Trade Alert: Hedging my fruit and a new way to think about your money

I am looking at my largest position, Apple, and wondering if I should nibble a couple put options to hedge it a little bit. There’s a lot of love flowing towards Apple these days, and very little bearishness. Recall that we’d added AAPL call options back when it was in the $70s and trimmed them down slowly into these new highs. My common in AAPL is still my biggest position right now even after taking profits on the last of those call options, but I’m not sure I want to actually sell much of the common rather than simply adding a few $AAPL call options with $100 or $98 strike prices dated out into October. So that’s exactly what I’m doing — hedging a small part of my common stock position in AAPL by buying enough puts to give insurance on about 1/5 the position rather than selling 1/5 of the common in AAPL.

I spent last week in San Francisco, meeting with Google Glass representatives, a few other tech company executives, and speaking at the MoneyShow in San Francisco. I must have met 100 people at the show who told me they read The Cody Word on Marketwatch and they’d come out to the show to meet me after seeing me mention it on here. I spent time learning and/or trying to help each and every one of the investors and traders at the show who stopped me to talk after my presentations or who stopped by the Scutify booth to chat. I’ll be happy to meet with you all in NYC and in Vegas next.

One of the most important recurring themes throughout most of the discussions there at the show was the need to review your investment and trading goals. Why are you risking your hard-earned capital investing and/or trading in the first place?

Whether you’re daytrading, swing trading or taking a buy-and-hold approach to your stock market interactions, it’s crucial to look out over the next 10,000 or more days. 10,000 days is about 30 years, and unless you’re over the age of 70, you probably need to be thinking about your money, your portfolios, and your entire net worth in terms of the next 20, 40, 50 years or more.

Here’s a neat trick I used repeatedly last week as I learned that I should probably write an entire book about the 10,000 day idea. Subtract your age from 70. Multiply that times 1.5x your household’s annual salary. That’s a good approximation of how much money you’re going to need to deal with during your career.

One reader I talked to at the show was in her mid-40s, single and making $100,000 a year. So, (70-45)*1.5*$100k = $3.75 million. She likes to swing-trade, but the question I asked her is whether or not her swing trade approach using the $200,000 she has in the stock market is a good long-term strategy for maximizing the risk/reward on her capital? When you put that $20,000 home run she had on some recent call options up next to the $3.75 million of income she’s going to bring into her house over the next few decades, you get some better perspective. Even better perspective comes when you think how hard it is to sustain a winning streak consistently when you’re short-term trading, market-timing and options gambling.

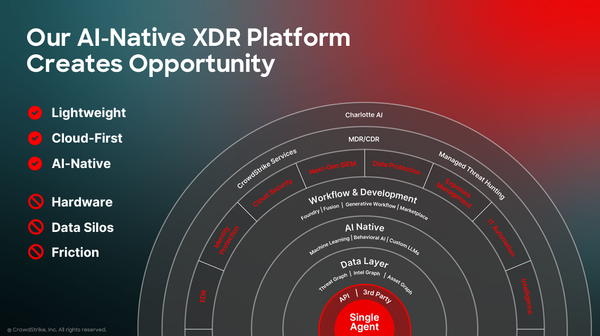

On the same note, I was on a keynote panel last week hosted by Rich Kaarsgard, the publisher of Forbes where we were supposed to be talking tech investments for the masses. I was aghast when a fellow panelist mentioned penny stocks and microcaps to the crowd as viable places for their money. Rich was graceful in moderating us as I kept it real and explained to the crowd why they should “never buy a penny stock.” I was thrilled to talk about my long-term Revolution Investing approach of trying to find companies that don’t just innovate and disrupt but that completely revolutionize an industry. I’d mentioned Ambarella AMBA, Intel INTC and Google GOOG as pureplays on the Wearables Revolution from my latest ebook.

See there? I’m looking out over the next 10,000 days and trying to invest in companies that could revolutionize the way we live. I might do some trading along the way too though.

All of which leads me to the close of today’s The Cody Word as well as your Deep Thought and Chart of the Day:

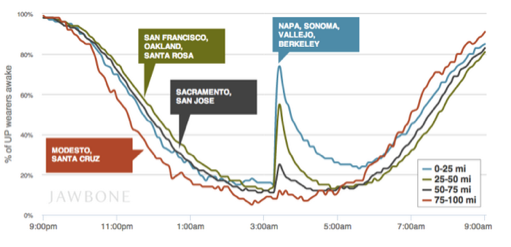

“It’s easy to see how, a population of people all wearing data-transmitting devices could act as a window into what’s going on in our world in real-time.” http://gizmo.do/13jzKAT

Fitness tracker data shows who the Bay Area earthquake woke up and precisely when.