Trade Alert: New Old Long Idea (Yes, A New Long!)

Although I have been writing recently about the Great Reset and the countless bearish anecdotes that I am seeing daily, in addition to looking for fraudulent or bubbled-up stocks to short, I continue to look for Revolutionary companies for us to invest in for the long-term. We are not in the phase of the market to be putting money to work in stocks trading at 20 times sales hoping that they will become profitable in the next 5-10 years. Instead, I am looking for companies that the market is not pricing in their current business and their potential to become Revolutionary right now. Investing money right now, no matter what the company’s future looks like, has the potential of going down if the market corrects like I expect it to. So any investment that I’m making now will be a slow scaling into has to have the potential to change the world and become a huge winner for us in the long-term.

With that said, my research is leading me back to a stock that we have been in before. They have dealt with the challenges the Covid pandemic has thrown at it and they are on the upswing of dealing with those challenges. The company is UBER. As I wrote in April of last year, I was worried that Uber, among a lot of other companies, would be able to get to the other side of the pandemic and not thrive but just simply survive. As the world shut down, the Uber team smartly pivoted from their ride share business to just keeping the company alive by delivering food to people holed up in their homes. And as I have written numerous times recently, I’m not sure that the world is totally past the pandemic, but the United States, where the majority of Uber’s business is located, is opening up before our eyes. Restaurants, planes, sporting events and theaters are filling to capacity as people yearn to get back to normal. Uber is one of the companies that will benefit most by this re-opening. And as the rest of the world is increasingly getting vaccinated more and more countries are going to mimic what we are seeing here.

There is a lot of competition worldwide in the ride sharing business. Uber’s competitors include Lyft, DiDi, Ola, Grab and numerous other small players. What is going to decide the ultimate winner or winners is scale. The biggest scale is going to win. To reach this scale, it’s going to continue to take a lot of money. After surviving the worst of the pandemic, Uber has maintained a decent balance sheet with around $6 billion in cash and about $7 billion in debt. Uber has no trouble borrowing money and with their stock back up to near all-time highs, they can raise money with a secondary anytime they want. It is this access to capital that will allow Uber to continue to invest in the business, gaining market share and reaching that scale that will be hard to compete with.

This year, over 100 million customers will use Uber. As I mentioned before, they are not just a ride-sharing app, but have grown their food delivery business drastically during the pandemic. As more and more people are heading out into the real-world, Uber Eats is going to face some difficult comps over last year’s numbers. But these Uber customers who are not having food delivered to their homes are more likely to be using Uber’s ride sharing business allowing Uber to keep and even grow their customer base. In addition to those two most critical segments, Uber has also grown its Uber Freight business, where they manage shipping freight for customers, to almost $1 billion in revenue last year. They are also growing their segments that deliver things such as groceries and with their 2020 acquisition of Drizly, are getting into the alcohol delivery business. Uber’s sheer size worldwide is quickly getting them to a critical mass of customers that will drive synergies between these business segments that will help with new customer acquisitions and drive economies of scale helping to keep their costs lower than the competition.

Let’s take a look at valuation. After making a profit in 2018, Uber has had a couple of years of losing money. Without a doubt the pandemic contributed to their losses in 2020, but as I mentioned earlier, their business is coming back pretty fast and I see Uber as a company that is similar to Amazon in that they have been investing in the business to grow market share and have many levers to pull to begin showing a profit when they have reached the critical mass that they need to dominate the competition. You have probably seen the huge profits that Amazon is throwing off now that profitability is in focus. In fact, in the most recent earnings call, Uber’s CFO stated that they will do everything in their power to begin showing a profit towards the end of this year.

