Trade Alert: Housecleaning and a color-coded list of my latest positions

I strive to give you guys the very best product I can, and I always know that I can do better. Before I jump in to this report, I want to request some feedback from each of you — what do you like about TradingWithCody.com and what would you like to see improved?

The whole point of my Revolution Investing approach is to try to safely and profitably navigate the Brave New Economy that’s come to rule our world especially since 2008 when the bailouts started. With that in mind, here’s a most complete picture of my own latest positions. First though, I’m going to clean the portfolio up and continue to raise some more cash while the cash raisin’s good. I’m letting go of some of my smallest positions on both the long and short side. I’m selling the last of our Autodesk, which has been a tiny position for awhile now and it’s time to just let the basket of 3-D stocks do our work for us. Likewise with the Outerwall position. Time to take some losses on the tiny position of puts we bought in that name awhile ago as a hedge to the rest of the portfolio.

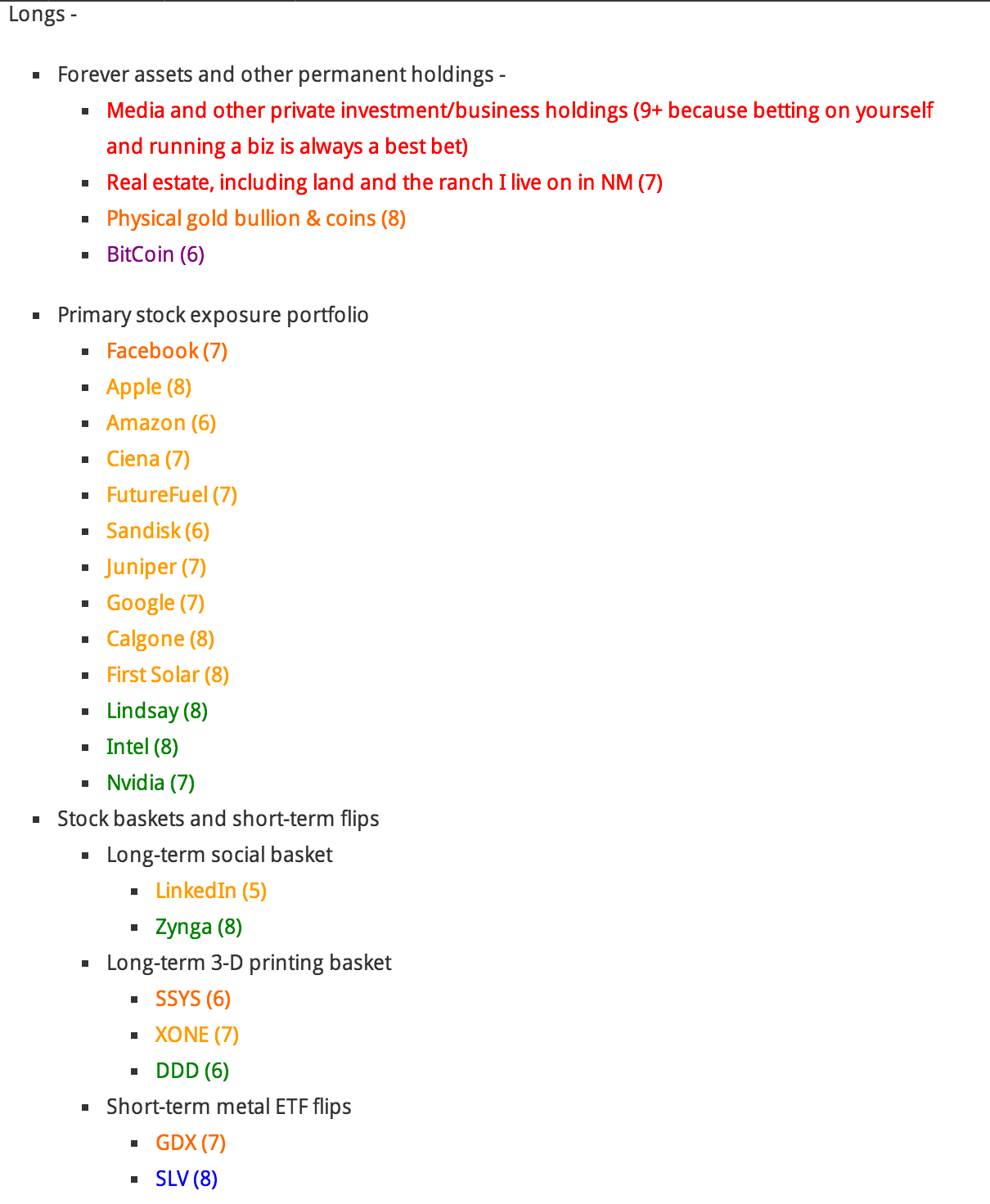

I’ve broken the list into Longs and Shorts. And from there, I’ve broken down each list into even further into refined categories. Using a Civil War Map I was studying over the weekend as inspiration, I’ve added a color code to the list to convey even more information about the size of each position, which are already listed within each refined category in order of overall weighting in my own portfolios. The darker the color (Longs are in blue and shorts are in red), the bigger the position is relative to the entire portfolio.

