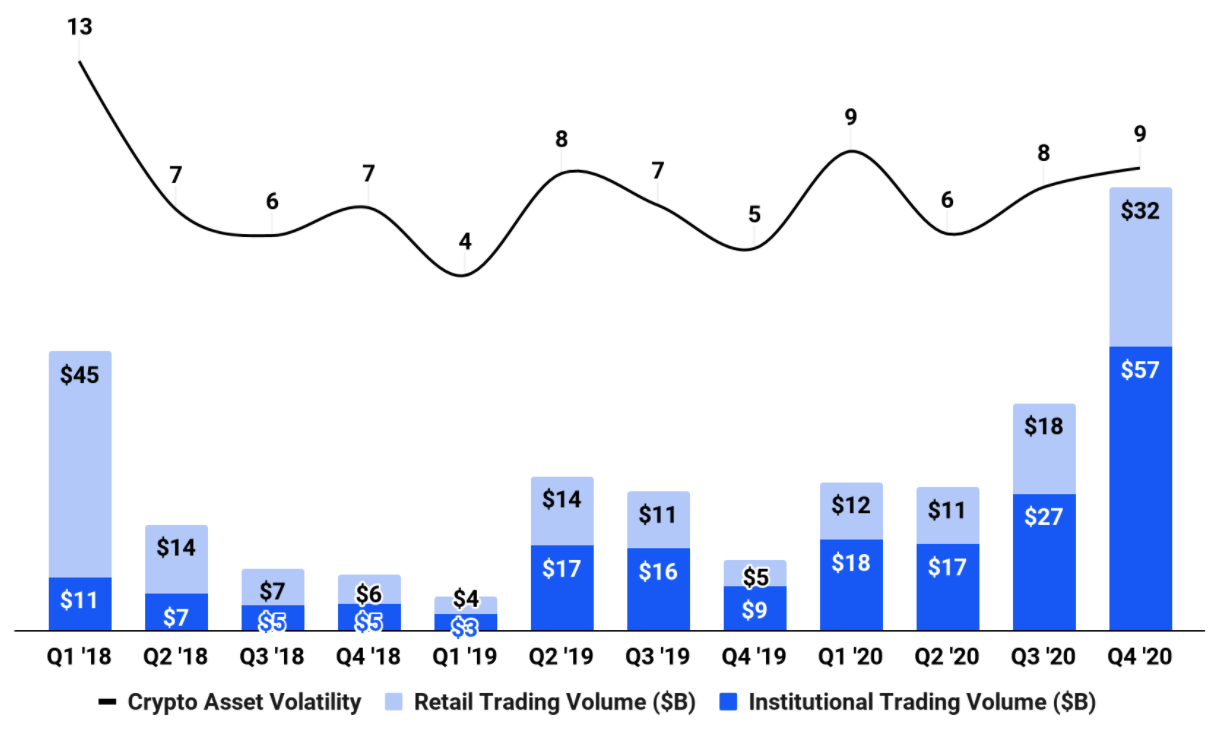

Make no mistake, crypto has been and will be volatile. As disclosed in their S-1 filing, Coinbase anticipates continued short-term volatility on their way to long-term success, “While we have grown rapidly, similar to the evolution of the internet, e-commerce, and prior paradigm shifts in technology, our journey has not been linear. Our growth has come in waves driven by innovation in the cryptoeconomy and requires long-term perspective to evaluate our performance. Each wave expands the existing retail user community and further diversifies the ecosystem by attracting new market participants such as institutions and developers. In the short-term, we experience high variance in Trading Volume and net revenue between quarters driven by the volatile nature of the crypto asset markets. Over longer periods, we have experienced clear growth, with median quarterly Trading Volume increasing from $17 billion to $21 billion to $38 billion in 2018, 2019, and 2020, respectively.”

So let us look a little closer at exactly how Coinbase is becoming the platform for the cryptoeconomy. As I mentioned before, they are the dominant player in the crypto trading/brokerage market. Coinbase has become the Great Legitimizer when it comes to cryptocurrencies. If a coin/token is trading on Coinbase, you can be confident that it is legitimate, liquid and has a use case. Just because you have a couple of billionaires pumping a coin to the moon does not guarantee that you can get it trading on Coinbase.

Last year, they brought in over a billion dollars in trading revenue from their verified user base of over 43 million customers. For some perspective, ROKU has 51 million and in the United States there are around 70 million stock brokerage accounts. Let me repeat that: Coinbase on its own, has more than half as many brokerage customers as there are stock brokerage accounts in this country.

