Trade Alert: Economic analysis, trumpets, cannons and gold

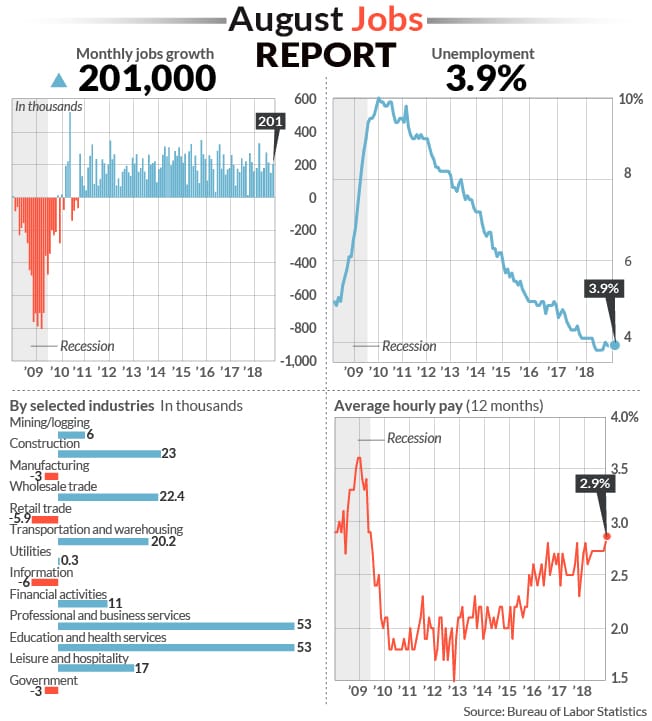

The economy is booming, unemployment is at levels not seen in generations, wages finally started creeping up:

