Trade Alert: The Inevitable March

“I can remember planning for leisure

Living in peace and freedom from fear

Science that promised to make us a new world

Religion and prejudice disappear I can remember when this was the future

Where it was gonna be at back then

Now religion and nuclear energy have united To threaten, oh God! Amen” – Pet Shop Boys

We are buying SMR in the hedge fund and in our personal accounts too. Here’s Bryce’s report that explains why. We plan on making it a medium-sized position and have been nibbling on it slowly for the past week to get started on it. This stock is not a terribly liquid and it can pop when this report comes out so, as always, please be careful about chasing it all at once all today. We will have this week’s chat tomorrow (Wednesday) at 10pm ET in the TWC Chat Room or just email us your question to support@tradingwithcody.com.

Synopsis.

In 2007, Cody wrote that the ultimate endgame of the internet is the “total empowerment of the end user.” This same premise holds true in the energy market. Ultimately we believe that through improving methods of energy generation consumers, businesses, and small communities will be able to make their own power. For example, this trend is already underway with the widespread adoption of residential solar systems. However, most consumers and businesses still get the vast majority of their energy from large-scale, government-protected, monopolistic utility companies. According to the IEA, only 3.6% of global electricity generation in 2020 came from solar. Thus, the world will need to add significantly more generating capacity if we are to wean ourselves off of fossil fuel sources. Additionally, wind and solar have an inherent intermittency problem (meaning that they do not produce reliable energy, e.g. when the wind isn’t blowing or the sun isn’t shining). To accomodate this intermittency problem, wind and solar would require massive and expensive storage capabilities to supply power to the grid when they are not generating power. Because of these limitations, it will be nearly impossible to supply the entire electric grid soley with renewable sources like wind and solar without having another reliable baseload power source. Historically, this source has been fossil fuels (primarily coal and natural gas). However, as we ultimately transition away from fossil fuels, another baseload power source is needed to provide reliable, affordable, scaleable, and clean energy.

