Trade Alert: Selling remainder JRJC puts, Markets commentary and my first two months trading

Time to sell the last of our JRJC puts for some very nice gains. The stocks is down nearly 60% in the six weeks since we bet on the stock going down with out of the money puts. My last tranche of remaining puts now have gains between 200-300%. With the stock below $5 a share now and back near its average price from last year, I’m going to declare full victory on this trade and move on. If JRJC spikes to $10 on hype again, I’ll likely go back and revisit it with some puts again. Let the market dictate whether we ever swing at a JRJC pith again or not.

Markets and stocks commentaryThis volatility is wild. And as Robert Marcin has noted, this kind of wild volatility is probably not bullish for the near-term.

Tensions high as volatility climbs. Bulls are scared of days like this and the days like this are frequent lately. Bears are scared of another fake sell-off followed by yet new all-time highs in the $DJIA $COMP $SPY, etc. Who’s more scared right now though, the bulls or the bears?

I always preach scaling into whatever your favorite stocks are (I like $SNDK $FB $GOOG right now but am not scaling into more yet as I own all 3 from much lower) on broad market weakness, and so if you have been wanting to start buying some stock, now’s a great time to slowly start to scale in with a 1/5 of a full position tranche or so. Careful out there, as always!

Remember when you first started trading?JSpaZ asks: What were your first 2 months in the market like? #question

For me, it was 1997 and the dot com bubble was about to take off. I had recently quit my job as a stock broker at Oppenheimer to figure out a new business plan for my own life, and I had a little bit of money from my last couple commission paychecks. The first day I went to trade I was at a girlfriend’s apartment in Boroughpark, Brookly and my laptop wouldn’t connect over the $AOL dial up from her place. I’d wanted to buy some NSOL (Network solutions, the dotcom registry monopoly) at the open, but couldn’t without being able to log onto the Internet. Two hours later, back at my own place again, but having missed the market open, I finally got online. NSOL was up 20% since the open. I didn’t want to chase it. As I recall, I bought ANIC, a $3 stock instead. NSOL went up 15x from there. ANIC later went bankrupt.

The Big Data Revolution Is ComingI think I know what my next book should be — Stocks for the Big Data Revolution. The speed with which industries can go from nothing to billions in just a few quarters is remarkable. “GE announced that revenue from its IoT software business will be $1.1BB this year, probably the fastest a G.E. business has hit the $1BB mark.The company did it entirely with sensor-equipped G.E. machines, including 1.4MM pieces of medical equipment and 28,000 jet engines. Each day it now gathers 50 million pieces of data from 10 million sensors, off equipment worth $1TT”

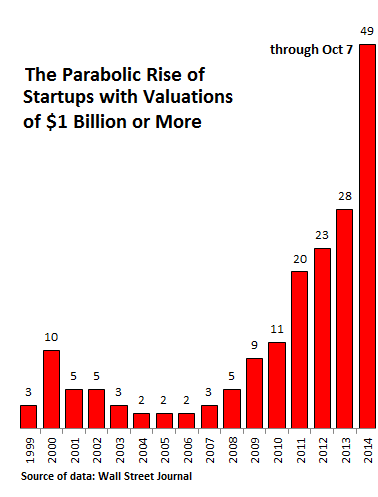

Scutify Chart of the Day comes from Jesse Colombo: “Mega-startups go parabolic.”

I used to do a Weekly Feature for TheStreet.com back in 2006 and 2007 called, “This Won’t End Well,” and that’s exactly the kind of chart I used to highlight to show that there was a bubble brewing. That bubble popped in 2008 when the financial crisis. The question now is, when will this ongoing bubble-blowing bull market we’re living through pop? Or are we seeing the bubble pop right now?