Trade Alert: It’s So Easy And Everyday It’s Getting Closer

“People tell me [caution]’s for fools. So, here I go, breaking all the rules.

It seems so easy (Seems so easy, seems so easy). Oh so doggone easy (Doggone easy, doggone easy).

It seems so easy (Seems so easy, seems so easy, seems so easy)

Where [profits are] concerned, my heart has learned.” – based on Buddy Holly’s “It’s So Easy” one of my favorite songs to play and sing on guitar with my old pal Rod before The Coronavirus Crisis put a stop to jam sessions

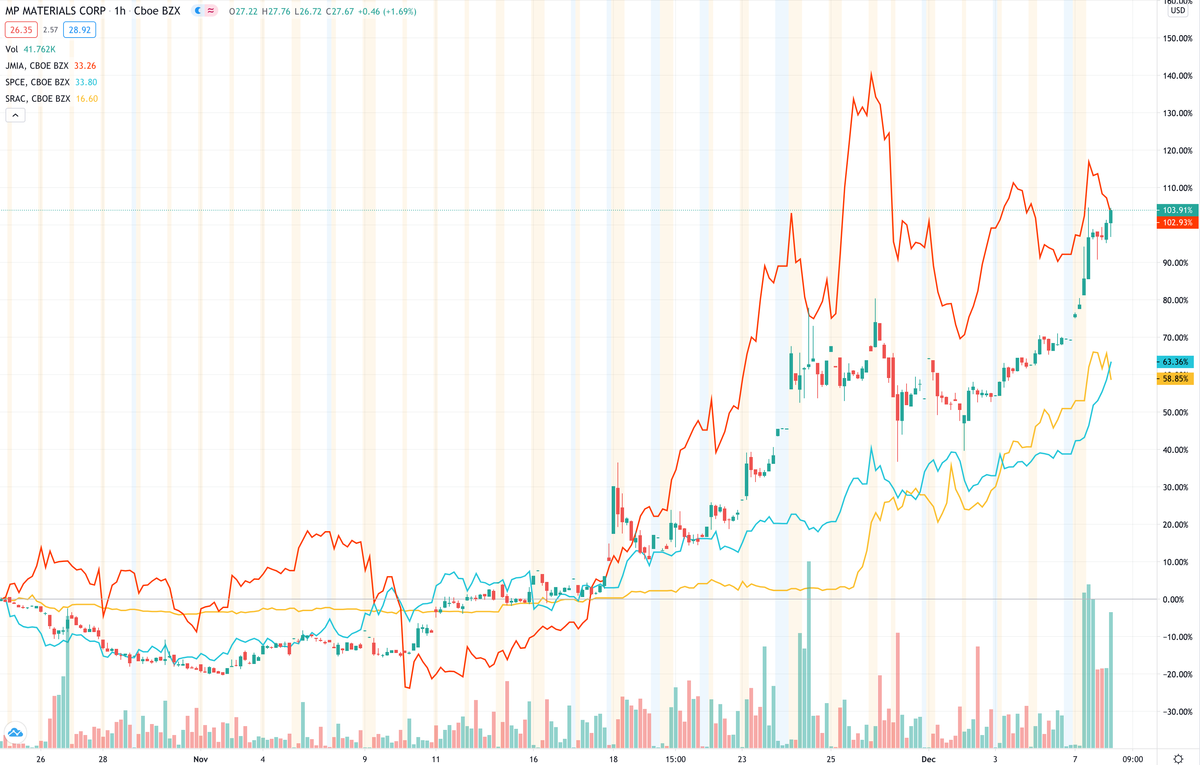

Are we having fun yet? I mean, it’s like I throw a Trade Alert about buying a new stock and the thing goes relentlessly straight up for days on end. Here’s a six week chart of my recent Trade Alert buys:

It’s so easy, right?

But let me throw out a Public Service Announcement reminder here — investing is not supposed to be fun!