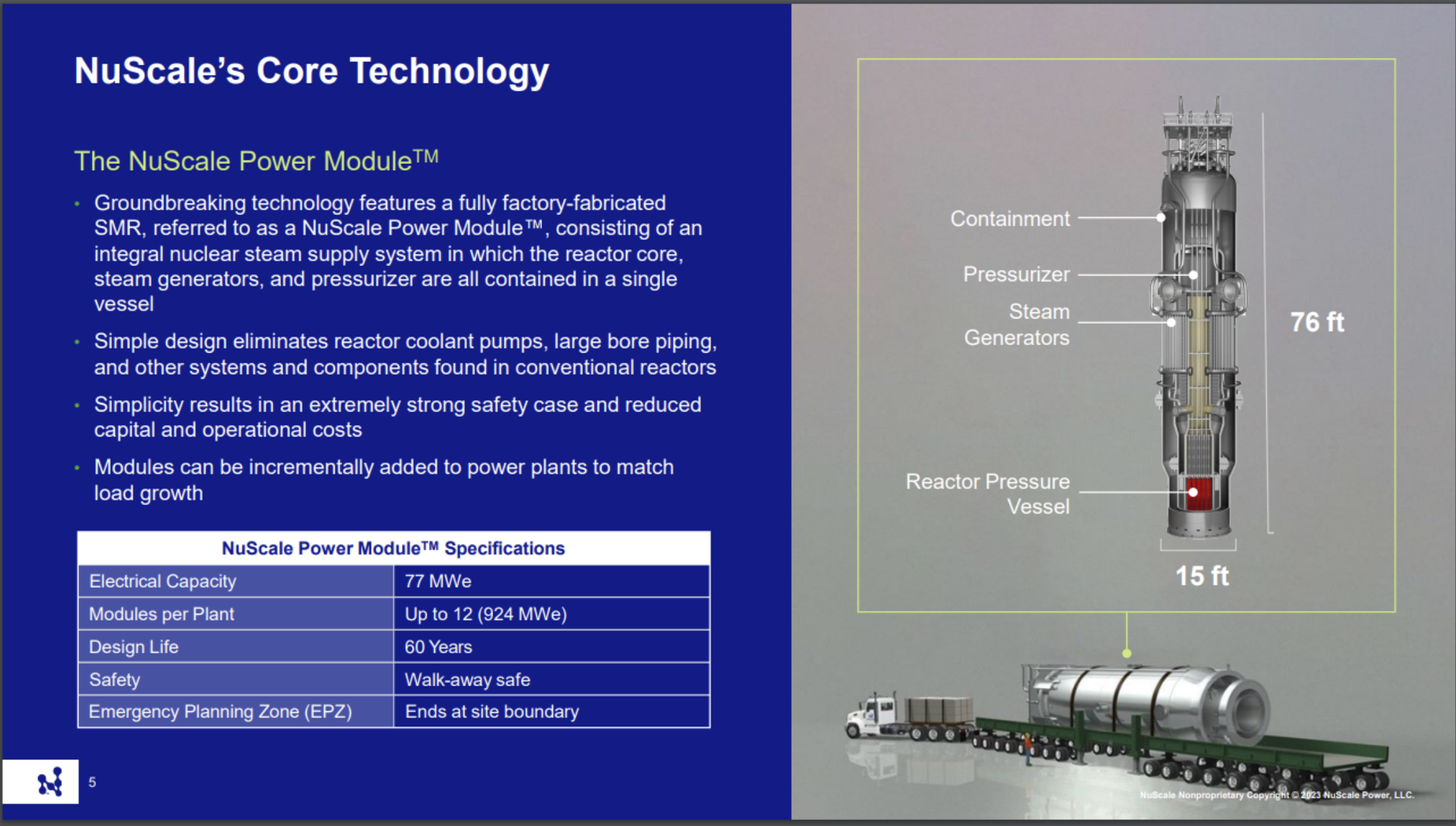

This is where nuclear fits in. While nuclear power itself is obviously nothing new, NuScale Power Corporation is designing small-scale nuclear reactors that are much safer and easier to construct compared to traditional nuclear power plants. NuScale’s small modular reactors (SMRs) will be built in factories and shipped to the destination with minimal assembly required on site. The required safety buffer around a NuScale power plant is less than 1/100th of that of a traditional plant. NuScale is also far ahead of its competition in the small-nuclear space as it has already received approval of its SMR design from the U.S. Nuclear Regulatory Commission (NRC), has two committed customers, and expects to have power plants using its SMRs in operation by 2029. Further, NuScale’s product utilizes the same proven light-water reactor design which has been in use in the United States for over 60 years, and thus it offers higher degrees of reliability and an established supply chain compared to its competitors. What NuScale has done differently from traditional power plants is it has significantly improved on this proven technology by creating a system that does not need external power and pumps to cool the reactor in the event of an emergency, thus eliminating one of the major pitfalls of nuclear power which contributed to disasters at Fukushima, Three Mile Island, and Chernobyl. Thus, we like NuScale because of its incredibly innovative technology, it is the first to market in its industry, and advances the decentralization of power.

Key Metrics.

Exhibit 1

| Market Cap, curr (mm) | $1,900 |

| Total Revenue (ttm) | $11.8mm |

| Current Gross Margin | 38% |

| Net Cash (mm) | $267.7 |

| Price/Sales (ttm) | 161 |

| YoY Revenue Growth (ttm) | 312% |

Source: Yahoo Finance.

SMR Background.

NuScale was founded in 2007 and was granted an exclusive license to develop SMRs based on technology designed by a team at Oregon State University. In 2011, Fluor Corpoation, a global construction and procurement company, invested in NuScale and became its majority investor. Since that time, NuScale has continued developing its technology, securing customers, and building out its supply chain. Additionally, on October 16, 2020, the U.S. Department of Energy approved a cost-share award of nearly $1.36 billion to the Utah Associated Municipal Power Systems (UAMPS) to develop the first NuScale SMR project in the nation.

