Trade Alert: Small cap nibble, big cap trim and markets set-up

A little portfolio maintenance here, with one nibble and one trim.

I’m going to nibble some Axogen here. The stock has finally come down a little bit from our buying pressure since I added it to the portfolio a couple weeks ago.

Also, remembering always that as Jim Cramer says, discipline trumps conviction, let’s trim some of our biggest positions that in big rally mode. I’m going to trim a little bit of my rather large position in Google GOOG which I’d added to in those panicky August lows. I’m going trim about 1/7th of my position. I think Google’s earnings reports tonight could be very strong and I’m finding it hard to do this trade. Of course, as you know, it’s often the hardest trade to make that’s the right one.

Now let’s get some perspective on near-term, mid-term and l0ng-term set-ups for the broader stock markets.

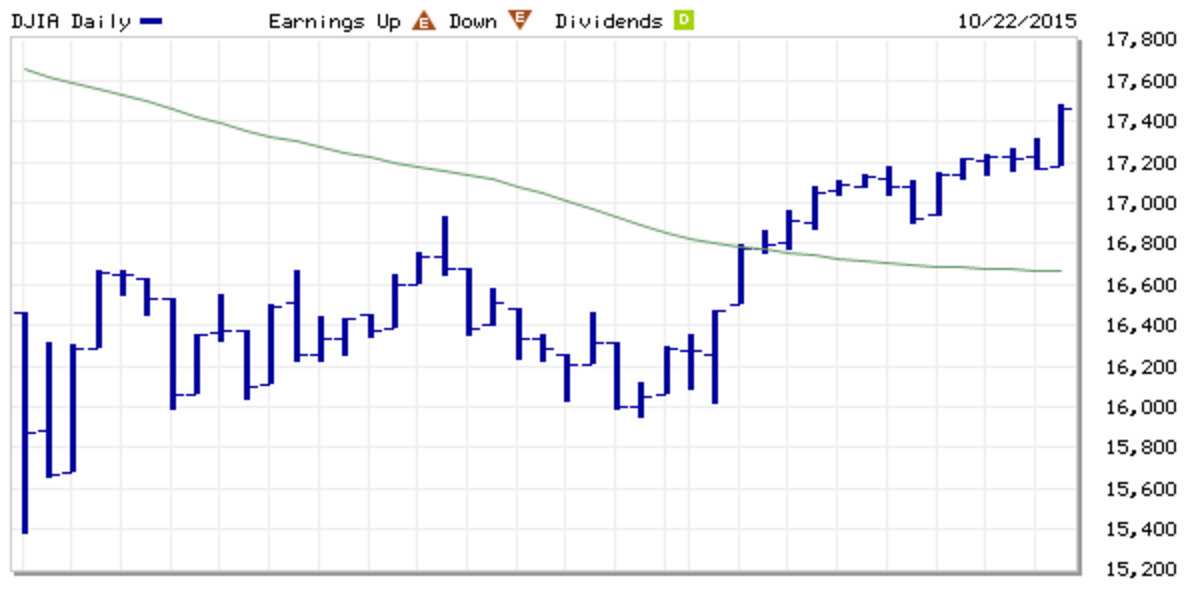

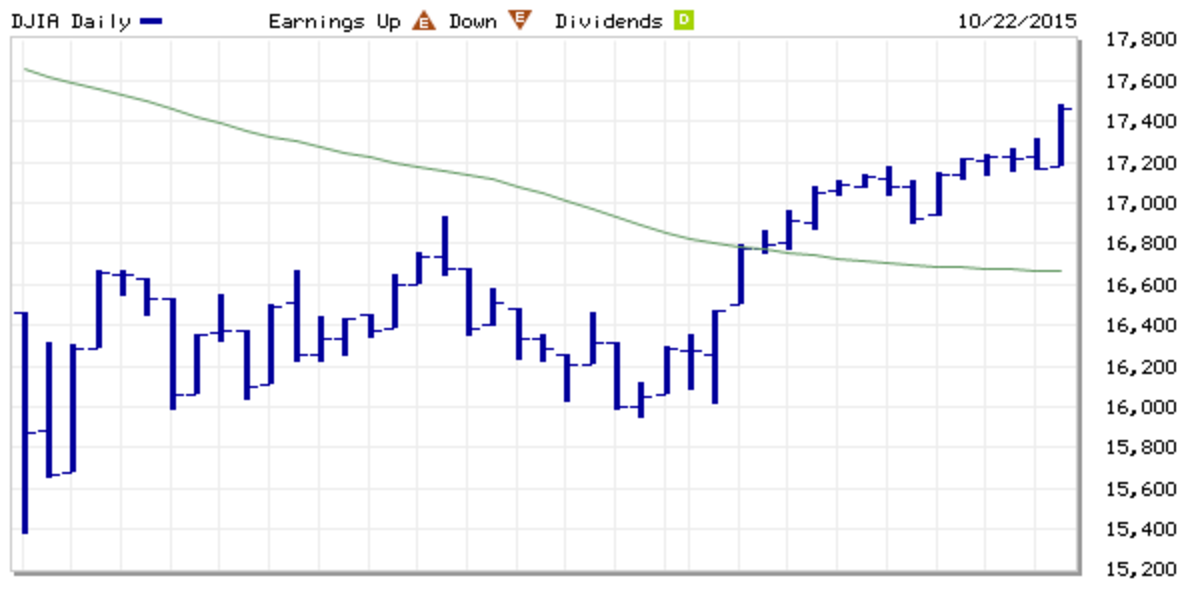

Near-term, stock markets are continuing their relentless climb higher from the panicky August lows. Every major index and most individual stocks have bounced 15% or more from that -1000 point DJIA opening in August. Everyone has been waiting for a retest of the August lows and most continue to expect that stocks might be due for a pullback or at least a pause. I wouldn’t want to try to game that as the overall Bubble-Blowing Bull Market remains intact.

