Trade Alert: Snap

I’m going to put a little cash to work as I’ve got two new buys for you this week — starting with this new position this morning, so let’s jump in.

I’m going to build a small position in Snapchat (Snap, they call themselves now which is conveniently also their stock symbol) common stock. The company’s just been public for a couple quarterly earnings reports, both of which have disappointed Wall Street. Expectations are now very low for the next quarter or two. Meanwhile, recall those headlines from after Snapchat came public about all those millennials who opened their first brokerage account just to buy Snapchat. Any of the weak-handed holders from that group are surely washed out by now and I doubt those who still hold their Snapchat are ever planning to sell, win or lose.

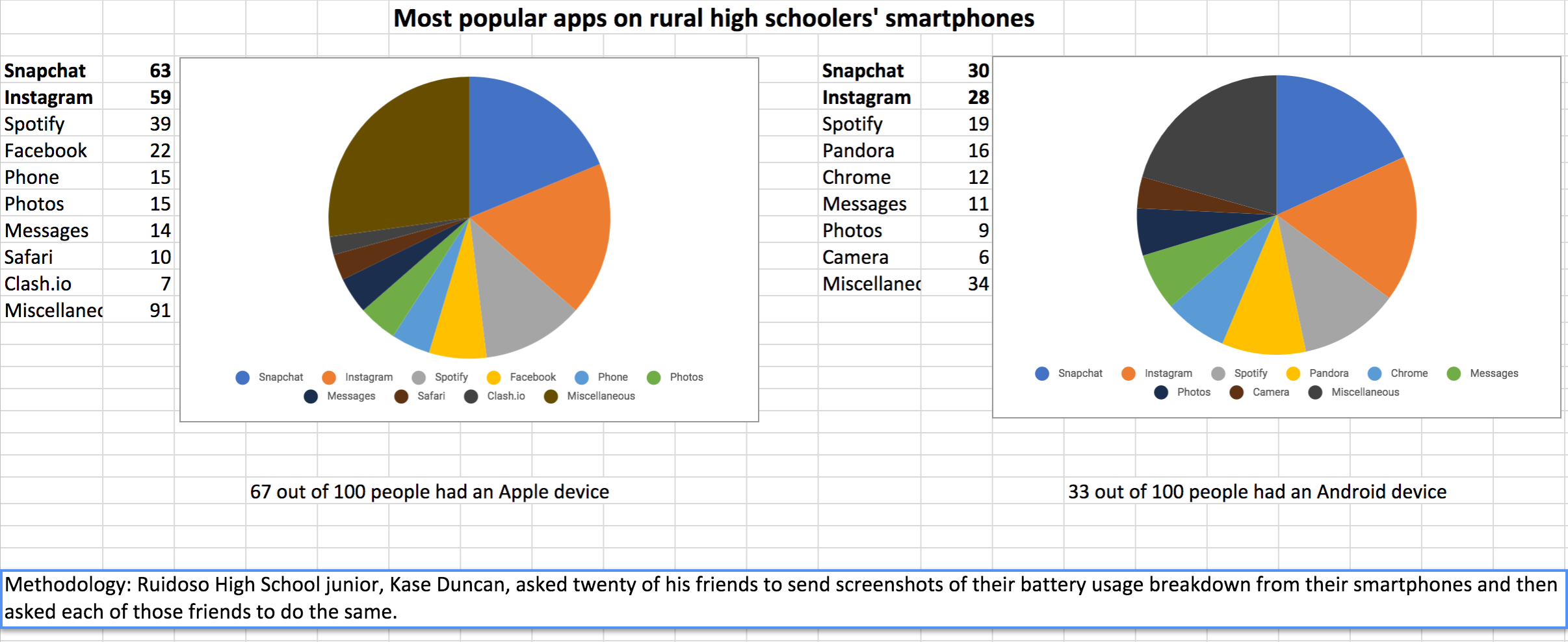

Finally, I just think Snapchat’s still got some real opportunity to grow into a bigger user base because so much of it’s user base is right now the youth in the most important tech-leading country in the world, the US. Teens in the US are addicted to their Snapchat, as evidenced by the not-quite-statistically-significant survey of rural high school students in New Mexico that I had a young assistant of mine do for an assignment. (See image and stats below.)

In coming years, the odds are that Snapchat can grow to hundreds of millions of users across the globe as youth around the world and older people in the US and around the world start following the trend-setting youth of the US. Twitter was never a teen/youth-dominant brand. Facebook once was. And Instagram still rivals Snapchat amongst the youth in the US and is dominant amongst the youth in many other countries too.

That might give Snapchat some problems, but if you ever watched any teen surf their phone during dinner and desert and afterward while you’re watching TV and even while they’re doing homework, you can see that they are usually bored and have plenty of time to do both and many other apps too. Winning in the App Revolution isn’t always a zero-sum game, as evidenced by the hundreds of app companies that are worth billions of dollars in the world.

Meanwhile, everywhere I go, I see ads on Pepsi bottles to get free giveaways every hour by using your Snap app to engage with the Pepsi bottle.

The stock has rallied a bit of late but is still down nearly 50% from its post-IPO highs and at a $17 billion market cap could provide some nice upside of 5 times or more our investment if they deliver on growth in users and revenue and earnings in years ahead. If they fail to report decent numbers the next couple quarters, the stock would probably be cut in half from here and we could take a loss of 50%. So there’s your risk/reward profile on this stock.

I’m planning on buying a smallish Snapchat common stock position starting today by buying 1/3 of how many shares I eventually plan to buy.

I’ll have another new trade alert for a new position tomorrow so stay tuned.