Trade Alert: Here Are The Best (and Worst) Positioned Companies For The Space Revolution

It has been a wild week for The Space Revolution. In the first few hours of the day we had Cathie Wood’s Ark Space Exploration and Innovation ETF (ARKX) beginning to trade and another SpaceX Starship prototype exploding while attempting to bring itself back to earth. We have also had a lot of volatility in both the space names that we love and with the ones that we do not. This feels like a good time for me to give a little more clarity on my thoughts about the Space Revolution in which we have been accumulating positions in and some names which I am starting to bet against (I’m only betting against the stocks in the hedge fund and not in my personal account). I am treating my Space Revolution investments as a basket of new technology space companies that are disrupting the legacy space industry by bringing newer, better and more cost effective technologies to the market. I am hedging this basket by shorting (mainly with in the money relatively close in dated put options) legacy space companies that have older more expensive technologies and generally have pretty poor balance sheets. So here is the play.

Longs:

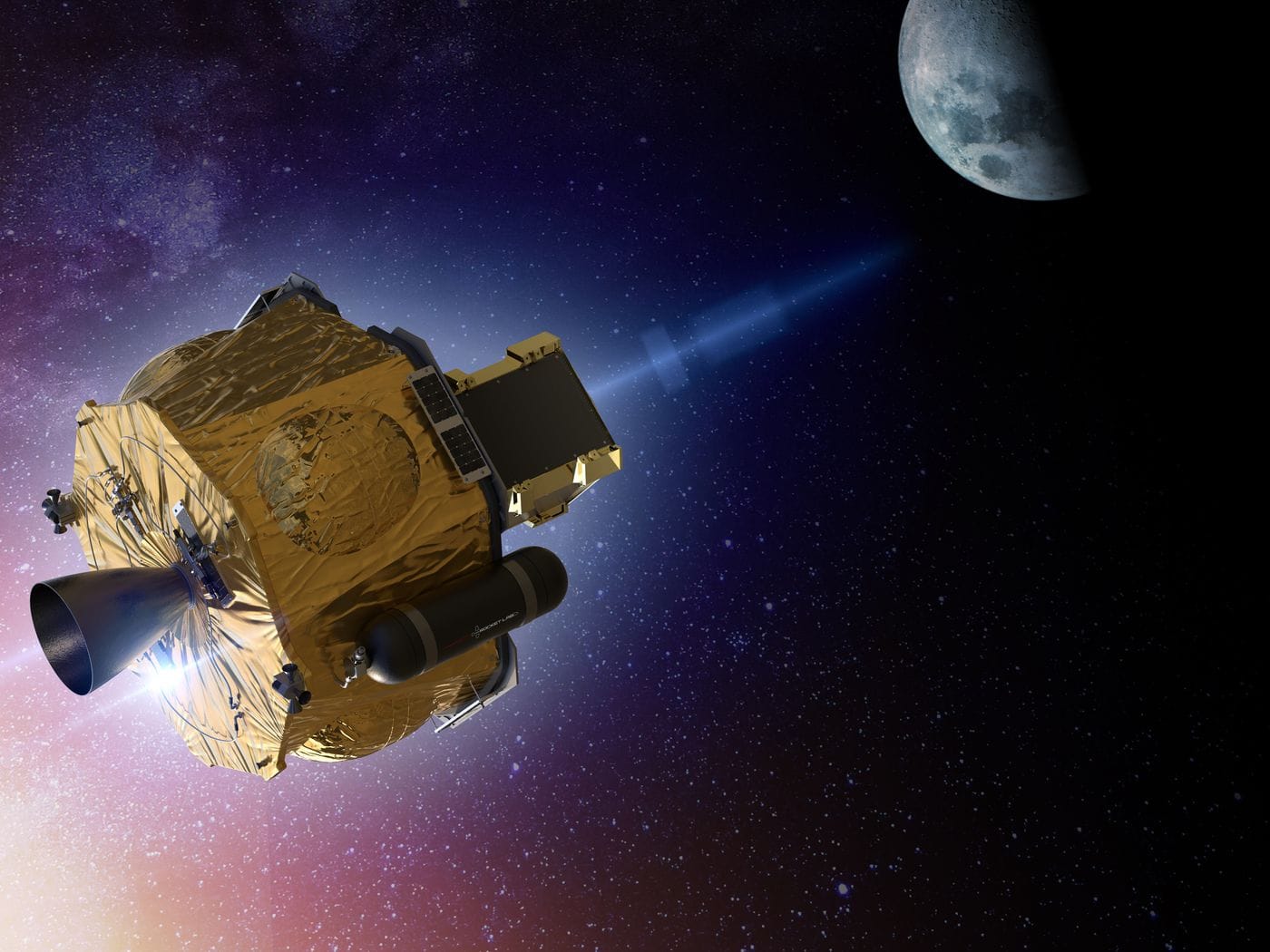

- Rocket Lab/Vector Acquisition Corporation (VACQ): I have written extensively about my favorite publicly-traded space company. This vertically integrated company is involved in multiple areas in the Space Revolution. They are currently sending satellites to orbit, will be sending astronauts to space, build their own Photon satellites (which do a lot more than the typical old technology satellites), and produce components for others to use in their own satellites. This is the company that’s closest to emulating some of SpaceX’s many successes. SpaceX is privately-held and very hard to invest in (although I own some SpaceX equity in the hedge fund) which makes Rocket Lab the best publicly-traded Space Revolution play.

