Trade Alert: Snap And The Importance Of Valuations

What a quarterly earnings report from SNAP. What a move in all the big social media stocks. Let’s look at some of our long-term SNAP analysis here along with some of our other history with social media and other tech stocks that have been so wildly outperforming this year and get a sense of why I always pay so much attention to valuations.

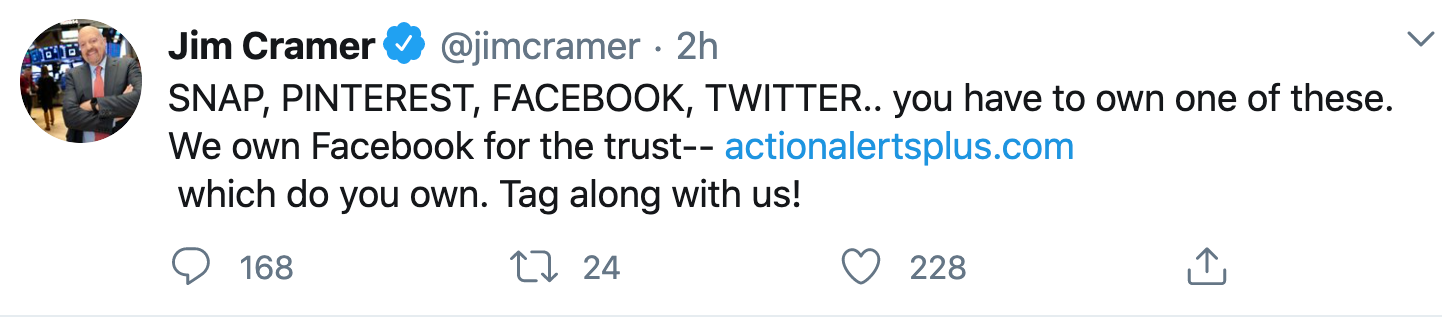

I saw my old friend Jim Cramer posted the following last night:

And guess what I realized. Not only do we own all four of the major social network stocks:

| Name | Symbol | Long or Short | Date Initiated | Price at first tranche | Recent Price |

| Facebook – FB | FB | Long | June 2012 | $26 | $281.94 |

| Twitter – TWTR | TWTR | Long | May 2016 | $14 | $50.13 |

| Snap – SNAP | SNAP | Long | October 2018 | $6.50 | $37.04 |

| Pinterest – PINS | PINS | Long | March 2020 | $13 | $51.84 |

…we also actually caught almost the exact bottom on each of the four major social media stocks over the years:

Looking at those charts and how we had the patience to wait for the valuations of each one of those stocks to get somewhere that made the risk/reward scenario too compelling to pass up. I want to drive a point home about what has been our approach to buying any/all of our stocks over the years actually: It’s not just picking good stocks. It’s paying attention to valuations of those stocks so that you pay a good price to set yourself up for gains over time.

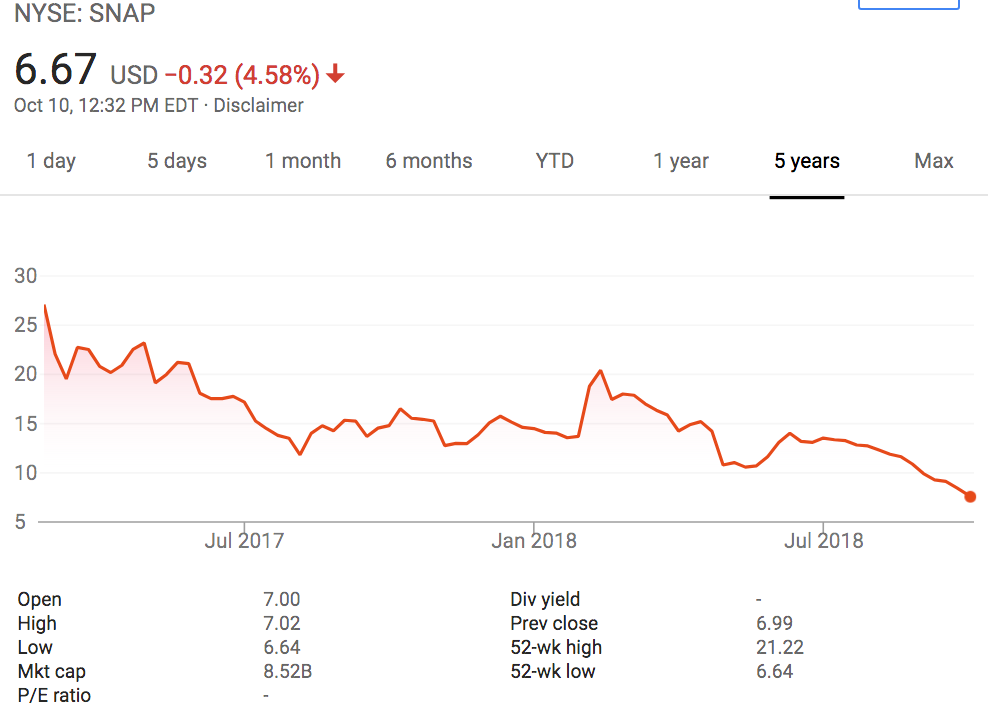

In that vein, it’s instructive to look back at what I was writing about SNAP when we bought it at what I thought at the time — and which turned out to be indeed be the case — that SNAP’s valuation was too good pass up at $6ish per share back in October 2018 in an article called “Trade Alert: Snap? Yeah, Snap. Here’s the analysis and strategy“:

