Trade Alert: The best stock for The Gaming Revolution

Here’s another long-term Revolutionary investment that I am putting into both the hedge fund and in my personal account. This one comes from another Revolutionary sector that I want exposure to — The Gaming Revolution.

First a note about positioning (and as I explained in the chat this morning), in the hedge fund, I’m comfortable having a few more positions (and being more active shorting) than I am in my personal portfolio. I’d prefer to have about 20 longs, 5 or more shorts, and maybe some cryptos and crowdfunding investments in the hedge fund. I try to consider some of the cloud or 5G Revolution baskets as a single stock when I do build a basket, so the “20 longs” is liable to grow at times when I see opportunities.

The gaming industry has seen an interesting shift in the competitive landscape over the last 18 months. Specifically, a company called EPIC Games released a game called Fortnite about 18 months ago. Since then, Fortnite has garnered huge market share and has grown to over 200m global users. Fortnite’s success has caused the established gaming companies (TTWO, EA, ATVI) expectations and stocks to fall. It is this pullback in the stocks that is providing us with an opportunity. The best name of the three is EA. The reasons are as follows:

Positives:

- Apex Legends: EA released a game called Apex Legends February 4th, 2019. The game reached over 50m users in its first month of game play. The quick ascent to 50mn players puts Apex’s user base at a quarter of Fortnite’s estimated 200mn users, and creates a significant opportunity for in-game monetization. Note, through 1 month of gameplay Fortnite had 20mn users and it took over 4 months to reach the 50mn user mark. Apex Legends is a similar Free For Play game like Fortnite.

- EA’s stock pull back provides opportunity: EA’s stock price was approximately $150/sh in mid July of 2019. The continued success of Apex Legends could cause the stock to easily rise 20% from today’s level of $102.

- Google and Apple: Both Google and Apple have recently announced new gaming initiatives that will be rolled out to their respective customer bases. This is a positive for the gaming industry. For example. One morning in the near future a news headline could read: “Google partners with XYZ Gaming in order to have access to their gaming content”. This would cause a nice move in the gaming stocks.

- Positive Seasonality: The gaming stocks have a history of experiencing positive seasonality during the calendar 4th quarter. This is due to an uptick in demand from holiday shoppers. The holiday season is just 7 months away.

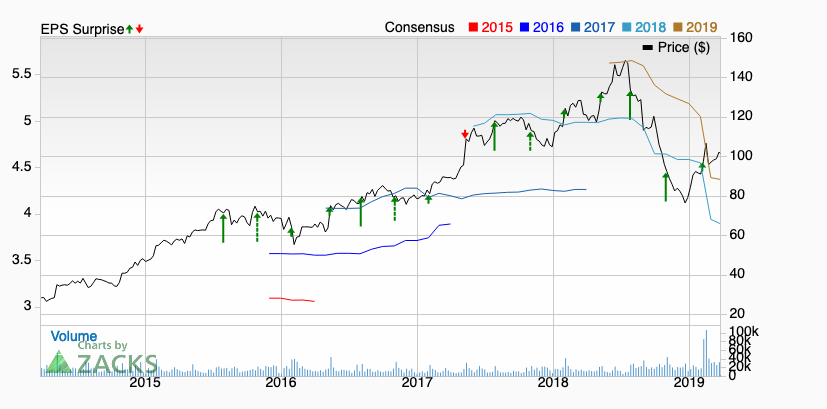

- Earnings revisions: EA has experienced negative earnings revisions from the street for C2019. This can be seen in the chart above as the brown line depicts how earnings expectations have been lowered by the sell side. Normally this would be viewed as a negative, but the initial success of Apex Legends could help EA beat these lowered expectations.

Negatives:

- The $60 per packaged game is a big business. Who is at most risk if consoles games go free? The near-term risk is if gamers balk at paying $60 per game when rival games are free. ATVI has the least exposure with 36% of revs from consoles. EA, UBI and TTWO generated 71%, 74% and 81%, respectively, of rev from consoles. EA’s estimates have been cut by the street because of the concern for its box gaming business. With a fixed number of publishers selling box games, they all stand to benefit if Free To Play expands the gaming market.

- Valuation: EA is trading at a NTM PE of 23X and a NTM REV multiple of approximately 6X. This might be viewed as expensive for some value investors. (Then again, EA’s Gross Margins are approximately 75%.)

- Fortnite is the blueprint for how console games will make money going forward. Fortnite’s free-to-play (FTP) model attracted an audience of 200MM players, an order of magnitude larger than the biggest full-price ($60) games. (Then again, The game generated a record $2.4B (est) rev in ’18, proving FTP can drive superior results than the full price $60 box model.)

Neutral:

- The $38B console video game market’s decade-long digital transformation appears to be accelerating, as it now seems inevitable that more games will adopt Fortnite’s ‘free-to-play,’ games-as-a-service model. This will expand the market long term, but also presents near-term risk and uncertainty.

- In a world where games are free there will be fewer, bigger games. The largest franchises like Fortnite, Apex (EA), COD (ATVI) and GTA (TTWO) look best positioned. Traditional media looks like losers as Free To Play models captivate ever larger gaming audiences. Retailers like GME are also losers.

EA – Electronic Arts

Electronic Arts Inc. is a leading global interactive entertainment software company. EA delivers games, content and online services for Internet-connected consoles, personal computers, mobile phones and tablets. EA has more than 300 million registered customers around the world. Headquartered in Redwood City, California, EA is recognized for a portfolio of critically acclaimed, high-quality blockbuster brands such as Apex Legends, The Sims, Madden NFL, EA SPORTS FIFA, Battlefield, Dragon Age and Plants vs. Zombies.

Disclosure: At the time of publication, the firm in which Willard is a partner and/or Mr. Willard had positions in some of the stocks mentioned above although positions can change at any time and without notice.