I don’t know, folks — if you’ve been reading my analysis, you know that I see a lot of frothiness in the valuations of the markets overall and especially in many individual stocks out there. On the other hand, you’ve probably noticed that I’ve been patiently finding some new potential gems that still look quite undervalued for the long-term.

We’re having another good quarter to end the year (knock on wood). We’ve had some remarkable, maybe even historic returns since we launched Trading With Cody back in 2011 (knock on wood again) and I’m not resting on my laurels. The froth in the markets is starting to bring us the opportunity to slowly but surely build our hedges in the hedge fund by selectivity starting to short some of the most ridiculously bubbled up stocks that have little or no operations but claim to be “Electric Vehicle” or “Cloud” plays. I see a lot of stocks that are trading for hundreds of millions or billions of dollars that will likely end up back at the penny stock status in which they’d spent the last few years. I even trimmed a little of our recent purchases across the board, trimming a little bit of SPCE, MP, JMIA and even a little bit of SRAC as the spike there has gone straight up since we bought it last week.

On the other hand, I’m not doing those types of hedges in my personal account even I did do a little more trimming yet again in the personal account today. Speaking of SRAC, tomorrow I’ll send out a couple of the best reports I got from followers about SRAC.

Looking out into next year, I am excited about the opportunities I see developing in The Space, Robotics and other burgeoning Revolutions that are being quite undervalued and misunderstood because it’s still so early in these markets’ development.

At some point in the next few months, probably sooner rather than later, I expect we will see some serious pullbacks in the broader stock markets and that many individual stocks, of both good and bad companies, will be crushed at that point. This year, with the economic and stock market crash that happened in the spring and had already subsided by the end of the summer, was another year that exemplified why I created my “Kurtzweil Rate of Change” theory:

What happens if it all works out?

Even if it doesn’t work out, how low will we go and how long will we be there?

I’ve talked for years (ironically) about how the economic/stock market bubbles and busts that we live through run on ‘Internet time’ which means they happen much more quickly than in decades past. Reading Ray Kurzweil’s The Singularity Is Near has helped me understand that I shouldn’t call this concept ‘Internet time’ because that’s a bit too limited of an explanation for it. The fact is that mankind itself, our society specifically, is growing our innovation, prosperity and economies exponentially.

And if there will be billions of times more technological advances in the next few decades as there was for the first few millions of years of mankind’s existence, then you can imagine that the ups and downs and bubbles and crashes will play out many times in the next few decades but that the general trend of technology, society, the economy and the most Revolutionary Stocks in the markets, will all be quite hockey up over those next few decades.”

*From my full article from the lows on December 26, 2018 (when the markets had crashed and were bottoming) called Evaluating The Risk Factors: Sentiment, Valuations and Geopolitical.

Cody back in real-time December 7, 2020. If and when we get another 5-10% (and perhaps a 15-20%) pullback in the markets — again, something I expect might happen in January if not before the end of the year — I see a lot of names I’ll be ready to pounce on and then build into 10,000 Day positions, so stay tuned for those if and when we get the pitches.

And to reiterate, I’d suggest taking advantage of these crazy spikes in so many of our stocks and other stocks, I’d suggest making sure you’re note being too aggressive right now and that you’ve got enough cash on the sidelines that you won’t be terribly hurt when this Bubble-Blowing Bull Market finally puts in another swing lower, sweet chariot. The markets dole out pain, not just profits. Be ready, be vigilant while you can and don’t get caught being greedy.

In the meantime, I’m hedged and actively protecting capital even as I ride our many big winners.

“Everyday, [the pullback’s] gettin’ closer,

[Markets] goin’ faster than a roller coaster,

[Pullbacks] like yours will surely come [our] way, (hey, hey, hey)

Everyday, it’s a gettin’ faster, Everyone says go ahead and [buy more]

Love like yours will surely come my way, (hey, hey, hey)” – based on Buddy Holly’s “Every Day” another one of my favorite songs to play and sing on guitar with my old pal Rod before The Coronavirus Crisis put a stop to jam sessions and one that my daughters love too

I leave you with a shot of a pre-Covid jam session from 11 years ago.