Trade Alert: The Great Reset Ain’t Over

“I must caution you that you cannot live in the past. The 1971-72 season is now history and we must look toward the future. The past cannot change what is to come. The work that you do each and every day is the only true way to improve and prepare yourself for what is to come. You cannot change the past and you can influence the future only by what you do today” (John Wooden, UCLA Bruins basketball coach, 1972).

I don’t know what made my pull John Wooden’s autobiography off my shelf last night after at least 30 years of having read the book in high school when I was obsessed with becoming a Division 1 basketball player, but I did. And it was weird when flipped to the 27th chapter and saw the above quote taken from a letter that Coach Wooden wrote to his team in 1972 following a season in which they went 30-0. I mean, I had literally just been passionately explaining to my wife why I am still feeling so compelled to Reset my brain, my analysis…and even my life.

Last week’s scare with emergency surgery on my six year-old daughter’s one good eye shook me up more than I want to admit. I had a rough time getting back into work after having taken off a week for the first time in at least year or two when we learned about Amaris diagnosis last Monday. It also made me realize that my Great Reset is not over. In addition to making changes at my office and in the hedge fund positioning, I realized I need to get back to eating healthier, drinking less and making other improvements in my personal life. But back to the hedge fund…

Over the last fifteen to twenty years, I have had some wildly successful stock picks. Those of you that have been with me for a while have heard me mention numerous times about buying and holding Apple from 25 cents a share, owning Google since the IPO, correctly recognizing the potential of Facebook in the $20s near all-time lows and you have probably listened to me tell you about how I saw the potential in Bitcoin when I started accepting it as a payment back in 2013 around $100. These are things to be proud of when you do what I do for a living. And I guess it’s all right for us to celebrate our wins, but we can not sit around resting on our laurels if we want to be the best, if we want to go undefeated again, if we want to dominate the Wall Street Leagues out there.

I am no longer going to rest on my laurels and use prior victories to justify what I am doing today, tomorrow or anytime in the future for that matter. I have heard and even used that phrase before, but what does it really mean to rest on one’s laurels? Merriam-Webster defines the idiom as, “to be satisfied with past success and do nothing to achieve further success.” The phrase traces it roots back to ancient Greece where laurel wreaths were a symbol of victory and status. Although the “doing nothing to achieve further success” part of the definition does not apply to me, as part of the reflection I am doing during the Great Reset, the question I am asking myself is “Am I doing enough to be truly great going forward?”

So as part of the cleansing process, I have continued to go through the portfolio and eliminated reasons such as “I bought it at the lows” or “It has been a huge winner for us” as justification for continuing to own stocks that I really do not want to own anymore. So here is a major Trade Alert as I continue to reset and reinvent. These are the stocks that even after great runs and making a lot of profit in that I am selling, because just like Coach Wooden says, I can only influence the future by what I am doing today not what I have done in the past.

I reserve the right, as always, to revisit each and every one of these names.

- SQ Square– I am in Square at about $55 a share and I have been holding onto it because of that. I have to admit that part of the reason I have been holding onto SQ is because I got in at such a low price and have such a huge gain in this position. That is not a good enough reason to hold onto a stock. That is one big reason why many hedge fund managers struggle to repeat the successes that they had earlier on in their careers. Square’s margins are not that good at 29%. Revenue growth is slowing to less than 15% next year. As you can see where we bought SQ with the blue dot in the chart below, it has been a great run but it is time to let go of Square.

- SONY Sony – It has been almost seven years since we bought our first tranche of Sony at $18. If I was looking to make my first purchase in Sony today, I would be looking at a company with gross margins less than 30% that is growing at less than ten percent this year and next with earnings per share that are forecasted to decrease about 35% next year trading at a high valuation. As much as I hate to let it go, I am selling it and moving on.

