Trade Alert: March 2024

This is a relatively small-cap stock and it is close to all-time highs, so we are not loading up on it just yet, but we are excited about this Revolutionary biotech company that we think has the potential to be a very high gross margin, multi-billion dollar revenue business in just a few years.

We started buying shares in TransMedics Group (TMDX). This is a relatively small-cap stock and it is close to all-time highs, so we are not loading up on it just yet, but we are excited about this Revolutionary biotech company that we think has the potential to be a very high gross margin, multi-billion dollar revenue business in just a few years.

As you will see below, we have been studying this company for some time and we recently had the chance to catch up with the CFO via Zoom, and we are excited about what we learned.

Key Statistics

- Stock Price: $86.57

- Market Cap (mm): $2,772

- Total Revenue (ttm): $242

- Gross Margin (ttm): 63.64%

- Operating Margin (ttm): <11.89%>

- Net Cash Per Share (as of 12/31/23): <$3.61>

- Price/Sales (ttm): 11.45

- YoY Revenue Growth (ttm): 159%

- Consensus 2023 Revenue Growth Est.: 51.9%

Summary

We have probably all known someone — or perhaps even experienced this personally — who has had to wait on a long waitlist to get an organ transplant. Right now there are over 100,000 people in the US waiting on an organ transplant, and unfortunately the demand for organs always vastly exceeds the supply. Even if a potential organ becomes available, the organ has to be a biological “match” for the recipient and it has to be healthy enough that the doctors are willing to use it. What this translate to is a very inefficient use of the organs that are available for transplant and long wait times to get them. Tens of thousands of people die each year waiting for organ transplants.

Enter TransMedics. TransMedics developed a portable medical device known as a “perfusion” machine which is used to keep transplant organs alive during transport. Traditionally, all organs were transported from the donor to the recipient in a cooler (yes, literally a Yeti cooler at times), and the vast majority of organs today are still transported on ice. However, TransMedics’ Revolutionary device — which they refer to as the Organ Care System, or OCS (pictured below) — keeps organs alive and functioning for much longer than traditional methods by continually pumping real blood, vitamins, and nutrients through the organ, and monitoring its functioning until it is placed in the recipient.

For example, a liver on ice can live about 4-6 hours outside of the body, but with OCS it could last up to 40 hours. This Revolutionary technology is saving lives by facilitating thousands of transplants that previously were infeasible because the donor and the recipient were too far away from each other, or because the organ failed or was otherwise unusable by the time it reached the recipient. TransMedics is the only major company that offers a portable perfusion device like OCS and although there is some potential competition on the horizon, we expect TransMedics will be able to maintain near monopoly status in this market for the foreseeable future.

TransMedics grew revenue about 160% YoY in the fourth quarter and the company is now GAAP profitable. It’s not necessarily cheap, trading at about 7.5x 2024 sales estimates, but with a company growing this fast and with relatively high margins (60%+), we think this is not a bad entry point to start buying the stock. As always, we will use tranches and will buy more if/when this stock gives us a major pullback.

The Business

TransMedics was started by Dr. Waleed Hassanein in 1998 and he remains the company’s President and CEO. Dr. Hassanein founded the company because he knew that the over-100-year-old form factor for transporting organs (ice chests) needed to be updated to improve health outcomes. As mentioned, organ demand has always far exceeded the supply of organs because only a small percentage of the people who pass away each year are eligible organ donors due to health issues, age, weight, etc. Supply is further restricted by transportation issues, with only 2-3 out of every 10 donated organs eligible for use once they finally reach the intended recipient. Dr. Hassanein built the OCS to increase the amount of useable organs (with OCS about 8 out of every 10 organs donated can be used). Here is a good video of the CEO explaining TransMedics’ story and his vision for the company. TransMedics came public in May of 2019 at $16/share.