SMR’s Innovative Technology.

NuScale has developed a nuclear reactor that is self-contained in a housing unit that is roughly the size of a single-wide mobile home. This represents a significant departure from the large buildings and hundreds of acres typically dedicated to traditional nuclear power plants.

NuScale’s SMRs come in 4, 6, and 12 reactor configurations, which allows the technology to be scaled based on the power needs of the customer. What makes NuScale’s SMRs unique is the inherent safety features built into the module which prevents a meltdown in the event of a disaster. Typical nuclear reactors require large pumps to move cooling water around the reactor core to prevent overheating. In the event of a power failure, these pumps must be powered by backup generators or other outside sources. The failure of this critical safety mechanism can cause a meltdown, which is exactly what happened at Fukushima when waves from a tsunami breached a stormwall and took out the backup generators powering the pumps cooling the reactors. NuScale’s design on the other hand is self-contained and essentially self cooling. It has an unlimited “coping period” which means it will not have a meltdown in the event of a power loss, even without operator involvement.

Because of this dramatic increase in the safety of the reactors, the NRC approved a much smaller Emergency Planning Zone (EPZ) for NuScale’s power modules. A traditional nuclear power plant requires a 10-mile radius EPZ, while NuScale’s SMRs only need roughly 40 acres, less than 1/100th of the required land of traditional nuclear. This means that SMRs can be installed in numerous locations that are not suited for traditional nuclear power plants.

In addition to the significant safety features, NuScale has an advantage in that power plants using its technology can be built much quicker than traditional nuclear plants. These SMRs will be factory built by NuScale’s strategic investor, Doosan, and then shipped to the site for assembly by another one of NuScale’s strategic investors, Fluor. With typical nuclear power plants, most of the delays and cost overruns are the result of issues with the physical construction of the plant itself (not the reactors necessarily) which is done at a much larger scale and is much more complex than SMR constrution. This feature should allow NuScale SMRs to be more rapidly adopted and prevent cost overruns which have come to be expected with large-scale nuclear projects.

SMR’s Business Model and Growth Plan.