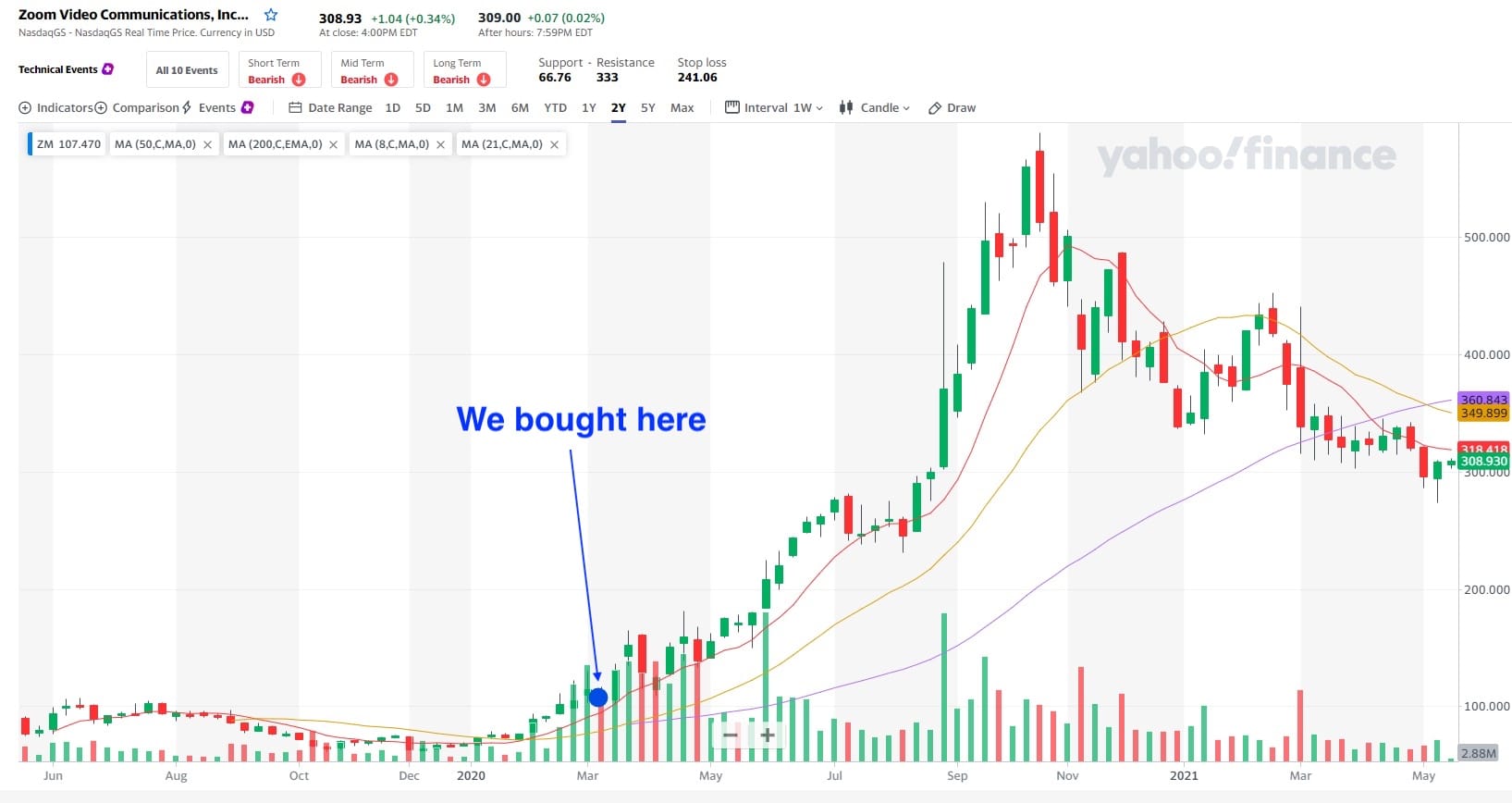

- ZM Zoom – As I have mentioned before, I am not so sure that we as a planet are completely past the Covid-19 pandemic. In fact, even in a post-Coronavirus Crisis world, I do think that the workplace has permanently changed and the future will be more of a hybrid model with more working remotely than we had prior to Covid. But I have a hard time seeing how Zoom will be able to justify its current $100 billion-ish valuation with the increase in competition that I mentioned in the latest Latest Positions. It was a great run over the last fourteen months but I am letting go of ZM.