As of right now, Coinbase is highly dependent on Bitcoin and Ethereum. In 2020, over 56% of their trading volume was from the two cryptocurrencies. As the price and volatility of BTC and ETH go up so does Coinbase’s trading volume which in turn drives revenue higher. Some analysts covering COIN are predicting that the current cycle of higher prices and volatility in Bitcoin and Ethereum is getting closer to the end and because of this, they are predicting the rapid growth in COIN’s trading transaction revenue to slow down to being roughly flat year-over-year in 2022.

In a recent interview, CEO Brian Armstrong said that in the short to medium term he does not see any margin compression on their transaction fee revenues. In fact, he said that there is a custody fee that is baked into the transaction fee that he does not see going away. With that said, he does see the potential for some fee compression over the long-term. Armstrong also added that they are investing in other growth areas for the company so that in five to ten years he sees 50% or more of the company’s revenue coming from non-transaction fee revenue. These additional revenue streams include a debit card, staking interest (where they function similar to a traditional bank in lending out customer’s crypto and earning a higher interest than they pay back to customer), and a custody business where they store crypto assets for institutional customers.

When doing the valuation work on COIN, I looked at PYPL and their $290 billion valuation. Why is PayPal worth that much and how could Coinbase get to a similar valuation one day? Well, one big reason that PYPL is worth so much is the over 28 million business owners like myself are locked into paying a lot of money over and over to PayPal to process payments for us. My next thought was why is Coinbase not doing this with crypto payments. A few years ago, I accepted Bitcoin as payment for a TradingWithCody subscription. The company that processed those payments for me is no longer around and when they disappeared, so did my Bitcoins. If only a company like Coinbase, who has never lost customer funds due to a hack could do this for me. That is a service that I would gladly pay for.

Well, the reason I am holding my nose starting to buy Coinbase at this valuation, is because I found out in while researching Coinbase, that they already have exactly such a product called Coinbase Commerce. This is exactly what I was looking for (you might notice if you are not logged in on TradingWithCody.com that we now have little blue button on the homepage where I am accepting crypto payments again. This time through Coinbase). The thing that so excited me about finding this Coinbase Commerce solution and the way it can become a de facto standard for processing crypto payments is the fact that I had seen it mentioned in any analysis anywhere that I’ve read. With all of the research reports and articles that I have read about COIN, not one time did I see Coinbase Commerce mentioned. This is exactly what I am looking for when I dig into a company. I want to find something valuable that people either do not know about or do not care about. This is a really big deal as the company could potentially becoming the secure, reputable crypto payment processor for the e-commerce world.

In addition to determining if a company is indeed a Revolutionary company in a Revolutionary market, as part of my process I like to find companies that are trading at valuations that could potentially deliver 5x-10x upside. Before I looked at the numbers, I was expecting COIN to be expensive on every metric. I was pleasantly surprised. For a newly public company especially one in a growth area like cryptocurrency, COIN is pretty reasonably valued. Granted it is not a stock trading at less than cash on the balance sheet like Apple was back in 2003 when I bought it, but it is pretty fair at 11 times this and next year’s sales estimates which is similar to PayPal’s multiple. However, trading at the same multiple for two years in a row does imply that revenue is not growing. As I explained earlier, analysts believe that their revenue growth is going to be pretty flat next year. Part of the reasoning behind that is that many believe that the exponential growth we have witnessed in crypto will slow down or even go down along with lower commission rates as competition heats up. But I think that Coinbase’s growth trajectory will continue to grow probably even next year and certainly over the long-term. Especially as the other non-transaction revenue streams come online and gain momentum.

On the profitability side, Coinbase is already profitable. with earnings per share of $1.64 last year and forecasted to explode to $7.44 this year. That gives the company a P/E of about 40 on this year’s earnings. That is a little high but definitely not outrageous for a company that has grown so much in the last couple of years. The balance sheet is in great shape with over $1.1 billion dollars and no long-term debt.

This market has been crazy recently, especially for a lot of our stocks that trade a high multiples. It is times like these that we need to remember that we are investing for the next 10,000 days not for today or next week or even next month. We stick to our playbook and buy Revolutionary companies when the price is right and we trim them at higher levels when we can, not when people are panicking and feel like they have to bail on their investments out of fear. Like I said earlier, this is my first tranche in buying COIN. Coinbase reports quarterly earnings on May 13 after the close and could have a huge move in either direction. If/when it makes that move I will reanalyze and decide if it is time to add to this new long-term position.