Originally, the company made all of its revenue by selling the OCS device. There are two components to TransMedics’ device sales: (1) a one-time purchase of the machine itself; and (2) disposable cartridges that hold the organ which can only be used once each. Essentially, this is a razor and razor-blade type business model where TransMedics sells the initial equipment at a relatively low margin and makes most of its profit on the disposable cartridges. Net/net, the device business has consistently generated gross margins of around 70%, which is at the high end of the range for medical device sales.

More recently, however, the company expanded into the logistics and services businesses and now offers an end-to-end platform for organ transplants. TransMedics sells its devices through its branded “National OCS Program” (NOP), in which TransMedics handles every aspect of getting the organ from the donor to the recipient. Today, TransMedics owns its own jets and employs teams of doctors and nurses that go to the donor hospital, place the organ in the OCS, and then monitor the organ on its way to the recipient. By switching to the NOP model, TransMedics alleviated many of the pain points and inefficiencies in the organ transplant process.

Revolutionary Kickers

As always, we are looking for companies that are truly Revolutionary. These are the companies that fundamentally change the way we live our lives, the way we do business, the way we experience the world, etc. In our article from last June, What does it mean to be a Revolution Investor?, we explained that Revolutions are paradigm shifts.

So what makes TransMedics Revolutionary? First and foremost, the OCS system facilitates thousands of life-saving organ transplants that otherwise would not have happened if OCS did not exist. This technology increased the viable lifespan of an organ outside of the body by a factor of 10x. Moreover, it increased the useability of donated organs by a factor of 4x. Remember, there are tens of thousands of people that die every year waiting on organ transplants. This is a truly life-saving/life-changing technology that currently only TransMedics makes.

In the future, next-gen OCSs will be even more cost-efficient and will enable even longer periods of viability outside of the body. If the technology gets good enough, OCS may enable the creation of what we think of as “organ banks,” where thousands of healthy organs can be safely held in a repository for days or weeks instead of having to be used essentially right away as they are now. If healthy organs can be stored for weeks or months, then the chances that they can be matched up with a compatible recipient who needs that specific organ go up dramatically. This would be a radical shift from the “just-in-time” system that has governed the organ transplant system to date and will further increase the lives saved using OCS.

Additionally, OCSs may be able to handle more international organ transplants (TMDX’s international sales are de minimus currently), potentially opening up the entire world to those in need of organs. For all of history, growth in organ transplants has been supply-constrained. If the entire world is now a potentially eligible donor, then hundreds of thousands of people may be able to get organs that they otherwise would not get. We think the possibility even exists that the waiting list, which currently stands at over 100,000 people in the US alone, could go away if organs from anywhere in the world are available to help those in need.

In sum, TransMedics technology meets the definition of a “paradigm shift” because it can (1) eliminate the just-in-time organ transplant system currently in place; (2) has the potential to eliminate the organ waitlist; and (3) save hundreds of thousands, and potentially millions of lives over the coming decades if the technology improves as we think it might.

