The AI Revolution Takes A Great Leap Forward (And A Couple Small Trade Alerts)

The AI Revolution continues to gain steam. For those that missed it, Jenson Huang — the CEO of NVIDIA (NVDA) — delivered an extremely impressive keynote address at NVIDIA’s GTC (which stands for GPU Technology Conference, in other words, its an acronym of an acronym) on Monday.

We wanted to pass on our analysis and discuss a few of the things that stood out to us in this speech. You can re-watch the speech here.

- NVIDIA’s continued dominance

We are now nearly a year and a half into The AI Revolution being at the center of nearly everyone’s attention, and yet no other chip company has gotten close to catching NVIDIA. NVIDIA’s existing chips, the A100, H100, and H200 still remain the industry standard for AI training & inference chips, and demand for these chips far exceeds supply. NVIDIA continues to charge upwards of $40,000 for one H200 chip which yields the company 80% gross margins (extremely high for the chip industry). Those high gross margins and virtually unlimited demand are attracting competitors to the market, including established firms like Intel (INTC) and AMD (AMD), and startups like Groq and Cerebras. While we continue to think that eventually some of these companies or others will probably develop AI chips that can compete with NVIDIA’s, it may be longer than we originally thought. NVIDIA’s chips are already head and shoulders above the competition, and NVIDIA’s CUDA software platform combined with its integrations with other software platforms like Cadence (CDNS), Synopsis (SNPS), Ansys (ANSS), and Autodesk (ADSK) dramatically increase the value and utility of NVIDIA’s chips to its customers. And with NVIDIA’s latest developments like “Blackwell” which it introduced on Monday, it looks like the gap between NVIDIA and its competitors might be getting even wider.

NVIDIA’s main customers are some of the largest tech companies in the world, including Meta (META), Amazon (AMZN), Google (GOOG), Microsoft (MSFT), and Tesla (TSLA). These companies are all racing to build the best AI applications and eventually shooting to create artificial general intelligence (AGI). These companies have very large cash piles to spend building out AI infrastructure, and they probably don’t want to risk falling behind each other by building out that infrastructure with a subpar chip from Intel or AMD. In other words, if you plan to spend $30 billion on capex for data centers like Meta is, you probably want to have the biggest portion of that going to cutting-edge chips from NVIDIA to make sure your applications are as good as possible. Eventually, Meta and Amazon and others will build their own AI chips, but they will want to make dang sure their custom silicon is cutting edge before they start officially reducing reliance on NVIDIA chips.