- Astra Space/Holicity (HOL): Here is another name that I have recently started buying in tranches. In a recent Trade Alert, I introduced you to this company and why I think it is also going to be a winner. Just like a lot of our space stocks, HOL has been very volatile this week. I’m pretty sure that investors have been trying to front run Cathie’s ETF that’s beginning to trade and have been buying and selling space stocks based on whether she will include them in ARKX. Yesterday, ARK published a list of holdings that are going to go into the ETF. I think some of the names that are the largest holdings at launch are probably headfakes to keep Wall Street from front running her favorite space stocks before she could start buying them. In the end, it does not matter to me what she does in her ETF, I just think that it could explain some of the recent volatility that we are seeing in some of our names that are not included in her list.

- Redwire/Genesis Park Acquisition Company (GNPK): This company announced last week on March 25 that it is coming public via a SPAC. Of all the SPAC’s that we have seen announce deals recently, this one is coming public at perhaps the most reasonable valuation and certainly at the smallest valuation of $675 million market cap. The company, which is rolling up small Space Revolution suppliers, says it is already profitable, free cash flow positive and forecasted to grow the topline at about 60% a year for the next five years. Redwire is a “picks and shovels” play for space. They are a combination of seven different space infrastructure companies that were combined into one holding company. They could have an exciting future that includes building and repairing space infrastructure on orbit, supplying component parts to a variety of space companies, and digital engineering of spacecraft. I’ve started buying a first tranche of what I expect will be a medium-sized holding in this name this week.

- BlackSky/Osprey Technology Acquisition Corporation (SFTW): This company just hitched a ride on a Rocket Lab rocket to launch an earth observation satellite into space. They were so happy with Rocket Lab that they signed a deal to launch eight more satellites this year. BlackSky is building a constellation of these earth observation satellites that will be able to monitor activity on earth from dusk until dawn and through their proprietary software, be able to provide actionable intelligence to their customers in a variety of industries. The company sees about two thirds of their revenue coming from their on demand satellite images and about one third coming from a recurring revenue model that sells the data that their software algorithms tailor for their customers. Like with GNPK, I’ve started buying a first tranche of what I expect will be a medium-sized holding in SFTW this week.

- Spire/NavSight Holdings (NSH): Spire is a direct competitor with BlackSky. The market for their products is so large that there are going to be multiple winners in this “space”. If you have been following the container ship stuck in the Suez Canal for the past week, I am sure you have seen a lot of high resolution satellite images of it stuck in the mud. In addition to taking pictures of the aftermath, here is an example of how Spire’s technology could have prevented it. The possibilities of potential use cases for this technology is almost limitless. Just like BlackSky, Spire runs their collected data through their own software and sells it to their end users. Both companies are building a huge database of information taken from space that will be usable to countless customers. Both SFTW and NSH are trading around 14 times 2022 revenue. Which ain’t cheap, but hopefully won’t turn out to be too expensive for companies with so much growth potential ahead. I’ve started buying a smaller position in this name this week, leaving lots of room to buy more over time as I plan on keeping NSH a smallish position.

The above are the companies that I have included in my long basket of Space Revolution companies. As I have said before, there will be many more exciting companies coming public and I will do my best to bring those to you. As more and more of these companies come in and disrupt the legacy players in space, I will be hedging the space portfolio by shorting the companies that will be losing market share, just hanging on or even completely going out of business. As I mentioned earlier, I am doing this with short dated, in the money put options. Here are a few of the companies that I have either started building small short positions in and/or have bought some puts as I think the companies below are in trouble.

Shorts:

- Comtech Communications (CMTL): This space company was founded in 1967. Check out their website, it looks like it has not been updated since 1967. The company sells old technology products that are used in satellite ground station technologies, including modems, amplifiers, frequency converters, and network software to modulate, demodulate, and amplify signals, as well as to carry voice, video, and/or data over networks; and public safety and location technologies covering 911 call routing solutions that allow cellular carriers and over the Internet carriers to deliver emergency calls to public safety emergency call centers. That does not sound very revolutionary to me. Comtech has been losing money for the last few years while their revenue just continues to stagnate. They have $47 million in the bank and owe debt of $181 million. That is not exactly the kind of pristine balance sheet you need to protect a dying business. Small cap stock, so be extra careful if you buy or short this name.