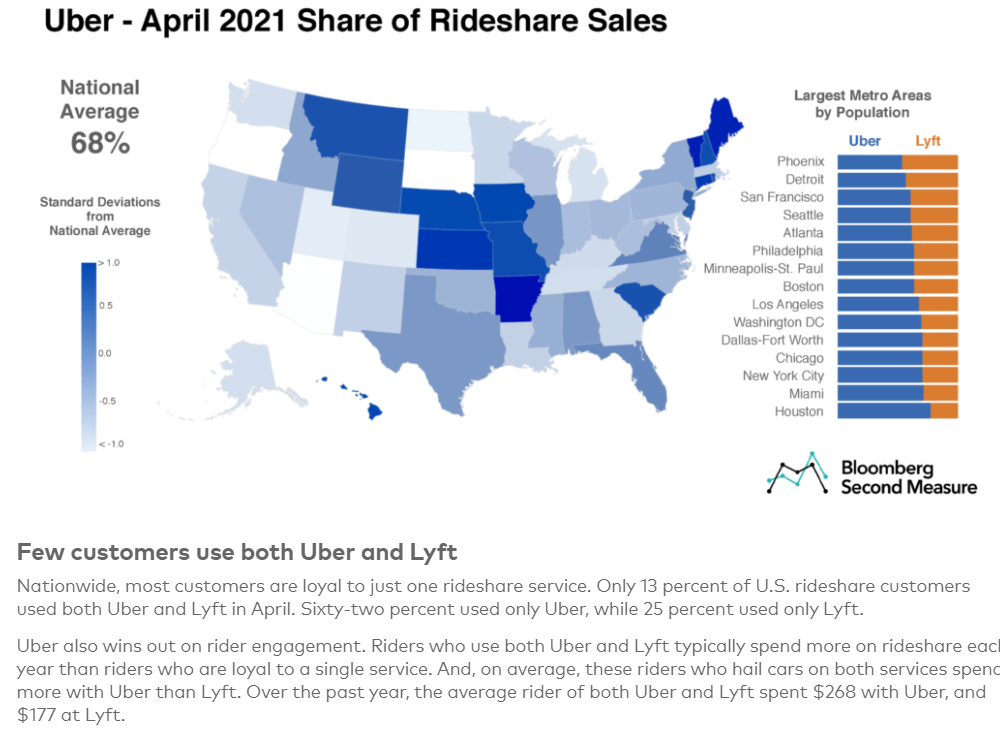

Revenue is forecasted to grow about 40% per year for the next two year to around $22 billion in 2022. That gives Uber a price to sales of less than 1 this year and next. That is pretty cheap for a company with gross margins over 50%. Let’s compare that to their biggest competitor in the U.S., Lyft. Lyft is forecasted to grow revenues just under 20% this year and 40% in 2022. Their gross margins come in lower at around 39%. Lyft’s price to sales is 2.2 this year and 1.6 next year. Analysts expect Lyft to become profitable next year which might explain why Lyft is trading at a higher multiple. It is likely that will reverse once Uber decides to focus on their attention on profitability.

One of my main concerns with all ride sharing companies is concerning their ability to attract drivers. As businesses continue to open you have surely noticed a lot of help wanted signs on storefronts. Uber and the others are not immune to that difficulty in finding people willing to get back to work. Uber has recently committed $250 million towards temporarily incentivizing drivers to work for them. I think this is a step in the right direction and will give those willing to drive for Uber the ability to make a livable wage driving full-time or as a side hustle. This also goes back to the scale that I was talking about earlier and it is likely that Uber will be able to pass on these higher costs to their customers.

Uber is already one of those companies that I like to mention that their name is synonymous with the service that they provide. With 68% of the U.S. market share and being the number one ride share provider in most markets that they serve, Uber is likely on the verge of becoming something that we can’t live without. It is time to start scaling in before the market recognizes this.

Uber is trading at around $50 a share which is higher that the levels it traded at pre-pandemic. The market is forward looking and it is forecasting that Uber is past its biggest challenges. I am buying a little here, 20% off its February highs and plan to make this a long-term position as I feel they are on the verge of finally becoming Revolutionary.

Cory Greak assisted in writing this analysis.

We’ll do this week’s live Q&A Chat at 11am ET Friday. Join me in the TWC Chat Room or just email us your question to support@tradingwithcody.com.