Trade Alert: This Hedgie Is Hedging As The Blow-Off Top Action Is Back

We’ll do this week’s Live Q&A Chat at 2pm ET in the TWC Chat Room or just email us your question to support@tradingwithcody.com.

Please Follow us on our LinkedIn Page and Connect and Follow Cody here.

It’s been a wild year so far and the market has been completely dominated by the mega cap tech stocks as they’ve accounted for all of the broader market’s gains this year. Long-time Trading With Cody subscribers have, of course, been in all the mega cap tech stocks except for Microsoft for years, long before they were worth hundreds of billions or trillions of dollars. As I’ve long explained that these are “Forever Longs” in my personal account after we bought them, I continue to hold these steady there. But I don’t think it’s a great or even a good idea to start buying these names like AMZN, AAPL, GOOG, NVDA, TSLA that we’ve owned for years while they’re up in a straight line lately and up thousands of percent each since I first sent out their respective Trade Alerts to buy them years ago.

In fact, it’s feeling a bit like we are going through another Blow-Off Top phase in the semiconductors and perhaps some of these mega cap tech stalwarts right now. The last time I talked about the Blow Off Top phase was back in November 2021 when I wrote:

“Ever heard the term “blow-off top” in regards to the market?

Investopedia defines it as: A blow-off top is a chart pattern that shows a steep and rapid increase in a security’s price and trading volume, followed by a steep and rapid drop in price—usually on significant or high volume as well. The rapid changes indicated by a blow-off top, also called a blow-off move or exhaustion move, can be the result of actual news or pure speculation.

