Trade Alert: The Bubble is finally here, so what should we do now?

Trading With Cody subscribers can click here to read this article.

We got in front of the Cloud Revolution early and now we are riding it into Cloud Bubble territory. I wrote books about it like”30 Stocks for the Cloud Revolution” and about a hundred articles for Marketwatch, WSJ, USAToday and elsewhere about why we had to be in front of what’s now getting to be an actual Cloud Bubble).

Likewise, it has turned out that the Cloud Revolution, in large part driven by the App Revolution, might be the single biggest fundamental driver for the companies that got in front of it early enough to become the dominant players. Amazon, Google, Microsoft are going to generated tens of billions of dollars in Cloud Revenue this year, up from nothing meaningful just five years ago when I wrote that book.

Let me move onto another topic that’s related…

Driving in to work this morning, I heard Ben Bernanke say on CNBC (italics mine):

“It wasn’t too long ago when people… were saying we were going to be having hyperinflation, huge stock-market bubbles, and dollar collapse and all kinds of terrible things were going to come,” Bernanke said in an interview on CNBC, as part of a round of interviews to coincide with the publication of the paperback edition of his book, The Courage to Act. “But in fact, it has gone pretty smoothly,” he said. The economy is doing “pretty well”

I’m afraid that Bernanke is often a contrarian indicator…and what’s the deal in calling a book “The Courage To Act, when it’s a book about transferring trillions of dollars in wealth from taxpayers to bank and corporate shareholders in the name of “Bailing Out” the banks? Is that title just blatant propaganda for the Fed’s ongoing bailout missions and the Regime that supports it and the banks that own it? Or does it say a lot about the psychology of any Federal Reserve Chairman? Or both?

Here’s some historical reference underscoring how Bernanke can be a contrarian indicator:

(February 15, 2006) “Housing markets are cooling a bit. Our expectation is that the decline in activity or the slowing in activity will be moderate, that house prices will probably continue to rise.”

(January 10, 2008) “The Federal Reserve is not currently forecasting a recession.”

And here’s one more topic that’s also related:

You guys know how I’ve been deadly focused on making sure we’re not missing any Black Swans and/or missing the top in the economic cycle and/or that we’re not about to miss the next stock market crash. For the last six or seven years now, my analysis has continually pointed towards steady growth in the economic cycle and the fundamentals that support it. And for the last six or seven years, we’ve been bullish and net long and have made some great money in the stock market.