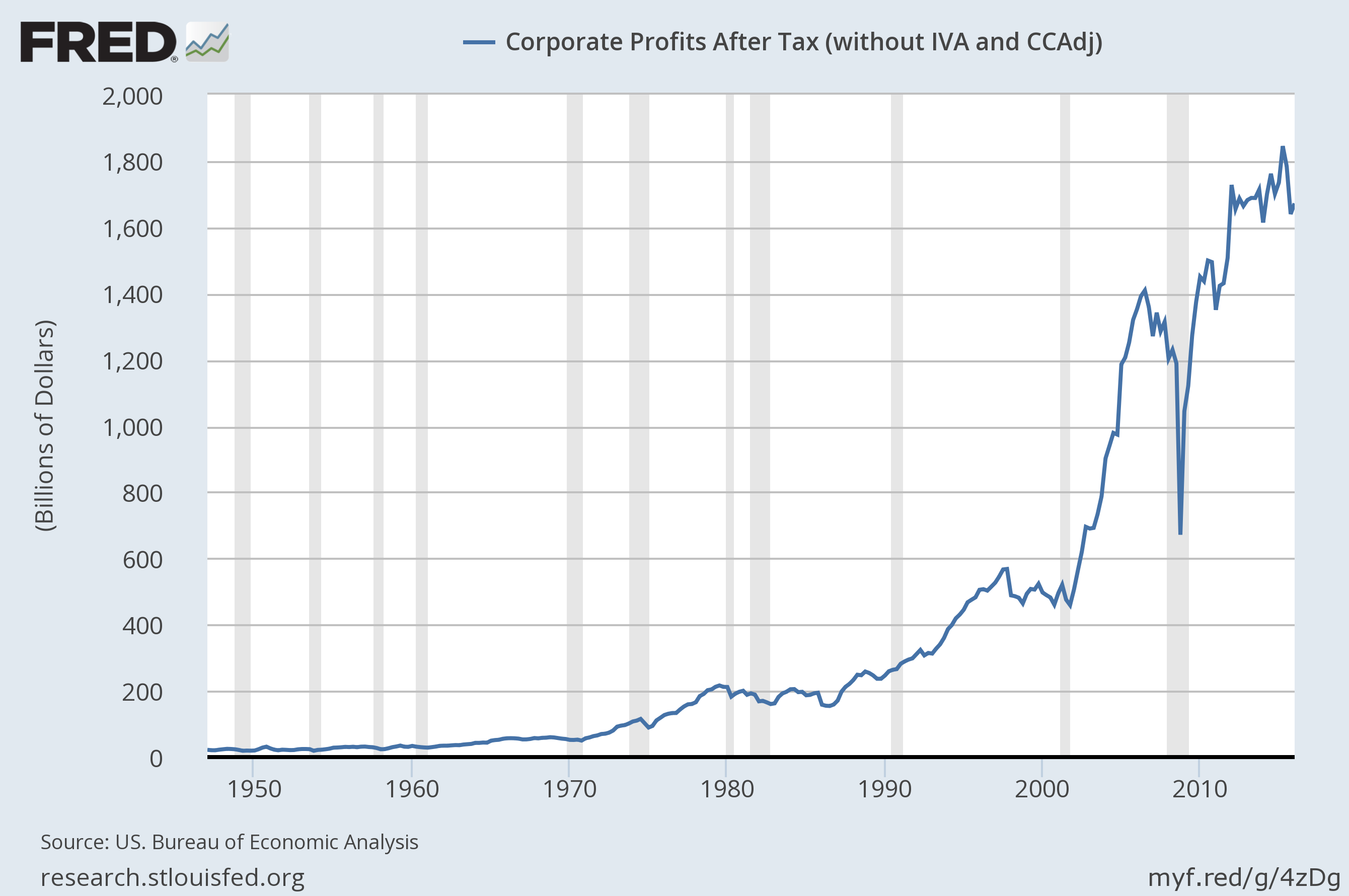

— and most importantly to investors, corporate earnings are through the roof.

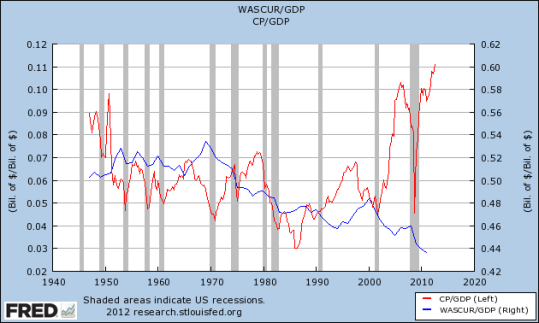

The Federal Reserve, The Republicans, The Democrats, the whole Republican Democrat Regime will try to take credit for the economic boom — but as I’d explained four years ago when I was interviewed on this news clip, it’s “the working American person” who should take credit for the boom. The Republican Democrat Regime can take credit for how much more of the overall pie the corporations get vs the rest of the country, including say, labor’s wages (the red line is corporate profits; the blue line is private sector wages):

