Trade Alert – Earnings round robin tournament

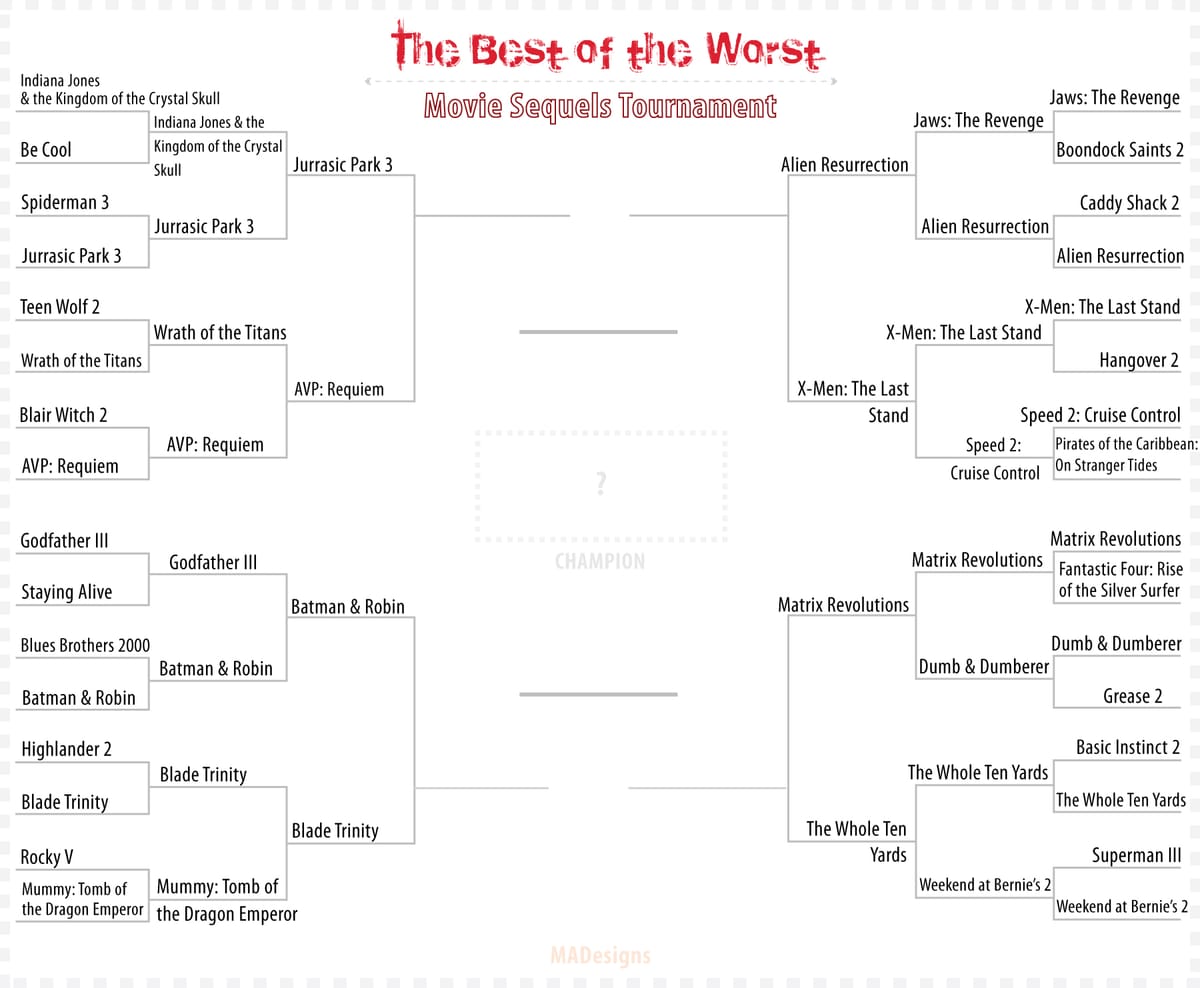

I haven’t seen a lot of the movies on the list, but from sheer disappointment, I’d go with Godfather III as the worst movie sequel of all-time. And from just plain horrible unwatchable-ness I’d vote for Rocky V.

Let’s run through some of our portfolio stocks which have reported earnings and update our analysis.

DDD – The company reported strong growth in earnings and revenues but guided next year’s earnings’ range lower even as it guided next year’s revenue range higher. That is, the company is going to spend a lot of money on expanding its capacity and ability to grow supply next year, even as it expects to sell even more 3-D printers than previously. Given that this is a very early stage in the game, that’s exactly what we want to see from a growth company like this — investing in more growth. Think of how Amazon continues to spend huge amounts of its revenues investing in its business and infrastructure even as those revenues would otherwise show up as earnings for the company. These 3-D Printing stocks like DDD and SSYS and XONE have valuations measured by price-to-sales, not price-to-earnings, and there’s a lot of topline growth required for them to grow into these market caps, so I’m sticking with the basket as is.

TQNT – Not a great quarter given how high my own expectations for growth were heading into the report. That said, I do think it’s all systems go here for Triquint as its average selling price is headed higher and unit growth looks good as its components for smartphones are in demand for many of the latest models, including the iPhone 5S. Long-time subscribers know that I prefer to use a “tranche” method to buying a stock, which means buying only a part of how much you eventually want to own in the stock and then tranche-ing into more over time as the pitches come. With TQNT down 10% since I added it to the portfolio and with the next year or two looking promising, it’s a name I’d look to add a second tranche to here. I’m buying a second tranche of common stock here.

CREE – We added Cree to the portfolio three months ago when the stock had crashed and then settled down after its quarterly report disappointed Wall Street. Rinse and repeat here. Nothing’s changed about CREE being the purest play on LED lighting, a secularly-growing and market-share taking industry, even if margins weren’t as good as Wall Street’s finest analysts had modeled for the last 75 work days. Another name I’m likely to add a tranche to here, but not yet.

INTC – The yield here of nearly 4% keeps me in the name, as does the belief that INTC’s huge investments into mobile research and development will eventually result in marketshare in tablets and smartphones and wearable computing.

Amazon – See above about how smartly the company has been plowing its revenues back into its businesses to fuel topline growth so that eventually earnings will be even bigger than otherwise. But what a market cap Amazon sports now, at $165 billion. Time to trim this one, in a tranche-kind of way, taking some maybe about 1/5 or 1/4 of our shares off the table and holding the rest steady for the long-term.

Apple – Here’s a company that’s past its topline-growth-prime and is increasingly under pressure to figure out how to generate more margins and more earnings per dollar of sales. The quarterly report gave Wall Street and investors what they wanted and the stock will now likely trade based on iPhone 5S and iPad sales into the holiday season, with the stock price tracking their popularity. The stock is still far off its all-time highs but is up big from recent lows, and I’m holding it steady as is here.