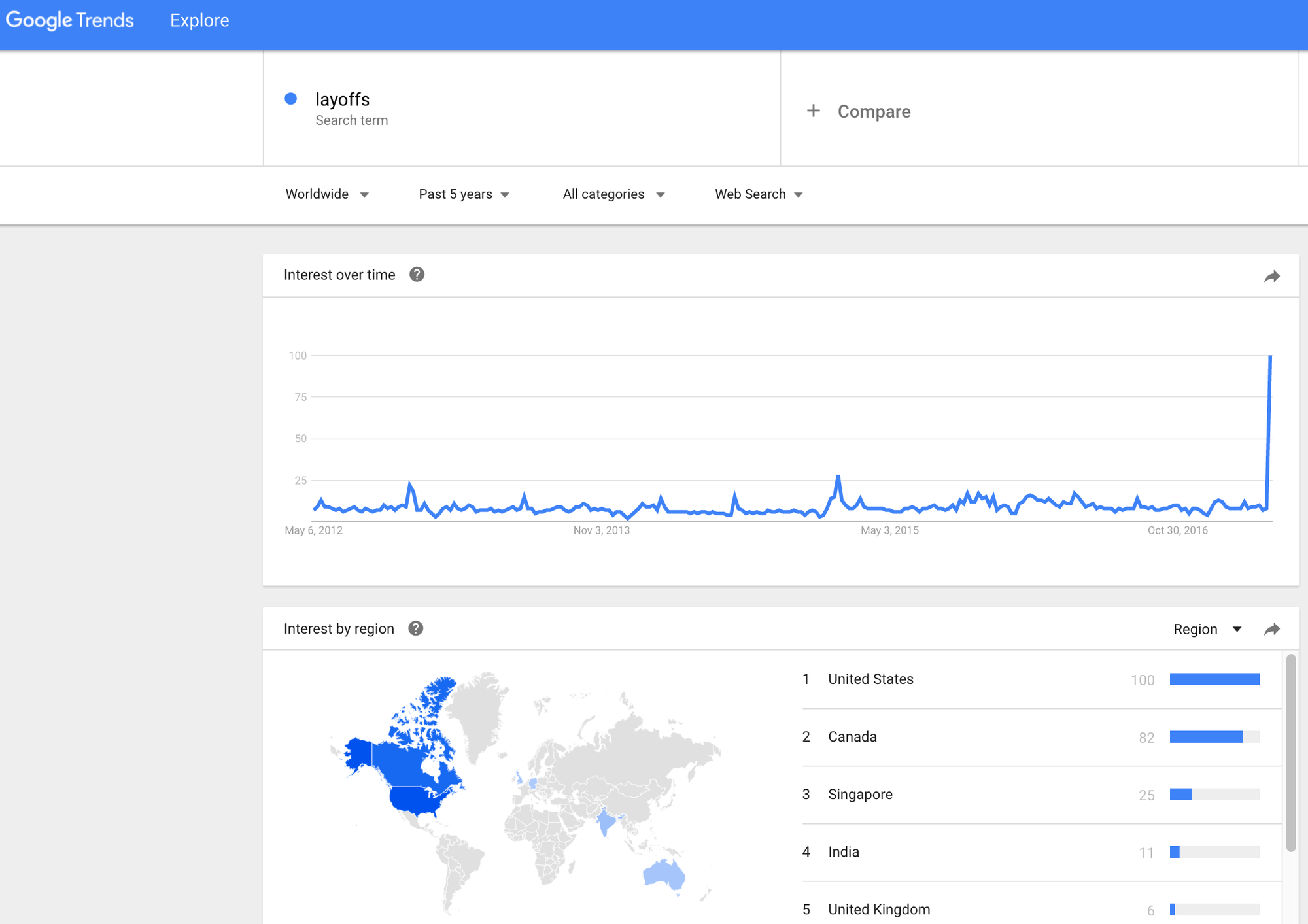

I still don’t think the cycle is about to turn right now. But I’m wondering if we’re starting to see some cracks start to show, namely layoffs. ESPN is the highest profile layer-offer right now, as the company’s letting go of hundreds of employees, including TV faces and former star athletes. But I noticed in the Boston Globe that Brigham and Women’s Hospital, one of Boston’s largest employers, is cutting 1600 or 9% of their workforce too.

That prompted me to look at Google Trends for the word “Layoffs”:

