Trade Alert: Strategies For This Blow-Off Top Market

“That’s how any good bubble starts, with enough people getting far enough ahead of themselves that the reality becomes a self-perpetuating phenomenon. Again, we probably aren’t at that tipping point just yet, but it’s coming. I don’t want to let this scare you off, we are likely at least a couple years away from a bubble bursting; the amounts being raised for new tech VC funds pales in comparison the good ol’ 90s. And there is a genuine content/social/App/Cloud revolution underway. In the meantime if you aren’t profiting from the inflating bubble, you are losing out to in the form of an under-performing portfolio and higher prices. Which is why I want you to be long the companies that underpin this New Bubble. So that’s Apple, with its mobile devices, Google with its stranglehold on search.” Cody Willard, 2012

A lot has changed since 2012, including how we are no longer just in “The New Bubble” as I was calling it back in 2012, but we are finally fully in the throes of The Blow-Off Top Phase Of The Bubble-Bull Market as I’ve been calling the market set up lately. It’s just a matter of time, probably measured in weeks or months at this point, before many stocks and cryptos and other bubbles come tumbling down.

There’s too much speculation, euphoria and greed running rampant in the market and society right now. There’s no fear. That doesn’t mean it will all come crashing down tomorrow, but I’m getting increasingly uncomfortable with the ongoing Blow-Off Top Phase of The Bubble-Blowing Bull Market that we’ve been very successfully riding for the past eleven years now.

I asked back in the midst of the crash and economic shut down last spring several times that perhaps the biggest question for the markets was if tens of trillions of dollars in monetary and fiscal pumping from every major economy in the world would be enough to overcome the near-term collapse in earnings and economic activity. The answer has been a resounding YES.

It’s clear now that there are trillions of dollars chasing speculative gains in the stock market, in the crypto markets, in the real estate markets and in just about every market on the planet except for gold and silver (they are probably next?). Look at this chart of small cap stocks performance over the last three years. That straight up vertical line ain’t normal.

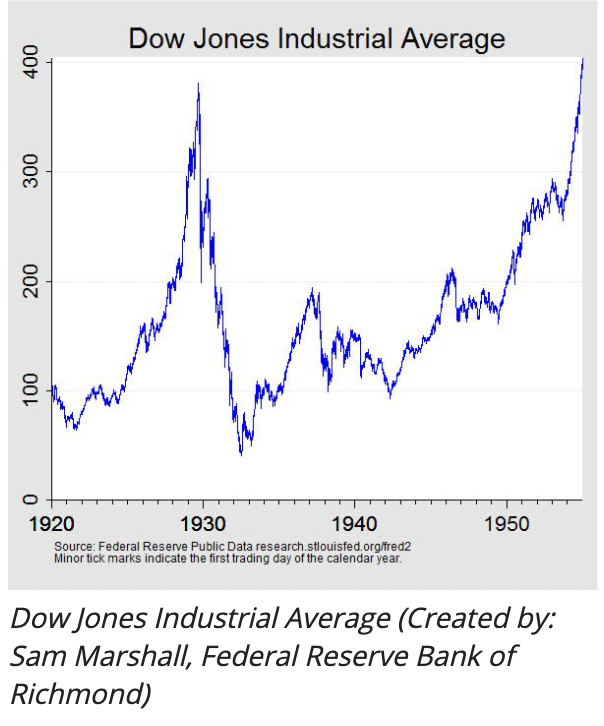

I’ve gone through the web and found a bunch of related and interesting quotes about Bubbles and Crashes in the US markets over the last hundred years to try to help us get some semblance of historical markers for Bubbles turning into Crashes.

“By purchasing securities at that time the Federal reserve banks were in fact successful in easing the condition of the money market and in exerting a favorable influence on the international financial situation.” – Federal Reserve Board, 1927

“The Federal Reserve Board neither assumes the right nor has it any disposition to set itself up as an arbiter of security speculation or values.” – Federal Reserve Board, February 1929

“I think the Federal Reserve Board deserves the greatest commendation for its refusal to be influenced by this stock-speculating crowd. What those people want is a recurrence of what happened 10 years ago. They have run away with the market. They have been permitted to use the trust credits of the Federal reserve system for stock-gambling purposes, which they should not have been permitted to do. and which the law inhibits their doing. They were permitted to do that; and now, to correct the situation that they themselves have precipitated they want the commerce and industry of the country penalized by a raise in the rediscount rate. No; it should not be done, and the Federal Reserve Board at Washington deserve to be commended for resisting that powerful influence.” – Senator Glass, D., Virginia, one of the authors of the Federal Reserve Act, June 1929