Finally, I give each stock a current rating from 1 to 10, 1 being “Get out of this position now!” and 10 being “Sell the farm, I’ve found a perfect investment” (there will never be a 10 rating, because there is no such thing as a perfect investment, of course). Anyway, here’s the list:

Longs –

- Forever assets and other permanent holdings –

- Media and other private investment/business holdings (9+ because betting on yourself and running a biz is always a best bet)

- Real estate, including land and the ranch I live on in NM (7)

- Physical gold bullion & coins (8)

- BitCoin (6)

- Primary stock exposure portfolio

- Facebook (7)

- Apple (8)

- Amazon (6)

- Ciena (7)

- FutureFuel (7)

- Sandisk (6)

- Juniper (7)

- Google (7)

- Calgone (8)

- First Solar (8)

- Lindsay (8)

- Intel (8)

- Nvidia (7)

- Stock baskets and short-term flips

- Long-term social basket

- LinkedIn (5)

- Zynga (8)

- Long-term 3-D printing basket

- SSYS (6)

- XONE (7)

- DDD (6)

- Short-term metal ETF flips

- GDX (7)

- SLV (8)

- GLD (7)

- Long-term social basket

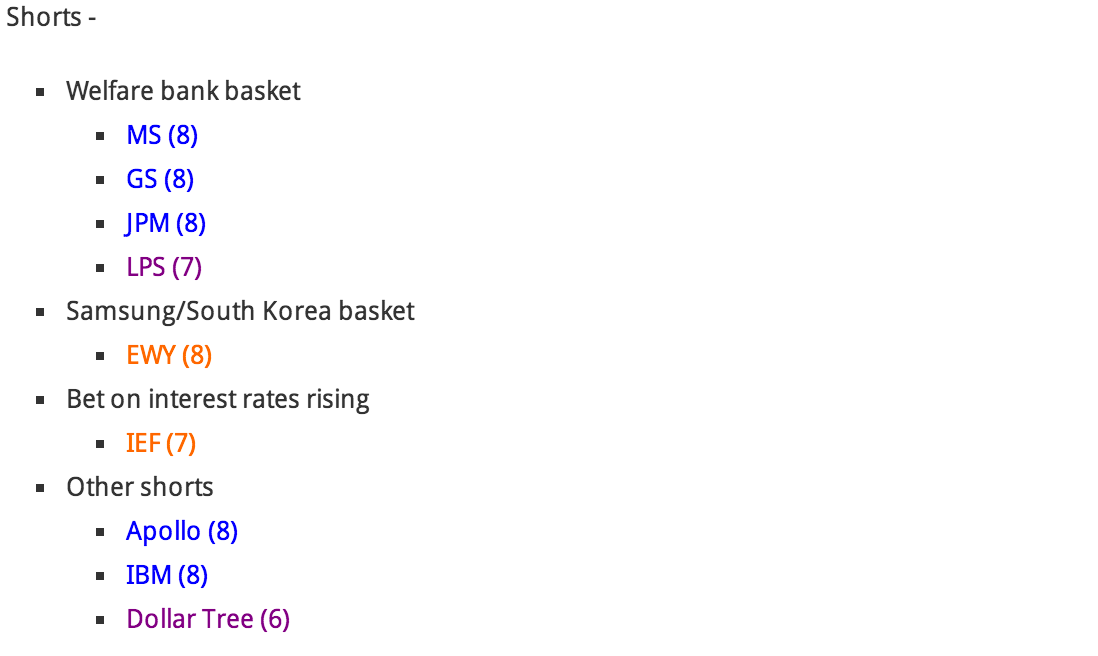

Shorts –

- Welfare bank basket

- MS (8)

- GS (8)

- JPM (8)

- LPS (7)

- Samsung/South Korea basket

- EWY (8)

- Bet on interest rates rising

- IEF (7)

- Other shorts

- Apollo (8)

- IBM (8)

- Dollar Tree (6)

And don’t forget to send me some feedback at support@tradingwithcody.com so we can continue to make this product ever more value add to you.