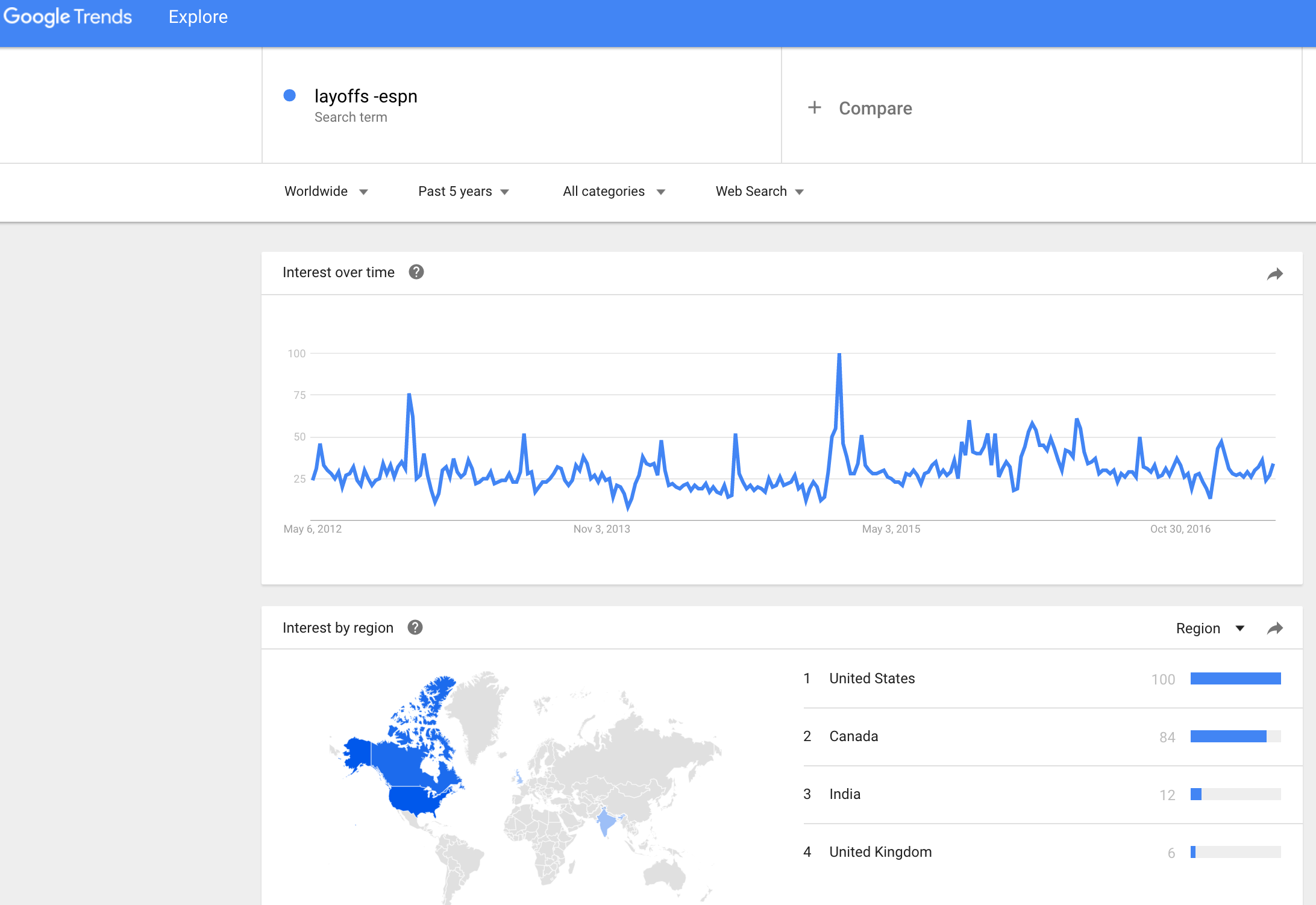

On the other hand, I was at dinner with the president of giant Boston infrastructure company and he, like so many other CEOs I’ve spoken to in the last few months, talked about how tight the labor market is and how the lack of good workers out there is one of the biggest constraints on growth. So then I wondered to myself that maybe it’s all those high-profile ESPN layoffs that’s the reason for the spike in “Layoffs” trending rather than it being an indicator that layoffs have indeed suddenly spiked. So before you freak out too much about that chart, let’s remove the word “-ESPN” from that chart:

