Trade Alert: This Rocket Ship Company Could Be A Rocket Ship Stock Too

I’m constantly scouring the world for the best ways to invest in what I think is the most obvious next trillion dollar marketplace, The Space Revolution. Recently, a handful of Space-related companies have started coming public (or preparing to come public in declared mergers) via SPACs. Most of these companies look too risky and/or even questionable in their management teams and business plans.

On the other hand, today I’m bringing you another name that I think has positioned themselves to be one of the big winners in the coming multi-trillion dollar market. The company is called Rocket Lab. It’s being brought public by a SPAC, trading under the symbol VACQ. In the history of spaceflight, only two private companies have delivered regular and reliable access to orbit for real revenue. I’m sure most of you have heard of one of these companies, SpaceX. Well, Rocket Lab is the other. Rocket Lab is building a vertically integrated platform (you know I love these) to enable the hundreds and soon to be thousands of companies building satellites a simple, fast, and cost effective method of launching into orbit. Here’s a cool video about the company.

Rocket Lab has scaled to a monthly launch cadence faster than any commercial launch provider in history. It took them only 6 years.

During that time, Rocket Lab has launched 18 rockets to space, deploying 97 satellites and even recently demonstrated the ability to recover the first stage of the rocket for use on later missions. The company’s first rocket, Electron, is targeting the market requiring smaller payloads (Electron can deliver up to 300Kg to orbit), and customers requiring flexibility with launch timelines (currently 132 launch slots available every year). One industry forecast projects 38K satellites to be built and launched from 2020-2029. Of those, 90% are to weigh less than 300Kg. Besides being first to market, another thing that sets Rocket Lab’s Electron rocket apart from their small rocket competition, is their unique Kick stage booster. Kick stage is a “third stage” booster that allows Rocket Lab the ability to launch multiple satellites for different customers on a rideshare rocket and deliver each of those satellites to different orbits/planes. When we think of the tens or possibly hundreds of thousands of small satellites going to orbit in the near future, this added flexibility to the customer is likely to capture a large percentage of the small satellite market. This Kick stage technology is perhaps Rocket Labs’ biggest technological advantage.

