Trade Alert: Trimming A Few Puts, But Mostly Holding Steady For Now

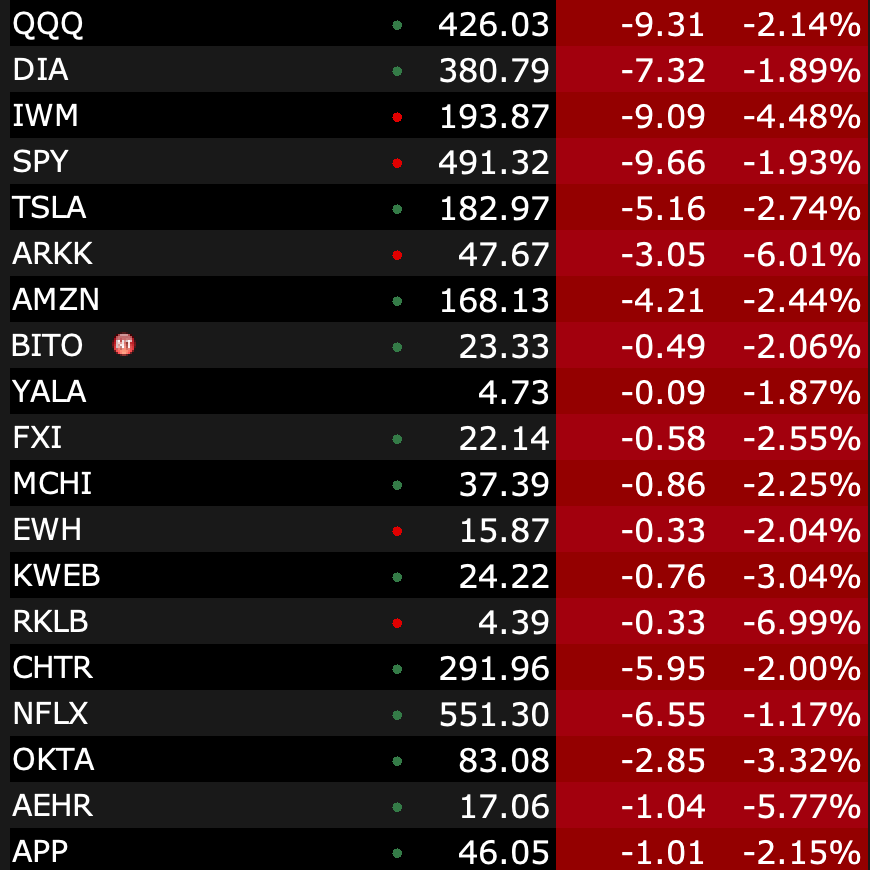

Markets are ugly today with the DJIA down about 750 points, the Nasdaq down 2.25%, and the Russell 2000 down nearly 4.5% as of this writing. The breadth of red vs green on the screens is pretty remarkable, as evidenced in the picture of random stocks/ETFs below:

Markets sold off after the CPI report came in slightly worse than expected and all of a sudden people decided that maybe the Fed could not blindly start cutting interest rates as soon as they thought. We have been cautious for the last few weeks or so and we sent out a Trade Alert on Friday stating that “we are doing some trimming and hedging today as this market feels pretty frothy and this might even be a blow-off top right here.” And as we noted at the end of that post on Friday, “We added hedges via puts on some of the indices like iShares Semiconductor ETF (SOXX) and Global X Cloud Computing ETF (CLOU).”

We’ve done basically no outright buying of any longs today but we did trim a few of the Global X Cloud Computing ETF (CLOU) and iShares Semiconductor ETF (SOXX) puts that we bought on Friday and unwound parts of a few other hedges we’ve had on including selling some AI puts and some CVNA puts.

That said, many stocks are in bubbly territory still and it would not surprise us to see some bigger moves to the downside from here for many of those names.

Steady as she goes for now. As a side note, Robinhood Markets (HOOD) reports earnings tonight and we’ll be excited to hear how the fourth quarter ended up and how the company’s growth plans are coming along including the 3% IRA match, the crypto Europe launch, the UK launch, and — probably most exciting of all — the potential for an AI-powered advisor this year. We are mostly holding our Robinhood position steady for now.