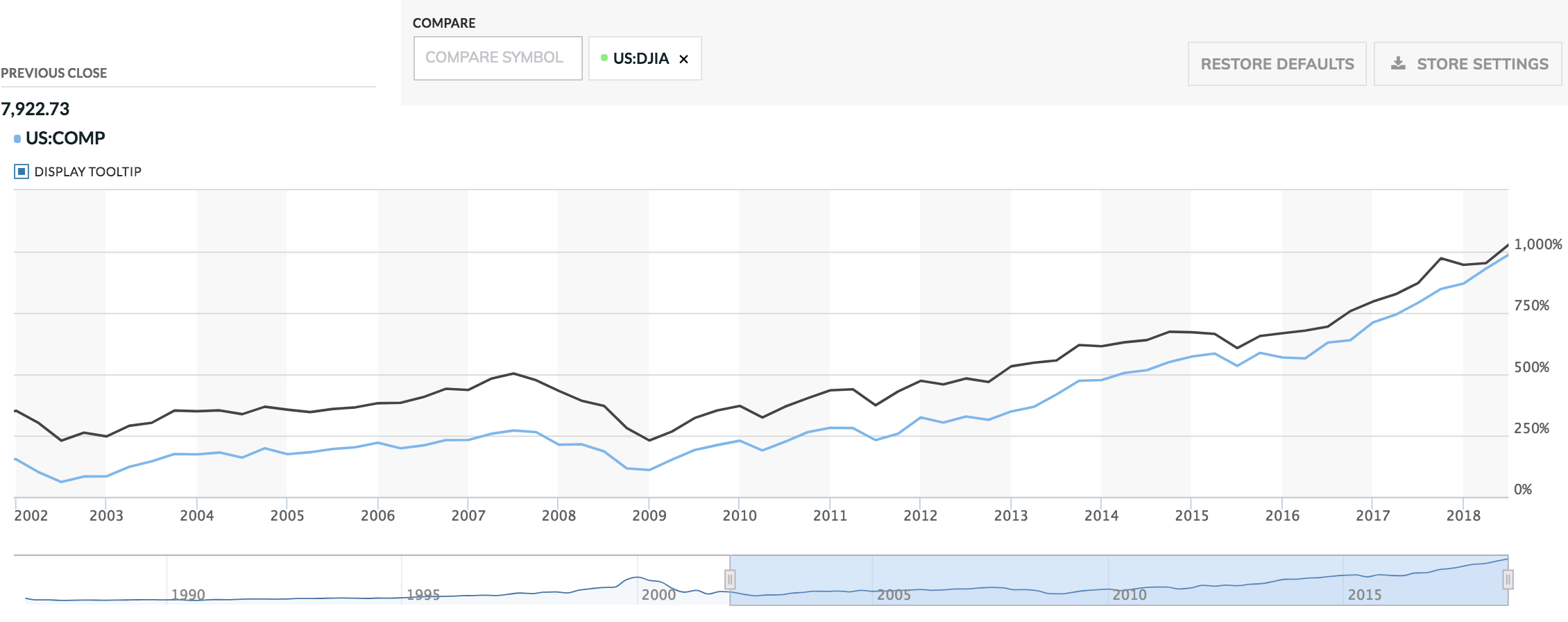

And of course stock markets have been on a straight up run for eight years in a row in what I explained would turn into a Bubble-Blowing Bull Market.

