Trade Alert: Gold Standard of Network Security

I just landed in LA-LA Land. Why is it raining here? Why doesn’t anyone in LA know how to drive in the rain? I am headed over to AEG Headquarters for my first meeting. Four more after that today and a whole bunch more this week. Stay tuned for more.

Today I am revisiting a stock that we owned and made a good chunk of change on a couple of years ago. That stock is Palo Alto Networks which is $PANW. The same reasons we bought Palo Alto Network two years ago is why I am stepping in and buying it today. The stock is about the same level it was at when I first purchased it back in March 2015.

The stock is down $30-$40 from where I had sold it six months after purchasing it. One of the main reasons I had sold the stock was that it had gotten very expensive relative to its revenues and earnings. Fast forward two years, and with the stock down 30% from the levels at which I sold it, even as revenues have more than doubled and cash flow has gone through the roof. Lower valuation plus higher revenues and more cash flow equals cheaper stock.

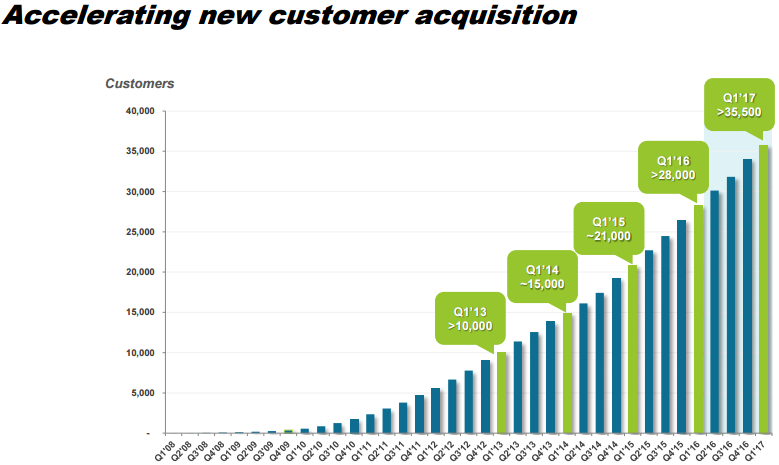

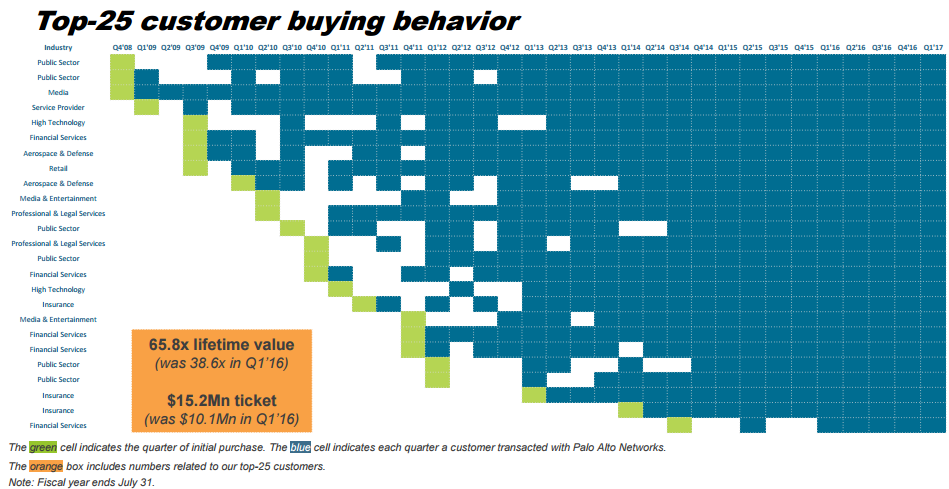

Palo Alto Networks has seemingly already established itself as the standard-bearer for network security. The company’s customer list is accelerating and its possible that revenue growth itself accelerates this year and or next year from an already very impressive 30%-50% growth rate.

Here’s how the company describes itself: “Palo Alto Networks, Inc. provides enterprise security platform to enterprises, service providers, and government entities worldwide. Its platform includes Next-Generation Firewall that delivers application, user, and content visibility and control, as well as protection against network-based cyber threats; and Threat Intelligence Cloud that offers central intelligence capabilities, as well as automated delivery of preventative measures against cyber attacks.”

I am going to start buying a 1/3 tranche in this position today and tomorrow.

Here are some additional fundamentals, analysis, and notes.

- PANW’s Subscription and Support revenue has grown at a significantly faster rate than Product revenue and that is providing a slight headwind to gross margins; the Subscription and Support segment had a gross margin of 73.1% in the last twelve months vs. 74.0% for the Product segment.

- Over the last three years, revenue growth has been driven by rising demand in the U.S., with 65.4% of total revenue coming from the U.S. in FY 2016 (up from 64.0% in FY 2015 and 60.7% in FY 2014). Revenue is also growing in the company’s other major geographic regions (EMEA, APAC, and Other Americas) but at a slower rate. In FY 2016, U.S. revenue grew 51.9% YOY to $901.8 million, EMEA revenue grew 38.3% YOY to $247.1 million, APAC revenue grew 43.8% YOY to $158.2 million, and Other America revenue grew 56.6% YOY to $71.4 million

- The company is still not profitable, even on an adjusted (Non-GAAP) basis, but it is expected to generate Adjusted Net Income of $272.5 million ($2.81 EPS) in FY 2017

- Free cash flow has been consistently positive since FY 2011 and in the last twelve months PANW generated $640.8 million in FCF, which equates to 5.5% of its Enterprise Value.

- All of PANW’s $506.2 million in convertible debt was eligible to be converted during FQ2 2017, which ended on January 31, 2017. The convertible debt had a principal amount of $575.0 and was convertible into up to 5.2 million shares of common stock (5.2 million shares = 5.7% of the 91.7 million shares outstanding as of November 11, 2016.

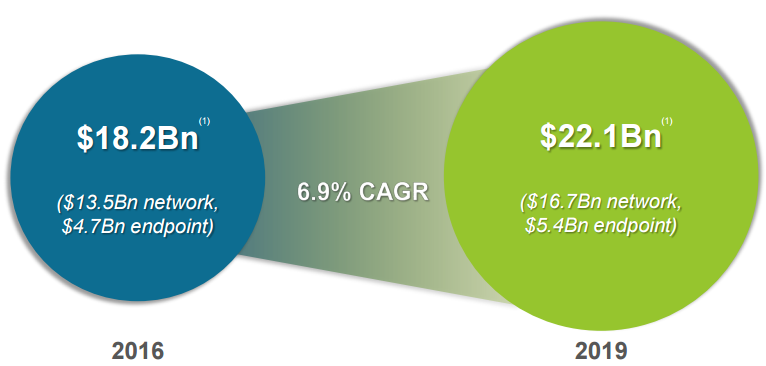

Other beneficial information can be found in PANW’s FQ1 2017 earnings call presentation. A few interesting images have been copied below (Note: Please view the PDF slides for the original version):