Trade Alert: Trimming And Even Selling Some Here

I’m back and am pretty much full speed after that heart attack thingee I lived through a couple weeks ago. Fact is that I’m actually feeling pretty darn well and healthy at this point. I’m eating better, I don’t get to drink beer any more and on Friday I go to the New Heart Foundation to get my new workout regimen. I can’t wait to get for the weather to get a little better so I can go outside and play some outdoor, non-simulated golf for the first time in a few months.

I’ve talked before about the golf simulator I put in my rural offices and I’ve played it enough the last few months that I’m hoping my handicap might actually have dropped since I last played outside. Both of the golf games I use on the simulator are built on the Unity engine. That said, I am taking a little bit off the table here after this recent double off the lows where I’d mentioned in a Trade Alert or two that I was buying more.

In fact, I did a little more selling today in the hedge fund than I’ve done in a while. I sold all of our NVDA common which we’ve had for a very long time and which has been a huge winner for us. I still have all the NVDA in my personal account where I’d bought it back at a split-adjusted $7 per share several years ago. I still admire the company and expect it to continue to grow, especially as AI has become so hot lately. But that’s a double edged sword as the “hotness” of the AI sector has helped juice the NVDA stock price too, maybe even more than the actual demand for Nvidia’s chips that Softee/OpenAI needs to make their ChatGPT stuff work on the Microsoft Cloud.

Likewise, I sold out of the MDB common taking a nice gain and moving on. I’m holding onto the only remaining stock from my Cloud Basket, SNOW for now.

I also sold the BITO bitcoin position out of the hedge fund today too.

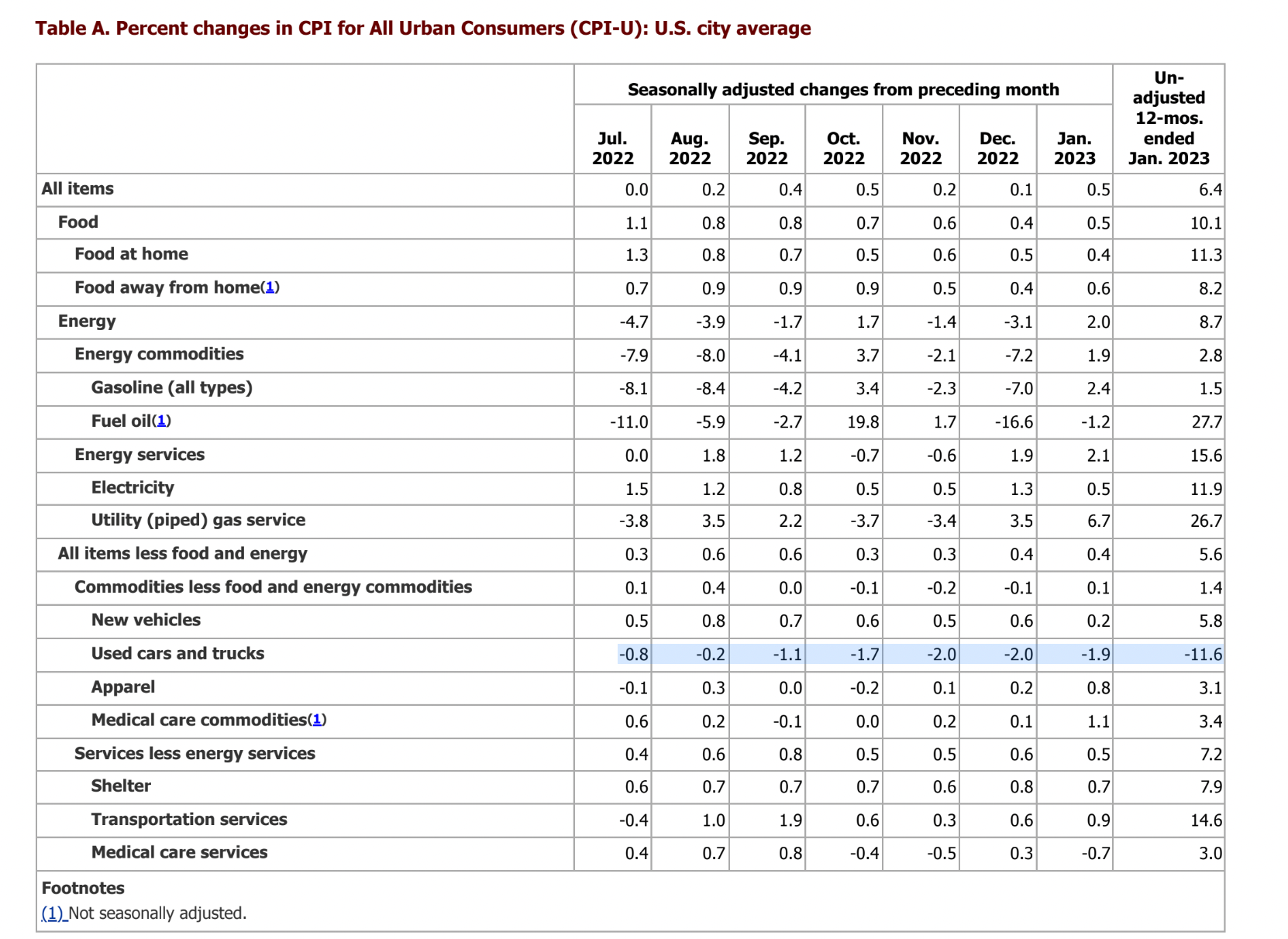

A single CPI report doesn’t help us analyze the economy and the markets per se, but it can be helpful to read these press releases. Notice that car prices are the only deflationary sector from the last month. Also notice that transportation services, (UBER) was really inflationary / had strong pricing.

I’ll be writing more analysis this week and next and Bryce is continuing to analyze and will be writing up some analysis on our individual stocks like we did with UBER a couple weeks ago (nice move on that one!) We are pretty much holding the UBER steady for now and holding some of our LYFT puts that I’d mentioned as a pair trade for the UBER long a few weeks ago.

Let’s do this week’s Live Q&A Chat at noon ET in the TradingWithCody.com chat room or just hit reply to this email and I’ll include your question and my answer in the transcript.