Trade Alert – Patience is a virtue

Travel can be tough anyway, but on Sunday afternoon in Baltimore, when I’d gotten to the airport, boarded the plane and then been ordered off as the flight got canceled, I lost a day of work and that’s why you didn’t hear from me til late last night. Markets are down fractionally but tempers and tension amongst traders and money mangers remains high. Path of least resistance still remains downward for the broader markets and for most high-beta stocks too. Patience is a virtue kind of market for now.

Google Glass is not available to the mainstream public yet, and I paid a full $1500 to purchase a set. There’s no way that Google will be expecting the public to pay more than a few hundred dollars a pair for these things when they do release them to the public. More likely, I expect a $200 or so price point which might even be subsidized by your wireless carrier.

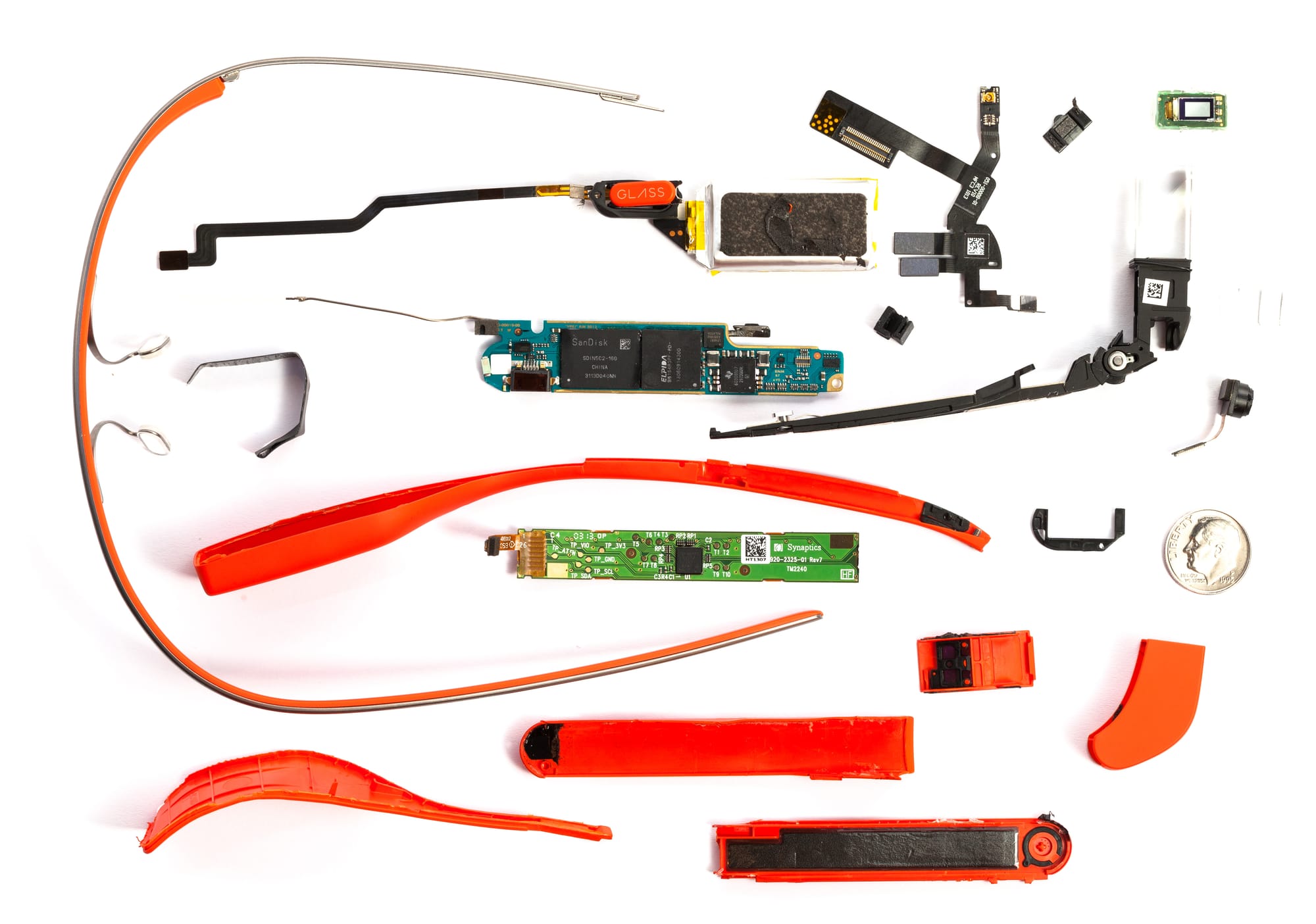

Google’s likely presently selling a few thousand of these Google Glass units each quarter. That’s not moving the needle for many of the suppliers into Google Glass, especially when you’re a behemoth like, say, Texas Instruments. Texas Instruments TXN makes the primary computer chip (aka, Central Processing Unit or CPU) that makes Google Glass run in the same way an Intel Chip makes your Windows PC run. TXN also makes the chip that takes your voice and turns it into digital bits and bytes. Sandisk supplies the memory chips for Google Glass.

I expect that Google will end up selling millions of Google Glass and similar type wearables over the next five years, and if they do move millions of units of these things, Texas Instruments and Sandisk will both benefit. Even as large as they are — TXN will do $12 billion and Sandisk will do $7 billion in sales this year — a few more million chips being sold into Google Glass and other wearables will big plenty big enough to move the needle for each company.

I already own Sandisk and have for years and plan to continue to own it partly because it will benefit from the Wearables Revolution along with so many other memory-intensive tech trends. Texas Instruments is a good investment too, though I don’t own it.

A much more risky way to get exposure to Google Glass and the potential for Google to sell millions of units of them is Himax. Himax makes the eye piece in the Google Glass wearable that I keep raving about. Google actually bought about 6% of Himax back last year when they started buying the eye pieces from the company.

The stock is down 60% this year. While I don’t expect that growing eye piece demand from Google Glass is going to change the direction of the company’s fundamental outlook in the next six months, I do like the risk/reward potential here, as Himax would see its sales and profits explode if it can keep Google’s business as Glass hits the market in the next year or two.

Himax gets most of its revenues right now from selling 3G chipsets to Chinese handset vendors. China is moving to 4G and while Himax does make 4G chipsets, they’re not getting the traction in the 4G market in China that they did in the 3G. I do think there’s a chance that the company’s also catching some traction in the China LTE component market as Chinese smartphone vendors take market share there, but that’s another risk to this investment.

I’m adding HIMX common stock to my own portfolio, a small tranche for now, still just looking to slowly build up this position.

PS. Here’s my schedule for the MoneyShow in San Francisco on August 21-23. Click here to sign up.