Trade Alert: Latest Positions with flashbacks (and quite a few trims)

Don’t forget this week’s Live Q&A Chat tomorrow morning at 7am ET in the TWC Chat Room or just email us your question to support@tradingwithcody.com.

Here is a list of my latest personal portfolio positions and most of the hedge fund positions with updated commentary and ratings for each position. You’ll notice there are several trades (marked in bold) that I’m making, mostly raising just a little more cash and locking in some profits.

I’ve broken the list into Longs and Shorts. I’ve further broken the list down in order of highest-rated to lowest-rated. Those ratings go from 1 to 10, 1 being “Get out of this position now!” and 10 being “Sell the farm, I’ve found a perfect investment.” The stocks that are bolded are those that I consider to be “core” holdings and am unlikely to ever sell out of them entirely.

Longs –

- Forever assets and other permanent holdings –

- Media, hedge fund and other private investment/business holdings (9+ because betting on yourself and running a business is always a best bet)

- Real estate, including the office I work out of, some land and the ranch I live on in NM (8)

- Physical gold bullion & coins (8)

- (Driverless Revolution) –

- TSLA Tesla (8+) – I remember the “iPod is a fad” and other bearish arguments from when I first bought Apple back in March 2003, so I did some googling on the topic and found a few interesting articles:

