Trade Alert: More trims; PLUS Everything You Need To Know About 3D Systems Corp.

Before I jump into the hard core DDD analysis, let’s talk markets and stocks and trading for today. Feet to fire it feels like we go higher today, but again, I’m not making any moves on that analysis. I am however continuing to follow my playbook which means continuing to trim a little bit here and there on some of our biggest positions which have also been our biggest winners and are continuing to grow outsized as the call options we have in Apple, Google and Fusion-IO for example have kicked in on these big rallies.

So I’m looking to sell down some more of my Apple calls which expire out in January and have strikes around $700. I’ve sold most of the lower strike priced calls so far which lowers my risk on the downside somewhat, but I’d like to roll some of these calls out into longer dates and higher strike prices so I can have a little bit less capital exposed to Apple.

Same with my Google calls which expire over the next few months– I’m trying to sell down some more of those and might look to roll some of those proceeds into some longer-dated calls with higher strike prices.

And I am going to sell all of the remaining September FIO calls from this trade back in April.

I’m still bullish, still net long, but am just looking to gently trim back on some more of these huge winners while they are up. Now onto Everything You Need to Know About 3D Systems:

In 1988 Hewlett-Packard HPQ introduced the HP Deskjet, the first truly mass-market home printer.

This is from from HP’s corporate history page:

The DeskJet offered continuous plain-paper printing and higher print quality than its inkjet predecessors. At about $1,000, it was the least expensive non-impact printer on the market at the time it was introduced. By 1993, when HP had achieved enough sales volume to employ economies of scale, the list price was $365.

That means over five years the price of a printer fell about 64%, making it affordable to a much (much) wider audience. HP’s stock is up something like 3000% since 1988 (not including dividends). Today printer’s are so cheap they’re a free promotional device with the purchase of a PC (they want to sell you the ink– more on that later). The exact same dynamics, collapsing costs, a widening audience leading to mass adoption, are happening right now with 3D printing in general and DDD in specific.

DDD’s revenue base is almost all enterprise at this point. Ford is a huge customer as is Boeing. 3D offers not only a cost savings for printed parts but supply chain relief. The auto industry bailout was corporate welfare for the car companies but was also a credit injection to keep the auto parts supply chain intact. Right now car companies use 3D printing mostly for prototyping but over time you can expect more of your cars interior to be printed. And you can absolutely expect in the next decade the 3D printing becomes a part of defense strategy. When an aerospace part is milled from titanium there’s huge waste and the part is pretty heavy. With 3D printing titanium powder can be layered to make the part to exact specifications at huge weight and cost savings. I want to invest in companies that disrupt Too Inefficient To Fail industries and 3D Systems platform does just that.

Almost no analyst is talking about DDD’s medical printing business but it looks really compelling to me. In the next five years hospitals will print everything from hearing aids to basic medical devices. What really excites me in the short term is the prosthesis market. In May DDD bought Bespoke Innovations, a company that specializes in printed custom fit prosthetics. Check out this picture of a soccer player with a Bespoke lower leg.

Very cool stuff and very cool for the bottom-line. The prosthetic industry is full of distributors, middle-men and medicare merchants that have pushed up the cost for a lower extremity to an obscene range of $5000 to $50,000. DDD’s platform will absolutely take that down 80% over the next decade. In fact I think a possible catalyst for the stock will be when insurance companies start paying for custom prostheses panels.