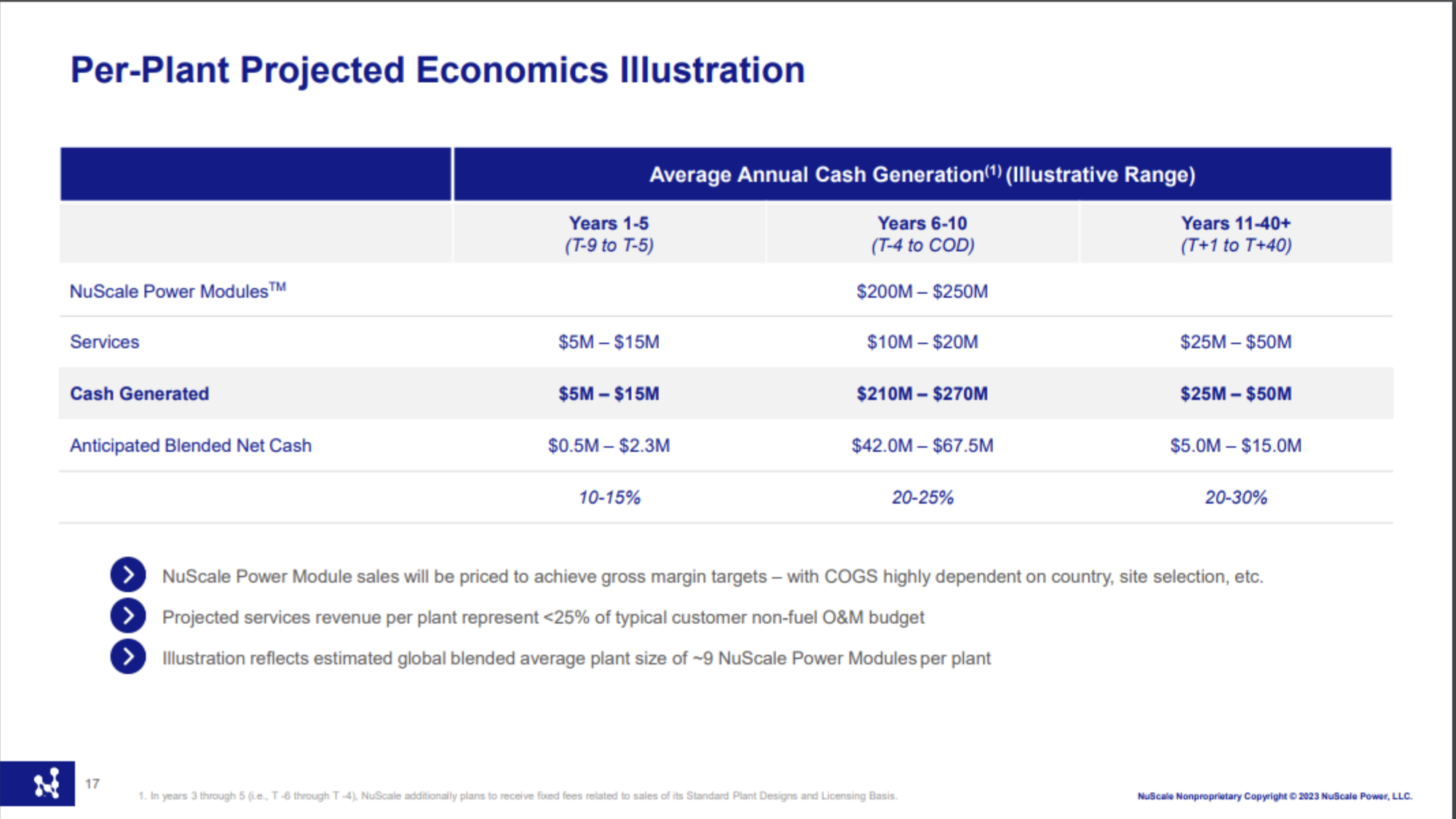

NuScale has a low-capex business model consisting of both services and product sales. The product sales side of the business includes the license and sale of NuScale’s VOYGR power plant modules to utility companies. In tandem with the sale of the SMRs, NuScale will generate services revenue from the licensing, support, testing, training, refueling, and program management of the power plants utilizing its SMRs. This revenue is expected to extend over the full 60+ year life of the power plant. Significantly, given NuScale’s experience in getting approvals from the NRC, NuScale will generate consulting revenue as it helps its customers plan, develop, and gain approval for the installation of new nuclear plants, and this revenue will be generated starting at least eight years before the SMRs are actually installed. Below is an excerpt from NuScale’s investor presentation demonstrating the per-plant economics of its business model:

Using these estimates, our model (shown below) reflects that the company could be generating over $1bb in revenue by 2028 and is trading at roughly 7x 2028 estimated profits. In 2029, we expect the company will start delivering the SMR units which will greatly contribute to even higher revenues and profit margins. Take a look at the Price-to-Profit ratios in years 2029-2032.

| New Committed Customers | Cumulative Customers | Total Revenue | Rev Growth | Gross Margin | Gross Profit | Op. Ex. | Op. Income | Op Margin | P/P | |

| 2023 | 3 | 2 | $50 | – | 30% | $15 | $166 | -$151 | -302.00% | -12.25 |

| 2024 | 13 | 5 | $180 | 260.00% | 30% | $54 | $174 | -$120 | -66.83% | -15.38 |

| 2025 | 15 | 18 | $330 | 83.33% | 30% | $99 | $183 | -$84 | -25.46% | -22.02 |

| 2026 | 25 | 33 | $580 | 75.76% | 30% | $174 | $220 | -$46 | -7.87% | -40.55 |

| 2027 | 12 | 58 | $700 | 20.69% | 30% | $210 | $264 | -$54 | -7.65% | -34.55 |

| 2028 | 12 | 70 | $1,970 | 181.43% | 31% | $611 | $316 | $294 | 14.95% | 6.28 |

| 2029 | 12 | 82 | $5,080 | 157.87% | 32% | $1,626 | $379 | $1,246 | 24.53% | 1.48 |