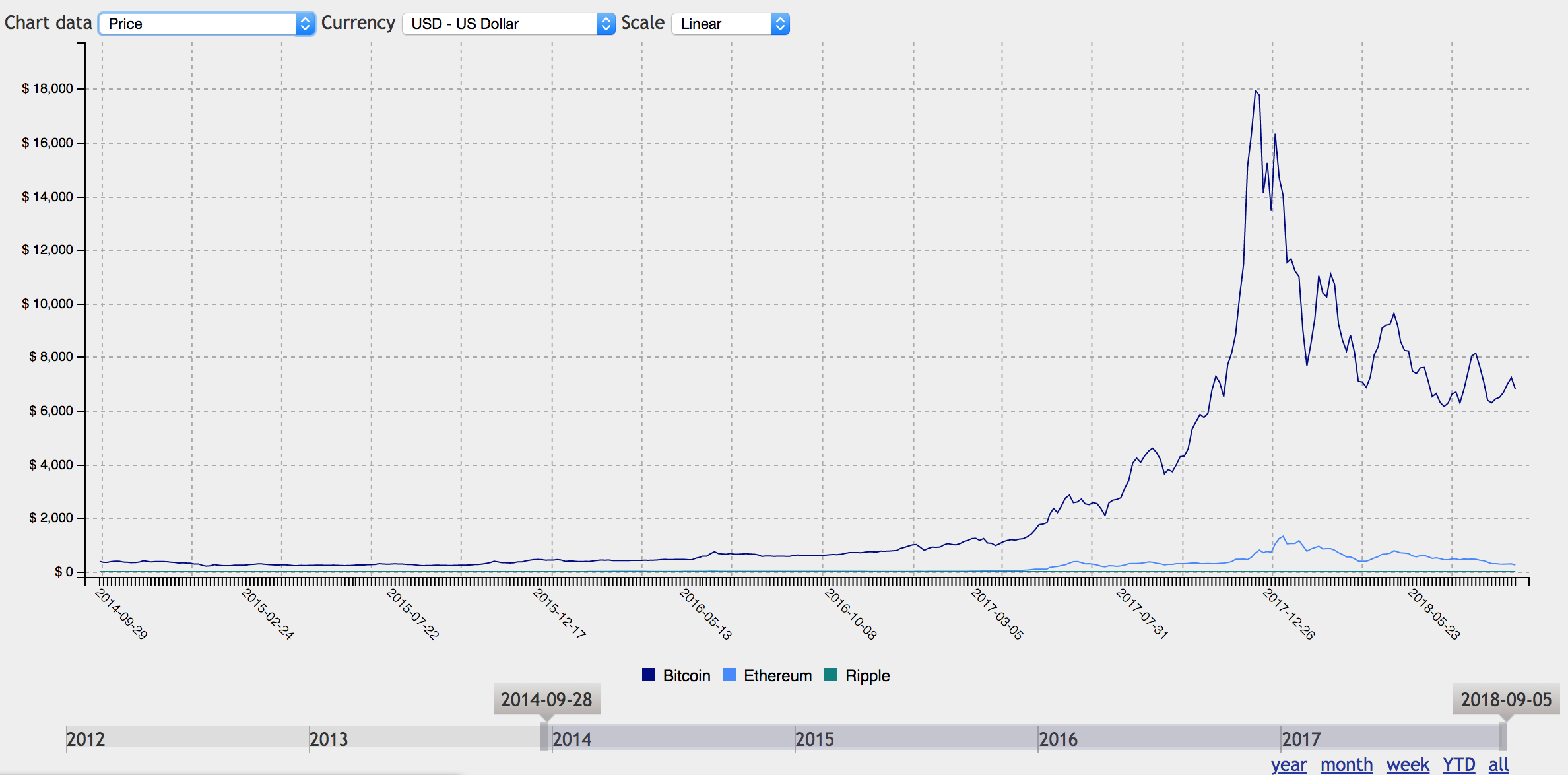

Cryptocurrencies bubbled up like tulips, huh?

And they are still are still bubbled, still going through the post-bubble crash).

