Trade Alert: Investing In The New Republic Note

I’ve mentioned in the past that I’m on the Advisory Board at Republic, a leading crowdfunding platform (check them out at republic.co). I’ve linked to their site several times in the past and have found some interesting startups that might be worth throwing a tiny bit of investment capital at, but I’ve not pulled the trigger because I wanted to spread some of the risk out across more startups. In the same way that I always suggest spreading your risk across many names, especially those rare times when we short and/or buy puts on smaller companies, that’s what I suggest doing when you invest in startups. The companies that raise money on Republic are early stage ventures and are clearly much riskier than the average stock on the stock market. If only there were a way to see exposure from all the companies that have ever raised money on Republic’s crowdfunding and private syndication platforms, so that we could have broad exposure if and when some of the companies end up going IPO or getting acquired…well, starting Thursday there will be.

I’ve been advising Republic and their co-founder, Kendrick Nguyen, on creating a crypto product that would do just that — a “Republic Note” that would enable any investor to let investors share in Republic’s success.

I mentioned the Republic Note in the chat last week and I received a few questions from Trading With Cody subscribers about it, which I then sent along to Republic to answer themselves:

Question #1: is there any information on Republic’s performance and returns? I realize it’s newish, but it must have some history.

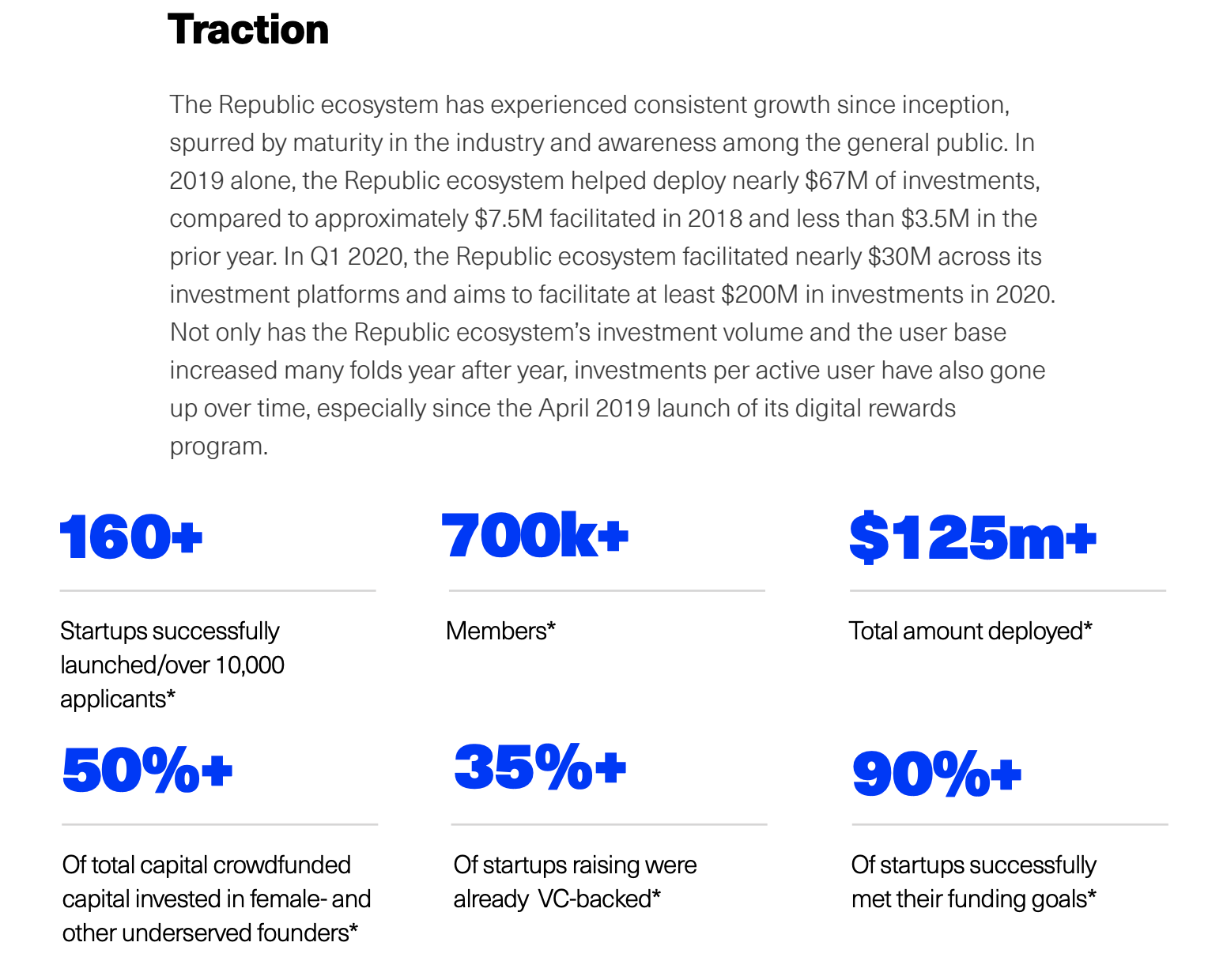

This information can be found in our whitepaper starting on page 29, but please see this screenshot below for a quick preview:

Question #2: It sounds like Republic Note is sort of like a mutual fund interest in all the startups on Republic, is that loosely fair?

The Republic Note is a profit sharing token issued by the technological center of Republic, Republic Core LLC. It allows you to share in Republic Core’s profits when certain conditions are met. Specifically, Republic’s crowdfunding platform and private capital platform receive cash and an upside potential in every company they raise money for, in the form of equity, carried interest, tokens, etc. If and when those positions succeed some or all of those earnings will be paid back to Republic Core and ultimately to Republic Note holders.

Question #3: Can you shed some light on how capital raised through Republic Note will be allocated among the startups? Is it weighted or is it pro rata?

The Republic Note fundraise is to raise capital for Republic Core. This capital is not being raised or distributed for startups that are raising on Republic’s platform.

Now to be sure, once again, investing is risky. Investing in startups is even riskier. I do think the ability to buy into a wide swath of start ups that Republic has already vetted will alleviate some of that risk and I’m going to buy a little bit of the Republic Note as I do think there is some real value that is likely to be created by the companies we’re getting exposure to in the Republic Note.

Click here to get started buying the Republic Note if you are an accredited investor or reserve your interest if you are unaccredited.

Disclosure: At the time of publication, the firm in which Mr. Willard is a partner and/or Mr. Willard had positions in some of the stocks mentioned above although positions can change at any time and without notice. Nothing in this newsletter shall constitute or be construed as an offering of securities or as investment advice or any recommendation as to an investment or other strategy by Republic Advisory Services or any of its affiliates. All information provided in this newsletter is impersonal and not tailored to the needs of any person, entity, or group of persons.