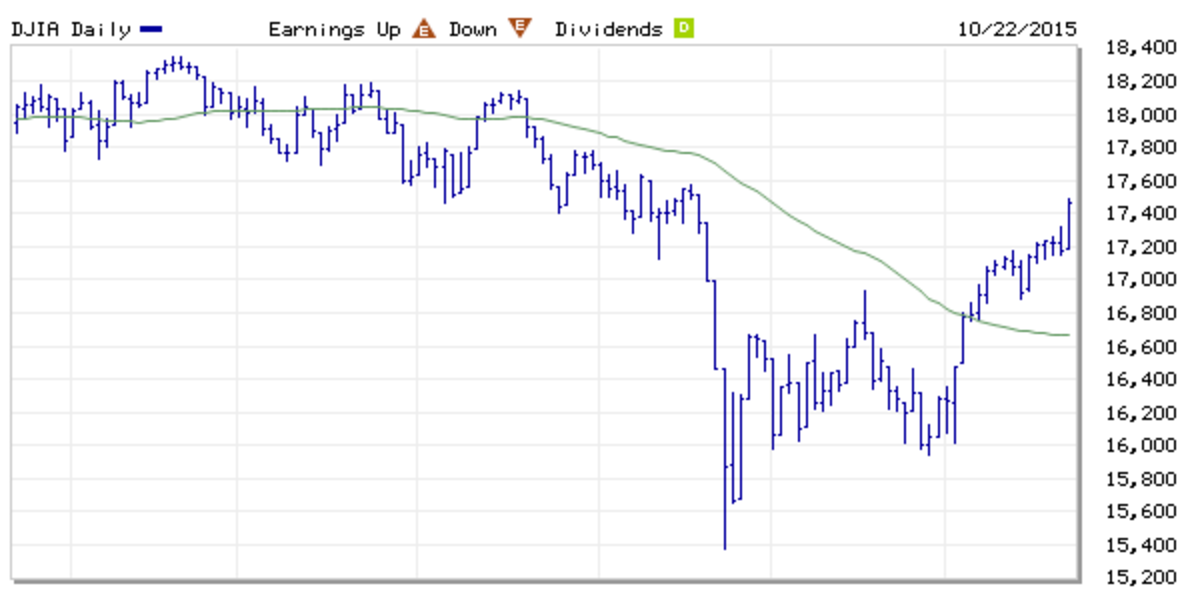

Mid-term, we’re still down from where we were just a few months ago. The broader indices are back within striking distance of those highs from earlier this year hiding the fact that many stocks are down 50% or more from the levels they saw back in those heady days. Can the markets run to new highs in the next few weeks? Maybe. I do expect we’ll see new all-time highs in the broader indices early in 2016.

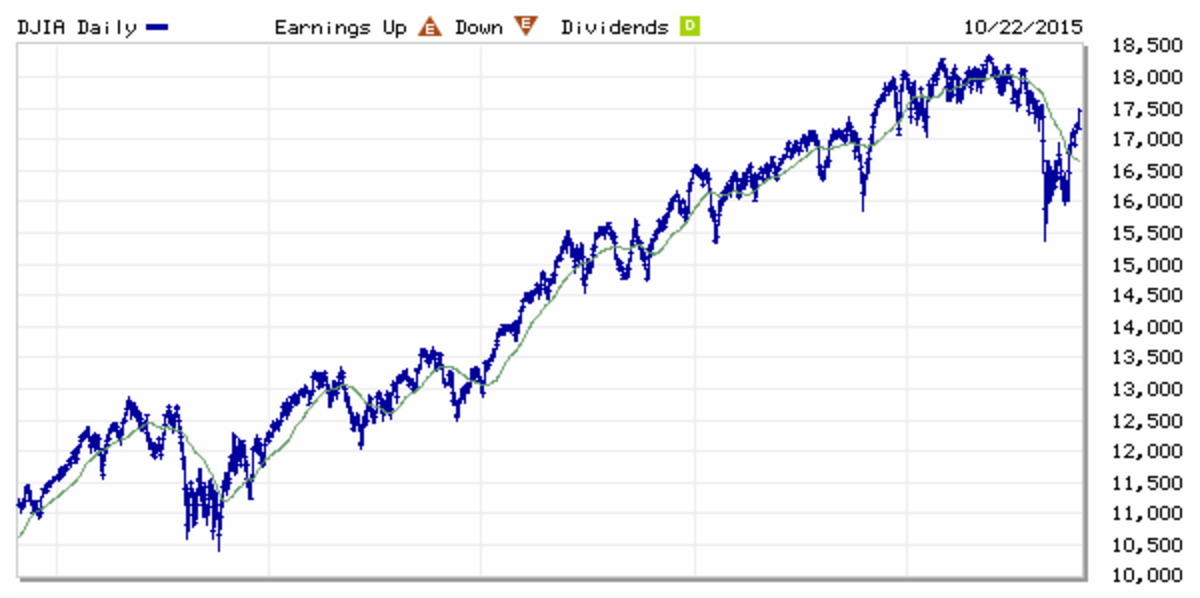

Longer-term, stocks are once again up huge from where they were three, five and seven years ago. The S&P 500 itself is back above that 2000 level that puts it in rarified levels that it had never even been close to in history until this time last year. The Nasdaq of course is back to levels it hasn’t seen since the great dot com bubble popped back fifteen years. I am nowhere near as aggressively long and vocally bullish as long-time readers will remember I was back in 2010-2013. I expect stock markets will crash again at some point in the next few years, so we want to be flexible as we head into the longer-term. As always.

At any rate, it’s a stock picker’s market, not a stock market right now. Tech looks strong as semiconductors and other industries consolidate amidst continued growth. Biotech and pharma and health care look treacherous. But there are plenty of tech stocks at new lows and there are a few health care-related stocks near all-time highs. So pick carefully.