| 2030 | 12 | 94 | $8,650 | 70.28% | 33% | $2,855 | $455 | $2,399 | 27.74% | 0.77 |

| 2031 | 12 | 106 | $14,520 | 67.86% | 34% | $4,937 | $546 | $4,390 | 30.24% | 0.42 |

| 2032 | 12 | 118 | $17,400 | 19.83% | 35% | $6,090 | $574 | $5,516 | 31.70% | 0.34 |

Discussion of Downside Risks.

As with many early stage companies right now, the primary downside risk in the near term is that NuScale might need to raise capital on unfavorable terms. Based on our projections, NuScale could be forced to raise additional funding in the next 18-24 months. However, we spoke to NuScale’s IR department and they confirmed that the company has multiple llevers to reduce cash burn if needed given its light capex model. But given the expected growth of the company and the with two key contracts already in place, NuScale may be able to continue to fund its growth with operating cash flow. Additionally, we feel that the NuScale may be able to raise money from the U.S. DOE (either through additional grants or loans) given that the department has already committed over $1.3bb to the CFPP utilizing NuScale’s SMRs. As three presidential administrations (of both parties) have already demonstrated significant committment to NuScale’s technology, and since NuScale is the only SMR thus far approved by the NRC, we think it is unlikley that the government would bail on NuScale. Accordingly, we are not overly concerned with the risk of NuScale raising additional money and diluting current shareholders.

Additionally, NuScale will be competing against existing forms of carbon-free power, such as wind and solar, and its technology may not be adopted to the scale that we anticipate. While nuclear energy is one of the most reliable forms of energy, it is not necessarily the cheapest. The chart below shows a comparison of energy costs by generating type:

Especially as renewable energy continues to decrease in cost, NuScale’s small-scale nuclear reactors may prove to be uneconomic. In NuScale’s most recent cost estimate to the CFPP, the LCOE came out to $89 KW/h versus the originally estimated $58 KW/h. However, the CFPP approved the cost increase and chose to move forward with the project. Thus, we are confident that small-scale nuclear will be an economically-viable option for power generation for the foreseeable future.

There is also the risk that NuScale’s technology is not widely adopted because of the perceived safety risk. While the public’s views toward nuclear power seem to have shifted, historically nuclear power has been perceived as unsafe. Disasters such as Fukushima, Three Mile Island, and Chernobyl are not far out of the public’s mind, and there will likely be pushback to widespread installation of nuclear power plants around the country. However, we feel that rising energy costs and the widespread support for carbon-free energy has made nuclear a more popular energy source recently. Together with the fact that the federal government has already acknowledged that SMRs are demonstrably safer than traditional nuclear should mitigate the risk presented by public resistance to SMR installations.

Lastly, we note that NuScale also faces execution risk. As with any early stage company, there is significant risk that management fails to execute on its growth strategy. Given the significant regulatory and financial hurdles involved with developing nuclear power, there is a chance that NuScale fails to get its technology off the ground. However, we like the risk/reward setup here given the extremely large addressable market for SMRs should the technology prove viable.

Summary.

This is a venture capital-like bet on a truly transformative technology that has the potential to improve the lives of millions, if not billions of people around the globe. As we have with renewables (like buying SEDG at $13 in 2016), we are continuing to bet on the decentralization of power while at the same time protecting our planet, and NuScale fits that bill to a tee. Widespread adoption of SMRs would truly make power more afforadable and reliable for millions of people and we are excited to see what the future holds for this small company.