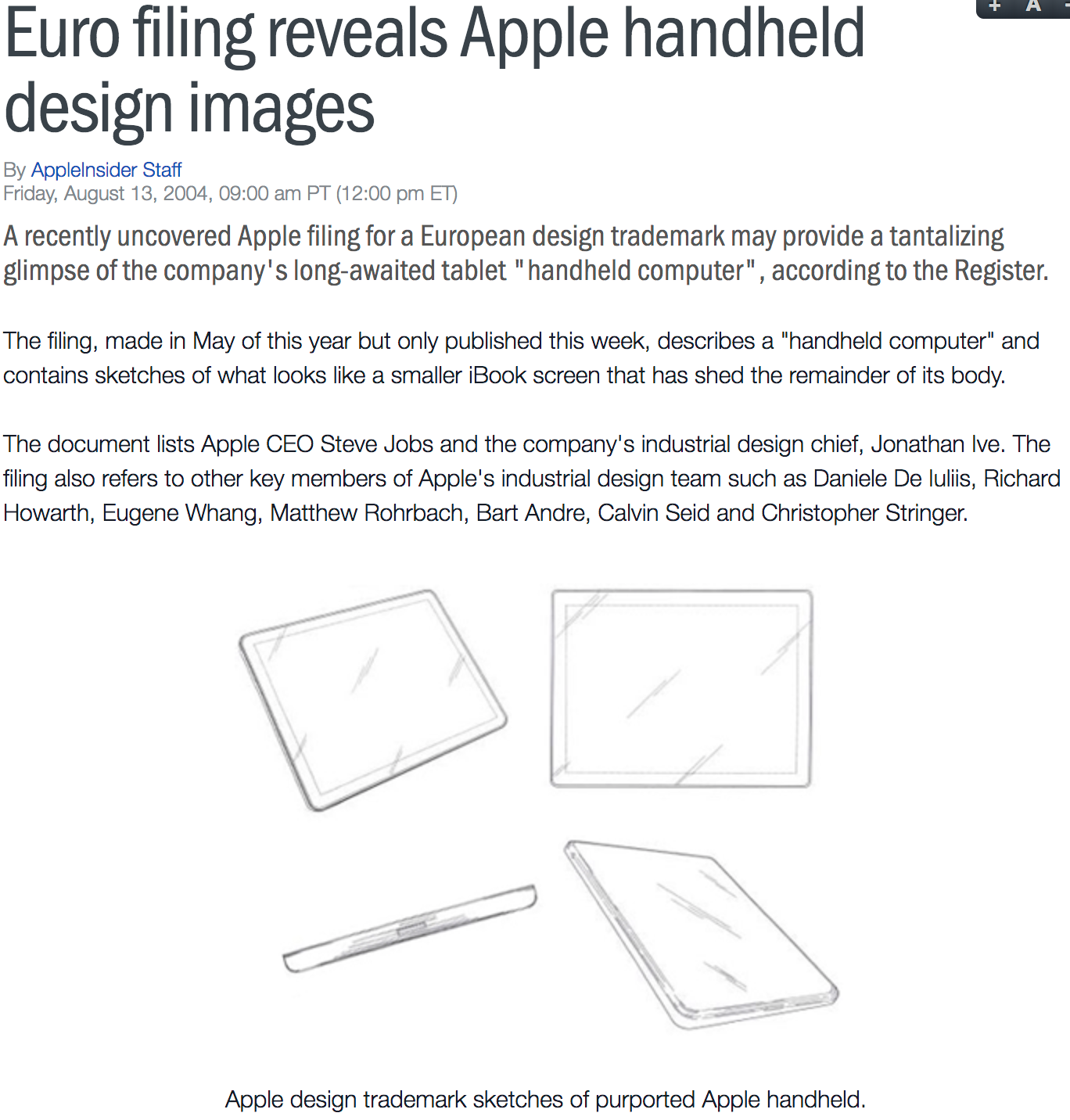

IPod [sic] Sales Boost Apple’s Bottom Line: “Reporting exceptionally positive earnings and sales for its first fiscal quarter 2004, Apple said it sold 733,000 iPod digital music players which generated $256 million in sales, compared to 829,000 Macintosh computers which generated almost $1.3 billion in sales. The increase in iPod sales amounts to a surge of 235% from the year-ago quarter.” That means back in 2003, Apple was selling 500,000 iPods year at an average selling price of $49 a pop. Apple has sold more than two billion iPhones since 2008 (four years after filing for the idea’s design trademark, per image below). Telsa might sell 500,000 cars this in the next 12 months at an ASP of more than $50,000. I wonder how many various and amazing vehicles will sell in fifteen years and how many total vehicles it will have sold by 2035. If it survives the next 12 months.

Pretty wild to look back, isn’t it? I also remember how hard it was to believe in my analysis that the Apple iPod would eventually become a computer for your your pocket. Let’s continue with another couple headlines from 2004.

Pretty wild to look back, isn’t it? I also remember how hard it was to believe in my analysis that the Apple iPod would eventually become a computer for your your pocket. Let’s continue with another couple headlines from 2004.

Wall Street analysts have soured on Apple: “Writing Apple’s obituary has become a favorite pastime of many technology and financial journalists.” I used to get tons of emails and comments on my articles on TheStreet about how doomed Apple was supposed to be back when I bought the stock for a split-adjusted $1 per share when people, including the best of the Wall Street analysts, still thought that Steve Jobs wouldn’t be able to save Apple. Sound familiar with Tesla and Elon Musk these days?

Take a bite out of this Apple – “The iPod maker still has great prospects but it makes sense for investors to cash in on gains. ‘Apple has been very good to us,’ said Buckingham. ‘But I’m not that greedy. I’m content to let others fight over the last 10 to 15 bucks of upside.'” If (and it’s certainly still an if) this TSLA investment works out, we’ll have to remember to let it run just like I have with my AAPL investment over the last sixteen years. - UBER Uber (8) – You never want to oversimplify your investment strategies too much, but then again, you don’t want to overthink things either. Point being that when a company has created and dominates its own industry to the point where it’s a now a verb (“Let’s uber to the airport”) — and the verb that it has replaced is a 130 years old term, at that (“Let’s taxi to the airport”), it’s usually worth throwing a little bit of risk capital at it. That said, the company needs to grow revenues 30% or more per year for the next three to five years (at least) and to turn cash flow positive in the next two to three years or I would likely have to sell it at some point.

- TSLA Tesla (8+) – I remember the “iPod is a fad” and other bearish arguments from when I first bought Apple back in March 2003, so I did some googling on the topic and found a few interesting articles:

- (Social Revolution)

- FB Facebook (8) – I suppose the next year or two is going to be more about Libra, the new Facebook cryptocurrency* (*it’s not really a cryptocurrency), than it will be about the earnings. The market thinks that Libra could generate tens of billions of dollars in new revenue streams for Facebook in the next decade. That’s a big potential upside to what the markets have been expecting. And that promise probably means that FB is a relatively safer (lower downside potential) play than most of our names right now and for the next year. Then, it’ll be show-me time and the risk/reward for late 2020 and early 2021 might be skewed the other way. For now, I like the FB set up.