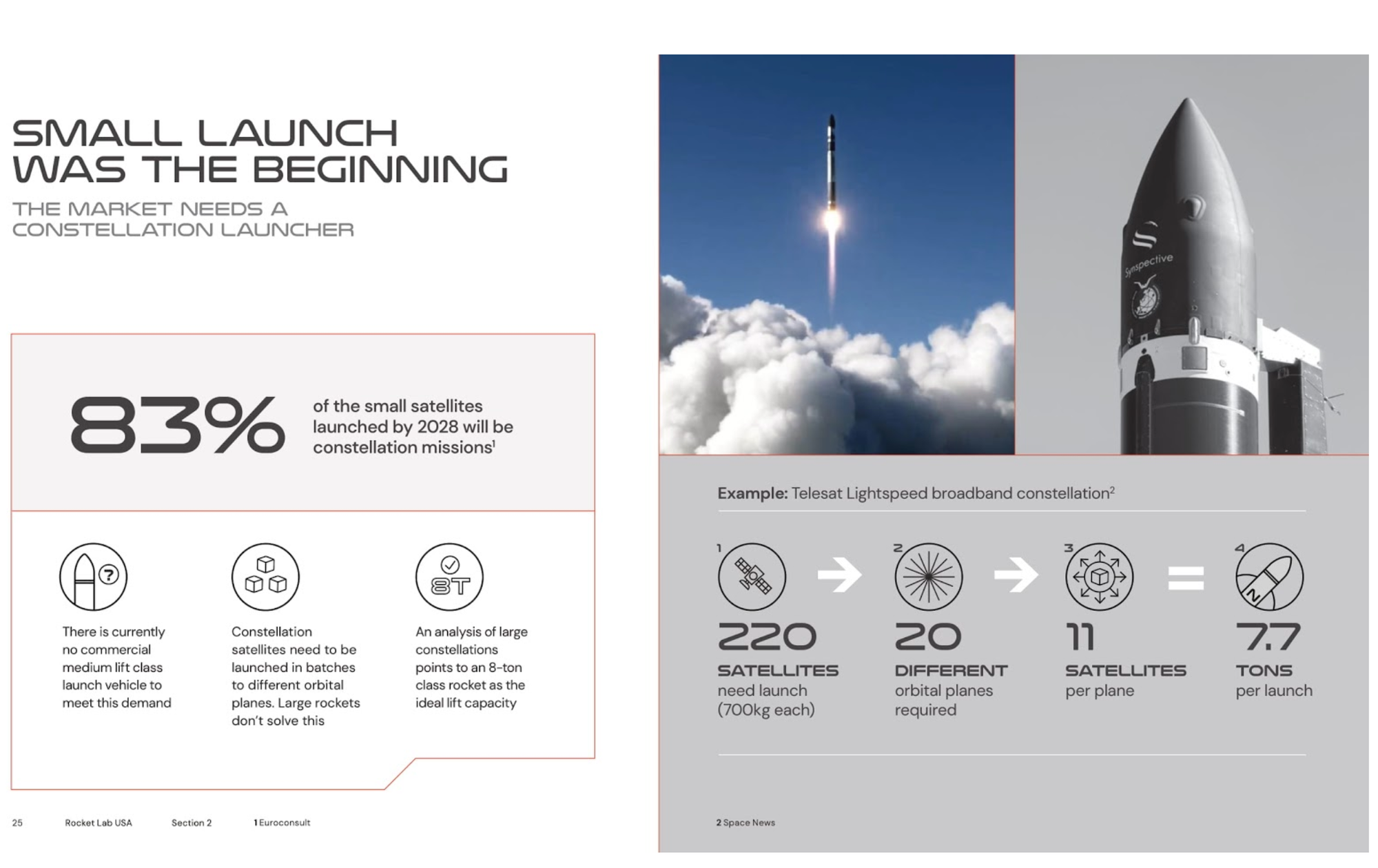

One thing that Rocket Lab has learned while working with their many satellite customers is that in the future of satellite deployment, customer’s small satellites are going to need to work together in constellations of many small satellites forming a network. These satellites are going to need to be deployed in batches, to different orbital planes. Rocket Lab has recently introduced a new rocket, Neutron, which targets this larger payload market. Neutron (8000Kg payload capacity) fills the current void between the small (<300Kg payload) rockets and the extremely large rockets currently being launched by SpaceX’s Falcon 9 (22,800Kg). In addition to delivering satellite payload, Neutron is being developed to carry both resupply cargo and even astronauts. Neutron is scheduled to make its first commercial launch in 2024.

An even larger market that Rocket Lab is going after is what they call Space Systems. This market is being met by their Photon satellite bus system. Basically they take the Kick Stage from their Electron rocket and modify so that the Kick Stage bus itself becomes a fully functional satellite itself, which allows customers to attach their payload directly to the Photon shuttle that then goes into orbit. They already have on of their Photon vehicles already turned into a functioning satellite in orbit. Think of this as a satellite as a service business. Photon is a big part of that PLATFORM that I mentioned earlier. Evidence of the future potential of Photon is being selected by NASA to deliver a cubesat into orbit later this year. This satellite is an early part of the Artemis program which will land the first woman and next man on the moon by 2024. Rocket Lab is using an Electron rocket and Photon spacecraft to support this early portion of this mission to the moon.

Now you might be thinking about the competition from names that you’ve heard of like SpaceX and Blue Origin. Whereas both of those companies are focused on huge rockets launching big payloads into space, Rocket Lab is focused on the small/medium payloads and on the market that depends on speed to launch not to mention the cost of launch. SpaceX charges about $62M for a dedicated launch. Rocket Lab on the other hand advertises a dedicated launch for $5.7M which can be lowered even further with a shared ride with other customers. Rocket Lab will face competition in the small rocket market in the near future, but I think with their head start and technological advances, they will meet those challenges.

On to the financials. Unlike a lot of companies going public via a Spac, Rocket Lab currently has paying customers bringing in revenue. Last year, Rocket Lab had revenue of $35M. That number is forecasted to go up to $69M this year. As the company begins to scale, they see that number growing exponentially to over $1.5B in 2027. If the Space Revolution continues to grow the hundreds of billions starting to be thrown at it from the capital markets, I think that $1.5 billion estimate for 2027 might be met in 2025 and the exponential growth from there would continue and perhaps even accelerate.

As part of the SPAC process, Rocket Lab released their projections of being profitable in 2023 and cash flow positive in 2024. After that, they plan on profits increasing rapidly and throwing off a significant amount of free cash flow.

Valuing this company today, it’s definitely not cheap. However, they see growing the topline at a compounded annual growth rate of over 68% over the next 6 years. Remember, we are investing for the next 10,000 days so I see VACQ as an opportunity for us to get a venture capital type investment at an reasonable valuation of under $6B, or about 30x next year’s sales estimates. And as always, I look to get in ahead of the rest of the world, starting our investments in this new Revolutionary sector before it becomes a multi-trillion dollar market. As always, especially with speculative type start-up companies, start small and use tranches. I’m buying my first tranche of about one third of a full position and will add in the coming weeks, especially if we get a dip.

Clearly, my research and analysis indicate that The Space Revolution is going to be the next, most obvious trillion dollar economy that I want to get in front of. And, like always, I want to add value to that analysis by finding the best, most Revolutionary companies in this sector. SpaceX is clearly the big dog in private Space for now, but there are other great companies that we should buy when they come public. Rocket Labs is the other great private Space company and the only one that is now about to come public that we can buy on a stock exchange. I’m going to let go of SRAC, one of our other Space Stocks and perhaps SRAC’s biggest last mile competitor too.

So to be review then, I am selling SRAC and replacing it with this, a much better, more diversified and much further along Space Revolution company.