2. NVIDIA’s Impressive Rate of Innovation

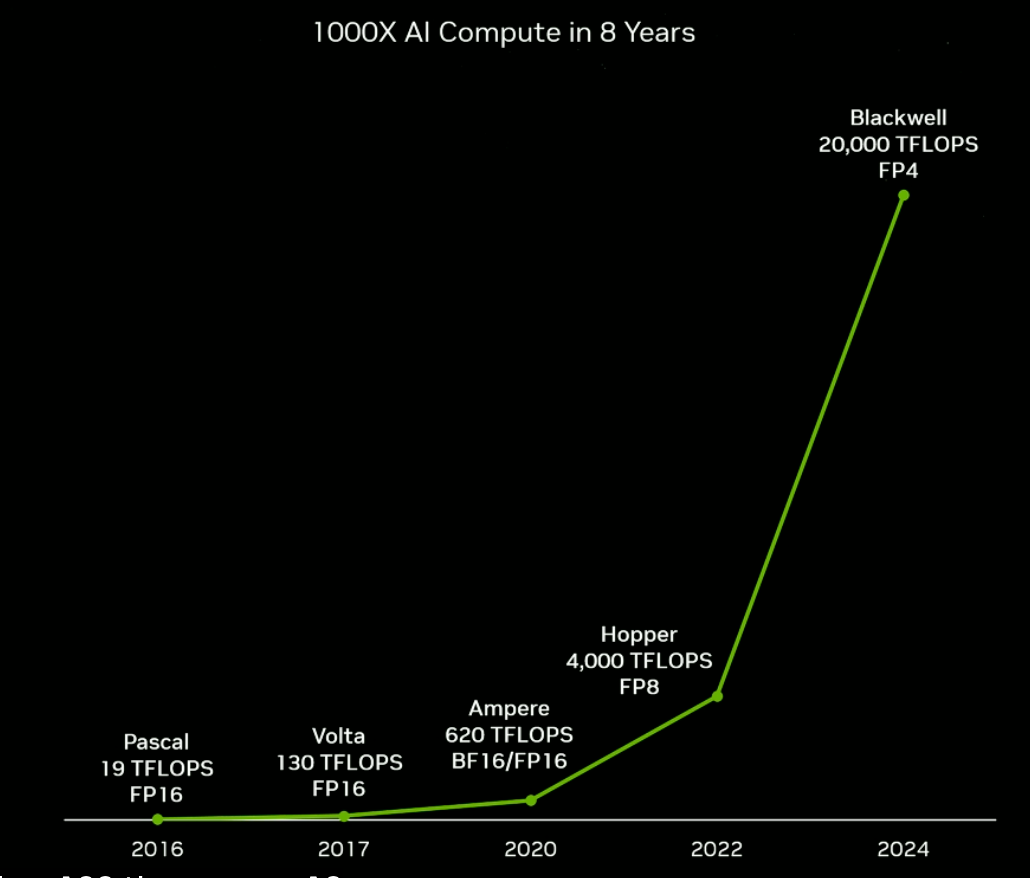

NVIDIA is taking Moore’s Law to the next level. For those that are not familiar, Moore’s Law is not really a law of physics or engineering, but rather it is an observation that computing power roughly doubles every two years and the cost of compute cuts in half in the same time period. This phenomenon has steadily held true for most of the last sixty years, but now NVIDIA is rapidly accelerating the increase in computing power. Jenson Huang explained that with its new Blackwell chip, NVIDIA has created a 1000x expansion in AI Compute power in 8 years, whereas under Moore’s law, we would expect to see a 100x expansion in 10 years.

Put simply, there’s a good reason why NVIDIA is so dominant in the AI chip world right now. They are truly pushing the limits of physics with each new chip design, and each new generation of chips will enable even more powerful new AI applications. We have been saying that the biggest constraint to achieving AGI is limits on compute power and chip availability. The company that builds the biggest and smartest brain, if you will, will be the company with the largest quantity of the most powerful chips, and right now the most powerful chips (by a long shot) come from NVIDIA.

3. NVIDIA’s Omniverse and Robotics Platform

NVIDIA launched its “infrastructure-as-a-service” software platform called “Omniverse” back in 2022 and it continues to gain importance in the world of manufacturing, automation, graphic design, and robotics. Here’s how ChatGPT explains what Omniverse does:

“Designed as a powerful, multi-GPU, real-time simulation and collaboration platform for 3D production workflows and AI, Omniverse aims to transform how creators, engineers, and researchers work together and create virtual worlds and simulations. At its core, the Omniverse platform is built around the Universal Scene Description (USD) framework developed by Pixar. USD serves as a comprehensive way to describe, compose, and interchange complex 3D scenes that include geometry, shaders, lighting, and animations among multiple applications and services. This makes Omniverse particularly powerful for projects that involve multiple users and software tools, as it ensures interoperability and seamless collaboration across various 3D content creation tools and workflows.”

Engineers, architects, and other designers already use Omniverse to build, develop, and test, real-life objects like cars, ships, robots, factories, and entire cities. Omniverse is integrated into design/automation software from Adobe (ADBE), Autodesk (ADSK), Rockwell (ROK) and others. With AI, Omniverse more accurately simulates real-world physics which makes it extremely useful for building and testing objects in the virtual world before expending the time and money of building them in real life.

