Trade Alert – Half a cover, small tranche trim, and the chart of the day

Well, it’s sure ugly out there again. Especially in the momentum stocks and in retail stocks. You’ve got Tesla down another 3% and the 3-D Printing stocks like DDD and VJET down 5% across the board, the retailers like Sears down and Barnes & Nobel down 20% and 5% respectively, and lots of other ugly action out there today. Step back and look at at one year charts though, and you’ll see that most all stocks in the market are still up big from this time last year.

I’ve repeatedly noted that I’ve been scaling into more protection and reducing my net long exposure using puts in the XRT and shorting Pandora again and adding puts in some of the recently spiked and now crashing fuel cell stocks like PLUG.

We’ve got some nice gains in the XRT puts and some rather huge gains in the Pandora short and the PLUG puts. Pandora is now down in a straight line from $39 to $27 per share, and I’d re-entered the short position on its way down at $35 or so. I’m going to lock in about half the gains in my Pandora short position here today.

Meanwhile, I’ve been late taking some gains in Google, as the stock peaked 15% higher than its current quote and I’m going to sell a small tranche of my Google stock, both the GOOG and the GOOGL, which I have held steady for years from much lower levels. From a simple trading perspective and from a portfolio management perspective, I want to take down a bit of my exposure to Google as it is indeed still flying high from most valuation standpoints.

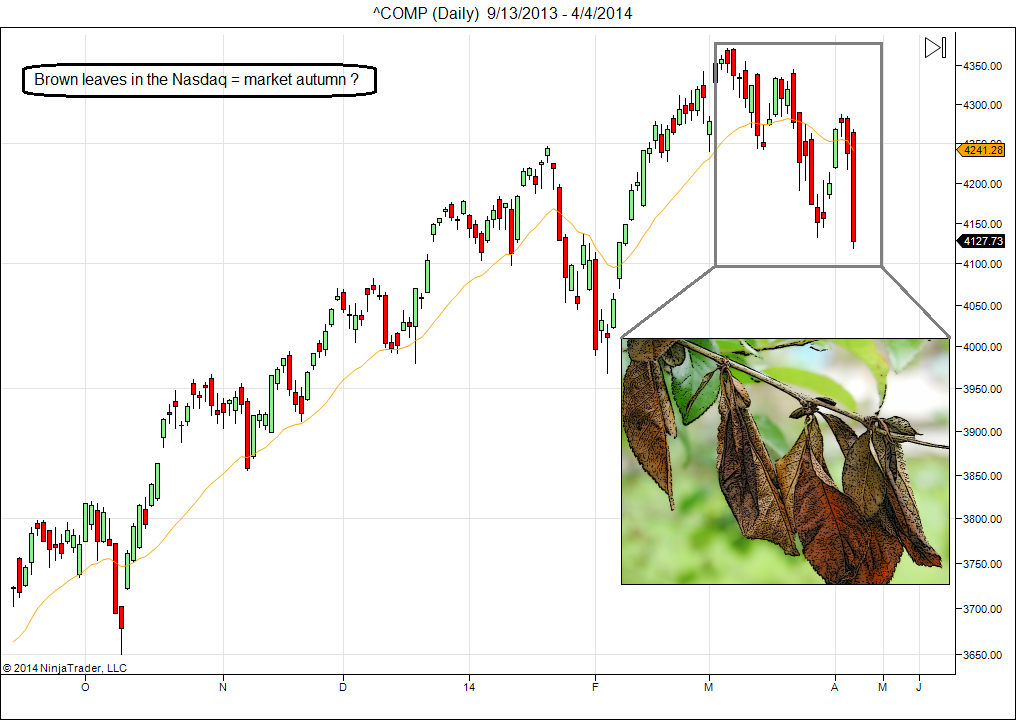

As for the broader markets, I continue to be cautious about the near-term and bullish about the mid-term. I’d like the opportunity to cover some of these shorts and sell some of these protection puts at lower levels in coming weeks and I expect we’ll get that opportunity. The Nasdaq chart has really been busted from the recent sell-off in momentum stocks but the broader indices like the S&P 500 and the DJIA remain stubbornly near their all-time highs, masking the ugliness underneath. The question is whether or not the broader markets’ resilience is going to pull those momentum stocks right back to their highs or whether the trashing of the momentum stocks is going to pull those broader indices down a good 10% or so.

As I’ve said for five years now, as the Federal Reserve keeps unprecedented “emergency extraordinary measures” of easy money and 0% interest rates and as the Republican Democrat and global governments policies are all geared to corporate profit growth, my analysis and my playbook continue to point to ever bigger bubble blowing bull markets ahead in the stock market in general and in the highflying momentum stocks. To be sure, all that money that continues to come into the stock market from retirees and retail investors around the world who are presently being forced into risky stocks and other risky assets since 0% interest rates don’t provide income, is clearly creating imbalances in the economy and the markets. And unfortunately, anybody with any money at all in the world today, has no choice but to continue to navigate these policies and their effects as best as we can. All of which means that we’ll have to continue to work every day to get through this cycle, which by definition, will also end at some point.

I don’t think the recent weakness in momentum stocks and the biotechs and the markets in general is indicative that the cycle has turned. More likely, I expect to see the bubble blowing bull market re-commence probably sometime this summer, after some continued near-term weakness in the markets finally creates some fear and some broad market panicky selling, and the bulls get worn down and start to run.

For now, as today’s chart of the day courtesy of LunaticTrader shows, there’s only brown leaves on the chart. You’ll want to see some broken branches.

Obviously, nobody can see the exact future and there could be a natural disaster or a remarkable new invention or tech innovation or so on and so forth that would change everything I just outlined. I’m not foolish enough to think that I can successfully navigate such economies, societies and markets by betting my entire portfolio one way or another.

Going back to my portfolio, you’ll see that’s why I’ve slowly scaled out of some longs and taken profits on small parts of my long portfolio and why I’ve slowly been trying to add some short-term downside protection and puts and new shorts.

Always remember that investing and trading, even daytrading, is never about getting properly positioned for the next few hours or the next few days or even the next few months but that over time you need to have a few mindblowing big winners, a few great steady stocks and to minimize your losses over the next 3,000 or 10,000 or even 20,000 days of your life, depending on your age.

So do your homework, believe in your analysis and stick to your playbook. How hard can it be? It ain’t easy, but we can do it.