“You know what? Snapchat’s valuation is starting to get interesting here, especially from a relative value standpoint. How bubbly high the valuations are for so many middling technology companies that aren’t profitable, are growing 20-30% per year and are trading at 10-15x next year’s sales estimates. SMAR was trading at 10x next year’s sales estimates, TRXC was trading at 25x next year’s sales estimates and TLRY was trading at 80x next year’s sales estimates the last time I checked when asked to look at those names by TradingWithCody.com subscribers.

Well Snapchat isn’t just any middling technology company. It’s one of the only handful of social network companies in the US, and social networking is a hundred billion dollar a year industry. It’s also growing at 30% plus per year. And Snap, trading right here right now at $6.70 per share is down 40% in straight line, is nearly 80% down from its all-time highs, is down 60% from the IPO and the chart looks terrible.

But that means the valuation might actually be, well, relatively cheap? Let’s look.

Snap’s market cap is right now at $8.7 billion, which means it’s trading at only(?) about 5x next year’s sales estimates.

And like I said at the top, I don’t think there’s any stock out there that’s more hated right now than Snap. Which is sometimes the best time to start a position in a name.”

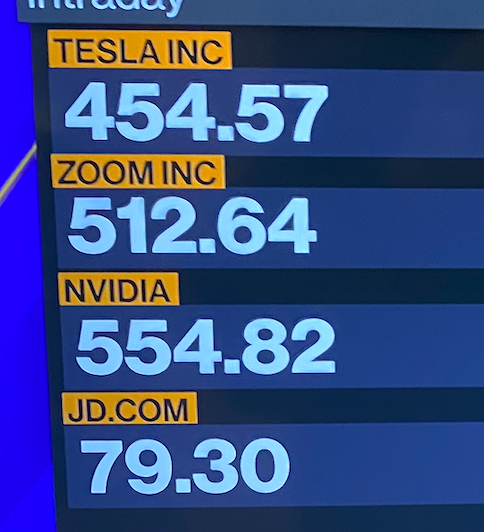

Likewise, last week I heard on Bloomberg that the best performing stocks in the Nasdaq 100 this year are:

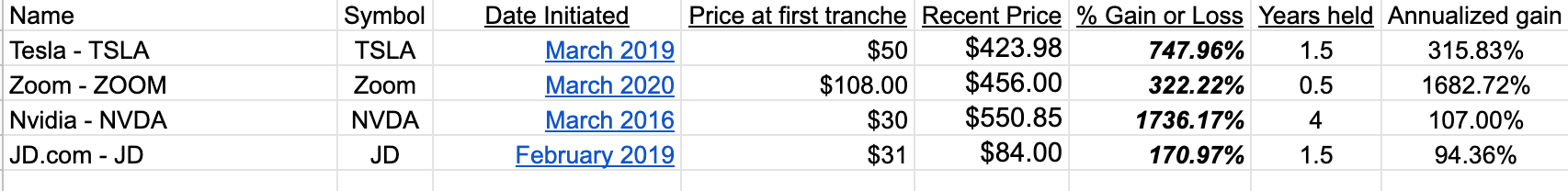

Guess what — we had all four them this year, didn’t we? We bought TSLA at $50 last year, ZM at $110 in March this year, NVDA at $30 just four years ago, and we bought JD last year at $31.

| Name | Symbol | Long or Short | Date Initiated | Price at first tranche | Recent Price |

| Tesla – TSLA | TSLA | Long | March 2019 | $50 | $423.98 |

| Zoom – ZOOM | Zoom | Long | March 2020 | $108.00 | $456.00 |

| Nvidia – NVDA | NVDA | Long | March 2016 | $30 | $550.85 |

| JD.com – JD | JD | Long | February 2019 | $31 | $84.00 |

Our history with these four stocks again drives home the point about being patient with our entry points into individual stocks and using valuation metrics along with our long-term Revolutionary Trends analysis to find winners at good prices. It’s highly unlike that these eight names in this article will continue to outperform the markets so huge next year mainly because they are up so tremendously much this year and last year. Which would mean that if people who are today buying these stocks or aforementioned the social media stocks might underperform in coming years even. To be clear though, obviously I continue to own and mostly hold each of these names.

So, no surprise here that I’m going to trim about some, maybe 1/5 or so of my SNAP in both the hedge fund and my personal account (as our playbook dictates) on this huge pop today coming on top of the huge gains we already have in the stock courtesy of having bought it when the valuation was cheap and the stock chart was horrible.

Let’s do this week’s Live Q&A Chat at 11am ET tomorrow (Thursday).