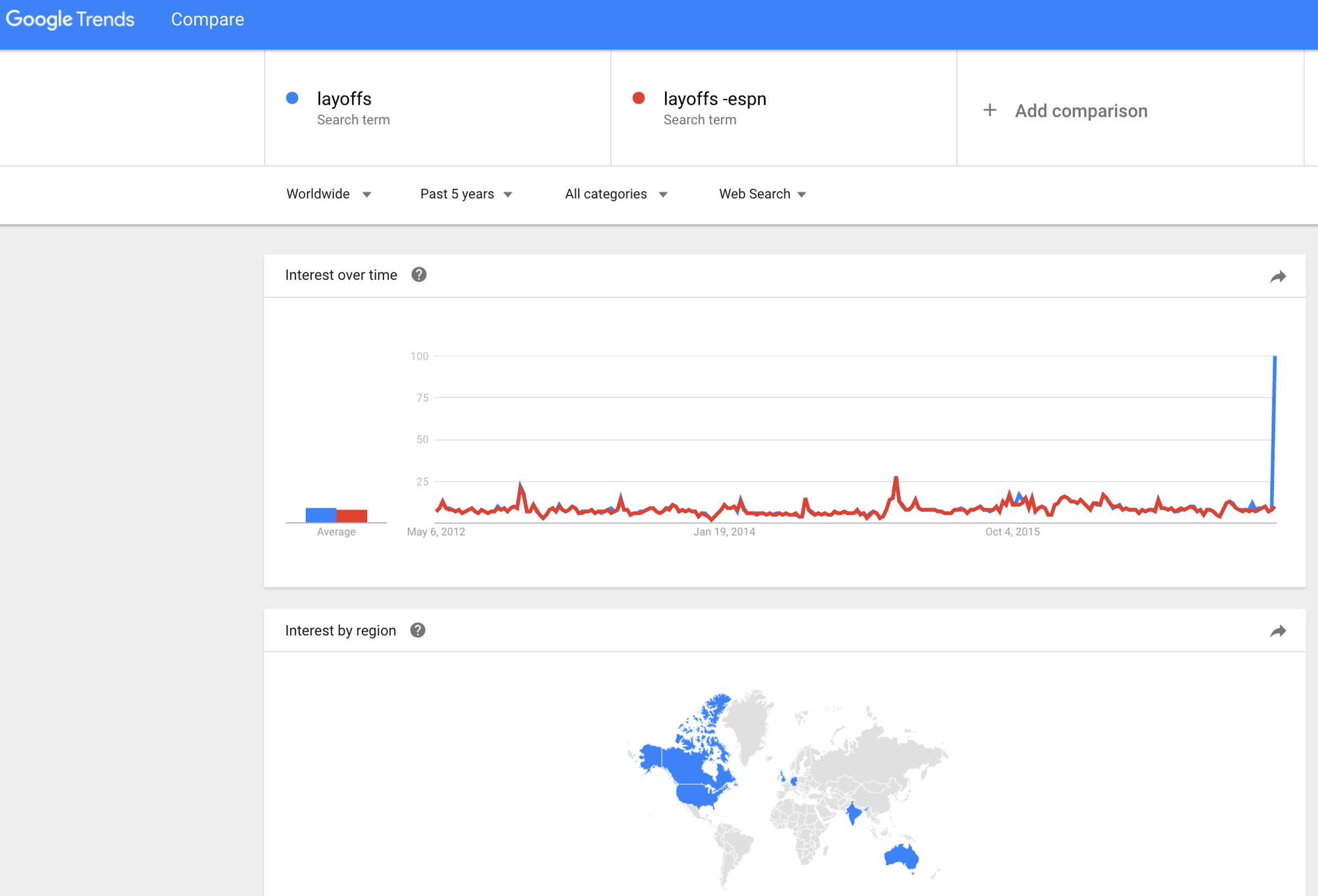

Here are the two charts overlayed, just to double-assure ourselves:

So, what’s the upshot of these three topics? Even though I can and do remain remain bullish overall, I want to step back even a bit more and do some trimming of some of our many huge winners, reduce a tiny bit more of our net long exposure and reduce some exposure to the Cloud Bubble specifically.

As I wrote in an article called “Buy app, cloud stocks and short energy, financials” back in 2011 (italics mine):

“Can you talk about this kind of growth in any other marketplace in the world? No, because the world has never seen such marketplaces come through. And if RCA can go from $85 to $550 in a year and if the radio marketplace bubbled as companies like RCA were able to raise so much money to spend on expanding their businesses, then what does that history lesson say about the probability that we’re heading into an app marketplace bubble. And if early TV investors created lasting fortunes as the TV bubble grew and then popped, then what does that say about early app investors today? And if there were billions to be made in the Internet bubble before it popped, then what does that say about the trillions to be made in the app/cloud/smartphone/tablet bubble as it’s being blown up before it eventually someday pops?

It says we’re right for staying focused on the biggest opportunities that the world has ever seen. And it means we need to be ready to sell someday — when this playbook for making fortunes in big bubbles before they expand says that we’re getting closer to the pop.”

Let’s listen to our own advice even as we remember that we don’t have to be “All-In” or “All-Out” in the stock markets at any given time. So…

I’m going to sell the GIMO and take my losses on this name. It’s a cloud revolution play, but I’m growing increasingly disappointed in the company disappointing Wall Street on growth. Mea culpa.

I’m also going to trim 5% of my Amazon today.

I’m going to trim 10% of my Axogen today as its at yet new all-time highs as it’s tripled from where we bought a couple years ago.

Snap’s stock has rallied more than 10% since we bought those SNAP call options a couple weeks ago and our options are up 50% or so. I’m likely to trim maybe 10% of those options just to lock in some of those profits that we’ve already got. But as you know I think SNAP could pop another 20% in the next week or two as they report earnings. So I’m certainly not about to sell all of them.