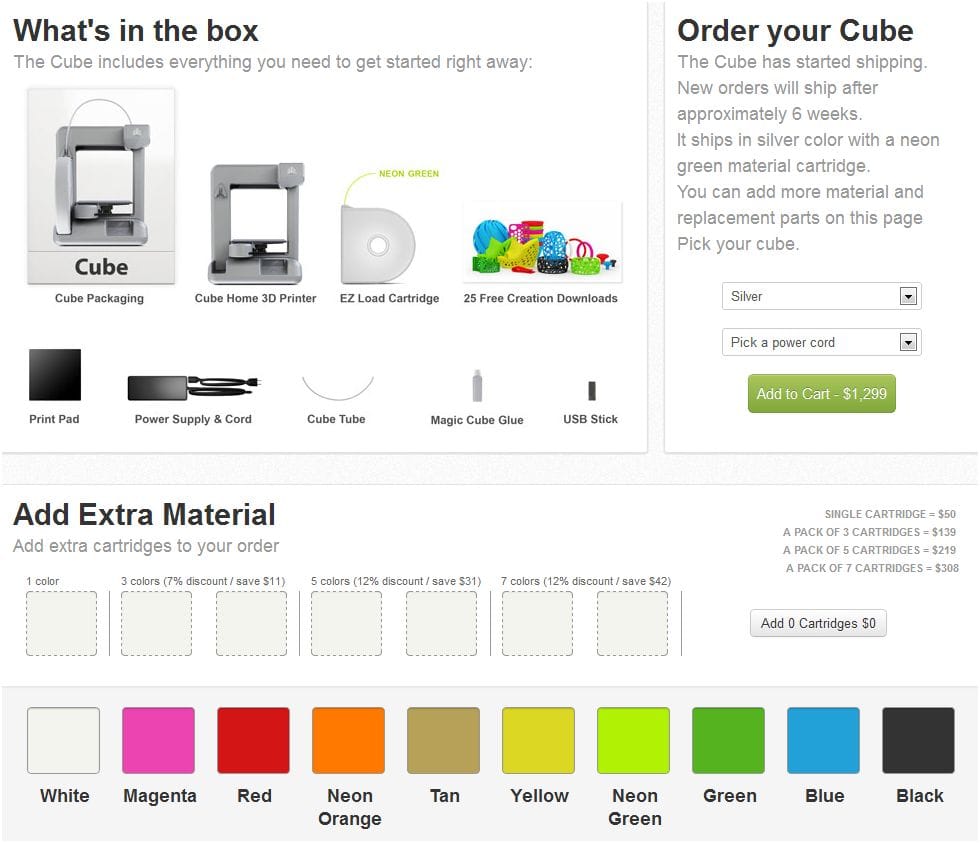

The consumer business does look promising though I wish DDD would just go ahead and buy Brooklyn-based internet darling Makerbot already. DDD’s 3D printer for the home is nothing to sneeze at though. Check out their Cubify ordering page:

$1300 isn’t quite there yet in terms of mass-adoption price point—but it’s getting close. $1300 is like buying 2.6 basic ipads, when the price drops to a two ipad multiple that’s when I think Cubify will see some real traction. DDD is planning to let people sell their designs and creations right on Cubify; any real revenue from being the Amazon for 3d printed objects is likely 2-4 years away. What isn’t that distant is the revenue from “Add Extra Material”.

DDD is building their product lines to look an awful lot like the razor-and-blade model that Gillette (now part of P&G PG) pioneered. By razor-and-blade I mean any business where you sell a product that needs to be reloaded, refilled, refurbished, serviced, at predictable intervals. Why do you think HP offers printers for free? Because they really want to sell you incredibly high-margin ink, nearly $26 billion of it in 2011. If medical device stocks are more your speed think Intuitive Surgical ISRG. In general I absolutely love companies with a razor-and-blade model; the true cost is opaque and people love paying tomorrow for a hamburger today.

I’m really excited about how this business model will play out for DDD. With printer ink there isn’t much more to jazz up. Color and laser were the last true big innovations, everything else from has been incremental. P&G spent a billion dollars making a three-blade razor (now up to six) for a reason. Razors were getting commoditized and cheap knockoffs from private label brands were taking market share. Any time a company can convince customers they have a new, better, faster widget (with more blades) they can charge more money for it. But the nature of 3D printing is different. Look at that razor in your medicine cabinet. Unless you’re rocking a Bic (ouch) it’s probably a composite of a couple kinds of plastic. The 3D printers of today can already deal with about fourteen types of material at once. The printers of the very near future will be able to handle a couple dozen. That means DDD will sell dozens of different cartridges, with different colors and materials, all with very fat margins. Who knows when you’ll start printing your own actual blades for the razor you printed too. Don’t go to the store to replace the dull blades on your razor, just print it on your Cubify.

In the last quarter the growth of sales from printers dipped about 12%, which isn’t ideal for investors, but actually doesn’t overly worry me. DDD has been pushing lower and lower cost models to win market share and create customer lock-in. Recurring revenues, almost entirely attributable to printer supplies and service, came in at 69% of sales. I think 2013 revenues could be about double or $500M, with significant margin expansion. The highest analyst estimate right now is $435M.

DDD has about $3 in cash per share and I expect that to grow as they digest some purchases and slow down on the acquisition spree. Capital IQ puts their PEG ratio (Price Earnings to Growth) at just over 2.5 which I can live with. The stock will almost certainly take a hit sometime in the next year, it’s up 150% in the last 52-weeks. I plan to own this one through some wild ups and downs, but hopefully mostly ups, over the next few years.