Trade Alert: The Great Reset Starts By Culling Four Longs From The Portfolio

I often tell you all that one of the main reasons you subscribe to my service is because I help keep you from trading too much. There’s something to be said for an anti-trading approach when we’re trying to build wealth for the long-run. I especially do a good job of keeping us from selling all of our winners, many of which we literally bought at almost their exact lows years ago (or even just last year). I often look at my portfolio and wonder why I even trimmed any stocks. Which might be exactly the wrong lesson to take from the stock markets at this particular moment when we’ve ridden a Bubble-Blowing Bull Market for more than a decade.

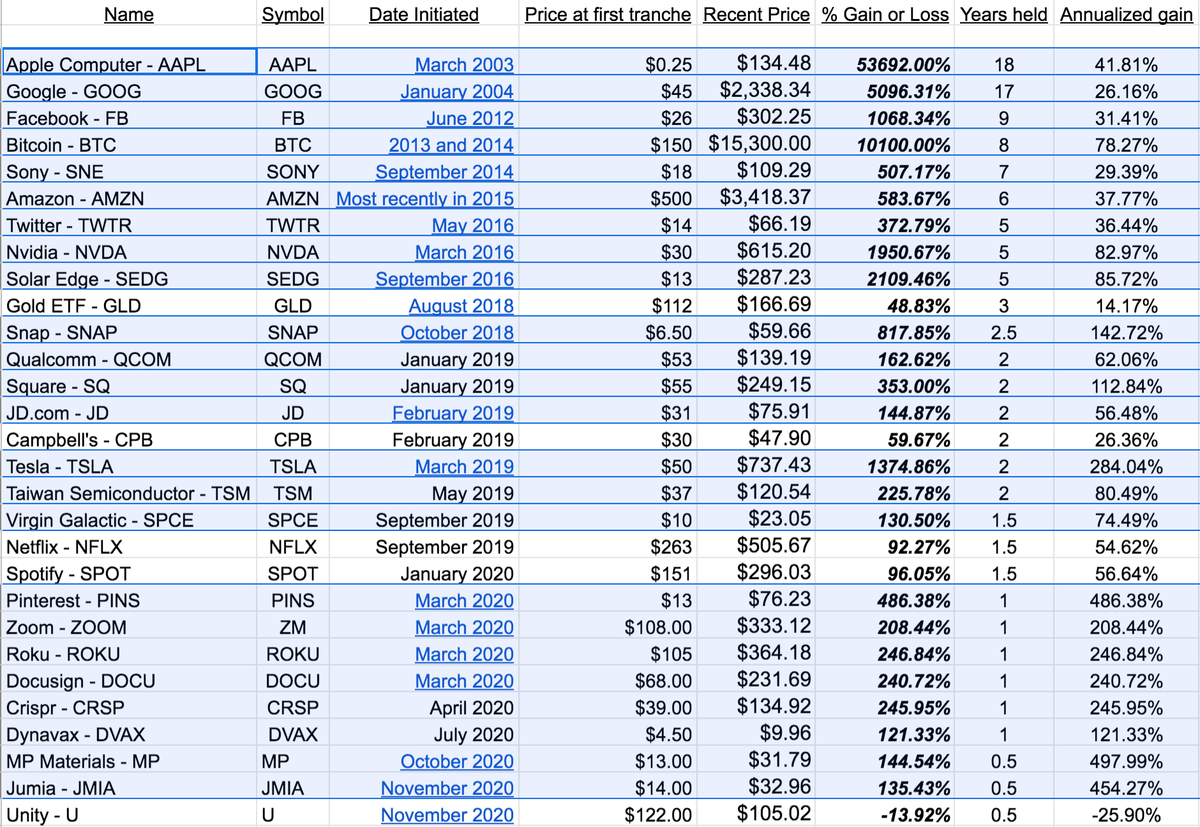

I’m also all about being flexible and opportunistic while trying to protect our capital. We have seven ten-baggers and two dozen or so positions that are up more than double from where we bought them (highlighted below) and I’m feeling torn on what to do with some of the names that haven’t performed for us, and even on some of the names that have winners. And right now, with so many new retail investors in the stock market pool, with just about every asset on the planet having gone vertical in the last year after this long Bubble-Blowing Bull Market, I’m feeling a lot more emotions about my positions and my hedges. Emotions are the enemy to the successful investor and trader. (We haven’t added the Space Stocks to the below spreadsheet yet by the way).

When we have so many positions and hedges and options as I seem to have ended up with lately, it gets harder to see the actual risk/reward set up in our portfolios. Having too many positions can also hurt long-term performance as you end up over-diversified to the point where you’re at best going to match the broader stock markets’ performance.

So I’m doing a Great Reset in my mind, my emotions, my portfolio. I’m starting with letting go of four long positions as well quite a few of my short hedges in the hedge fund too.

* I’m selling all of my Campbell’s Soup (CPB). I’m selling all of my Dynavax (DVAX). I’m selling all of my gold ETF (GLD). I’m selling all of my Unity (U).

* I’ve covered (taken off, haha) my British Shorts (EWU) and I covered my DISH Networks (DISH) short too. As always, I reserve the right to revisit each of these names that I’m closing out for now.

I’m likely to cull the portfolio by another three to five names in the next few days too, as we do our Latest Positions overview. Speaking of which, we’ll be sending out a Latest Positions write-up with updated analysis and ratings for each of our positions starting later today with Part 1 of 3. I’ll have more about why we’re making the moves in each individual name above in today’s write up, so stay tuned for that.