- TWTR Twitter (8) – Twitter is slowly but surely continuing to become the de facto standard outlet for organizations and celebrities to get their word out to the public. Trump’s tweeting has further entrenched this dominance, of course. Trading at 9x next year’s sales estimates and 30x next year’s earnings estimates with 15-20% topline growth, makes the valuation of this stock probably about “fair value” in this market. On the other hand, that aforementioned dominance is probably worth a helluva lot more in the long-term than the markets are valuing it at. I’ve owned Twitter personally since it was about $14 per share and in the hedge fund in the low $30s. It’s one of my larger positions and I plan to keep it that way for a long time, unless something drastic changes.

- SNAP Snap (7) – It’s probably time to trim some of our SNAP and most all of our SNAP call options, both of which we’ve owned from the mid-single digits to today’s nearly $15 quote. Last time, I wrote, “Simply put, kids and adults alike would agree that Snap is the most fun and innovative social network app out there,” and that’s probably the best reason to continue owning SNAP here. The fact is that it’s trading at about the same price to sales ratio that Twitter is trading at even though it’s growing its top line 30% per year, twice as fast as Twitter. Then again, Snap, unlike Twitter, is not profitable yet. Two years out, this company could be kicking off close to $1 per share if they monetize (and keep growing) their traffic right. Consider this a Trade Alert — I’m trimming 15% of my SNAP.

- (5G Revolution)

- VZ Verizon (6) – I’m more a trimmer than a buyer of Verizon lately, and am going to trim another 20% here, so consider this another Trade Alert. I like the dividend and the likely upside to the stock from new potential revenue streams from 5G. Here’s the set up though — it’s likely that Verizon will win the carrier side of The 5G Revolution in the US, as long T-Mobile and Sprint don’t merge. A combined T-Mobile and Sprint just might have the better bandwidth and frequencies for 5G and a better (less expensive) technology pathway to get there. I’ll hold Verizon until we get a ruling on the TMUS/S merger.

- TMUS T-Mobile (8) – I’m holding some TMUS call options that are near-the-money in expectation that this merger is approved in the next few weeks. I’ve been planning to nibble some TMUS common stock and am going to go ahead and do so this week. Consider this a Trade Alert that I’m starting a small TMUS position.

- QCOM Qualcomm (8) – Last time I wrote, “The company is primed to be a leader in 5G chips for the next three years and analysts will have to be raising their estimates and the stock is trading at 12x this year’s earnings estimates. If you have call options that are up 2000% or more, you might want to trim some of them. But this stock still has very good asymmetric risk/reward scenarios here.” Nothing’s changed here except that The Great Trade War is likely to take some of next year’s earnings estimates lower by maybe 10-15%. I still think the stock is terribly cheap and attractive here looking out of the next five years.

- (Cloud Revolution)

- Palo Alto Networks (6) – I’m worried that the residual business of selling appliances to protect networks is holding back Palo Alto. Certainly the Street is not impressed with the last two quarterly reports. I’m making some calls and doing some more homework on this one.

- DELL Dell (6) – Big pullback here in this stock and the valuation is once again getting to be more attractive again here back below 8x next year’s earnings estimates. Then again, it’s not quite the 6x earnings it was when we bought it at $42 and with low single digit topline growth and too much debt on the balance sheets and the complicated share structure (and how this stock has been trading in lockstep with VMW and it’s likely to continue I suppose) — well, I’m thinking it might be easier to someday maybe just buy VMW. In the meantime, I’m going to go ahead and sell about 1/2 my DELL here, locking in some of these remaining gains, as I just would rather have the cash on hand, so consider this another Trade Alert.

- SQ Square (7) – You see the Square checkouts every where you go these days. And online sales are nothing to sneeze at here either. Jack Dorsey, the CEO of both Square and Twitter, is another genius. We’ve got nice gains in SQ and I’m holding it steady here.

- NVDA Nvidia (6) – As I wrote last time: “We know that Nvidia’s chip sales to Tesla for the Full Self Driving computer are gone since Tesla started building their own chips. That said, the company’s chips are still in big demand for data centers, AI and other fast growing, Revolutionary sectors.” Having owned this stock since it was below $30 three years ago, I’m not about to bail on it. But I don’t think it deserves to be one of my biggest positions. I’m sitting tight on it for now.

