Trade Alert: Short this euro education company

Thanks for all the well-wishes that keep pouring in after last week’s inferno scorched my land. My dog, my woman, my house and my guitar are all safe, so I’m pretty damn thankful.

This week Greece didn’t give markets the Sunday Smackdown everyone was worried about. No, the party that is pliant to the whims of German bankers (central and investment) eeked a miniscule margin of victory, and will keep Greece on the perma-austerity path. Here’s what the EURUSD did since last time we met:

And here’s what the Spanish bonds yields have done in the last month. In case you don’t trade the sovereign debt market, that’s a helluva spike. As you’re reading this, Spain will be going to market for almost $4 billion of shortterm money, and on Thursday they’ll hit up investors for almost $2 billion of long term debt. If investors treat Spain like their debt-to-GDP ratio is 146%, not the official (and fraudulent) 72%, we could be looking at huge swings in the EURUSD back down to 1.23 and a new leg in the end game.

(Source: Bloomberg)

But the euro-welfarists are trying everything they can to make 7% the new normal. Check out this quote from BusinessWeek (emphasis mine):

“Seven percent for Spain is not unsustainable, it is uncomfortable,” Holger Schmieding, chief economist at Berenberg Bank, said in an interview on Bloomberg Television’s “The Pulse” with Maryam Nemazee. “The risk is always that it doesn’t stop at 7 percent — that it goes to 8 and 9 percent and then we would have a full-blown panic.”

Umm, Mr. Chief Economist the time to freak-out is before the full-blown panic. Unbelievable.

Meanwhile, those of us dealing in reality should be thinking about opportunities if the common currency is thrown out. So what happens if, overnight, BMW’s stock is priced in Deutsche marks, Total S.A. is priced in French francs and Eni S.p.A is priced in Italian lira?? Don’t answer, it’s rhetorical, absolutely no one knows, and you need to stay miles (or kilometers for my E.U. readers) away from the pundits that claim to know.

Here’s what you can be sure of: the sun rise will, trees will grow, people will buy stuff and money will move around the globe. This week on The Cody Word I pointed out that buying when the narrative switches to Euro doom means you could have grabbed Apple AAPL for $250 in 2010.

Regardless of the the crisis du jour, today we’re adding a short that has serious euro problems to contend with and sits on the edge of about three secular trends not in its favor.

I’m adding Pearson PSO as a short to our Revolution Investing portfolio, because not only is about to get whacked from macro concerns, but it’s main business is collapsing before its eyes. Pearson is a media behemoth, they publish the Financial Times, Penguin books and a huge education business. PSO has a market cap of just over $15 billion and trades at about 10x Enterprise Value/Ebitda.

Let’s take a crack at FT first, since that’s the public face of the company. FT (which I used to write for) had a banner year last year and now has 260,000 paying digital subscribers, with the revenue mix of subscribers/advertising hitting 50/50. While that sounds great, and I’m always happy to see a quality product succeed, at $243.88 per subscriber that comes out to about $63 million dollars, which isn’t paying the king’s ransom. Meanwhile newsprint ad rates are going off the cliff, and mobile rates just aren’t making up the slack. And with Facebook introducing dynamic ads that live on top of your social graph, full page static paper ads are never going back to cash-cow status. Plus I think the FT group offloaded it’s stake in FTSE at exactly the wrong moment.

Now to Penguin. While their ebook revenue growth is nothing to sneeze at, more than double in 2011 to $201.9 million, it’s not going to be enough to off-set the perpetual decline in print revenues. Check out this quote from Penguin Group USA CEO David Shanks:

Shanks noted that the gains in e-book sales started to help defray some of the costs of physical book returns in 2011, but said that with print books continuing to represent 80% of sales, Penguin still needs to retain “most of our infrastructure.”

What he’s saying is the Penguin is going keep paying for fat expense accounts so publishers in New York can cultivate authors and the hyper-literate aura they so love, because that’s critical to success in the book business, right? No of course. Amazon has thrown down the gauntlet and gone into the publishing game directly, leveraging the Kindle and their enormous customer base. Penguin and other old-line publishers have had no choice but to fall in line with Apple, which has earned them an anti-trust suit from the Feds.