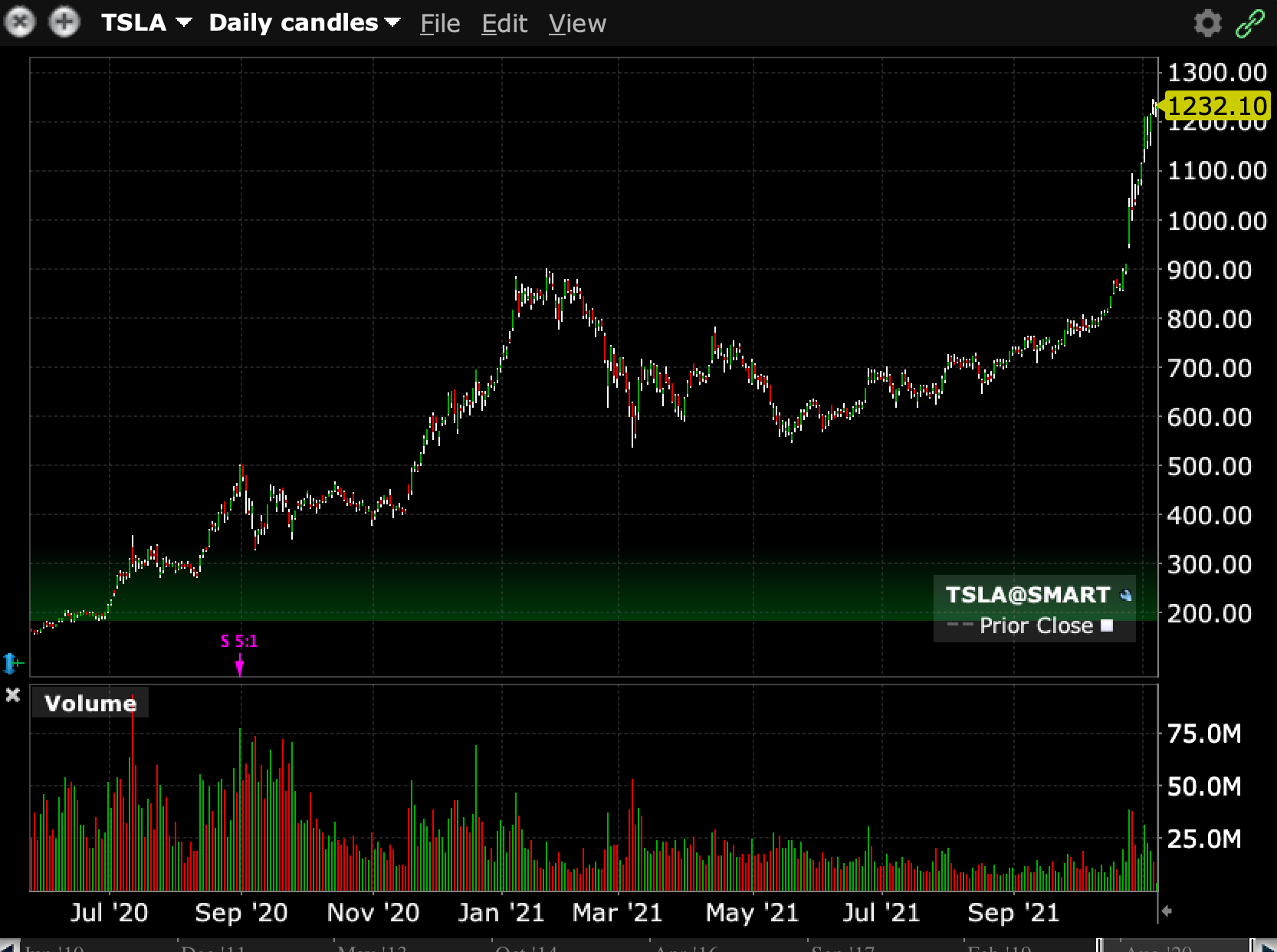

When I look at Tesla’s chart I get a bit worried that we’re in the midst of a blow-off top.

Then I look at NVDA’s chart and I get even more worried that we’re in the midst of a blow-off top.

Then I look at SMH’s chart and I’m like, yup, if an ETF, a collection of stocks, is acting like this, we’re probably in the midst of a blow-off top.

Not all blow-off tops are the same and to be sure, I’m not sure that this is a blow-off top. But here are some recent historical examples of what can happen to stocks after a blow-off top.

Clearly, Tesla and Nvidia have much better fundamentals than Zillow or Peloton and there’s little reason to think that TSLA or NVDA or SMH specifically will drop 70% from these levels. But there are plenty of other stocks out there right now that are probably in a blow-off top phase that will end up with them being down 70% from these current levels. I implore you to go through your portfolios right now and consider getting out of one or two names that have gone vertical but that probably are way too speculative to justify the moves.

I think we’ll look back in a month or two and realize that this current moment was a better moment to trim/sell/short than to buy into the blow-off toppy action.”

How crazy is it that TSLA and NVDA did indeed drop a full 70%, starting almost immediately after I wrote that article in November 2021. NVDA has of course bounced hard off those lows that we saw it hit after it dropped almost every day for a year in 2022 and hit new all-time highs with a one trillion dollar market cap yesterday morning. TSLA is still more than 50% lower than it was in November 2021. The SMH dropped 40%+ after hitting those November 2021 Blow-Off Top levels and has since bounced back to almost those levels, but it’s still $10 below where it traded back then even with this week’s 15% gain.

These semiconductors indices might very well have another 10-15% near-term gain from here but I think it’s more likely that they have a hard time getting through these current levels and that there’s probably some downside in them both near-term and long-term. In the hedge fund, I am short some SMH and have been adding some SOXX shorts here and also some puts on the SOXX dated out to June and July with various strikes both near- and out-of-the-money. I also added a few puts on SPY and QQQ here and will look to buy some more puts over the next few trading days depending on the market action. I’ll send out more Trade Alerts if and when I do more. In the personal account, on the other hand, I’m trimming a little bit of NVDA and some META but not using puts or shorts.

Be careful and don’t let yourself get greedy right now. There’s no fear except from the shorts and bears right now. Bulls are very confident and feeling smart. That will change eventually, even if today’s not a near-term top.

See you at the chat.