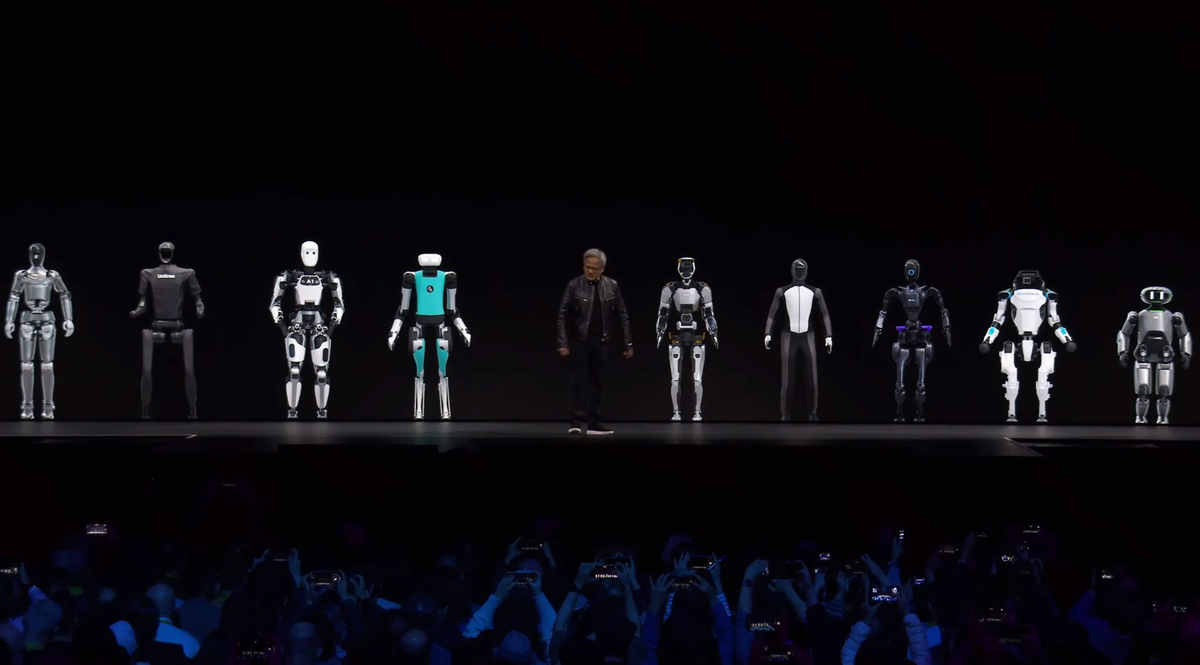

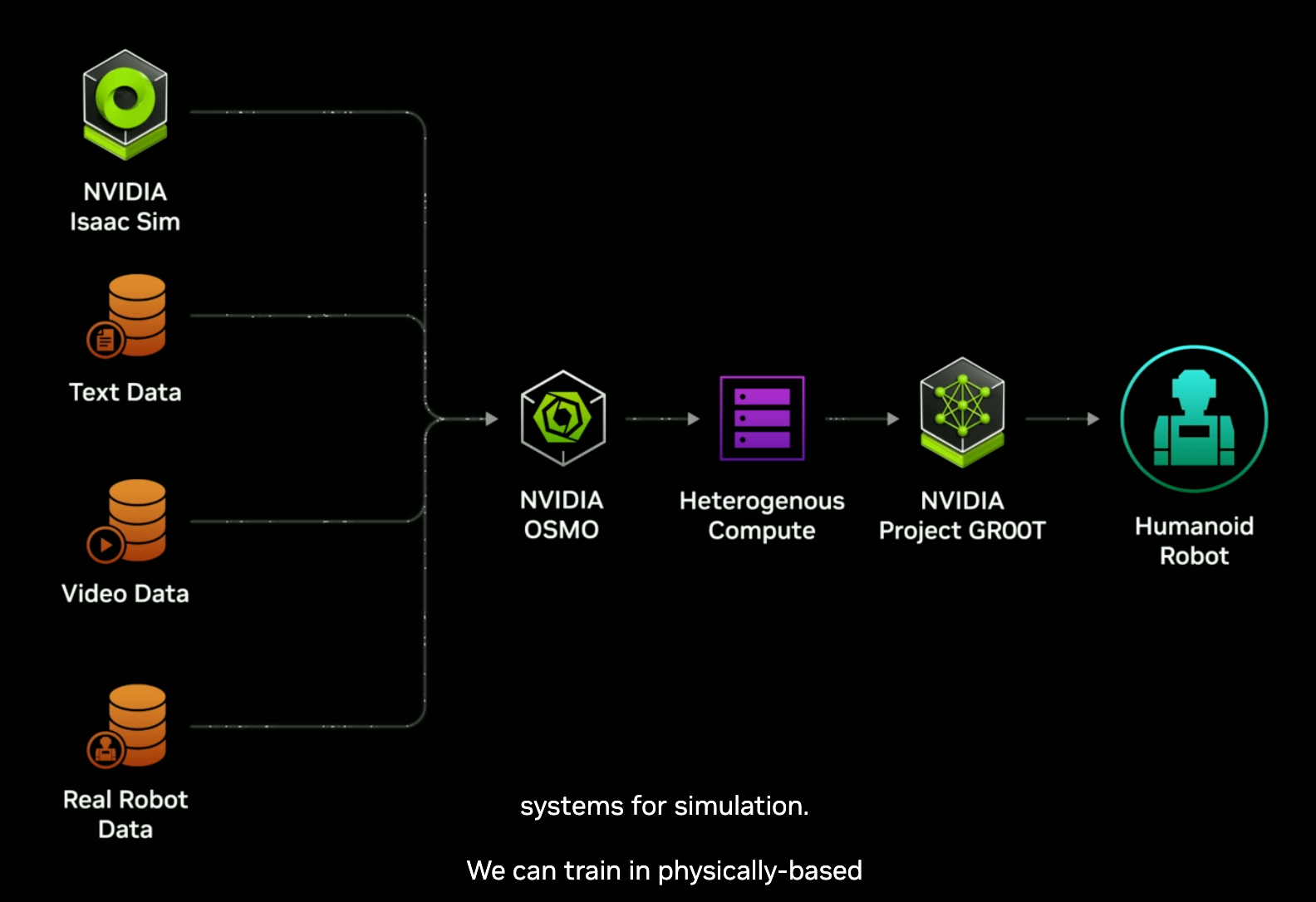

At GTC, NVIDIA introduced new additions to its robotics platform which, when used in conjunction with Omniverse, will enable a rapid acceleration of the Robotics Revolution. Currently, almost all robots (which are primarily used in factories) are preprogrammed to do specific tasks. However, with NVIDIA’s new products including Project GROOT, which is a “general purpose foundation model,” we expect that development of humanoid robots is about to enter a new era. GROOT enables robots to learn from simulation (in the Omniverse) and real-world training from humans and then simulate those actions autonomously. NVIDIA also sells its “Jetson” system on module (SOM) which is a packaged GPU, CPU, and memory device that is installed in robots. Essentially, NVIDIA sells everything a robot developer needs to design, train, and run a humanoid robot.

There are now a dozen or so companies working on humanoid robots, and everyone but Tesla (TSLA) will probably depend on NVIDIA’s platform to build and train their robots, and even Tesla is using NVIDIA chips to help create Tesla’s robotics platform. Jensen Huang wrapped up his keynote at GTC with two AI-powered “droids” from Disney (DIS) following him around on stage that were designed and trained using NVIDIA’s platform. (Did you know that Disney (DIS) owns the trademark for the term “droid” having bought Lucasfilms a few years back?).