Our Model

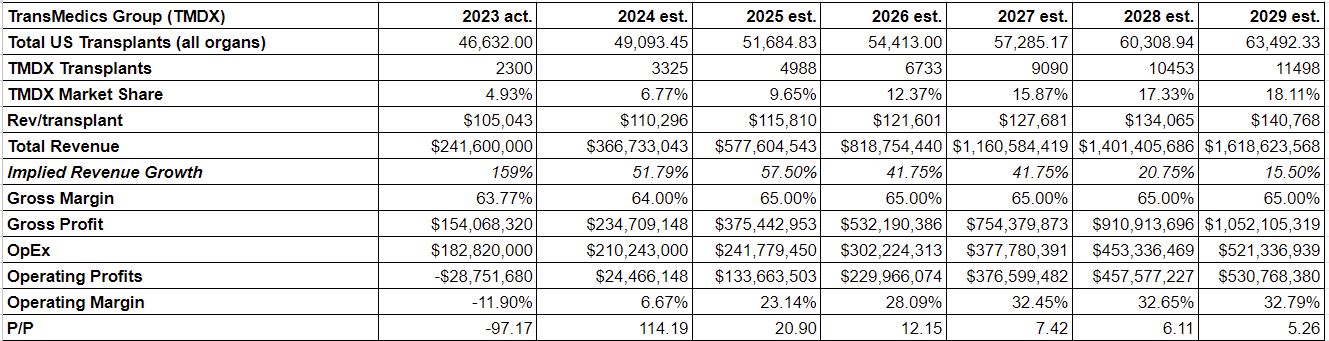

Our model essentially tracks management’s goals and stated targets for the next five years. To begin, the CEO expects that the company will complete at least 10,000 transplants by the year 2028. We assume that will happen which implies a roughly 43% topline compounded annual growth rate (CAGR) for the next five years. Gross margins have dipped from the roughly 70%-level since the company started doing its own logistics and services but management is shooting to keep gross margins in the mid-60s going forward, and we use 65% as our long-term gross margin percentage. Lastly, the CEO is aiming for 30% operating margins at mature revenue levels and we have the company hitting that metric in 2027. All in all, we think this is a fairly realistic model. Our assumptions are in line with management’s goals and the only real risk here is that TransMedics fails to execute on its plan. However, with over four years of operational excellence in the rear-view mirror, we think management has more than demonstrated its capability to execute well and will likely hit its goals over the next five years.

Given these assumptions, TransMedics is trading at a 12.77 price/operating profits (p/p) ratio three years out and a 6.4 p/p five years out, which is very attractive in our view.

Risks

As mentioned earlier, TransMedics is still expensive on a price/sales ratio and needs to continue to grow rapidly in order to justify this valuation. As always, we nibble on stocks like these and wait for a pullback to build the position into the size we want it to be.

Furthermore, the company currently operates as a near monopoly in the portable perfusion market as it is already the subject of some government scrutiny, including accusations of price gouging and other anti-competitive practices by Representative Paul A. Gosar. However, this appears to be a largely one-off issue and we do not expect TransMedics to be the subject of any substantial anti-trust action any time soon, although that is always possible. There have also been some proposed changes to the way the government allocates organs and that could pose some near-term changes to the way TransMedics operates, but we do not think it will affect the underlying business.

There are also early signs of some competition in the mobile perfusion market including from a new method of transplant known as normothermic regional perfusion (NRP). With this method of transplant, blood is pumped through a dead donor’s body to keep the organs alive. Some studies suggest that this is a cheaper method of performing perfusion but many organizations have raised significant ethical concerns with this method of transplant since it runs the risk of potentially reviving the donor (although that risk is fairly minimal). This would violate the number-one rule in transplants which is the “dead donor rule,” which essentially means that the donor must actually be dead and doctors are never allowed to remove organs from a donor who might still be alive. Nevertheless, the possibility of competition is always on the horizon and could start to eat into TransMedic’s healthy gross margins if a serious alternative is brought to market.

Additionally, we always mention execution risk when it comes to small-cap companies like TransMedics. Even if the market for TransMedics’ services continues to grow as it has been, the company could mishandle an organ, or a plane could crash on its way to a donor, or any other number of horrible things could happen in the process of transplanting a living organ (we pray it never does). Moreover, the management team — while experienced and by all accounts very good at their job — could start to fail as it attempts to grow the business to a much larger scale. Teams that are good at running startups are not always the best when it comes to managing a mature business.

Lastly, we mention that GLP-1s (weight-loss drugs like Ozempic) could potentially reduce the overall demand for organ transplants. If the population is dramatically healthier and in better shape in the coming decades, that would be great for society but it might also mean that people’s organs stop failing as frequently. This could hurt TransMedics’ business in the long run, although we think this is unlikely as there are still a lot of illnesses that are not related to obesity that cause people to need organ transplants.

Conclusion

TransMedics is already Revolutionizing the medical transplant industry and it is just getting started.

We think there is a clear path to many years of high-growth for this company. Again, this is just a starter position for us and we are not loading up on this stock given the current valuation.

However, TransMedics is still a compelling growth story and we think this will be a great stock to own for the next 5, 10, and 20 years.