Trade Alert: The algo’s and media suddenly fear Recession

This morning, apparently the “real” yield curve inverted. Not that fake yield curve that inverted a few times already, in which you might have made the mistake of thinking that the 30-year Treasury or the 3-month Treasury might be important. No, apparently, it was only the 10 year and the 2 year that matter as inverted indicators.

And as every single outlet I read today explained to me: “The yield on the 2-year Treasury note topped the 10-year rate, a so-called yield curve inversion that has been a precursor to past recessions.”

Apparently, the algorithms and the news media all have the same playbook. Here’s a sampling of all the recession warnings that popped up on CNBC, NY Times, Marketwatch, etc:

Main yield curve inverts as 2-year yield tops 10-year rate, triggering recession warning

Bond markets are sending one big global recession warning

Stock losses deepen as key recession indicator sparks new alarm

The bond market’s recession warnings are getting louder

Treasury yield curve inverts, triggering bond-market recession indicator

Dow plunges 650 points after bond market flashes a recession warning

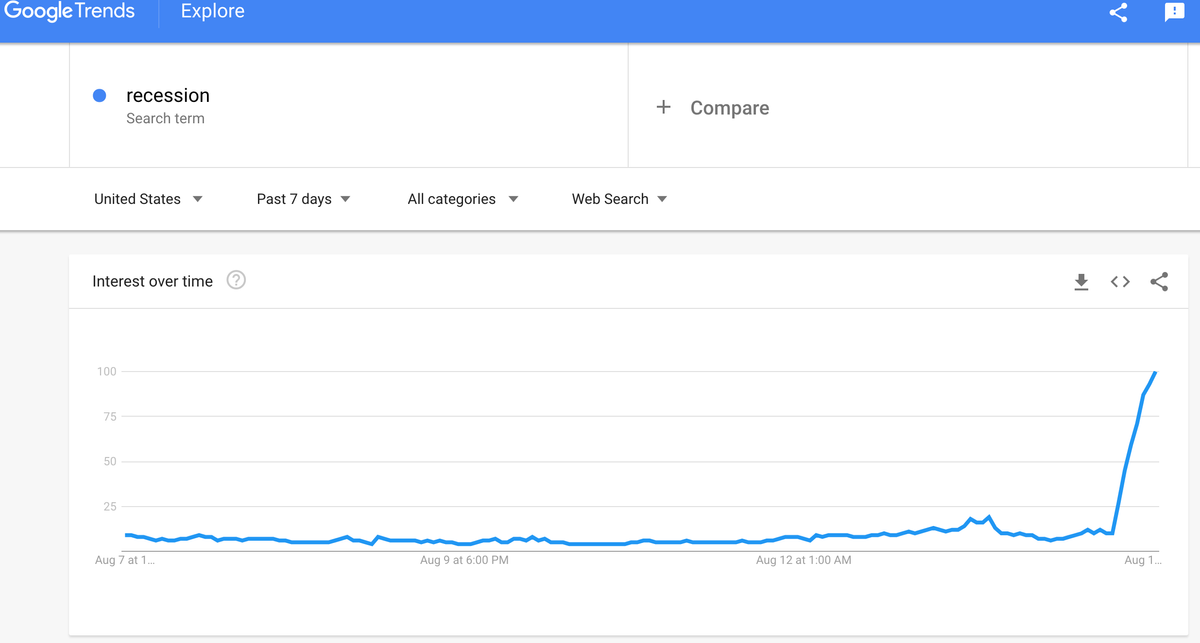

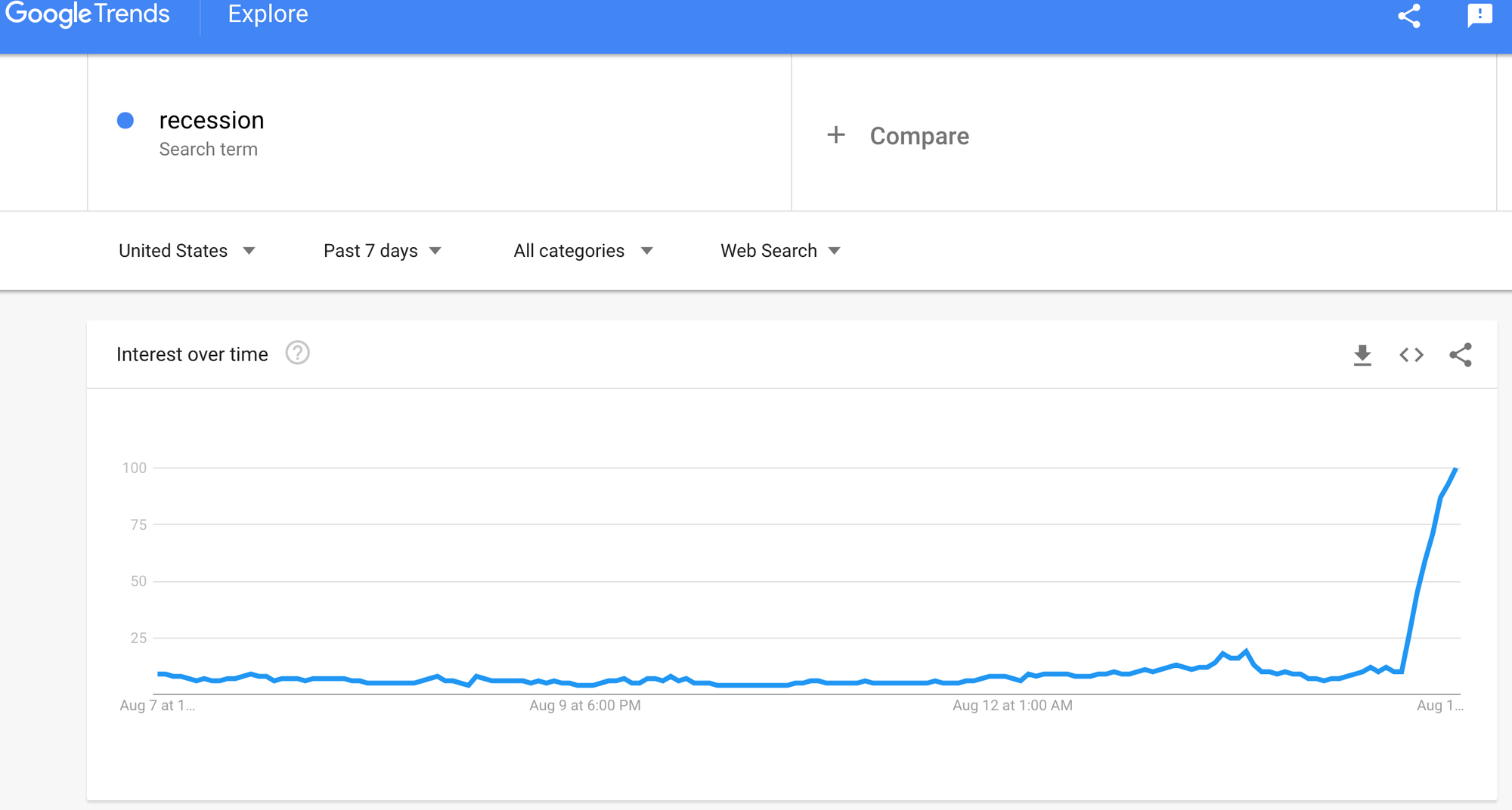

Just look at the Google Trends for “recession” in the last week:

I don’t want to be glib about today’s panicky sell-off or about the very strong possibility that the US could indeed be headed into recession. But I also know that when some random economic indicator gets this much overwhelming focus in both the markets and the media, that people just might be over-reacting right now. The US might indeed be headed towards recession, but then again, it might just be a false flag this time. It’s not that a US recession is fait accompli simply because the 2- and 10-year yields got inverted for a day. Let’s see if it’s still inverted in a week. And even then, it could still be a false recession flag.

That said, I can’t hardly believe how quickly the market is spiking, crashing, spiking, crashing. It’s day-to-day for the last couple weeks, and it’s been a rare occasion of seeing me do some quick trades. And once again today, I am indeed going to do a few little trades here, reversing what I did yesterday when I’d trimmed some longs and shorted some index ETFs and nibbled some more index puts.

I’m nibbling a little bit of AMZN, CSCO, SPLK, UBER. And I’m selling about 1/4 of my index put hedges, locking in some nice trading gains once again. I also covered a little bit of my VHC and HTZ shorts for nice gains.

Easy does it. Even if the algo’s and headlines make it hard.