Trade Alert: Buying some giga mega kilo bytes, mon

I have a Revolution Investment stock pick that I want to add to the portfolio. It’s called Gigamon, the symbol is GIMO, and here’s the story.

Hackers, cyber threats and the giant move to the cloud is making network security more important than ever. As a pure play on that, Gigamon’s website explains why their products and services are leading the way.

Can your current network security infrastructure provide:

- A complete view of physical and virtual networks

- Scalable metadata extraction for richer forensics

- Isolation of applications for targeted inspection

- Visibility to encrypted traffic for threat detection

- Inline bypass for connected security applications

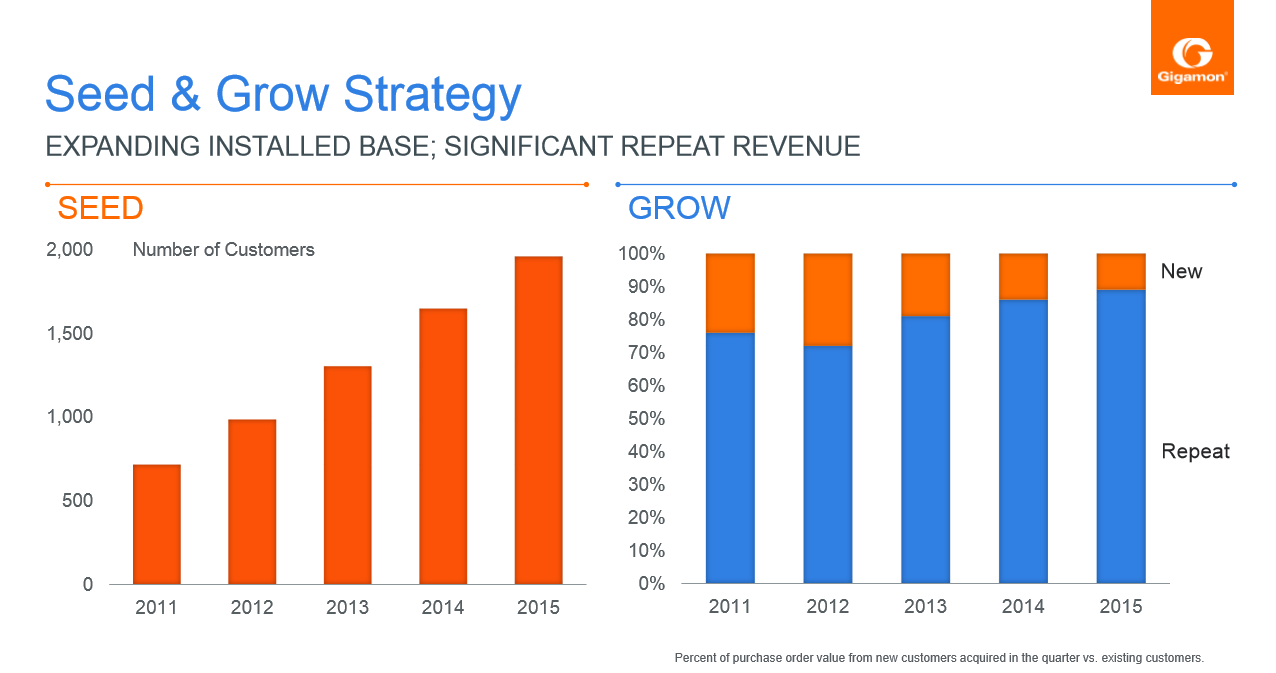

Basically companies like Amazon use Gigamon’s products and services to monitor, protect and learn from their cloud services. That’s right, Gigamon is set to grow along with the cloud market leader, Amazon Web Services. Of course the company is growing its customer base too. The company gets a lot of long-term visible recurring revenue from their customers and that recurring revenue typically sees higher margins over time too.

Gigamon came public three years ago near $20 a share and has since become nicely profitable with 30-50% annual topline growth rate which might slow down to a “mere” 25-35% or so this year. Analysts expect GIMO to earn $1.26 this year, up from 80 cents last year. And GIMO should earn more than $1.50 this year, and up to $2 per share if they really deliver on strong growth and margins.

Let’s split the difference and call it $1.75 for next year’s likely earnings per share. The stock is currently around $47 and that gives us a forward P/E of about 26. The company’s balance sheet is beautiful with $6 per share net cash, giving us an enterprise value to earnings ration of 23.

I think this company could earn upwards of $4 per share in another five years from now. Throw a 25-30 P/E on that number, and you’re looking at a potential $100-120 stock in a few years.

