Trade Alert: Taking more profits on puts as volatility begets volatility

Wow, ugly day again today. Volatility begets volatility, as I’d mentioned in last week’s Livestream Chat Transcript. You guys scared? Or patient?

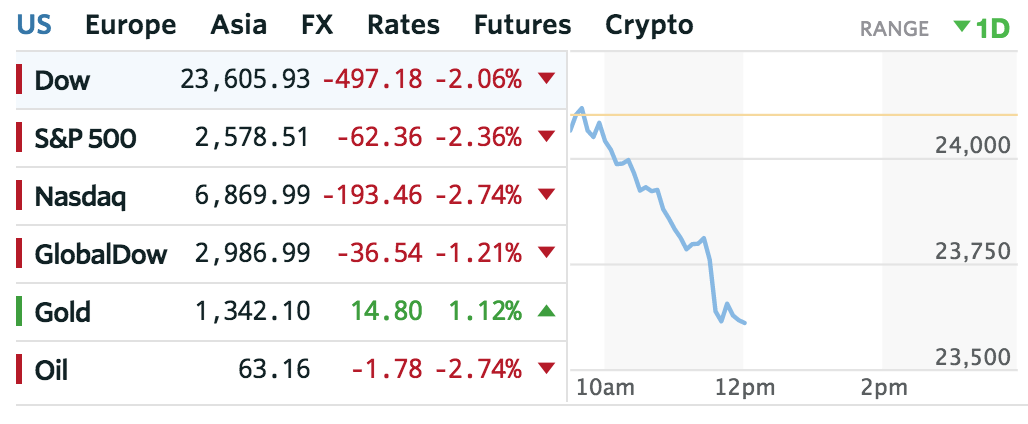

The Nasdaq has dropped 800 points, from 7600 to 6800 in the last couple weeks. Remember a few weeks ago when the markets tanked, put in a hard short-term bottom and then the Nasdaq bounced all the way to a new all-time high…a couple weeks ago?

The Nasdaq is now just 1% away from that panicky short-term bottom level.

The DJIA just fell right through that panicky short-term bottom in had put in.

The S&P 500 is right at that panicky short-term bottom from a few weeks ago.

You know I’ve been preaching caution, defense and have nibbled puts here and there starting just about a couple days before the markets put in their all-time high tops in and I’ve been adding to those puts on rallies, trimming them on market collapses.

So here we are again today, and yes, I’m going to trim about another 5-10% of my puts. I’m trimming some of the QQQ, DIA, SPY and IWM puts just about every time I have trimmed. I still have more than 60% of the puts I had at the time when I most recently bought more of these puts.