“There is no doubt if the conduct of the Board was not carried on in secrecy, if there was not a constant rumor in Wall Street and everywhere else of what the Federal Reserve Board were going to do, what they were thinking about doing, what they said in closed session, that there would not have been half the difficulties that now exist. I am confident that had the Federal Reserve Board talked openly and frankly at the beginning of this orgy of speculation and had said, If this situation does not slacken up, if the rates for call money continue to rise, if this diversion of money from legitimate industry to the gambling crowd does not stop, it will be the policy of the Federal Reserve Board to raise the discount rate to a material extent, this situation would have been very different.” — Senator Couzens, R., Michigan, June 1929

“Starting late in 1957 and carrying through the middle of August 1958, the United States Government securities market was subjected to a vast amount of speculative buying and liquidation. This speculation was damaging to market confidence,to the Treasury’s debt management operations, and to the Federal Reserve System’s open market operations. The experience warrants close scrutiny by all interested parties with a view to developing means of preventing recurrences.” – Federal Reserve Board, 1958

“Housing markets are cooling a bit. Our expectation is that the decline in activity or the slowing in activity will be moderate, that house prices will probably continue to rise.” – Ben Bernanke, January 10, 2008

“The Federal Reserve is not currently forecasting a recession.” Ben Bernanke, January 10, 2008

“Bitcoin at this time plays a very small role in the payment system. It is not a stable source of value and it does not constitute legal tender. It is a highly speculative asset,” – Janet Yellen, December 2017

“I would highlight that equity-market valuations at this point generally are quite high,” Ms. Yellen said in response to a question. “Now, they’re not so high when you compare the returns on equities to the returns on safe assets like bonds, which are also very low, but there are potential dangers there.” – Janet Yellen, June 2015

“It wasn’t too long ago when people … were saying we were going to be having hyperinflation, huge stock-market bubbles, and dollar collapse and all kinds of terrible things were going to come.” Ben Bernanke, 2017

“The whole focus on exit is premature if I may say. We’re focused on finishing the job we’re doing, which is supporting the economy, giving the economy the support it needs.” – Fed Head, Jerome Powell, January 2021

“We’re going to be patient. Expect us to wait and see and not react if we see small, and what we would view as very likely to be transient, effects on inflation,” – Fed Head, Jerome Powell, January 2021

What did we learn? The Fed is almost always wrong. They just bumble along and try to make sure their banker bosses are happy and that the public doesn’t get too upset about the Fed’s endless redistribution of wealth and bubble-blowing/crashes policies. You cannot ever rely on the Fed (or the government) for guidance on the economy or for help navigating the risks/rewards of their endlessly circular policies, choices and words.

I am here to tell you that it’s not a great time to be investing for the long-term. That doesn’t mean that you sell everything and in fact, many individual stocks, will go up in value for many years to come even from these levels (maybe SpaceX and Starlink for example). I also think that inflation could be coming back to the economy for several years here. Higher interest rates (perhaps look at shorting and/or buying puts on the TLT again?) and commodity inflation looks likely to kick in this year and for years to come (perhaps the DBA ETF might be interesting here?). In fact, consider this a Trade Alert that I’m doing a little of both — I’m buying a few TLT puts dated out to March and just a little bit out-of-the-money and I’m buying a little bit of DBA itself.

But I do think that the vast majority of the thousands of stocks that you can buy and sell and that more than 90% of the hundreds of cryptocurrencies that you can buy and sell are going to be available at much lower prices at some point in the next year or two. So be careful, be selective in what you buy. And don’t be greedy right now! I know that can be hard, but do you remember how hard it was to be buying aggressively back in March when the risk/reward was terrific and we were loading up on so many stocks? Making the hardest trade, making the hardest investment, is usually the right one.

Don’t go panicking, don’t go loading up on a bunch of shorts right now. But be cool and don’t think that you have to find the next stock that goes up 10-30% for a few days in a row or something. We are here to build our wealth in a repeatable, straightforward manner over the next ten, twenty or thirty years. Remember?