- ZEN Zendesk (7) – Stop me if you’re heard this before — Zendesk is barely profitable, growing topline at 30% per year and the stock is trading at 10x next year’s sales estimates. Zendesk has 70% plus gross margins. That makes this stock probably about fair value here in this market. But I do like the way this company has positioned themselves as a go-to customer solution. That said, I’m going to stay on top of this name and any cracks in the fundamentals, I’ll be ready to cut it.

- SPLK Splunk (7) – Last time I explained that “Splunk has one of the highest gross margins of any company I cover, at nearly 90% and the company is growing 20-25% topline per year. The company is becoming a major beneficiary of the Amazon Web Services (and also from Google’s and Microsoft’s cloud businesses too).” Another Revolutionary theme I like to invest in is when a company can save you much more money than you spend on their products. On Splunk’s site, you can figure out how much money you’re going to save using this calculator: “Select your use case and estimate how much your organization could save using Splunk software.”

- (Energy Revolution)

- SEDG SolarEdge (6) – The most recent quarterly report was so strong that the sellside analyst earnings estimates for next year went from just over $3 to nearly $4. That means the stock actually stayed at the same valuation on that metric as it went from $45 to $60 over the same time frame. This remains, along with First Solar, one of the best plays on The Solar Revolution.

- (China Middle Class Revolution)

- JD JD.com (7) – JD’s growing about 20% per year, it’s one of the most dominant forces in China’s Internet Revolution and we can own it for 28x next year’s earnings. This one, along with recent purchase BIDU constitutes just about the totality of my direct China exposure.

- BIDU Baidu (8) – I don’t think we should call Baidu the “China Google” but the fact is that the company is dominant in search and has a ton of investments and cash. 60 days ago, sellside estimates for BIDU for this year’s earnings were $8 and for next year, $11. Today, those estimates sit at $5 and $7.50. Of course, the stock had dropped more than 60% from $274 to $120 before the earnings report that brought those estimates down. Topline growth is going to be closer to 5-10% this year and maybe 15-20% next year. But go back to the balance sheet and it’s got $12 billion net cash (nearly 30% of the market cap). And the company’s investments range from AI to Driverless to equity in iQuiyi (IQ) and others totaling billions of dollars of worth, probably at least another $10 billion. That gets you to half its market cap. So maybe you call the enterprise value $20 billion and you’re buying this stock at less than 10x EV to next year’s earnings estimates.

- TSM TSM (8) – There’s a major move away from using Nvidia and Intel and other general purpose chips to things more like what Tesla, Google, Facebook, Apple and many others do by designing their own chips and outsourcing their production. TSM owns this industry and is paying more than 4% dividend in the meantime.

- (Defensive names)

- CPB Campbell’s (7) – The dividend was nearly 4.5% when we bought CPB at $32 but it’s now down to a 3.5% yield with the stock in the low $40s. It’s been a great run, but I think it’s time to trim this one down a bit more, and I’m trimming 10-15% of CPB here in the low $40s. Consider this another Trade Alert.

- Altria MO (7) – Altria’s nearly 7% dividend and its investment in Cronos making MO an indirect play on The Marijuana Revolution keeps me in this one despite the stock’s downtrend and ugly headlines (which come along with the business of selling tobacco and nicotine addictions that kill people).

- GLD Gold ETF (7) – In the most recent Latest Positions, I wrote: “Gold, which has sold off in April as I write this letter, is one of the few asset classes that isn’t through the roof this year. I think gold is likely headed higher later this year and, more confidently, over the next 10,000 days.” Boy, has it:

Now, gold might be ready for a rest. Yup, another Trade Alert, as I’m trimming 10-15% my GLD position, locking in some nice near-term profits.

Now, gold might be ready for a rest. Yup, another Trade Alert, as I’m trimming 10-15% my GLD position, locking in some nice near-term profits.

