Trade Alert: Taking a tranche of profits on JRJC puts PLUS Analysis on Apple, The Fed and the Alibaba IPO

I am slowly putting out some offers to sell about 1/5 of my JRJC puts. I never was able to borrow any shares to short on JRJC but I did get filled on my some my puts from a couple weeks ago when I’d written:

“Here’s one I’m trying to short right now and am bidding on some puts dated in October and January 2015 with strike prices ranging from $12.50 to down to $10s — JRJC. It’s a crappy, hyped up Chinese Internet stock that’s popped because the company claims they just became the first online brokers in China. I think this thing will be back below $5 a share by the end of the year.”

JRJC is down 11% on the day and is now down nearly 40% since we bought the puts.

Apple iPhone 6 and update on my AAPL puts$AAPL iPhone 6 sales are huge. Not a shocker to you and I but certainly impressive. The tech company said Friday preorders for its new iPhones are at a record but declined to provide specific figures. Users still have an opportunity to buy an iPhone 6 by Sept. 19, but iPhone 6 Plus orders will be delayed by three to four weeks. Analysts are projecting Apple to sell anywhere from 65 million to 75 million units by the year’s end. The AAPL stock feels teflon-like right now and has survived the initial sell-the-news set-up into its big product launches last week. I expect now that I might just end up eating a loss on my small AAPL put hedge, but that’s fine, as I’m still much more long with the common anyway. The puts are a decent hedge if the markets are too tank near-term, though I don’t expect that either, as I discuss below in the Fed part of this write-up.

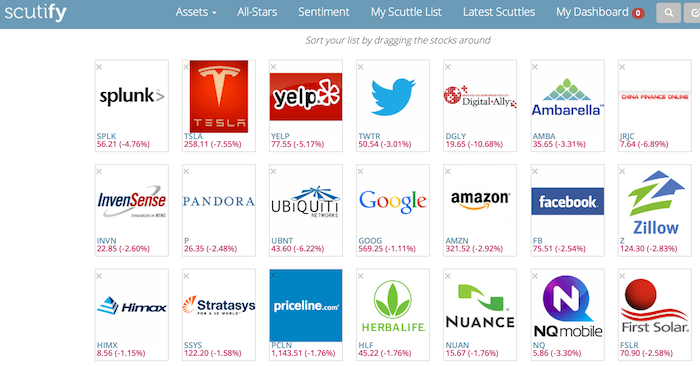

Markets this morningHigh-beta, momo stocks are getting CRUSHED today. The broader indices don’t show the ugliness out there. $SPLK $TSLA $JRJC$DGLY $UBNT all down 5% or more.

See image below of a bunch of the names being hit hardest. Careful out there for now.

Scutify Quote of the Morning: “The $BABA hype machine is in full effect for $YHOO & others… should have a bit of downside potential once the $BABA ‘proxy effect’ wears off & realization that this co’s future relies on Marissa’s immaculate stewardship of the cash hoard sets in. Risky bet!” I agree that I wouldn’t want to be betting on $YHOO CEO or the nonexistent growth they’ve generated there for years on end now.

I shouldn’t be surprised at all the $BABA -related stocks going thru the roof on the IPO hype, but I am. I’ve been waiting to vote Bearish Sentiment Views on Scutify and I might be tempted to buy some longer-dated puts on $YHOO in the next few days. I think this is getting to be a classic sell the news set up for YHOO and Softbank. I’ll be waiting to see how the valuation comes out and how it trades a bit before considering any long or short $BABAmyself.

Fed and the set-up for the markets this week analysisLike it or not, all eyes will be on the Fed again this week as the board gets together to chat with each other and put out their latest PR statements. I personally don’t expect the Fed to do or say anything that changes my long-held analysis that they are creating the ongoing greatest bubble-blowing bull market in history. But I can’t deny that “Fed to tweak message in policy meeting: analysts” is a real headline.

Ever hear the saying, “Don’t confuse genius with a bull market?” Remember how before he was despised how Greenspan was celebrated during good times and bubble blowing bull markets past? In this clip below from Arise TV 360, I’m asked if by anchor Andrew Schmertz, “Hasn’t the Fed sort of won, they’ve kept us out of a recession while Europe has slumped?” Watch the clip for my answer.

But in short – no, the Fed didn’t win.

And anyway, rates and the Fed are still in “emergency/extreme measures mode.” Maybe we can talk about starting to worry about the Fed’s role in this ongoing bubble blowing bull market coming to an end when rates get up to 3-4%. But rates at 0%, 1% or 2% are still very much below what’s “natural” or “normal”.

So how about this market and how to play it right now? You’ve got at least a couple bearish factors weighing on it this week. First, there’s the fact that expectations for the Fed’s meeting have gotten so ridiculous that anything other that’s not: “We expect the FOMC to have a moderately hawkish tone at its 16 to 17 Sep meeting,” would likely “spook the bulls” for the near-term. That, and Alibaba’s pending IPO this week draining some high-beta stocks as growth fund managers raise money so they don’t have to tell their investors that they missed “the latest Facebook/GoPro/Tesla” etc.

While some of my favorite longs like Yelp, Ambarella and Facebook are getting crushed today, they’re not down enough yet for me to start scaling into more. I am however still scaling into some Sony, making it a mid-sized position for now.

With 0% interest rates saving corporations billions while forcing millions of retirees and savers into riskier assets like stocks, we need to remain positioned to profit from the greatest bubble blowing bull market in history.

So the Fed can indeed propagandize and take victory laps all they want and we all just better get used to it for a while.