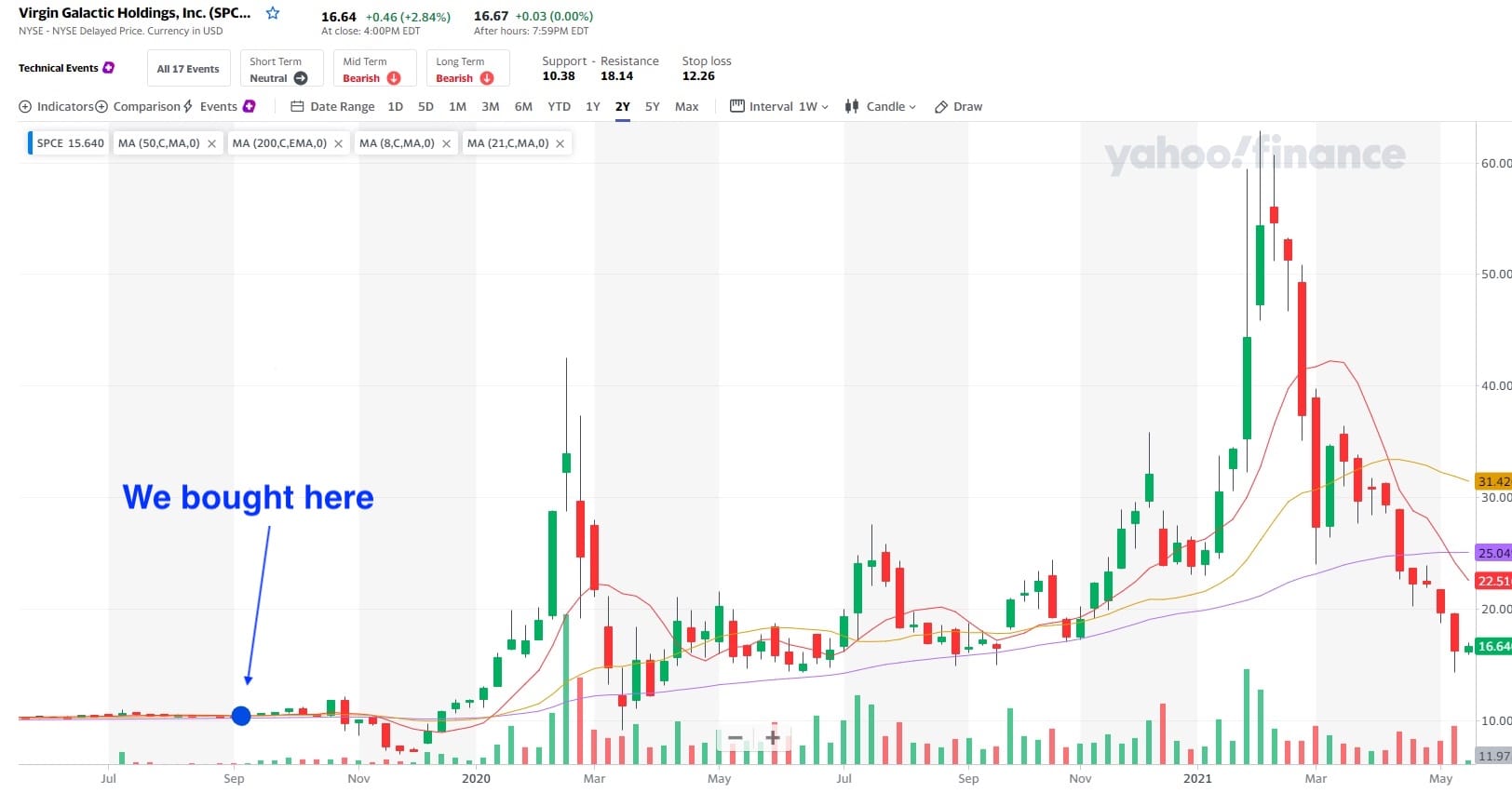

- SPCE Virgin Galactic – This one really stuck out to me and made me really try to find a reason that it is still in the portfolio. I could not find one. On the other hand, the reasons to sell are plenty with constant insider selling, failed test flights, no revenue and just getting left behind in the race to space. I really believe in the potential of the Space Revolution and this one overstayed its welcome in the portfolio because of that. We had quite a wild ride on this one riding it up from $10 to over $60 where I repeatedly suggested taking profits and wished that the company had done a secondary to raise more money. They didn’t. and back down. The stock and the company’s future have probably gone from a virtuous cycle to a vicious one. Hopefully you took advantage of the trade alert in February saying that $57 was a good place to take some profits.

We’ll do this week’s Live Q&A Chat Thursday morning at 10am ET. Join me in the TWC Chat Room or just email us your question to support@tradingwithcody.com.

(This article was produced with assistance from Cory Greak and Piper Adamian.)

I leave you with a few more quotes from John Wooden:

Talent is God given. Be humble. Fame is man-given. Be grateful. Conceit is self-given. Be careful.Never mistake activity for achievement.Ability may get you to the top, but it takes character to keep you there.Success is peace of mind which is a direct result of self-satisfaction in knowing you did your best to become the best you are capable of becoming.