- (The Trillion Dollar Basket)

- GOOG/GOOGL Google (7) – Stick with me for a double flashback, because in the prior Latest Positions update, I wrote, “In the prior Latest Positions update, I wrote this: ‘The company guided towards increased spending on cloud and data centers which didn’t impress Wall Street despite Google putting up great numbers last quarter. Sometimes I wonder if Android is Google’s most valuable asset, despite the fact that it doesn’t generate much revenue. Being the operating system on every Huawei and other Chinese smartphones means that Google, despite all the claims that Google’s not in China, is perhaps the most entrenched US company in China. Android runs billions of devices around the world. Google owns and controls the s-called open source code of Android. I’m not sure how or when Google will ever directly monetize that unrivaled global ubiquity, but Android’s critical mass is truly unrivaled in this world’s history.’ Since then, Google Alphabet reported another disappointing quarter and the stock has broken its range, technically speaking. Trading at 2ox next year’s recently reduced earnings estimates, and a recently guided down topline growth rate, the stock might be in no-man’s land.” Sounds about right, doesn’t it? That said, on June 3, I nibbled on some GOOG (and FB and AMZN) on the very day they bottomed and then recently trimmed them when they ran back towards their highs. It’s nice to catch some trading gains when a stock is basically still in no-man’s land, as GOOG probably still is.

- AAPL Apple (7) – I own Apple because it’s a core position that I’ve owned for 16 years and because they are going to benefit big-time over the next five years as The 5G Revolution drives a supercycle of upgrades. At 16x next year’s earnings estimates, I’m not thrilled about the valuation, but I hold it steady here for now.

- AMZN Amazon (7) – Nobody (but Elon Musk) calls Jeff Bezos and his space company a failure like they Elon Musk and his space company. But 15 years ago, there were plenty who thought Jeff Bezos and Amazon wouldn’t make a go of it:

“‘Look, they’ve shown us that the book business can be a very nice, profitable business online,’ said Mark J. Rowen, a senior Internet analyst at Prudential Securities. ‘The only problem is the book, video, music market is limited, and ultimately if Amazon is going to justify its market capitalization, it is going to have to show that other categories are viable on the Internet. So far, they have not shown that sales of other merchandise can grow rapidly and be profitable.'” No, I’m not trying to draw any parallels to the way people say that Tesla hasn’t proven that new products like the Model 3 can grow rapidly and profitable, but not that you mention it, yes, that’s a good parallel.

There’s more to ponder from 2004: “In fact, for the first quarter this year, sales of books, music and DVD’s and videos accounted for $443 million, or more than half of Amazon’s revenue. Its next-largest domestic category and its hope for the future — electronics, tools and kitchen equipment — brought in only $126 million. Sales from its international division were $225 million.” Amazon’s revenue was $800 million in total in the first quarter of 2002, in the first quarter of 2019 it was $60 billion, up 7500%. The stock was at $19 when this article was written, now it’s at nearly $2000 a share, up 10,000%.

By the way, that article mentions that “has sold less than 5 percent of his 111 million shares. In any case, he said, the sales do not reflect his level of confidence in Amazon’s future.” Those shares would be worth more than $200 billion instead of the $157 billion he’s worth by selling $1 billion or so of AMZN stock to fund his outside ventures like his space company.

- (Other)

- AXGN Axogen (7) – Axogen’s fundamental growth is fine and since I’ve owned the stock in my personal account since it was at less than $5 per share and have taken profits along the way, I’m just holding it steady both there and a tiny position in the hedge fund too.

- TST The Street (6) – We ended up with more than a double on this stock since we bought it two and half years ago at a split-adjusted $9 or so, with the dividends we got and buyout. I’m going to go ahead and sell the stock since the deal is for cash anyway. I will try to meet up with the new owners, Maven MVEN, when I’m in NYC next time just to see what they’re up to and what their plans are. Maybe we’ll end up buying some shares in that one, though I doubt it.

- BA Boeing (7) – The news flow turned positive and the stock has been in a nice rally since the last time I wrote up a Latest Positions. I’m still sticking with it and this analysis: “Gotta think BA is a good a lifelong hold as any other stock out there, no? Pretty much a duopoly. Now if there is another Max crash, all bets off.”