We are just barely starting the first inning of the new Robotics Revolution, and we think NVIDIA’s platform with its Omniverse simulation software, GROOT AI model, and Jetson SOM will be key to enabling rapid development of all new kinds of robots. We think Tesla is likely the only company that can compete with NVIDIA in offering this kind of software and hardware for robotics. It’s possible that NVIDIA and Tesla could end up being the operating systems/platforms that empower a new era of AI-enabled robots, somewhat similar to Apple and Google being the platforms that enabled The Smartphone and App Revolutions.

Conclusion

We are very impressed with everything NVIDIA has going on and seeing all of this rapid new development has us very excited about the future of The AI and Robotics Revolutions. We have been in NVIDIA stock since 2016 when we started writing about it as a great way to bet on the future of autonomous vehicles (which is also still in its very early innings) when NVDA stock was at $8/share. The stock is up huge this year (about 80% YTD) so we are not necessarily chasing it, but we would probably look to buy more below $800.

We did buy some January 2025 calls on Disney (DIS) with strikes around $120. We also picked up some May 2024 $260 calls on Rockwell (ROK) this morning. Lastly, we added a little Adobe (ADBE) common stock to the sheets this week and will likely buy more on further weakness. We like these companies at these levels because they are not at all-time highs and are all leaders in their respective fields. Moreover, they each have unique IP and software that will be critical to enabling the AI Revolution in tandem with everything happening at NVIDIA and Tesla.

Rock on. See you in the chat!