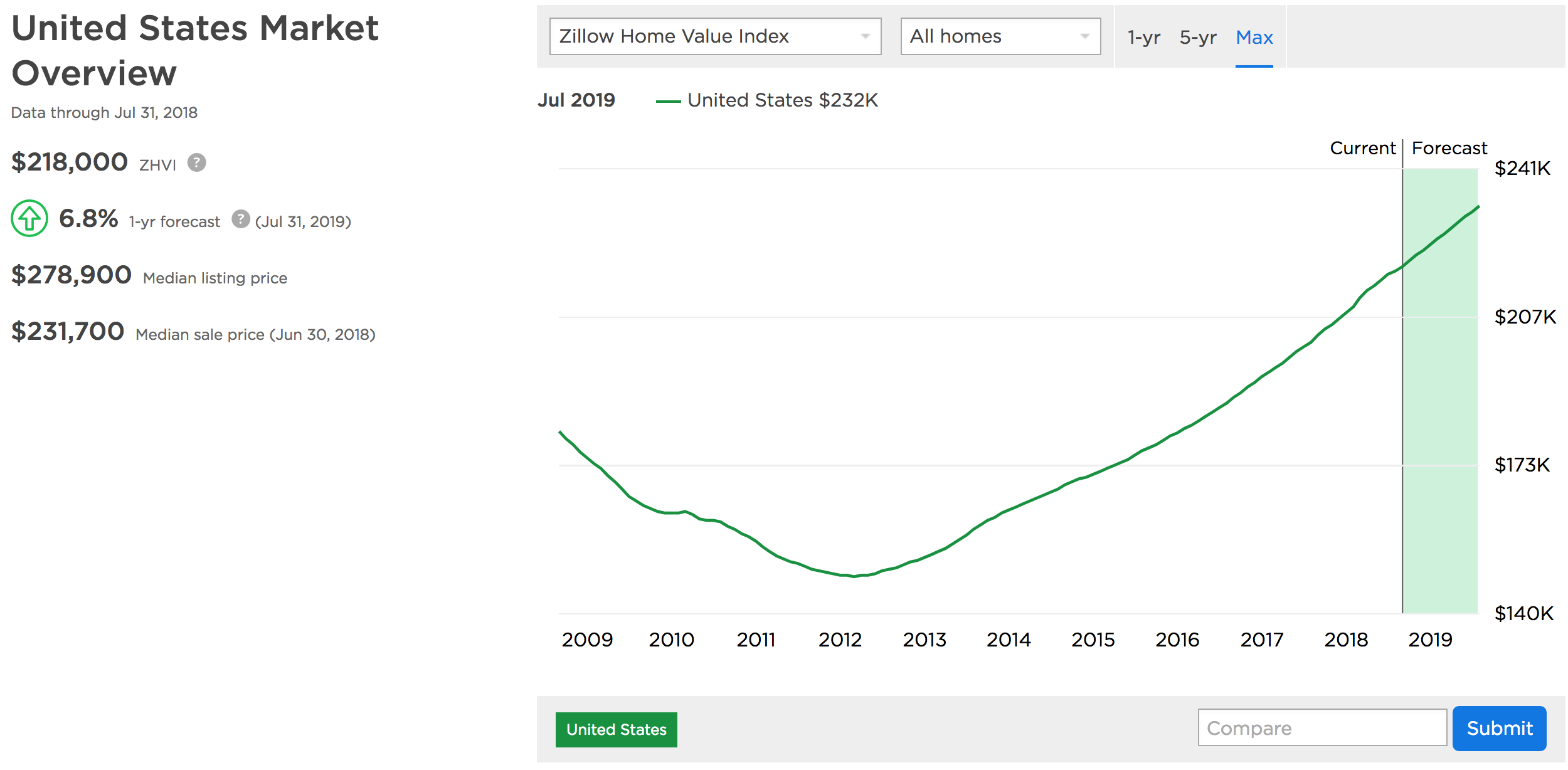

Real estate? How’s real estate doing?

Oh, all-time highs in housing prices across the US right now? Shocker.

Oil’s gushing profits right now too, huh?

Asset prices across the board are through the roof. Except for gold and silver, I guess, huh?

It can be tough to find great opportunities in this environment, but gold does indeed look like a good risk/reward set-up to me right here for both the near-term and the very long-term, so you’ve seen me nibble some GLD and I’m also going to buy some gold coins again. Read this book I wrote for more about how to buy gold and silver and why I think everybody should have a little bit of it in their portfolio (but not depend on it for their retirement or as a primary investment).

As for the rest of the aforementioned assets and the US economy, well — Sound the trumpets! Everything’s going great for investors these days.

And the best time to buy is when everything is going….oh wait. The best time to buy is when there is “blood in the streets.” The best time to sell is “on the sound of trumpets.”

The fact is that nobody’s really sure who made up the “blood on the streets” or “buy on the sound of cannons, sell on the sound of trumpets” phrases (Baron Rothschild made a fortune buying into the panic that followed the Battle of Waterloo against Napoleon and is credited with making up the phrase) but the point is a sound one.

It’s also phrased as “buying when others are scared and selling when others are greedy.” Are any investors scared right now? (Other than Tesla shareholders scared about Elon Musk’s erratic behavior, I mean, haha.)

But look back at those charts and know that the are data about the past, not the future. They show trends and rather strong, entrenched trends at that.

So I’m also far from declaring that the Bubble-Blowing Bull Market is over or that all these economic and market trends are suddenly about to reverse themselves.

Certainly there are fortunes to be made in good times and so we shouldn’t just be sitting around waiting for a crash. I’m on the hunt for unique opportunities, big and small, to put into my own portfolio right now and to share with you guys as I find them.

I’m going to nibble a little more GLD right now today and I’m going to buy some more gold coins. Nothing big. Just a tiny bit as I scan the economy and the markets and think there is a bit of opportunity here in gold.

No time for laurels-sitting.