Shorts –

- Primary short portfolio

- IBB Biotech ETF (7) – IBB’s been one of the best hedges we could have in the markets this year, but that could change in a heartbeat, I suppose. I do think medicine-related businesses will be under fire as the Republicans and Democrats who run for offices in the next elections will pretend that they’re going to do something about it. Closer to the election, if biotechs and hospitals and other healthcare industry stocks are getting crushed, there might be some good buying opportunities.

- QQQ Nasdaq 100 ETF (6) – I’ve bought just a few QQQ puts and shorted a small amount of QQQ common to keep some hedge exposure on.

- SMH Semiconductor ETF (6) – I’ve bought just a few SMH puts and shorted a small amount of SMH common to keep some hedge exposure on.

- IWM Small Cap ETF (7) – I’ve bought just a few IWM puts and shorted a small amount of IWM common to keep some hedge exposure on.

- SPY Small Cap ETF (7) – I’ve bought just a few SPY puts and shorted a small amount of SPY common to keep some hedge exposure on.

- EWU and EWUS British ETFs (6) – I’m mostly out of these short hedges, but still have a small short exposure in each.

- Tiny short hedges, rated about a (7) – in EGHT, VHC, GLUU, CVNA, SVMK and others. I might cover these at any time and I’m not expecting to make much money on these shorts. They’re just hedges for the hedge fund and I’m not sure any of these are no-brainer shorts. Please don’t just go around blindly shorting these for your personal portfolio.

Cryptocurrencies/tokens –

-

- Bitcoin (7) – I bought bitcoin futures for the hedge fund when bitcoin was still below $4000. I’ve added to that position a couple times on the way up to roll up to new months. I’m trimming about 1/3 of my bitcoin futures now, just locking in these gains, though I continue to hold a position.

- Stellar Lumens (6) – I think it’s best not to group all cryptos together and that over time, each will trade on its merits and perceived/accepted values. That’s probably what’s happening right now with Bitcoin.

- Ethereum (6) – I think it’s best not to group all cryptos together and that over time, each will trade on its merits and perceived/accepted values. That’s probably what’s happening right now with Bitcoin.

- Ripple (6) – I think it’s best not to group all cryptos together and that over time, each will trade on its merits and perceived/accepted values. That’s probably what’s happening right now with Bitcoin.

Disclosure: At the time of publication, the firm in which Mr. Willard is a partner and/or Mr. Willard had positions in some of the positions mentioned above although positions can change at any time and without notice.

Remember: I wouldn’t rush into a full position all at once in any of these stocks or any other position you’ll ever buy. Patience and allowing the market and time to work to your advantage by buying in tranches is key. Maybe 1/3 or 1/5 of whatever you might consider to be a “full position” in any particular stock. And I wouldn’t ever have more than 5-15% of your portfolio in any one stock position at any given time. The younger you are and/or the higher the trajectory of your career income, the more concentrated and risk-taking you can be with weighting in your portfolio. But spread your purchases and your risk out over time and over a several positions no matter your age or risk-averse level.

Scaling into a position using an approach of buying 1/3 or 1/5 tranches over time is how I build my personal portfolio positions, but there’s no scientific way to go about investing and trading. Sometimes you have to pay up for the latest tranche but I try to be patient and wait for a temporary sell-off to add to the existing position.

** NOTE FOR NEW SUBSCRIBERS:

If you’re new to TradingWithCody or if you’ve been a subscriber for a while but haven’t acted on much of my strategies yet and/or if you haven’t been in the markets, but you’re sick of getting 0% on your CDs, Treasuries, savings, checking, etc while the markets have been continually hitting all-time highs this year, what should you do now?

Before you ever make any trade, step back and catch your breath before moving any money anywhere. Rank your positions and your whole portfolio and make sure you’re not about to make any emotional moves with your money.

If you haven’t yet read “Everything You Need to Know About Investing” then spend a couple hours doing so, please. It’s a quick read but chock-full of important ideas, concepts and strategies that amateurs and pros alike should understand.

Then, take a look at my own personal portfolio’s Latest Positions and slowly start to scale into some of the ones you like best and/or the ones I have rated highest right now. I’d look to start scaling into a few of the many stocks in the Latest Positions that are at all-time highs along with a couple that we’ve recently featured in our Trade Alerts that I’ve personally been scaling into.

You can find an archive of Trade Alerts here.