- ViaSat, Inc. (VSAT): ViaSat provides satellite based broadband and communications services. I do not know about you, but I am pretty exciting about SpaceX’s Starlink broadband that is coming soon. They might provide a weeeeee little bit of competition to ViaSat. Or more likely, they’ll destroy it. Their balance sheet is even worse than Comtech’s. VSAT has $304 million in cash to “offset” the $1.7 billion in debt that they have to service. I do not like those odds.

- Kratos Defense and Security Solutions (KTOS): Currently trading at $28/share, this stock has had a huge run from $5 in March 2020. It must be growing like crazy, right? Nope. KTOS had revenue of $747 million in 2020, expecting $830 million in 2021 and forecasted to grow to $957 million in 2022. Now that revenue growth is not horrible, but with gross margins in the mid-20% range, I just do not see this company as one I want to own when so many new competitors for Space/Defense products are having billions thrown at them.

- Loral (LORL): This is one confusing company. LORL is a holding company that is merging with a very old technology company TeleSat Canada. The combined company is currently attempting to build out a $5 billion satellite constellation that will provide Wi-Fi to ships and aircraft as well as businesses and government customers. Funding this undertaking could be a problem for the two companies who have a combined cash balance of $850 million with $2.5 billion in debt.

- Maxar (MAXR): Maxar is another space company that has been around forever. Their stock has had a wild ride over the last six years after reaching a high over $80/share in 2015 to a low of around $4.50/share in 2019 and then back up to almost $60 this year before coming back down to the mid $30’s right now. Maxar builds and operates satellites for a variety of customers. One recent satellite that they built for SiriusXM experienced a major fault and is being classified as a total loss by SiriusXM. Having a $225 million satellite completely fail is not a good way to keep the customers happy. Revenues for the company are expected to be flat over the next year. Maxar is another legacy company with a less than stellar balance sheet. That said, I give them credit for being one of the companies to raise money through secondaries when their stock is through the roof. That said however, the $400 million doesn’t do much when they have to pay down some of the $2.5 billion of debt on their balance sheet that is offset by only $27 million in cash. In addition, the company is currently planning on spending $600 million to launch a new generation satellite network called WorldView Legion. Just like with LORL and TeleSat Canada, Maxar might have difficulty raising funds for this large expenditure. Speaking of TeleSat and their planned $5 billion satellite constellation, Maxar broke off from a joint venture with Thales Alenia Space where they were working together to collectively bid for the TeleSat constellation. After breaking the joint venture up, Maxar lost the $3 billion contract to Thales Alenia to build 298 satellites for Loral/Telesat.

- Iridium Communications (IRDM): Here is another company that has been around for a while. They mainly link small battery powered devices (Garmin) to their Iridium satellite network to provide voice and data satellite communications. Their revenue has remained relatively flat for the last few years and is only forecasted to grow 6% to $645 million next year. To keep the common balance sheet theme going, they have $237 million in cash with $1.59 billion in debt. Space and even the new Helium lofi global networks are likely to kill Iridium’s remaining cash cows.

I have one other category in my space basket that I am calling:

Stay Away:

- AST & Science/New Providence Acquisition Corporation (NPA): The company is planning on providing satellite based cell reception to rural areas. That’s not a bad idea, but I didn’t like what I found when I dug into the management team’s history or the overall nuts and bolts I found. I am not outright calling this company a fraud, but a lot of things have come up while researching it that just do not add up.

- Momentus/Stable Road Acquisition Corporation (SRAC): After owning this stock for a while, I changed my mind. The company has had delays in launch and national security issues involving the ownership of their company by a Russian national (who has since stepped away from the company). The company is billed as the “FedEx of space” based on their satellite tug that will move satellites around to different orbits. Rocket Lab is already doing this with Photon, and Rocket Lab does not have to depend on a third party launch provider like Momentus does. I might be wrong, but I just do not like the risk/reward scenario here. I am staying away from this one too.

In many ways, The Space Revolution is going to play out as the classic investment tale of Revolutionary companies bringing new technology that will likely disrupt the old technology. Owning a basket of companies that are Revolutionizing the galaxy while hedging them with some of the old school Space plays that have bad balance sheets and tough prospects ahead can help balance out some of the swings in the market. Remember that shorting stocks and/or buying options is very risky and for most people at home (including my own personal portfolio), should be done judiciously if at all. On the other hand, I continue to think that The Space Revolution is the clearest burgeoning trillion dollar marketplace to get in front of which is why I mostly focus and invest in the long ideas.

We will do this week’s Live Q&A chat at 10am ET on Thursday, in the TWC Chat Room or just email us your question to support@tradingwithcody.com.