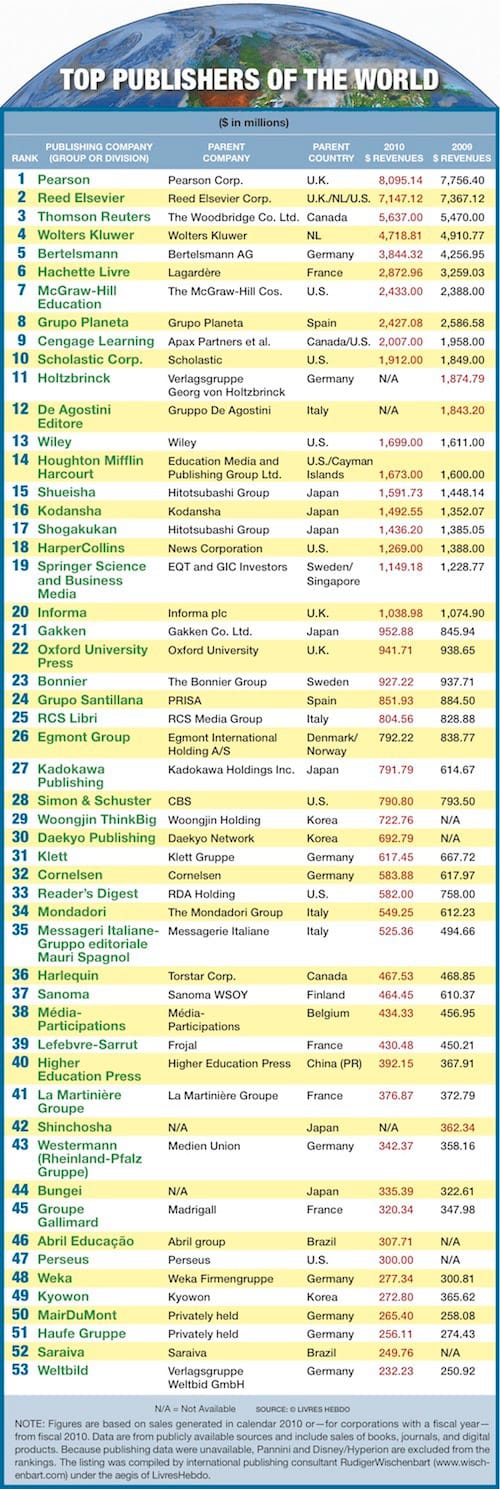

And the really big reason I want to be short Pearson is just how levered they are to the education market. Check out this graphic from Publisher’s Weekly:

Pearson is the world’s biggest publisher for one reason, its education publishing business. Let’s look at what Pearson admits about the macro picture:

“Austerity measures will continue to affect education spending in much of the developed world, but we see significant opportunity in emerging markets in China, south-east Asia, Latin America, the Middle East and Sub-Saharan Africa – which together accounted for more than 40pc of our International education revenues in 2011.”

You have to love how Pearson corporate adopts the notion that the emerging world will save us all. So what are those austerity measures in the developed world? How about Los Angeles cutting school libraries? Or Texas making students share textbooks? It’s much easier for school districts to just cut back on book budgets than to deal with teacher’s unions. And the publishing industry hasn’t endeared itself to it’s education customers, rolling out new editions constantly, and steadily pushing prices up. Pearsons textbooks revenues are doubly threatened by evaporating local budgets and brand new digital offerings. Right now Pearson is a partner with Apple in their textbook iniative, but over time their margins are going to be squeezed by an increasing number of credentialed and authoritatives sources that no long need a publishing house to publish a textbook. All they need is a Mac and ibook author.

The kicker to all of this is that Pearson has actually been expanding its footprint to siphon education budgets with testing services and the like. Texas has a $470 milliontesting contract with Pearson. But there’s a full-blown rebellion against Pearson’s education offers. I’ll leave you with “The Pineapple and Hare” controversy in New York State (where Pearson has a $32 million testing contract). Pearson took one of author’s Daniel Pinkwater’s stories, about a pineapple and some animals, and asked NYS students some reading comprehension questions. Only thing is that the questions were total nonsense. Here’s the author on how Pearson used his work:

OK, here is the deal. There are these companies that make up tests and various reading materials, and sell them to state departments of education for vast sums of money. One of the things they do is purchase rights from authors to use excerpts from books. For these they pay the authors non-vast sums of money.

That’s a pretty good summary of how Pearson makes the lion’s share of its profits. In the face of shrinking budgets, this kind of boldfaced junk won’t survive.

I’ll be shorting common stock in Pearson.