I’m starting to buy this stock today, buying about 1/3 of a full-sized position to get started. I’ll nibble some more shares in coming days.

Here are some additional notes from myself and my research associate, Liam Garrity-Rokus:

- Valuation isn’t bad. Company is profitable and is generating decent FCF so those are good signs

- Share count growth is a bit worrisome: share count is up nearly 120% since 2011.

- Business is not “capital intensive” in the traditional sense, because capex requirements are very low, but the working capital requirements are fairly high so that could make it difficult to increase FCF despite increasing sales and profit.

- Company benefits from growth in Amazon Web Services, which is an attractive aspect of their business model.

- Something that I think is worth looking into more is how they describe their customer base. The company seems to like publicizing their number of “end-user customers,” of which they currently have over 2,200, but in reality their business model appears to be one in which they sell through 2 channels: 1) sell to distributors who then sell to end-customers, and 2) sell directly to end-customers. Two distributors accounted for 60% of GIMO‘s total revenue YTD and 64% of its accounts receivable in the last quarter, which means the company has customer concentration risk. YTD GIMO‘s largest end-customer client accounted for 12% of total revenue.

- Products accounted for 68.9% of GIMO‘s total revenue in 2015 (down from 72.2% in 2012) and Services accounted for the remaining 31.1% (up from 27.8% in 2012). My guess is that Services have higher margins but the company doesn’t release that information.

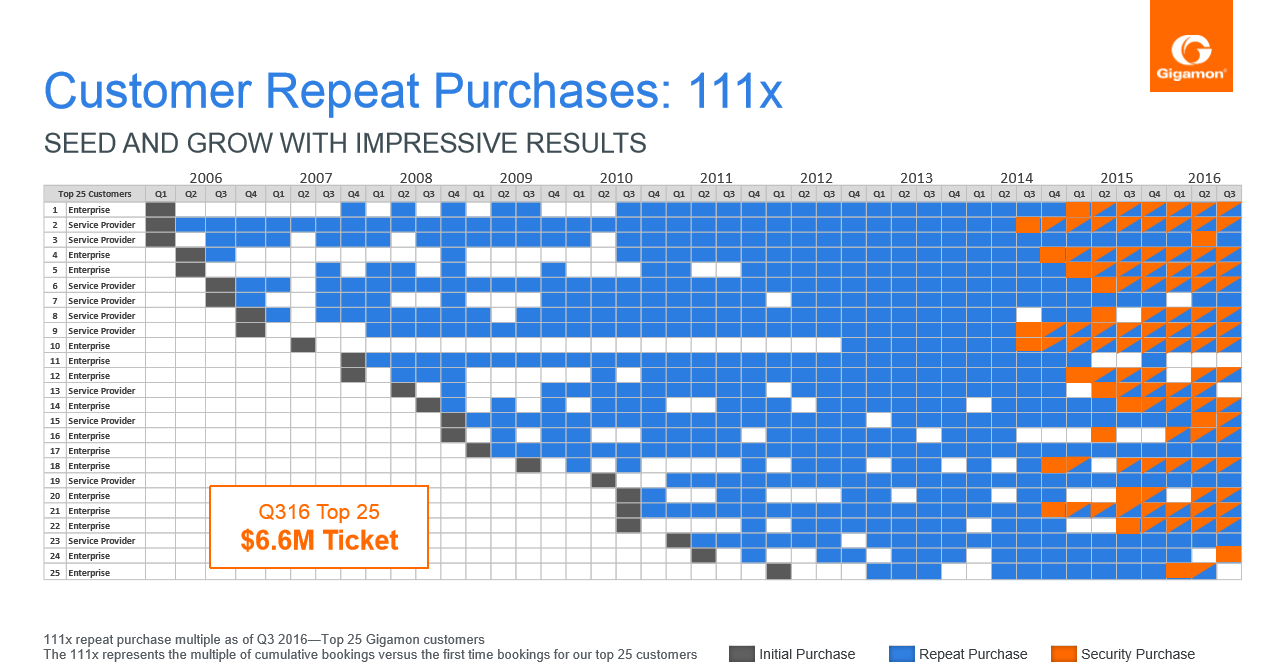

- The slides below are from GIMO‘s Q3 2016 investor presentation (can be found here). They would appear to indicate that GIMO‘s customer base is growing and that old customers are repeat purchasers, which is good. Customer growth for a company like this is going to be key because the more customers it can get and then retain the more service revenue it will get, which should hopefully provide a tailwind for margins.